Best Budgeting Apps 2024: Take Control of Your Finances

Jul 10, 2024

Due to the fast and exhausting pace of life today, we have less and less time left for daily routine tasks. Therefore, the modern man systematically seeks ways to simplify his routine. Of course, finances are no exception, where carelessness and unplanned actions can lead to severe losses. Controlling your finances is critical for materializing your goals, whether saving for a down payment, paying off debt, or simply living within your means.

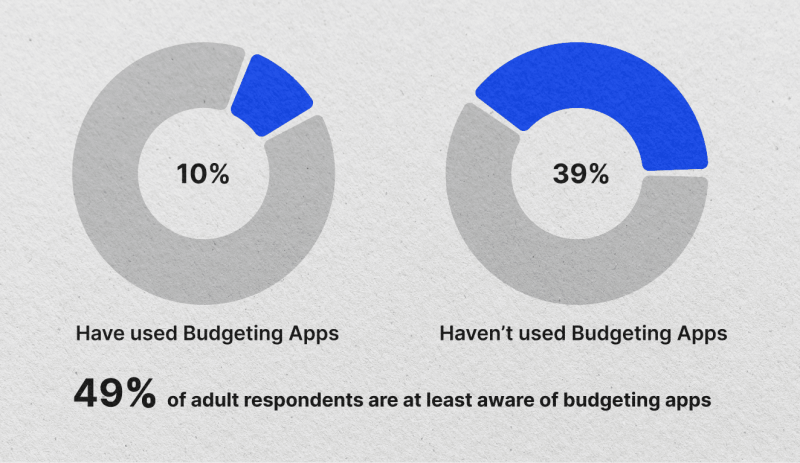

Budgeting apps can be powerful tools for tracking spending, setting goals, and staying on track. However, choosing the right one can be overwhelming, given the many options available. This article explores the best budgeting apps of 2024, highlighting their key features, strengths, and weaknesses to help you find the perfect fit for your needs.

Key Takeaways

- The best budgeting apps for 2024 offer a range of features, from basic expense tracking to advanced financial planning tools.

- Ease of use is a crucial factor when choosing a budgeting app. The top apps provide intuitive interfaces that simplify financial management, even for beginners.

- With the increasing importance of data security, the best budgeting apps ensure robust security measures.

Why You Need a Budgeting App

Budgeting is a fundamental aspect of the health of your financial accounts. By managing finances efficiently, individuals can bypass unnecessary credit card accounts, save for future desires, and ensure they are prepared for unexpected expenses. Here are key reasons why budgeting is essential:

Handling Finances Efficiently

A budget helps you understand where your money is going and identify areas where you can save money. This efficiency can lead to better financial decisions and more savings accounts.

Avoiding Debt and Saving for the Future

You can avoid overspending and accumulating debt by keeping track of your income and expenses. Budgeting also allows you to allocate funds toward goals to save money, whether for an emergency fund, a vacation, or retirement.

Benefits of Using Budgeting Apps

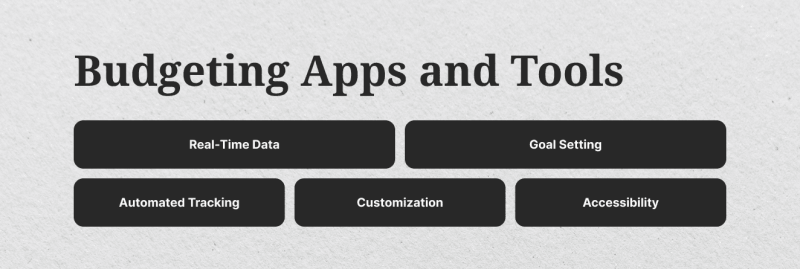

While traditional budgeting methods like spreadsheets or pen and paper can be effective, budgeting apps offer several advantages that make managing your finances more straightforward and more effective:

Real-time Tracking of Expenses

Budgeting apps provide up-to-date information on your spending. This instant visibility helps you manage your finances and make adjustments as needed.

Automatic Categorisation of Spending

Many apps automatically categorize your expenses (e.g., groceries, entertainment, bills), saving you time and providing a clear picture of where your money is going.

Goal Setting and Financial Planning

Budgeting apps often include features that allow you to set financial goals, such as saving a certain amount each month or paying off debt. They provide tools to track your progress and adjust your plan as needed.

Alerts and Reminders

Apps can send notifications for upcoming bills, low bank account balances, or unusual spending patterns. These alerts help avoid late fees, overdrafts, and other financial pitfalls.

Different Budgeting Methods

Various budgeting methods cater to different financial goals and personal preferences. Here’s a look at some popular budgeting methods and the apps that best support them:

Zero-Based Budgeting (ZBB)

Zero-based budgeting involves assigning every dollar of your income to a specific expense or savings account, ensuring that your total revenue minus total expenses equals zero.

Envelope Budgeting

Envelope budgeting involves allocating a certain amount of money to different spending categories, each represented by a physical or digital “envelope.” Once the money in an envelope is spent, you can’t spend more in that category until the next budgeting period.

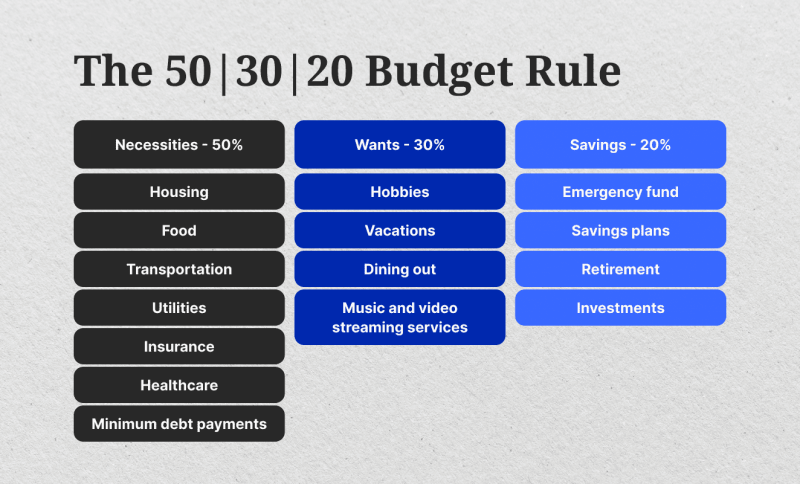

50/30/20 Rule

The 50/30/20 rule divides your after-tax income into three categories: 50% for needs, 30% for wants, and 20% for savings and debt repayment.

Traditional Budgeting

Traditional budgeting involves setting spending limits for various categories based on your net worth and regularly tracking your expenses to stay within those limits.

Pay Yourself First

This method prioritizes saving before any other expenses. You set aside a predetermined amount for the savings account and investment account first, then allocate the remaining income to other spending categories.

Fast Fact

In March 2024, the budgeting app Mint, which once had 3.6 million active users, was shut down. According to its parent company, Intuit, Mint wasn’t making enough money because it had the wrong business model: giving the product away for free and monetizing referrals.

Criteria for Choosing the Best Budget App

When selecting a budgeting app, it’s essential to consider several critical criteria to ensure the app meets your financial management needs and preferences. Here’s a detailed breakdown of what to look for:

User Interface and Experience

The app should be user-friendly and intuitive, making it easy for anyone to navigate and understand without extensive training or instructions.

Also, a clean, well-organized design is important as it greatly enhances usability. Look for apps with clear menus, easily accessible features, and a visually appealing layout that doesn’t overwhelm users.

Features and Functionality

The app should allow for easy and accurate expense tracking, ideally with automatic transaction categorization to simplify monitoring spending habits.

Additionally, effective budget planning features are crucial. The app should help you set budgets for different categories and track your progress against those budgets in real-time.

Look for an app that allows you to set and track savings goals and feature automated reminders for upcoming bills. Such features can help avoid late payments and associated fees while also staying motivated and focused on your financial objectives.

Compatibility

The best budgeting apps are available on multiple platforms, including iOS, Android, and the web. This ensures you can access your budget from any device, providing flexibility and convenience.

Seamless integration with your bank accounts and other financial institutions is essential as well for automatic transaction updates and accurate financial tracking.

Security

Ensure the app uses robust data encryption methods to protect sensitive financial information from unauthorized access.

Two-factor authentication (2FA) adds an extra layer of security, ensuring that even if someone gains access to your password, they still cannot access your bank account without a second verification form.

Budgeting Apps Cost

Determine what features are available for free and what features require a premium subscription. Free budgeting apps should offer basic functionality, while premium versions often provide advanced features.

Understand the pricing structure for premium features. Some apps offer a one-time purchase, while others may use a monthly or yearly subscription model. Consider your budget and how much you are willing to invest in a budgeting app.

Top Budgeting Apps of 2024

Now, let’s get familiar with the outstanding apps of the year.

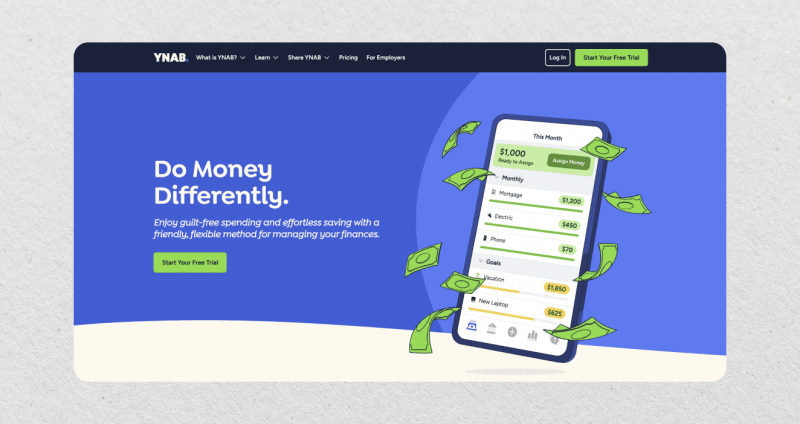

YNAB (You Need A Budget)

YNAB is a standout in the budgeting software market. It follows a proactive budgeting approach, teaching users to allocate every dollar to a specific purpose. YNAB’s methodology promotes mindful spending and financial discipline.

- Pros: Comprehensive budgeting philosophy, excellent support, and education resources.

- Cons: Monthly subscription fee, which might not suit everyone.

- Best For: Individuals looking to renovate their financial habits.

Empower (Former “Personal Capital”)

Empower’s personal dashboard excels in providing both budgeting tools and investment tracking. It integrates with your bank accounts and investment portfolios, offering a complete picture of your financial health.

- Pros: Investment tracking and retirement planning tools.

- Cons: Higher focus on wealth management, less emphasis on everyday budgeting features.

- Best For: Users with investments looking for a general financial management tool.

Goodbudget

Goodbudget uses the envelope budgeting system, allowing users to allocate funds into different “envelopes” for various spending categories. It’s simple and effective for those who prefer traditional budgeting methods.

- Pros: Simple envelope system, great for managing household budgets.

- Cons: Limited features in the free basic version.

- Best For: Users who prefer envelope budgeting.

PocketGuard

PocketGuard simplifies budgeting by showing users their disposable income after accounting for bills and necessities. It’s excellent for those who want to avoid overspending.

- Pros: Simple, clear interface, focuses on preventing overspending.

- Cons: Limited customization options.

- Best For: Users looking for straightforward budget tracking.

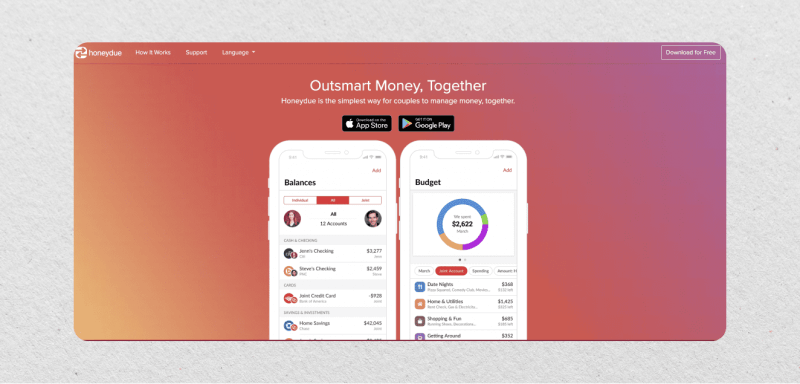

Honeydue

Honeydew is tailored for couples, offering features that allow partners to manage their finances together. It supports bill splitting, shared expenses, and financial transparency between partners.

- Pros: Couple-friendly features, free to use.

- Cons: Limited advanced financial tools.

- Best For: Couples managing shared finances.

Conclusion

The popularity of money management apps continues to grow as more people seek digital solutions for financial management. In 2024, these apps are expected to become even more advanced, integrating AI and machine learning to provide personalized financial advice and insights.

The best budgeting app for you depends on your individual needs and preferences. Consider your budgeting style, desired features, and budget when choosing. Explore the options listed above and experiment with different apps to find the perfect fit for your financial goals.