How to Start a Multi-Asset Brokerage?

June 04, 2025

In a financial world that never sleeps, traders demand more than just one market — they want everything, everywhere, all at once. Whether it’s crypto at midnight, Forex during economic releases, or indices on Monday mornings, the modern trader is multi-dimensional. If you’re considering entering the brokerage space, offering just one asset type won’t suffice.

This guide breaks down how to do it right, from technology and licensing to client acquisition and scaling, with a hands-on look at how different platforms make it easier than ever to launch a multi-asset brokerage today.

Key Takeaways

- Multi-asset brokerages attract a diverse range of clients and reduce their reliance on single revenue streams.

- Platforms like B2TRADER provide ready-made infrastructure for fast and reliable market matching.

- A scalable setup with proper licensing, liquidity, and risk controls is key to long-term growth.

Why Start a Multi-Asset Brokerage?

In the increasingly dynamic cash market of today, access to only a single market is no longer sufficient. Traders are better-informed, more sophisticated in their approaches, and more discerning in their requirements from a broker.

If you are looking at starting your own brokerage firm, pursuing the multi-asset direction is not a luxury anymore — it is becoming a necessity. This is why.

Meeting Diverse Client Needs

Modern traders rarely stick to one asset class. A client who trades Forex may also want to explore crypto. Someone interested in commodities might also follow stock indices.

By offering a broad range of instruments—from currencies and commodities to equities, ETFs, and cryptocurrencies — you position your business as a one-stop shop for retail and institutional clients alike.

This variety not only enhances your value proposition but also builds stronger, longer-lasting client relationships. People are less likely to switch when they can diversify their entire portfolio on a single platform.

Increased Revenue Opportunities

Each asset class brings its own volume and potential for commissions. When you run a multi-asset brokerage, you’re not reliant on one stream of income. For instance:

- Forex offers high-frequency trading and tight spreads.

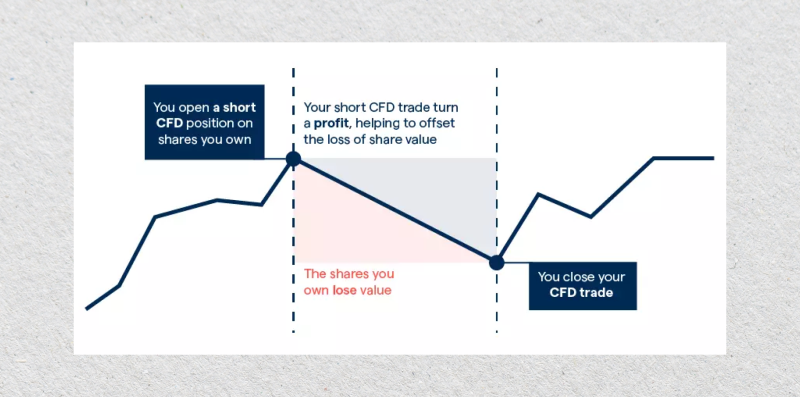

- CFDs and stocks might yield larger per-trade commissions.

- Crypto trading can come with higher volatility—and, therefore, higher fees.

Diversifying the assets you offer not only attracts more clients to you, but also generates various streams of revenue that can co-support one another in off cycles in the market.

Competitive Advantage in a Crowded Market

Let’s face it: the brokerage industry is competitive. New entrants are popping up all the time. What sets you apart? Offering only FX or only crypto is no longer enough. A multi-asset approach allows you to stand out as a comprehensive trading solution—not just another niche platform.

This becomes especially important when pitching to institutional clients, partners, or affiliates. Being multi-asset demonstrates that you’re serious, well-prepared, and scalable.

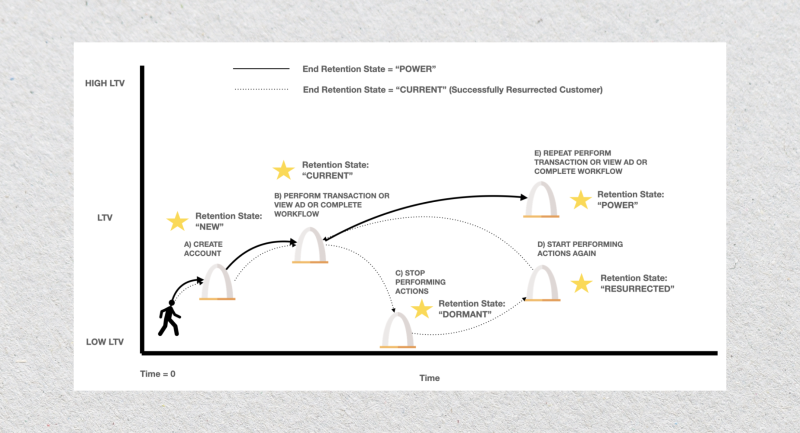

Better Client Retention

A key reason traders switch brokers is to access assets they can’t currently trade. If your platform offers everything from NASDAQ stocks to gold as well as ETH/USDT and EUR/USD, clients are far less likely to leave. They’ll grow with your platform.

More asset classes also mean more cross-selling opportunities. For instance, a user who comes for crypto trading might discover the ease of Forex or indices on your platform—and stick around.

Adaptability to Market Trends

Financial markets move in cycles. There are times when crypto trading volumes drop while traditional assets like stocks or gold surge. A multi-asset brokerage provides you with the flexibility to navigate these cycles.

Instead of being exposed to one volatile market, you can capitalise on whatever’s hot at the moment—be it meme stocks, inflation-driven commodities, or Forex movements tied to central bank decisions.

Strategic Scalability

Starting with a multi-asset mindset sets you up for strategic growth. You might launch with FX and CFDs, then add crypto and stocks later. Or you may begin by catering to retail clients, then expand into institutional partnerships, wealth management tools, or portfolio automation services.

Having a platform that supports multiple asset classes enables you to scale both vertically and horizontally—encompassing both features and target audiences.

Enhanced Brand Authority

Let’s not underestimate the power of perception. A multi-asset brokerage gives off the impression of being advanced, reliable, and globally focused. That branding alone attracts serious traders, affiliate marketers, and business partners.

Whether you’re presenting to a regulatory authority, pitching to investors, or onboarding liquidity providers, a diversified model gives you more weight and credibility in the conversation.

Fast Fact

Over 70% of modern traders use platforms that support more than one asset class, proving that flexibility isn’t just a feature — it’s a market expectation.

How to Start Multi-Asset Broker?

Initiating a multi-asset brokerage is opening up a platform that provides customers with access to various financial assets — Forex, CFDs, equities, cryptocurrencies, commodities, indices, ETFs, and bonds—through one trading panel.

The following is a comprehensive and authentic guide that includes the key steps, infrastructure, legal requirements, and strategic insights.

Define Your Business Model

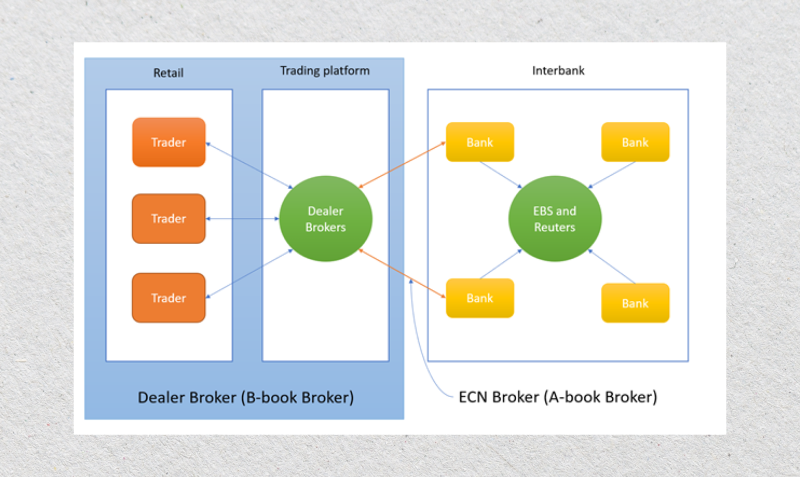

Before anything else, you need to define what kind of multi-asset broker you want to be. The core decision lies in choosing your execution model. As a market maker (B-Book), you take on the counterparty risk and internalise trades, which can be lucrative but carry more risk.

On the other hand, taking the STP/ECN route (A-Book) means acting as a conduit, routing orders to liquidity providers and earning through spreads or commissions—a less risky but potentially less profitable approach.

Many modern brokers opt for a hybrid model, switching dynamically between A-Book and B-Book depending on the client’s risk profile and behaviour. Once you’ve settled that, you need to outline your asset offering.

Successful multi-asset brokers usually offer Forex (the most liquid market), cryptocurrencies (volatile and popular), stocks and ETFs (household favorites), commodities and indices (ideal for hedging), and the ability to speculate on the underlying instrument without actually owning it in the form of CFDs.

Acquire Licenses and Stay Compliant

To start a multi-asset broker, you must operate within a legal framework that suits your growth strategy. Your choice of jurisdiction plays a huge role in defining operational costs, compliance requirements, and client trust.

High-level regulators like the FCA (UK), SEC/NFA (USA), or ASIC (Australia) provide unparalleled credibility but require rigid compliance with regulations and sizeable capital reserves.

Mid-level regulators, such as CySEC (Cyprus) or FSC (Mauritius), balance flexibility with regulation. For entry-level players, startup-oriented locations such as St. Vincent and the Grenadines, Belize, or Vanuatu provide more rapid entry and lower requirements but at a possible reputational cost.

In spite of the jurisdiction, such compliance infrastructure would consist of effective AML and KYC systems, real-time transaction monitoring, segregation of client funds, and regular financial auditing.

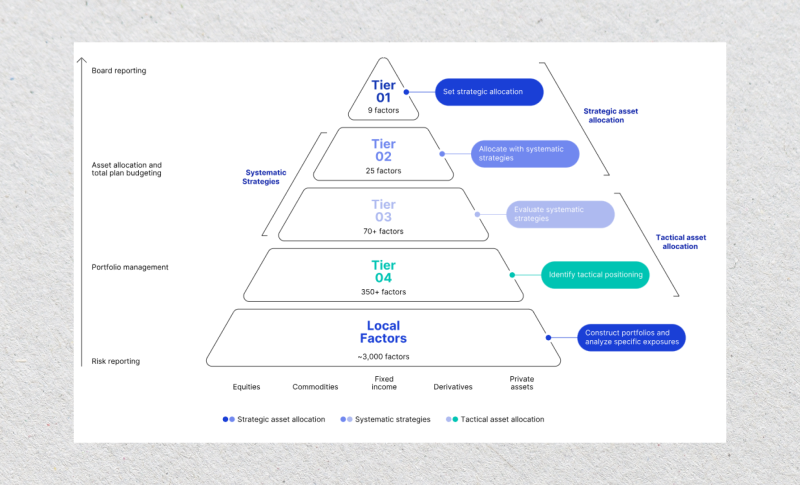

Build a World-Class Technology Stack

At the core of your brokerage is the multi-asset trading platform. Top choices are MetaTrader 4 and 5 (MT4/MT5)—market leaders with proven stability and broad adoption. cTrader has a clean, contemporary look, while a custom platform offers you full control over user experience and function (though with increased development cost).

Equally critical is your liquidity aggregation setup. Top-tier liquidity providers, such as B2BROKER or Finalto, supply deep market access. You’ll need a robust aggregation engine, FIX API integration, and low-latency routing to ensure high-quality execution.

Don’t overlook your brokerage CRM system—this is where you’ll manage onboarding, affiliate networks, payments, and client communications. A well-integrated back office system should also allow your team to monitor trading activity, manage risk, reconcile trades, and generate reports seamlessly.

Secure Liquidity and Manage Risk

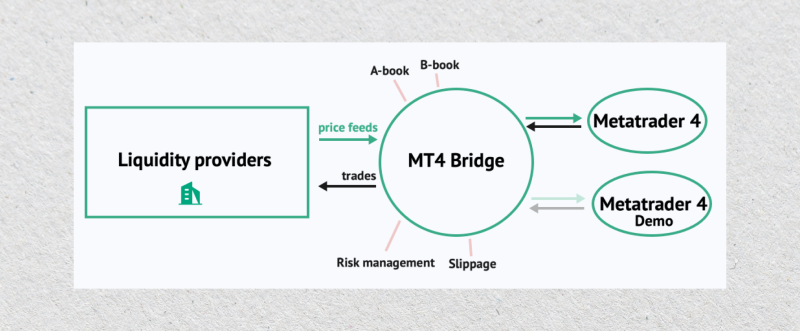

To thrive as a multi-asset broker, offering tight spreads and stable execution is a must. This involves partnering with multiple liquidity providers to diversify risk and access more favourable pricing. Using bridge technologies—like those from PrimeXM, OneZero, or B2BROKER—you can integrate platforms like MT5 with your liquidity pool.

Risk management is non-negotiable. You’ll need tools to monitor exposure, auto-hedge trades when needed, adjust leverage dynamically, and detect patterns that indicate harmful trading behaviour (such as latency arbitrage or toxic flow).

Set Up Payment and Banking Infrastructure

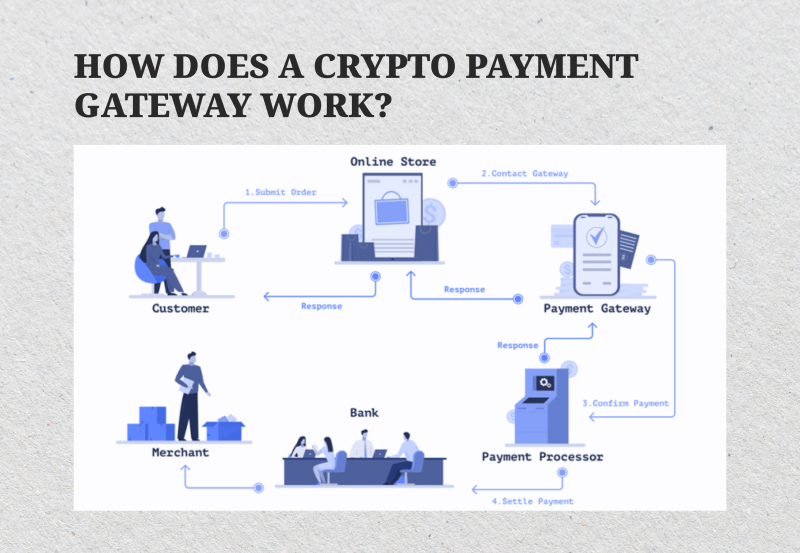

Your clients will expect fast, secure, and varied payment options. You should offer bank transfers, credit/debit card support, e-wallets like Skrill or PayPal, and increasingly, crypto payment methods.

Since brokerages are considered high-risk businesses by many banks, you’ll need to establish relationships with payment service providers that specialise in high-risk merchant accounts. Opening both operational and segregated client accounts in reputable institutions is essential to ensure compliance and foster trust.

Market Your Brokerage and Acquire Clients

Once you’ve built the foundation, it’s time to attract traders. A winning marketing strategy combines paid advertising, search engine optimisation, and content marketing through blogs, guides, and webinars. Organic traffic builds over time, but you’ll likely want to supplement it with Google Ads and social media campaigns for quicker traction.

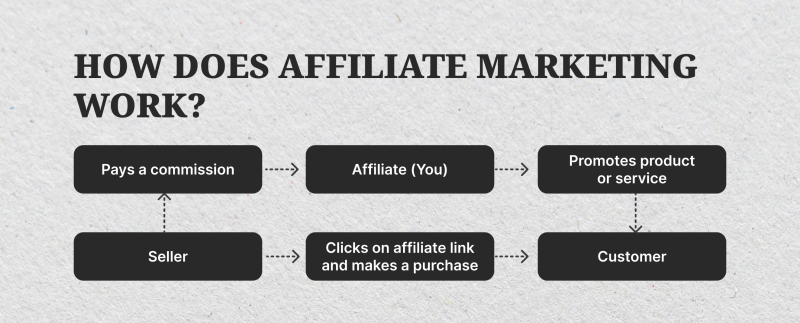

Equally important is your partnership strategy. Introducing Brokers (IBs), white-label agents and affiliate marketers can help you rapidly expand into new markets. Don’t forget localisation—offering multilingual support and region-specific campaigns makes a significant difference in conversion and retention.

Structure Your Legal Entity and Hire a Core Team

To open a multi-asset brokerage, you’ll need a properly incorporated company in the jurisdiction where you intend to be regulated. This will serve as the legal foundation of your operations.

As for your team, the key roles include a CEO or founder to steer the vision, a compliance officer to handle regulatory obligations, a head of trading to manage market exposure, a CTO or tech manager to oversee platform performance, and sales and marketing leads to drive growth. Reliable customer support is also crucial—your team must be ready to assist clients 24/5 or 24/7, depending on your offerings.

Launch, Improve, and Scale

Start with a soft launch—release your platform to a closed group of traders to gather feedback and fine-tune the user experience. This enables you to test systems, optimise performance, and prepare for broader visibility.

A full-scale launch follows once you’re confident in your product. This is where you accelerate user acquisition, activate IB networks, and build a community around your brand.

Scaling means expanding your asset list—perhaps adding futures or bonds—and integrating mobile apps or API access for advanced users. Social and copy trading are powerful features that can boost engagement and attract less experienced clients.

Enhance Your Offering with Advanced Features

As your business grows, consider offering white-label services to other brokers who wish to enter the space using your infrastructure. You can also offer proprietary trading programs, where you fund skilled traders to trade with your capital.

Finally, adding PAMM or MAM accounts helps you attract professional money managers who need tools to handle multiple clients under one umbrella.

Starting a Multi-Asset Brokerage with B2TRADER – A Real-World Approach

Launching a multi-asset brokerage today requires more than just vision—it demands the right technology from day one. For many new brokers, the first challenge is establishing a fast, stable, and scalable trading platform.

That’s where B2TRADER comes in. Designed by B2BROKER, B2TRADER is an ultimate multi-asset and multi-market trading platform built to power high-efficiency trading across multiple markets. Let’s explore what it looks like to actually use it to start a multi-asset broker.

Laying the Groundwork

Before diving into the tech, it’s essential to define the direction of your brokerage. Imagine you want to offer a mix of crypto spot markets, major Forex pairs, and a few global indices.

Your goal is to give clients access to a multi-asset trading platform that feels fast, intuitive, and professional. With this in mind, your infrastructure should be flexible enough to handle a range of instruments while delivering reliable execution speeds.

Bringing B2TRADER to the Center

At the core of your operation is B2TRADER — not just a matching engine but a powerful multi-asset and multi-market trading platform. Designed for high performance and scalability, B2TRADER ensures ultra-low latency execution, processing thousands of orders per second with millisecond precision. It supports a wide range of order types, including market, limit, and stop-limit orders, giving your traders the flexibility they need.

But B2TRADER offers more than speed. It empowers your brokerage with a seamless, intuitive interface to manage diverse instruments — whether you’re trading BTC/USD, EUR/USD, or NASDAQ-based indices.

Its industrial-grade infrastructure ensures the stability and depth of your order books, making it the powerhouse behind a truly professional brokerage setup.

Building the Ecosystem Around It

Of course, a matching engine doesn’t work in isolation. B2TRADER seamlessly integrates with a range of components that complement your multi-asset broker setup.

You’ll integrate a client-facing portal — B2CORE is a popular choice— to manage onboarding, know your customer (KYC) processes, deposits, and withdrawals.

From there, you’ll need payment solutions, which may include crypto gateways like B2BINPAY or traditional payment service providers (PSPs) that support card and bank transfers.

Liquidity is another critical element. With B2TRADER, you can plug into external liquidity providers or source liquidity internally, depending on your business model. The system supports aggregation and smart routing, helping you deliver the best execution for your clients.

Customising Your Market

Once the foundation is in place, you’ll start configuring the actual trading pairs and conditions. Let’s say you’re offering BTC/USD, ETH/USDT, EUR/USD, and the NASDAQ 100. Each market can be tailored with your own fee structures, spreads, and trade size limits. This is also where you define your commission model—whether that’s a flat maker/taker fee or something more dynamic.

Everything is managed through B2TRADER’s intuitive admin panel, which lets you make real-time adjustments as your brokerage evolves.

Going Live and Running Day-to-Day

After several weeks of internal testing, you’re ready to go live. Your front end is connected—either custom-developed or based on a white-label design—and users begin trading. From here, it’s all about monitoring activity, gathering feedback, and fine-tuning your setup.

B2TRADER provides real-time analytics, allowing you to monitor order flow, execution speed, and liquidity health. This helps you stay responsive, whether it’s adding new trading pairs or adjusting risk parameters.

Why B2TRADER Works for Multi-Asset Brokers

The real strength of B2TRADER lies in its readiness. Instead of spending months building your own tech from scratch, you’re working with a mature solution that’s been tried and tested across dozens of exchanges and brokerages. It’s reliable, fast, and designed to scale as your business grows.

For those seeking to establish a multi-asset brokerage with a solid foundation and minimal friction, B2TRADER provides a smart starting point. It gives you the flexibility to launch quickly, the stability to operate professionally, and the tools to expand into new asset classes when the time is right.

Conclusion

Launching a brokerage today no longer requires building everything from scratch. With modern trading technology solutions available, you can go live quickly using infrastructure that supports high-frequency trading, access to multiple asset classes, and deep liquidity pools.

The combination of seamless integration, real-time analytics, and ultra-low latency makes this setup ideal for entrepreneurs looking to enter the market efficiently and scale with confidence. It’s a proven model that powers many of the world’s leading trading platforms.

FAQ

What is a multi-asset brokerage?

A brokerage offering access to various asset classes like Forex, crypto, stocks, and commodities from one platform.

Do I need a license to open a multi-asset broker?

Yes, you need a license from a regulatory authority based on where you operate. Jurisdiction choice affects costs and credibility.

Can I start with just one asset class and expand later?

Absolutely. Many brokers launch with FX or crypto and gradually add more instruments.

What is B2TRADER and how does it help?

B2TRADER is a matching engine from B2BROKER that powers real-time order matching for multi-asset trading platforms.

How long does it take to launch a multi-asset brokerage?

With pre-built platforms like B2TRADER, it’s possible to launch within weeks instead of months.