Top 3 Liquidity Challenges Facing New Exchanges and How to Solve Them

July 29, 2025

Building a new exchange is like constructing a bridge in a storm—without strong foundations, everything risks collapse. While many startups focus on user interface or branding, the real engine behind every successful trading platform is liquidity. It’s what powers trust, trading volume, and financial resilience.

In this article, we’ll walk you through the top three liquidity challenges new exchanges face—and how smart solutions like B2CONNECT can turn risk into opportunity.

Key Takeaways

- Without deep books and fair pricing, even the best-designed exchanges won’t earn trader confidence.

- Features such as FIX API connectivity and aggregation engines are crucial for modern liquidity management.

- Real-time routing and hedging tools help maintain stable trading during turbulent markets.

Why Liquidity is a Priority for New Exchanges?

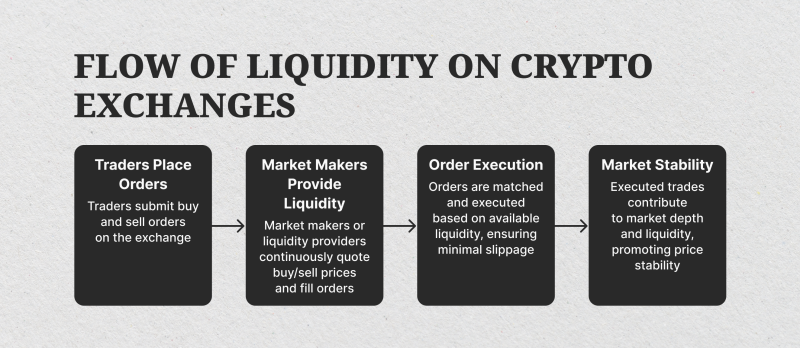

For newly launched exchanges, liquidity is more than just a technical parameter—instead, it determines operational efficiency, confidence, and financial risks.

Exchanges that lack an appropriate liquidity architecture, i.e., a crypto liquidity bridge or liquidity collection mechanism, are unable to attract and retain customers, withstand execution failures, and thus struggle to succeed in liquidity management under real market conditions.

So why does liquidity matter so much?

Creates Trust and Marketplace Credibility

An exchange’s liquidity emerges as a key indicator of public viability. When a trader assesses a platform, particularly in a highly competitive space like cryptocurrencies, they are concerned not only about the UI but also about entering and exiting positions seamlessly. Thin order books, wide spreads, or orders stuck for too long are signs of weak liquidity risk management and mediocre infrastructure.

To that end, liquidity does more than enable trades—it wins user confidence. Early market makers and early adopters interpret strong liquid assets and prompt trade execution as evidence that the exchange has professional management.

It’s all about first impressions, and failure to provide a liquid trading marketplace immediately damages credibility, which is hard to regain in the minds of retail and institutional participants.

Furthermore, healthy liquidity complements a better-performing exchange’s finances and liquidity, enabling it to fulfill its financial obligations. It reflects a liquid exchange’s ability to handle everyday obligations—not merely processing orders and handling withdrawals, but also responding to swift market changes—essential to long-term viability.

Real-time Quality of Trade Execution

An exchange’s ability to complete trades efficiently, fairly, and at stable price points is its most rudimentary functionality. Lacking adequate liquidity, every trade can significantly impact asset values, exacerbate cash flow burdens, or inflict damaging slippage that discourages usage.

Low liquidity also typically means high bid-ask spreads and frequent rejection of trades, especially for large or market-sensitive orders. Not only does it affect execution quality poorly, but it also imposes a sort of liquidity risk that destroys platform efficiency and erodes trust among users.

Inefficient liquidity management mechanisms exacerbate all these drawbacks, leading to inconsistent cash outflows and operational collapses during turbulent periods.

Poor implementation will always act as a barrier to high-frequency and algorithmic players. Suppose there are no suitable infrastructural facilities to support smooth pricing, low latency, and cash flow planning. In that case, the platform will be removed even before being featured on a due diligence shortlist.

Key to Attracting Both Retail and Institutional Traders

New exchanges are focused on capturing retail customers, but the most important growth driver is capturing financial institutions. Financial customers require uniform depth, low latency, and multi-venue access through technologies such as liquidity aggregation and FIX API connectivity.

Institutions consider factors such as liquidity coverage, high-grade liquidity quality, and the actions a platform takes to fulfill its short-term commitments during economic stress.

It requires more than one liquidity provider. Without a crypto liquidity aggregator or multi-feed liquidity bridge, no exchange can possibly attain institutional-grade execution quality.

Meanwhile, their retail customers are large beneficiaries of their liquidity products. Thin spreads, fastest fills, and accurate pricing all mean lower operational costs and better experiences all around—the two things that have immediate impacts on word-of-mouth growth and user retention. For both groups, frequent, liquid trading experiences are a given.

Foundation for Sustainable Growth and Risk Management

Liquidity is not just a performance parameter—it also plays a significant role in effective liquidity risk management, cash flow forecasting, and even regulatory compliance, such as the net stable funding ratio.

Liquidity facilitates the better absorption of market shocks, meets user redemptions, and ensures fair pricing, even in the face of rising market volatility or mass redemptions by depositors.

Notably, liquidity attracts yet more liquidity. As a platform gains depth and financial stability, it enters a virtuous feedback loop: more traders participate, order book depth increases, and spreads continue to tighten. It’s this flywheel that economically scales exchanges—reducing reliance on advertising or advertising alone to bring in traffic.

Alternatively, failure to properly address early liquidity challenges can begin a downward spiral. Liquidity difficulty arises when there are insufficient cash inflows to meet commitments, resulting in suspended trading, locked-up withdrawals, and long-term reputational damage.

Being unable to call upon liquid assets, being unable to react to future cash flows, or rebalancing the balance sheet during market episodes highlights the severe consequences of failure to properly manage liquidity risk.

Fast Fact

An exchange with tight spreads and deep liquidity can reduce user slippage by over 70%, dramatically improving retention and trading frequency.

Top 3 Liquidity Challenges Facing New Exchanges Today

Below, we examine the top three liquidity challenges that most newcomer exchanges face and break down how such challenges impact performance, trust, and long-term survival.

Challenge 1 — Low Order Book Depth

Shallow order book depth is one of the most obvious and expensive liquidity challenges for burgeoning exchanges. Lacking sufficient traders or liquidity providers in the first couple of days, the order book shall have very few active bids and asks around the market price.

This creates large spreads and significant slippage, primarily for larger or market-moving orders. Limit orders often remain unsent for extended periods, and market orders execute at undesirable prices, frustrating users and eroding trust.

The absence of discernible liquidity becomes self-perpetuating. Heavy players, including scalpers, institutions, and high-speed players, actively avoid places with thinly traded markets. Such players seek fast execution, tight spreads, and deep-depth qualities that an illiquid site outright cannot offer.

Several underlying causes contribute to this impediment. Some newly launched exchanges overlook the importance of offering early incentives for liquidity, such as maker rebates or volume-related rewards, to stimulate market engagement.

Others specialize in exotic or niche pairs of trades that do not achieve significant interest. Most importantly, many platforms go live with no market-making setup in place—whether internal engines or third-party bots — to keep spreads tight and contribute to book depth.

Addressing this problem needs a multi-layer solution. Running proven market-making bots in-house or from dedicated suppliers can instantly enhance spread management and ensure basic execution availability.

By utilizing liquidity mirroring or synthetic depth simulation, where book depth is partially reflected from larger venues, one can present a healthier market to the end user.

Maker-centric incentive drives also naturally generate volume by offering incentives for early trade action. Lastly, collaborating with LPs who can guarantee minimum market depth provides a safety net to maintain baseline liquidity under all market conditions.

Challenge 2 — Single Liquidity Provider Dependency

While access to one LP is one checkpoint for neophytes in the exchange business, relying on a single LP is a highly risky venture that can jeopardize both near-term success and longer-term sustainability.

Typically, the reason for relying is due to a limited budget, inexperience in integration competency, or the convenience of maintaining only one LP. This lean setup leaves the system utterly exposed to significant risk.

First and foremost, there is the risk of centralization. Without a single LP available, the exchange loses the opportunity to receive real-time quotes. Order books freeze or vanish, eroding traders’ confidence and shutting down trades.

The worst part is that the absence of price competition allows the LP to mark up spreads or provide inferior fills, primarily during times of high volatility. This translates to poor-quality executions and even exposes the user to the risk of being manipulated by the price.

It most often arises from cost-saving efforts or a lack of knowledge on how to implement the multi-feed liquidity architecture. The majority of platforms, especially those emerging with limited funds, don’t appreciate the value of establishing a redundant LP system from the beginning, leading to hefty liquidity challenges.

To manage this risk, exchanges seek to onboard at least two to three LPs in the early stages. By doing this, they achieve redundancy, enhance spread tightness, and promote effective price discovery.

Dynamic LP prioritization, in which the order flow’s routing is dependent on time-sensitive metrics such as latency, pricing depth, and rejection ratio, has the potential to optimize execution quality.

Prime-of-Prime vendors and turnkey liquidity centers, such as those from B2BROKER or other institutional networks, simplify access to diversified, pooled liquidity for smaller exchanges, reducing their technical and regulatory overhead.

Challenge 3 — Lack of Aggregation Technology

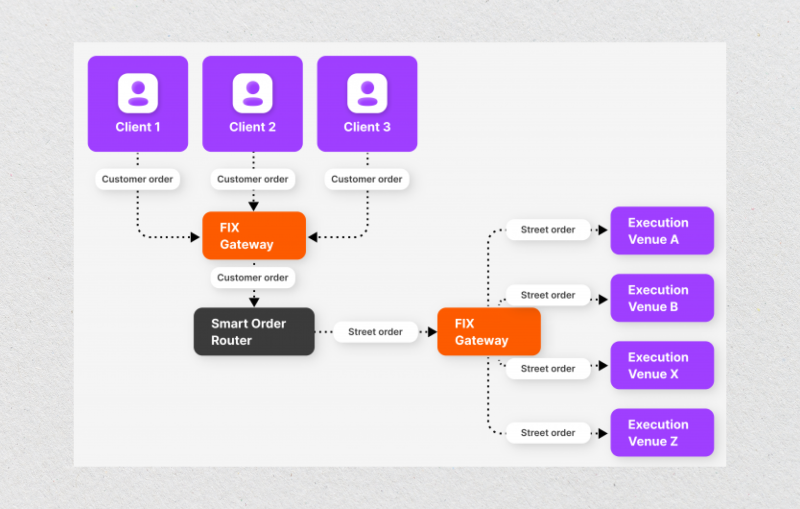

One of the most underestimated liquidity challenges for many new exchanges is the absence of professional-grade aggregation technology. Without a robust liquidity aggregator, incoming orders are routed blindly to a single LP or a basic price feed—missing out on better pricing and stronger execution possibilities available through multiple sources.

Liquidity aggregation technology serves the critical purpose of allowing exchanges to aggregate feeds from multiple LPs, optimize spread mixing, and smartly divide orders by price and volume availability.

Without it, the exchange will fail to handle large or complicated orders efficiently, leading to order rejections, failed trades, or customer disappointment. Worst of all, user orders might be sent to suboptimal quotes, losing traders real money and hurting the platform’s reputation.

These liquidity challenges most often stem from budgetary considerations or the strategic decision to build on lean, bare-bones trading engines with no support for aggregation. Other organizations also overestimate the value of FIX API routing, smart order routing (SOR), or multi-venue quote blending—all standards of the modern age.

Founders occasionally fail to realize the vital importance of these technologies until problems arise. To achieve this, exchanges must incorporate a purpose-designed liquidity aggregator, such as OneZero or YourBourse.

These enable easy connectivity to multiple LPs, sophisticated quote consolidation, and live spread watching. Coupled with smart order routing, the exchange is empowered to send flow dynamically to the best-priced venues—achieving the best execution for users on all asset pairs.

Case Study — How B2CONNECT Addresses Liquidity Problems for New Exchanges

There are often acute liquidity challenges that threaten the competitiveness and rapid growth of newly launched platforms. B2CONNECT, a product of B2BROKER, is a high-performance solution that effectively addresses these challenges through its advanced integrations and features.

To delve deeper into how B2CONNECT can transform your exchange’s liquidity infrastructure, visit the B2CONNECT product page.

Establishing Trustworthy Liquidity Relationships

New exchanges struggle to secure agreements with actual liquidity providers due to the lack of existing infrastructure or trading platforms. B2CONNECT addresses this by providing seamless access to a pool of top-tier liquidity providers, including prominent cryptocurrency exchanges such as Coinbase, Kraken, Crypto.com, and Binance.

The platform supports the best liquidity bridge technology and various connectivity methods, including FIX API, WebSocket, and REST, offering flexible and efficient connectivity to multiple liquidity sources.

Bootstrapping Order Book Depth and Trading Volume

A barrier to entry for newcomers to the world of exchanges is achieving meaningful order book depth and trading volumes. B2CONNECT breaks this barrier by aggregating multiple sources of Level 2 quotes, providing full market depth and competitive price discovery.

In addition, the platform’s synthetic engine enables the creation of customized trading instruments by combining various assets, which helps exchanges launch unique trading pairs and expand their audience reach.

Preserving Liquidity During Market

Market volatility can invoke liquidity dryness, which can have adverse effects on trade execution and consumer confidence. B2CONNECT enhances resiliency through smart order routing, which automatically distributes orders across multiple liquidity sources to achieve the best execution.

The platform also features sophisticated risk management tools, including configurable hedging parameters and real-time monitoring, which help exchanges manage liquidity challenges and control exposure more efficiently in highly volatile market situations.

Conclusion

Liquidity is not a luxury—it’s a non-negotiable component of a high-performance trading platform. From securing reputable lenders to navigating volatile markets, the exchanges that master liquidity win in the long term.

By integrating technologies like crypto liquidity aggregators and intelligent order routing, startups can not only survive their launch phase but also scale with confidence. And with tools like B2CONNECT, they don’t have to face these liquidity challenges alone.

For a personalized consultation and to see B2CONNECT in action, book a demo with the B2BROKER team today.

FAQ

Why is liquidity more important than branding for a new exchange?

Because traders care more about execution and pricing than aesthetics, liquidity drives performance and retention.

Can one liquidity provider be enough to launch?

No—depending on a single LP exposes you to outages, poor pricing, and reputational risk.

What is a crypto liquidity aggregator?

It’s a system that pulls liquidity from multiple sources to give your exchange tighter spreads and deeper books.

How does B2CONNECT help with liquidity during volatility?

It utilizes smart order routing and risk management tools to maintain stable pricing, even in extreme market conditions.