Venmo vs Cash App – Which Is Better?

Dec 22, 2023

The digital payments industry is actively transforming the way people handle their finances. According to recent statistics by McKinsey & Co. U.S., 89% of Americans used digital payments in 2022. Notably, this number rose by 7% compared to the data from 2021. At the same time, 64% of adults use digital payments globally, World Bank Group’s data reveals.

A significant contributing factor to this trend is the popularity of mobile payment apps such as Venmo and Cash App. These two peer-to-peer (P2P) mobile payment applications are the top choices for digital transactions in the US, offering similar features and services for their users. However, when it comes to choosing the best one in certain scenarios – Venmo vs Cash App – which app takes the crown?

Key Takeaways:

- Venmo has a more global reach due to its connection with PayPal’s network, while Cash App focuses solely on domestic transactions within the United States.

- Cash App offers more advanced tools and features for businesses compared to Venmo, including real-time sales tracking and invoices management.

- Both apps offer near-instant transfers to other users within their network, with Cash App having a slight advantage with its “Instant Deposit” feature.

- Factors such as fees, transaction speeds, business features, and security measures should be considered when choosing between the two apps.

What Is Venmo?

Venmo is a P2P payment app available in the U.S. that lets customers send money and receive it digitally, as well as make purchases with approved merchants. Founded in 2009, Venmo has quickly become one of the most popular mobile payment apps, boasting over 80 million users in 2023. In 2014, Venmo was acquired by PayPal, Inc., becoming a subsidiary of the global digital payment giant.

The app has 4.4 stars in the Google Play market, with 730 thousand reviews and more than 50 million downloads as of December 2023. At the same time, Venmo has an almost perfect 4.9 score in the App Store.

What Is Cash App?

Cash App is another P2P mobile payment app that allows users to send and receive money digitally. It was launched in 2013 by Block, Inc., as a competitor to Venmo and PayPal. As of 2023, Cash App has reached an impressive 45 million active users, which represents 16.1% of the US population.

Cash App has a lower rating in the Google Play market with 4.0 stars and over 50 million downloads. In the App Store, 5.6 million users rated the app, with the consensus rating standing at 4.8 stars as of December 2023.

User Interface and Design

Both Venmo and Cash App offer user-friendly interfaces that make it easy for anyone to navigate the app.

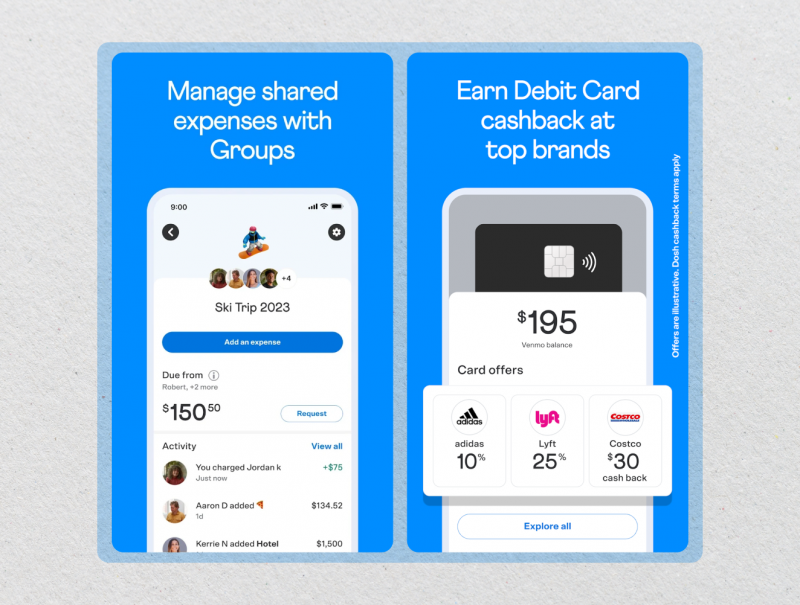

Venmo takes a more social approach with its newsfeed format and the ability to add emojis and captions to payments. The app appeals more to younger generations who enjoy sharing their transactions with friends.

With Venmo, you can choose to make your transactions public and share them with friends or the entire app’s user base. However, if you prefer to keep your transactions private, you can easily switch to a private account.

On the other hand, Cash App has a simple design with its trademark green and black color scheme. It focuses more on functionality rather than aesthetics, making it a preferred choice for users looking for simplicity and effectiveness.

User Identification

On Venmo, your username is used to identify you when sending or requesting money. This username can be customized to your liking, making it easier for friends and contacts to recognize you.

On the other hand, Cash App uses a $Cashtag as a user identifier. This is a unique username that starts with a “$”. Additionally, Cash App allows you to search for individuals or businesses by name, phone number, or email address, providing more options for finding contacts within the app.

Basic Features

Both Venmo and Cash App offer essential features such as the ability to send or request money, set up direct deposits, and use a debit or credit card for payments. However, there are some differences.

For example, while both apps allow users to work with cryptocurrency, Venmo allows for investments in crypto directly through the app. On the other hand, Cash App offers its users the option to purchase stocks and file taxes.

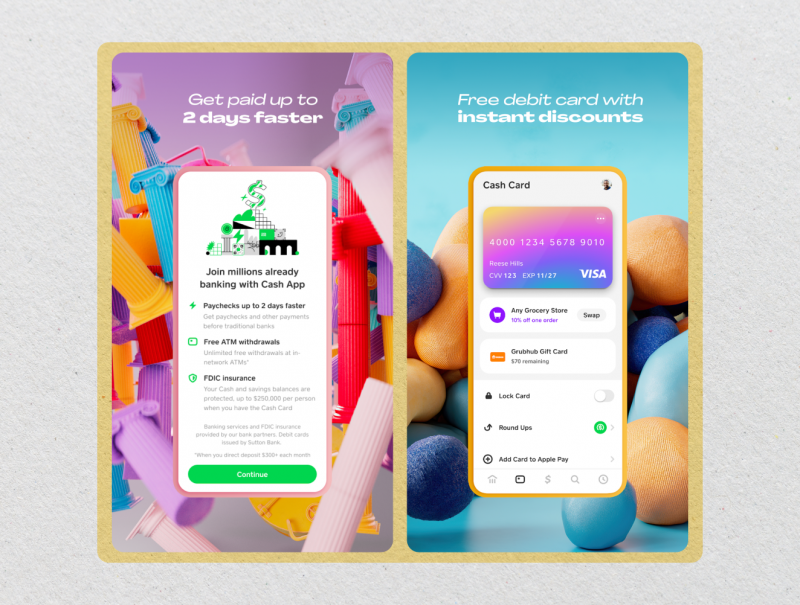

Additionally, Venmo account offers a debit card and credit card option for users to make purchases at select merchants, while Cash App offers a physical debit card – a Cash Card – which is tied to the user’s account, allowing for in-store and online purchases.

One significant difference between Venmo and Cash App is their approach to international transactions. As mentioned earlier, Venmo has a more global reach due to its connection with PayPal’s network. On the other hand, Cash App focuses solely on domestic transactions within the United States.

Banking Capabilities

Venmo and Cash App offer banking capabilities such as setting up direct deposits, which allow users to receive their paychecks or other payments directly into their accounts. This feature is not only convenient but also ensures faster access to funds compared to traditional banks.

However, it’s worth noting that these apps are not actual banks themselves. Instead, they are services that partner with established banks. Account balances held in both apps are insured by the FDIC through their respective bank partners.

Fees and Charges

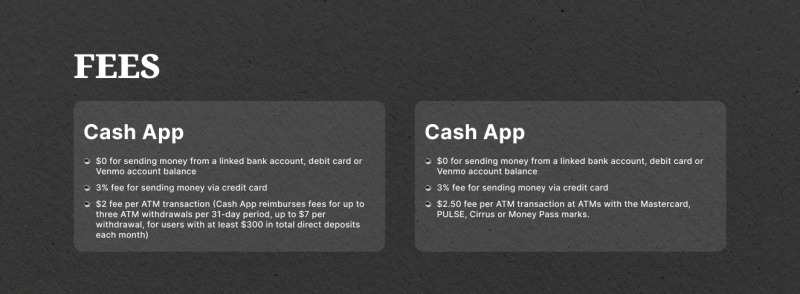

When it comes to fees and charges, both Venmo and Cash App have similar options for free transactions. Sending money through a linked bank account or using your balance incurs no cost on either platform. However, there are differences in fees when it comes to using credit cards.

Venmo charges a 3% fee for transactions made with a linked credit card, while Cash App charges 3% for credit card transactions and a 2.75% fee when accepting credit card payments as a business. There are also differences in fees for instant transfers, with Venmo charging 1.75% (minimum $0.25 fee, $25 maximum fee) and Cash App charging between 0.5% to 1.75% ($0.25 minimum fee).

Business Accounts

Both Venmo and Cash App offer options for businesses, allowing entrepreneurs to receive payments from customers. However, there are differences in how these services charge fees for business accounts.

While Venmo charges businesses a 1.9% fee plus $0.10 per transaction, Cash App charges a higher 2.5% fee for transactions accepted and a 2.75% fee for credit card payments. Another difference is that Venmo business accounts are subject to tax reporting, while Cash App does not mention any implications on their website.

Additionally, Cash App provides businesses with more advanced tools and features compared to Venmo. With Cash App’s ecosystem, business owners have access to real-time sales tracking and the ability to create invoices for clients. This can help streamline the transaction process and make it easier for businesses to keep track of their finances.

On the other hand, Venmo’s business features are more limited and primarily focused on personal use. While businesses can accept payments through Venmo, there is no option for tracking sales or managing inventory.

Transaction Speeds

One of the main concerns when it comes to money transfer apps is transaction speed. Both Venmo and Cash App offer near-instant transfers to users within their network. However, Cash App does have a slight advantage with its “Instant Deposit” feature. This feature allows customers to transfer funds from their Cash App balance to their bank account in seconds for a small fee.

Transaction Limits

Both Venmo and Cash App have transaction limits to prevent fraud and protect their clients. These limits may vary depending on the level of account verification.

Venmo has a $299.99 weekly spending limit for unverified accounts, with a combined weekly spending limit of $6,999.99, including transactions made through the Venmo Debit Card, merchant payments, and person-to-person payments. On the other hand, verified accounts have a $4,999.99 weekly spending limit for P2P payments.

Cash App has a $1,000 sending and receiving limit per 30-day period for unverified accounts. Users can increase their limits by verifying their account with additional personal information, such as their full name and social security number, potentially gaining access to higher sending and receiving limits.

Security

In terms of security, Cash App and Venmo both take it seriously:

Encryption Technologies

Both apps use state-of-the-art encryption technologies to protect your personal and financial information. This means that all data transmitted through their platforms is encrypted, making it extremely difficult for anonymous individuals to access or intercept your sensitive information.

Two-Factor Authentication

Cash App and Venmo also offer two-factor authentication as an extra layer of security for their users. In addition to entering your password, you will also need to provide a one-time code sent to your registered device before gaining access to your account.

App Access

While both Cash App and Venmo offer 2F authentication for login, Cash App goes further by giving users the option to set a PIN or use fingerprint identification for app access.

Venmo vs Cash App – Key Points

While both services have similar functionality and purpose, there are some differences and commons between the two that may impact your decision on which one to use. Let’s take a look at the key points:

- Free download and usage – Both Venmo and Cash App offer free download and do not charge any fees for creating an account or using the basic features of the app.

- Debit and credit card options – Both apps have debit card features that enable people to make purchases at authorized merchants. Additionally, Venmo offers credit cards, unlike Cash App. Cash App offers the option to link a credit card for payments, although this comes with a 3% fee.

- Instant P2P transfers – One of the main advantages of both Venmo and Cash App is their ability to instantly transfer money between users within their respective platforms. This makes it convenient for splitting bills, paying back friends, or making quick transactions.

- Direct deposit capabilities – Both Venmo and Cash App have direct deposit capabilities, allowing customers to receive their paychecks or government benefits directly into their accounts. This eliminates the need for physical checks and adds convenience.

- Tax filing feature – Cash App offers a unique feature called “Cash App Taxes”, which allows users to file their taxes for free. Venmo does not currently offer a similar feature.

- Investment opportunities – Cash App users can invest in stocks and Bitcoin, providing an additional avenue for financial growth. Venmo does not offer this feature, but it gives its customers the option of paying with cryptocurrency.

- Inability to cancel authorized transactions – Both Venmo and Cash App do not allow customers to cancel transactions, meaning that users cannot reverse payments made to other users or merchants. This can be a drawback in cases of fraud or mistaken transactions.

- No international transactions – Venmo does not allow for international money transfers, limiting their usefulness for those who frequently make global transactions. At the same time, Cash App allows for certain international transactions.

What Is Better: Cash App or Venmo?

In the end, whether Cash App or Venmo is better for you will depend on your specific needs and preferences. If you are primarily looking for a personal money transfer app with no fees and instant transfers, both apps would be suitable. However, if you also want features such as investment opportunities and tax filing capabilities, or if you own a small business and need advanced features, Cash App may be the better option.

At the same time, Venmo may be a better choice if you want to pay for purchases using a credit card or if you prefer the social aspect of the app, with features like splitting bills and requesting money from friends.

Both apps have their strengths and weaknesses, but at the end of the day, they both provide convenient and secure ways to transfer money and manage finances on the go.

FAQs

Can Cash App be used internationally?

No, Cash App can only be used for payments inside the US. Other countries and currencies are not supported by Cash App. Both the sender and recipient must have their own Cash App account in order to make cross-border payments.

Is Cash App safer than Venmo?

Both Cash App and Venmo are considered to be relatively safe when it comes to transferring money. However, it is important to note that there are inherent risks involved with any money transfer app. The best way to ensure the safety of your funds is to use a strong and unique password, enable two-factor authentication, and be cautious when sending money to unfamiliar individuals or businesses.

Is Venmo better than PayPal?

No, Venmo is not necessarily better than PayPal, as they both have their own unique features and are designed for different purposes. However, PayPal may be a better choice for small businesses due to its ability to have multiple team members access the payment processing platform. On the other hand, Venmo may be a better choice for sole proprietors who want a simple way to charge clients and accept payments.