What Is Altcoin Season Index? When Will Altcoins Outperform Bitcoin?

Nov 25, 2024

In November 2024 alone, the crypto market cap surged by $360 billion, with altcoins driving 40% of that explosive growth—a clear hint that altcoin season could be just around the corner. Known for turning small investments into massive gains, altcoin season takes place when alternative crypto assets outperform Bitcoin in both price growth and trading volume.

But how can you tell when the altseason is really here? A key tool for spotting these shifts is the Altcoin Season Index, which tracks how altcoins are performing against Bitcoin—making it easier to catch the wave before it peaks.

Key Takeaways

- The Altcoin Season Index shows whether the market is shifting toward altcoins, with readings above 75% indicating a confirmed altseason.

- Historical altcoin seasons in 2017-2018 and 2020-2021 show that these cycles can bring significant gains, especially in trending sectors like meme coins.

- Key strategies for the altcoin season include monitoring trading volumes, setting entry/exit points, and diversifying investments across promising altcoins.

What is Altcoin Season?

Altcoin season, often called “altseason,” is a period in which altcoins—cryptocurrencies other than Bitcoin—see strong price increases and gain market dominance over Bitcoin. In months, altcoins can see prices double, triple, or more as investors flock to promising projects, from established names like Ethereum and Solana to speculative meme coins.

Altcoin season typically comes with three main trends:

- Soaring Altcoin Prices: Altcoins surge in value, often outpacing Bitcoin, with some seeing gains of over 100% within weeks.

- Spike in Trading Volume: Investors flock to altcoins, boosting trading volumes, which in turn supports higher liquidity for these assets.

- Shift in Market Sentiment: As excitement builds, investor focus moves from Bitcoin to altcoins, driven by the prospect of higher returns for those ready to take on more risk.

Why Altcoin Season Offers High Rewards—and High Risks

Altcoin season can lead to massive profits, but the volatility can be intense. With smaller market caps, altcoins are often highly reactive to market sentiment, which can lead to rapid, unpredictable swings. The rewards can be substantial for those attuned to the early signs of altseason, but gains can disappear just as quickly without caution.

During Bitcoin season, on the other hand, BTC dominates both trading volume and investor interest, providing a more stable yet potentially less lucrative environment for those seeking high-risk, high-reward opportunities.

Altcoin Season vs. Bitcoin Season

Bitcoin and altcoin seasons represent distinct phases within the crypto cycle, each with its unique dynamics:

Bitcoin Season

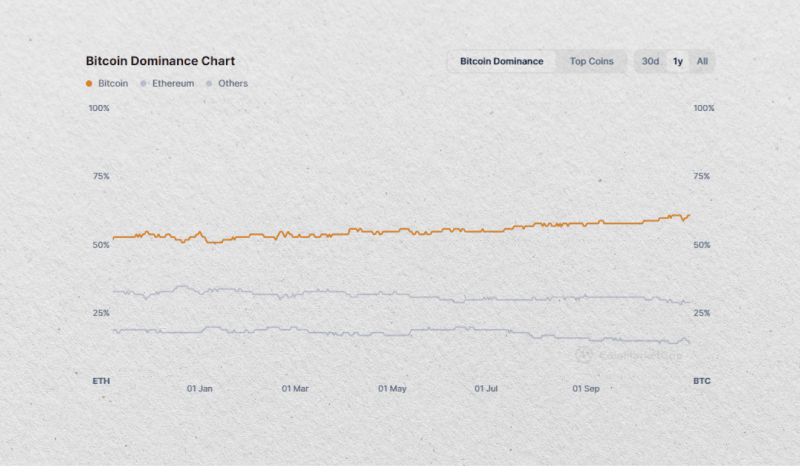

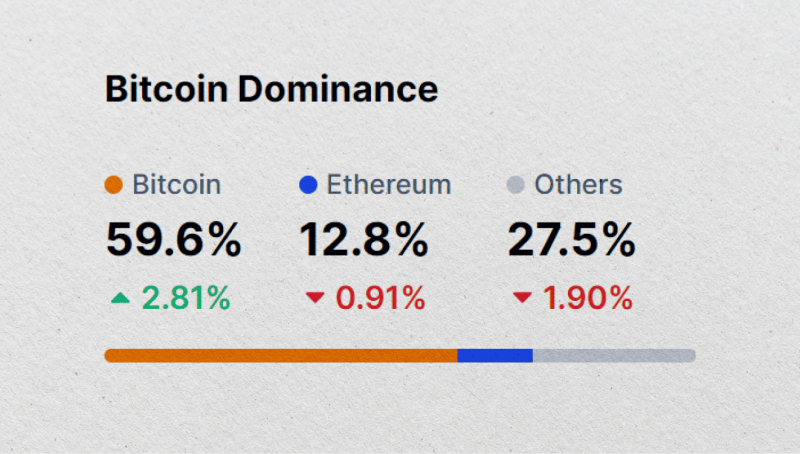

In Bitcoin season, Bitcoin experiences rapid growth and commands the market, often with a steady increase in trading volumes, market share and interest from institutional investors. For example, the price of crypto gold recently surged to a new all-time high of $93,400, driven by a combination of factors: the approval of Bitcoin ETFs earlier this year, the Bitcoin halving event in April, and the U.S. elections—all of which boosted its market dominance above 60%.

Bitcoin season is typically more stable; its strong reputation and broad acceptance make it a relatively “safe” choice among cryptocurrencies, especially during economic uncertainty or when investors hesitate to invest in more volatile altcoins.

Altcoin Season

By contrast, altcoin season marks a shift toward alternative cryptocurrencies. During the altseason, speculative interest in altcoins rises, with many projects seeing extraordinary gains. In 2020-2021, altcoin dominance in the market rose from 30% to over 60%, fueled by meme coins like Dogecoin and Shiba Inu.

Both market cycles have their own set of opportunities and challenges for investors. In Bitcoin season, investors often take a more conservative approach, holding BTC for steady gains. However, investors may diversify into promising altcoins during the altseason, often chasing higher returns in exchange for greater risk.

The Altcoin Season Index: How It Works and Why It’s Important

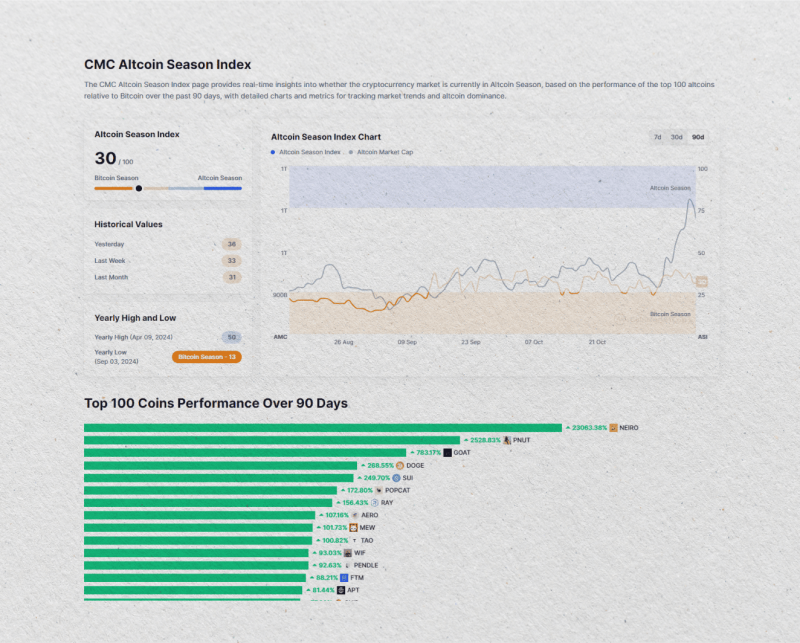

The Altcoin Season Index is a tool to help investors determine whether the market is shifting toward altcoins. It monitors the performance of the top altcoins compared to Bitcoin over the past 90 days, offering an aggregated view of market sentiment.

The Altcoin Season Index is based on several key factors:

- Altcoins/Bitcoin Relative Performance: If most altcoins (over 75%) have outperformed Bitcoin over a given period, the index considers it an altcoin season.

- Trading Volumes: The index also takes into account trading volumes. When altcoin trading volume significantly increases, it reflects higher demand and market liquidity.

- Market Dominance: Market dominance is a share of the total cryptocurrency market cap held by altcoins versus Bitcoin. When altcoins capture a greater market cap share, it indicates rising investor interest and a shift toward the altcoin season.

How to Read Altcoin Season Index?

The Altcoin Season Index provides different readings to indicate market conditions:

- Above 75%: Strong indication of an altcoin season.

- Between 25% and 75%: Mixed market, with solid performance from both Bitcoin and select altcoins.

- Below 25%: Sign of Bitcoin season dominance.

Platforms for Tracking the Altcoin Season Index

Popular platforms for monitoring the Altcoin Season Index include:

- Blockchain Center: One of the most popular platforms, Blockchain Center, offers a dedicated Altcoin Season Index chart that tracks the performance of the top 50 altcoins compared to Bitcoin.

- CoinMarketCap: CoinMarketCap also offers an Altcoin Season Index that covers a broader range of 100 altcoins. In addition to tracking dominance shifts, CMC provides details like yearly highs and lows in the Altcoin Index, detailed charts and metrics and a visually appealing interface.

With the current index around 35% (30% as per CMC), altcoins show some strength, but Bitcoin remains dominant as of November 2024. Investors can better gauge market sentiment and plan when to enter or exit altcoin positions by keeping an eye on this index.

Historical Altcoin Seasons: Key Trends and Lessons Learned

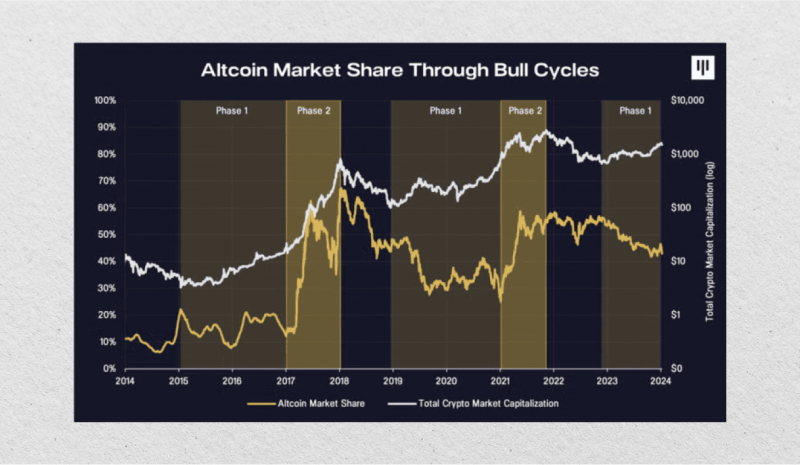

To better understand the current market, let’s look back at some of the most significant altcoin seasons in recent years and examine the trends and patterns that drove these surges. History shows that altcoin seasons often coincide with Bitcoin’s price consolidation or decline, during which investors seek new growth in altcoins.

2017-2018 Altcoin Season: The ICO Boom

The altcoin season of 2017-2018 was fueled by the rise of Initial Coin Offerings (ICOs), a popular fundraising method where blockchain projects launched their tokens for public investment. In this period, Bitcoin’s dominance dropped from 86.3% in late 2017 to as low as 38.69% at the start of 2018. Bitcoin’s price surged to nearly $20,000 by late 2017, only to fall below $6,000 by early 2018.

During this phase, altcoins gained rapid traction. Ethereum, for instance, grew from around $8 in early 2017 to over $1,400 in January 2018, mainly due to its position as the primary platform for ICOs. High-profile ICOs, like EOS and Tezos, raised substantial sums—EOS raised over $4 billion, and Tezos raised $232 million. However, as ICO projects attracted scrutiny from regulators, many projects failed to deliver, leading to a subsequent market correction and a steep decline in altcoin prices.

2020-2021 Altcoin Season: Rise of Meme Coins and NFTs

The next major altcoin season occurred in 2020-2021, marked by the COVID-19 pandemic, low interest rates, and increased interest in alternative investments. As Bitcoin’s price surged to new highs, peaking at $64,000 in April 2021, its market dominance dropped from around 70% to approximately 38% as investors poured into altcoins seeking high returns.

This era witnessed the rise of meme coins like Dogecoin (DOGE) and Shiba Inu (SHIB), which saw unprecedented gains driven by community enthusiasm and celebrity endorsements like Elon Musk. Dogecoin surged from less than $0.01 to over $0.60 by May 2021. The boom in non-fungible tokens (NFTs) also played a role, as projects like Ethereum and Solana benefited from the widespread adoption of NFTs.

Signs of an Approaching Altcoin Season

With the cryptocurrency market cycle, identifying the onset of an altcoin season can be challenging. However, several key indicators often signal a shift from Bitcoin dominance to altcoin dominance.

Altcoin Dominance Takes Center Stage

One of the clearest signals of altcoin season is a jump in altcoin dominance within the crypto market. As of the time of writing, Bitcoin holds a commanding 60% share, but if altcoin dominance starts to grow, keep an eye out — when Bitcoin’s dominance dips below 50%, it’s often a sign that investors are shifting focus to altcoins with higher growth potential.

Altcoin Trading Volumes Surge

When trading volumes for altcoins start climbing across major exchanges, it’s a strong sign of rising interest. Currently, stablecoins like Tether (USDT) and major assets like Bitcoin and Ethereum dominate trading volumes, but if you see smaller altcoins gaining traction, it’s often due to heightened speculative interest and liquidity—two critical components of a true altseason.

Price Breakouts Across Major Altcoins

If key altcoins begin breaking through resistance levels, it’s a sign that momentum is building. Recently, Solana (SOL) cracked the $200 barrier, and coins like Avalanche (AVAX) and Shiba Inu (SHIB) have been gaining over 50% in short periods. These sharp, sustained breakouts across various altcoins often signal that the market is shifting in their favour.

Shifts in Investor Sentiment and Behavior

When retail and institutional investors start eyeing altcoins over Bitcoin, it’s a strong indicator of an approaching altseason. As Bitcoin’s growth slows or consolidates, retail traders (and crypto “degens”) typically pivot to altcoins for their higher return potential. If “smart money” also moves in this direction, it’s a strong signal that altcoin season could be on the horizon, with institutional interest lending stability to the market.

Why 2025 Could Spark the Next Altcoin Season

With market conditions aligning, 2024 and 2025 might bring the long-awaited altcoin season, unleashing a wave of gains across alternative cryptocurrencies. Here’s why the stage is set for altseason to kick off:

1. Bitcoin’s Recent Price Surge

Bitcoin has rocketed to an all-time high of $93,400, drawing billions from institutional investors and pushing Bitcoin dominance over 60%. But as Bitcoin’s price stabilises, history suggests that investors may soon look to altcoins for even bigger returns. This “spillover effect” often follows Bitcoin’s peak performance as traders seek the next high-growth opportunity among altcoins.

2. Altcoin ETFs and the Ripple Effect for Altcoins

While Bitcoin spot ETFs created the precedent, the Ethereum-based ETFs were also approved earlier in 2024. Analysts predict Ethereum could climb to $4,500-$5,000 as new capital flows in. When major altcoins like Ethereum gain this level of traction, it’s often a launchpad for other altcoins, creating a ripple effect that drives widespread altseason momentum.

3. U.S. Economic Policy and Interest Rate Cuts

The Federal Reserve’s hints at potential interest rate cuts could make 2025 a golden year for high-risk assets like cryptocurrencies. Lower rates mean investors are less interested in bonds or savings accounts, prompting them to explore alternative investments with higher returns, like crypto. The last altcoin season in 2021 was spurred in part by low rates, and a similar environment now could set altcoins up for another major run.

4. Pro-Crypto Policy Shifts and U.S. Elections

With Donald Trump’s victory, the recent U.S. election has revived optimism in the crypto space. Trump’s pro-crypto policies, including his vision for a federal Bitcoin reserve and support for mining, are fueling market confidence.

Expected regulatory changes under his administration, including potentially replacing SEC Chair Gary Gensler, could ease pressures on crypto markets. This positive regulatory outlook not only boosts Bitcoin’s standing but could also trigger fresh enthusiasm for altcoins, particularly as meme coins celebrating Trump’s victory gain traction.

Altcoin Season Strategies

When the altcoin season starts, timing can make all the difference. With smart strategies in place, investors can ride the altseason wave to gain maximum returns with minimal risk. Here’s how to position yourself to catch the next big moves:

Keep a Close Eye on the Altcoin Season Index

Currently, at around 35%, the Altcoin Season Index suggests we’re not quite there yet, but any move above 75% signals full-blown altseason mode, meaning altcoins are outpacing Bitcoin consistently. By tracking this index, you can catch early signs and make moves just as the market sways towards altcoins.

Diversify Into High-Potential Altcoins

Altseason often lifts a variety of altcoins, but certain types are usually at the forefront. To capitalise on the season’s hottest performers, consider focusing on these tokens:

- Platform Coins like Ethereum (ETH), Solana (SOL), and Cardano (ADA) benefit from vast ecosystems and strong development support.

- Meme and Community-Driven Coins like Dogecoin (DOGE) and Shiba Inu (SHIB) often see sharp spikes in popularity during the altseason. While these can be highly speculative, small allocations could yield big returns.

- DeFi and GameFi Tokens attract interest for their real-world applications and innovative tech.

Diversifying among these types lets you capture the full spectrum of altcoin season, balancing the risk across multiple sectors.

Track Trading Volume and Liquidity Surges

When trading volumes surge, it signals a rise in interest and liquidity, making buying and selling quickly easier. As of this writing, Tether (USDT) and Bitcoin lead in trading volume, but Solana, Dogecoin, and Sui also show increased activity. Rising volume is a green flag that demand is building—follow these trends to spot where breakouts might occur, and you’ll be one step ahead.

Set Smart Entry and Exit Points

Volatility during altcoin season can be thrilling—but it’s also a double-edged sword. Define clear entry and exit points to protect profits and avoid impulsive decisions. For beginners, taking profits incrementally as prices rise can be wise, allowing you to lock in gains while staying invested. Many traders use stop-loss orders and target prices to keep emotions out of it and secure profits even during rapid price swings.

Use Technical Indicators to Read the Market

Altcoin season is fast-moving, and technical indicators can give you a decisive edge. Monitor indicators like the Moving Average Convergence Divergence (MACD), Relative Strength Index (RSI), and Bollinger Bands. For instance, a high RSI might indicate an overbought coin, while a MACD crossover could signal a bullish trend. In a volatile altseason, these indicators help you read market momentum and catch the next breakout before it happens.

Conclusion

With Bitcoin’s recent surge and a pro-crypto U.S. landscape, 2025 is shaping up to be a promising year for altcoins. The alt season offers an exciting potential for impressive returns but demands smart strategy and timing. Stay ahead of market shifts and act wisely by watching key metrics such as the Altcoin Season Index, volumes, and others.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Crypto investments are highly volatile and risky. Please conduct thorough research and consult a financial advisor before making any investment decisions.

FAQ

When does the altcoin season start?

Altcoin season doesn’t follow a set schedule and can be triggered by various factors. Typically, it happens after Bitcoin rallies and begins to consolidate or stabilise, leading investors to explore altcoins for potential gains.

What happens to Bitcoin during the alt season?

During altcoin season, Bitcoin’s price growth often slows, and its market dominance may decline as traders shift their focus and capital toward altcoins.

How do I know which altcoin is pumping?

Price and trading volume are key indicators of an altcoin’s momentum. Monitoring platforms like CMC or CoinGecko and real-time volume charts can reveal which altcoins are experiencing price hikes and rising activity.

How long will the alt season last?

There’s no exact duration for altcoin season—it can range from a few weeks to several months. While past altseasons have generally been brief, some analysts speculate that future altseasons could extend over longer periods as the crypto market matures.