What Is COTI? Payments, Token & Price Prediction

June 23, 2025

COTI is not an ordinary crypto token, but an infrastructure for digital money — fast, scalable, and ready for enterprise use. In May 2025, COTI was selected as a Pioneer Partner in the European Central Bank’s Digital Euro project, tasked with showcasing privacy-focused payment technology.

So, how exactly does the project work, and where is it headed?

Key Takeaways:

- It operates as a Layer 1 blockchain that uses DAG technology to provide fast, scalable, and low-cost payments.

- Its ecosystem includes payment tools, a staking Treasury, stablecoin infrastructure, and token issuance via MultiDAG.

- The native token $COTI powers fees, staking, and governance within the network.

What Is COTI?

COTI, which stands for ‘Currency of the Internet,’ launched in 2017 as a Layer 1 blockchain. It was built specifically to support practical digital financial applications, such as retail payments, stablecoins, and frameworks for national digital currencies.

What truly sets COTI apart from many traditional blockchains is its architecture. It is based on a Directed Acyclic Graph (DAG), a structure that allows the network to confirm thousands of transactions per second. This approach avoids the high fees and delays that often hinder conventional blockchain networks.

COTI’s main focus is providing the core infrastructure to create and manage digital money systems. To do this, it gives merchants, financial institutions, and developers a specific set of tools. With these tools, they can introduce their own payment solutions that are efficient and customizable.

Why Does It Called “Currency of the Internet”?

COTI positions itself as a digital-native foundation for payments, designed to move money across the internet as efficiently as data. It removes intermediaries, reduces costs, and provides near-instant confirmation times.

At its core is the Trustchain protocol. This consensus model ranks users and nodes by trust scores, helping the network prioritize legitimate activity and maintain security without compromising speed.

By supporting both fiat and crypto assets, COTI creates a flexible environment. The architecture is modular, allowing banks, fintech companies, and even governments to tailor payment systems to specific needs.

Who Is COTI Built For? Real-World Use Cases That Matter

- Merchants can use COTI Pay to accept crypto, stablecoins, and fiat in one system, reducing complexity and transaction costs.

- Banks and fintech providers can issue branded stablecoins on COTI’s infrastructure, with full control over compliance, issuance, and distribution.

- Governments can use COTI to develop central bank digital currencies (CBDCs) or local digital units with configurable monetary logic.

- Developers get access to a full tech stack for building decentralized apps, integrating payment flows, or launching financial tools.

COTI Coin & Tokenomics

COTI’s native token, $COTI, plays a central role in keeping the ecosystem functional and secure. It’s not just a tradable asset — it fuels transaction processing, staking rewards, governance voting, and node operations across the entire network.

$COTI is used by everyday users, merchants, validators, and developers. This consistent demand across all layers of the system gives the token clear and measurable utility — a key point for any investor evaluating long-term potential.

Use Cases That Go Beyond Speculation

$COTI is designed with multiple real-world functions in mind. Its use isn’t limited to speculation — it’s a working token within an operational network.

Key utilities include:

- Paying for transaction and network fees

- Staking into the Treasury to earn rewards

- Voting on governance proposals using gCOTI

- Operating or delegating to Trustchain nodes

This utility-driven model supports internal token demand and aligns economic incentives throughout the ecosystem.

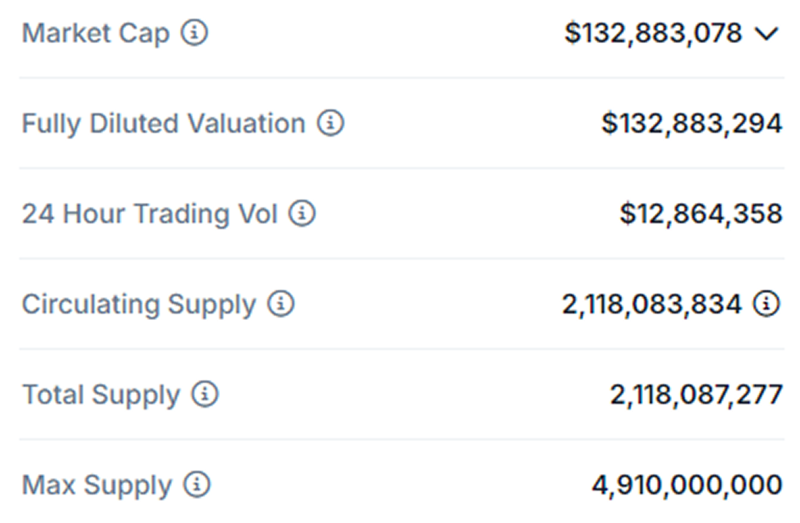

A Closer Look at the Token Supply

Understanding token supply is essential for assessing scarcity and inflation risk. As of now, the token metrics are as follows:

A capped supply with controlled token emissions helps reduce long-term inflationary pressure. Combined with staking and Treasury lockups, this creates a tighter supply over time — an important aspect for value preservation.

gCOTI: Where Utility Meets Governance

gCOTI is a non-tradable token distributed to Treasury stakers. It allows users to:

- Vote on protocol changes and proposals

- Influence Treasury operations

- Signal priorities for future development

A total of 1 billion gCOTI has been minted, with gradual release through on-chain activity. This model emphasizes earned governance over token buying, increasing decentralization.

Treasury Staking: Incentives with Built-In Commitment

COTI’s Treasury is the primary mechanism for staking. Participants lock up tokens and earn rewards based on overall network activity and Treasury balance. The longer the lock period, the better the yield.

Beyond returns, staking is also tied to governance. Users who stake receive gCOTI, a governance token that gives them a voice in the protocol’s evolution.

This structure rewards long-term holders and builds a more stable, community-driven ecosystem.

Latest Market Stats: What Traders Should Know

As of the start of June 2025, COTI’s live market indicators are:

- COTI Price: ~$0.0639 USD

- COTI coin market cap: ~$145 million USD

- 24h volume: ~$10 million USD

These figures reflect moderate liquidity and sustained investor interest. While COTI is not a top-50 asset by market cap, it maintains consistent exchange activity, which is crucial for entry and exit flexibility.

The Technology Behind COTI

Let’s take a closer look at the technology that powers the Currency of the Internet.

Why COTI Doesn’t Use a Traditional Blockchain

Most blockchains rely on blocks and miners. But this model quickly runs into problems when transaction volume increases. Network congestion, slow confirmations, and high fees are common. COTI addresses these issues by utilizing a Directed Acyclic Graph instead of a traditional blockchain.

COTI’s DAG, called the Cluster, doesn’t rely on blocks at all. Instead, each new transaction confirms two previous ones. This creates a network that grows horizontally, not linearly, allowing for faster, cheaper, and more scalable payments with no bottlenecks.

Trust Is the New Consensus: Introducing Trustchain

COTI uses a consensus algorithm called Trustchain. It doesn’t depend on proof-of-work or proof-of-stake. Instead, it evaluates every network participant based on a dynamic “trust score” — a rating calculated using historical behavior and transaction quality.

When a transaction is submitted, it selects two others with similar trust scores for confirmation. This system rewards honest actors. The higher your trust score, the faster and cheaper your transactions are. Bad actors are naturally deprioritized.

Proof of Trust: A Smarter Way to Secure the Network

To secure the network, COTI combines its Trustchain protocol with a lightweight proof-of-work mechanism. It’s called Proof of Trust. This hybrid model maintains the system’s speed and energy efficiency while still deterring spam and manipulation.

The key innovation here is balance. Trust drives the logic of the network, while minimal computation backs it with cryptographic certainty. Together, they offer strong security without excessive power consumption or slowdowns.

Designed for Scale: 100,000 Transactions per Second

COTI was built with one goal in mind — scale. Its infrastructure can handle over 100,000 transactions per second. That’s more than Visa or Mastercard in peak conditions, and far beyond what most crypto networks can deliver.

This performance makes COTI suitable for both consumer payments and enterprise-grade financial systems. The network doesn’t slow down as demand increases. In fact, it performs better the more it’s used — a rare trait in decentralized architecture.

COTI Ecosystem & Products

These products are designed to support real-world applications, from retail payments to enterprise infrastructure. Here’s a closer look at the most important parts of the COTI ecosystem:

- COTI Pay: Fast, Flexible Payments for Any Business

Merchants who use COTI Pay, the project’s main payment platform, get a single solution for processing transactions. They can accept payments not only in cryptocurrencies and stablecoins but also in traditional fiat money. The system works for both online sales and in-person purchases, making it a versatile tool for e-commerce sites and retail stores.

- Treasury 2.0: Where Staking Meets Governance

The COTI Treasury provides a way for users to earn rewards. This is done by locking their COTI tokens in its decentralized pool. The platform’s next version, Treasury 2.0, adds another layer to this system: governance. A utility token called gCOTI is what enables this governance function. Holders of this token are given voting rights on any proposed upgrades or changes to the ecosystem.

- MultiDAG 2.0: Create Your Own Token

The MultiDAG 2.0 protocol gives various users the ability to create custom tokens. This includes enterprises, project teams, and individual developers. Any tokens they create will run on COTI’s core infrastructure. These can be designed for many purposes, including as stablecoins, payment tokens, loyalty points, or even CBDCs.

- Djed: A New Breed of Stablecoin

Another key product is Djed, an algorithmic stablecoin that is overcollateralized. COTI developed it in partnership with Cardano. The stablecoin is specifically engineered to hold its price steady. It does this by using smart contracts and collateral reserves, a method well-suited for DeFi protocols.

How to Buy & Store COTI Safely

Buying COTI is a straightforward process, but it starts with choosing the right exchange. Most reputable platforms support $COTI trading pairs, and the token is actively traded with solid daily volume.

To buy COTI securely:

- Register on a reliable exchange (Binance, KuCoin, Kraken)

- Complete identity verification (KYC)

- Deposit funds (USD, EUR, BTC, or ETH)

- Find a COTI trading pair (e.g., COTI/USDT)

- Execute the purchase

- Transfer the tokens to a personal wallet

This final step — moving funds off-exchange — is often overlooked but critical for security.

Where to Store COTI After Purchase

After you buy COTI, you’ll need a safe place to store it. The right wallet depends on whether you hold COTI on Ethereum (ERC-20) or as a native asset on the Trustchain network.

Consider these options:

- Hardware wallets: Ledger Nano S/X, Trezor (for highest security)

- Software wallets: Trust Wallet, Exodus, MetaMask (user-friendly)

- COTI Pay Wallet: Required for native $COTI (Trustchain version)

Each offers different levels of convenience, but offline (cold) storage remains the most secure.

Protecting Your COTI: Security Tips That Matter

Cryptocurrency storage comes with responsibility. To avoid common risks, follow these simple but effective security practices:

- Enable two-factor authentication (2FA)

- Use strong, unique passwords

- Never share private keys or seed phrases

- Watch out for phishing websites and emails

- Regularly update your wallet and antivirus software

By taking basic precautions, you significantly reduce the risk of loss, whether from hacking, scams, or mistakes.

COTI Price Prediction & Analyst Forecasts

Buying and storing COTI is only part of the equation. For investors, understanding what the market expects (and why) is just as important.

Where Might COTI Go in 2025? Analysts Weigh In

Forecasts for COTI in 2025 vary widely. Some analysts see modest growth, while others expect a breakout if adoption accelerates. Coinfomania projects a trading range between $0.0722 and $0.12, with an average near $0.108, based on machine learning models and historical performance.

CryptoPredictions offers a more cautious outlook, estimating a high of $0.1109. Gate.io’s price tool suggests a conservative target of $0.0864. In contrast, BeInCrypto cites technical indicators that point to a potential rally toward $0.8595 — assuming strong market support.

What About the Long Term? A Look Toward 2030

Some long-range forecasts are more optimistic. CoinLore places COTI’s 2030 target at $1.43, reflecting strong projected growth. CryptoPredictions is more reserved, expecting a maximum of $0.845. DigitalCoinPrice offers a middle-ground view, placing the 2030 estimate at $0.33.

As always, these figures are speculative — useful as reference points, not guarantees.

What Could Influence COTI’s Future Value?

Several factors will likely shape how COTI performs over time:

- Adoption of COTI Pay and Treasury staking

- Institutional and government partnerships

- Overall market sentiment toward altcoins

- Execution of COTI’s long-term roadmap

Market conditions will change — and so will these projections. But understanding the logic behind them helps frame risk and opportunity.

Risks, Challenges & Competition

Knowing how to buy and store COTI is only part of the picture. Before making any investment decision, it’s essential to understand what could go wrong.

- Volatility: A Constant Factor in Crypto Markets

Like most digital assets, COTI is exposed to market volatility. Price swings may be driven by broader investor sentiment, macroeconomic news, or changes in liquidity. While this creates potential for gains, it also increases risk — especially for short-term holders.

COTI’s market capitalization remains relatively small. This can result in limited liquidity on some trading pairs, which may impact execution and slippage during high-volume periods.

- Security and Regulation: Core Risks to Watch

Blockchain systems aren’t immune to cyber threats. While COTI hasn’t faced major breaches, any future vulnerability could damage user confidence and adoption.

Equally important is regulation. COTI’s involvement in payment infrastructure and stablecoins means it must navigate evolving compliance standards across jurisdictions, especially in the EU and the US.

- Reliance on Technical Execution

COTI’s success hinges on its underlying technology. Features like DAG, Trustchain, and MultiDAG must remain secure, scalable, and properly maintained.

Any delays in roadmap execution or major technical failures could slow adoption or give competitors time to leap ahead.

- Facing the Competition: Who Else Is in the Race?

COTI competes in a growing field of blockchain-based payment systems and fintech platforms. Key rivals include:

- Radom – focuses on B2B crypto billing

- Tempo – specializes in fiat-to-crypto payments

- GetAntic – offers data monetization via blockchain

Each competitor has a different angle, but all target similar markets. COTI’s edge lies in its full-stack approach, but staying ahead won’t be automatic.

Final Thoughts

COTI is building infrastructure for digital finance. Its approach is different from traditional blockchains, relying on DAG technology and a trust-based system to improve speed, scalability, and efficiency. The project targets real use cases like payments, stablecoins, and enterprise tokenization.

For investors and traders, COTI offers both potential and uncertainty. The ecosystem is growing, and the technology is sound; however, risks remain, particularly in areas such as regulation, market competition, and execution.

Whether COTI will reach broader adoption depends on how well it delivers on its roadmap and how the market responds. As with any emerging technology, a cautious and informed approach is essential.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always do your own research before making investment decisions.

FAQ:

What is COTI coin?

COTI is the native token of the COTI network, a Layer 1 blockchain platform designed for fast, scalable digital payments. The token is used for transaction fees, staking, and governance.

Is COTI coin a good investment?

COTI offers real utility and unique technology, but it also faces market volatility and competition. As with any crypto asset, it should be evaluated based on risk tolerance and investment goals.

What is COTI’s all-time high?

COTI reached its all-time high of approximately $0.68 in September 2021. Since then, its price has followed broader market trends.