What is Finviz Stock Screener? Review & User Guide

Oct 17, 2024

As a trader and stock investor, most of your time will spent staring at price charts and market updates, scrolling through various websites to locate news and insights that will help you make the right call.

Finviz is a one-stop shop for your research and analysis needs, where you can view market information and gain valuable information to adjust your investments. Some describe it as the ultimate trader tool, while others mindfully use it.

So, what is the finviz stock screener? How does it help you make investing decisions? Let’s explore what you can find on this website.

Key Takeaways

- Finviz is a stock screener offering comprehensive price data, market updates, and economic calendars.

- Finviz stock screener offers free and paid membership, with real-time price refresh only available in the paid subscription.

- The finviz.com website incorporates almost 10k stocks in US and global markets.

- Beginner traders and institutional investors use the finviz platform for reliable portfolio management and backtesting.

Understanding Finviz Stock Screener

Finviz is a financial visualization website where you can find stock, crypto, and ETF market news, updates, and charts. The primary focus of stock screener finviz is shares and equities. However, the popularity of crypto trading and ETFs made its way to the website.

There are hundreds of digital assets and thousands of publicly traded companies. There are over 4,000 stock companies in the US alone across NASDAQ and NYSE, making it much more challenging for traders to track and analyze these shares.

However, the digitalization of trading platforms and exchange markets made accessing this information easier and welcomed more participants into this space. At the same time, it made their job more comprehensive, with a huge number of news websites, stock trackers, and investment advisors overwhelming the trader.

Therefore, finviz offers sophisticated access to stock news, updates, analysis, charts, and predictions. It also allows members to build and backtest their trading strategy and manage their portfolios in one place.

Finviz stock screener is trusted by individual traders and institutional investors like BNP Paribas, BNY Mellon, JPMorgan Chase, and HSBC.

How finviz.com Stock Screener Works?

Finviz derives data from trusted sources, such as the New York Stock Exchange and the NASDAQ stock market. It also uses API messaging to retrieve and display updates from market data providers and news aggregators like Thomson Reuters, Bloomberg, Yahoo Finance, and S&P Capital IQ.

It also sources information and reports from the SEC filings to compile publicly traded companies and ETFs in US and global markets.

However, it is not a foolproof source of information, and you must use it with caution. Lagging updates and connectivity issues may arise, and it is advisable to verify the information with other sources.

Who Uses Stock Screener Finviz?

Institutional and professional traders who want to keep track of market news and price updates in one place can use finviz to get a glance at best-performing, overbought, and growing stocks.

Beginners can also use this stock screener to simplify their monitoring process and replace multiple investing websites with a single platform.

How to Use Finviz Stock Screener?

Using finviz for your stock investment portfolio depends on your needs. If you want to simply track market prices and have a general understanding of how stocks are performing, you can have a snapshot from the homepage.

If you want to monitor grouped updates according to business types, country, or market capitalization, you can check the “Groups” tab and track performance data over various timelines.

You can also use the elite subscription to build your portfolio and backtest your investment strategy with members-only tools.

As such, finviz suits different needs, from the sole price tracking purpose to comprehensive performance monitoring and portfolio creation.

Fast Fact

Besides finviz, TradingView, Yahoo Finance, and Stockopedia are the best stock screeners, each offering a different set of trading signals, update rates, and market access.

Benefits of Finviz Stock Screener Website

Finviz is a comprehensive website for stock traders, and although it may get overwhelming, this platform provides various features you can use.

Market Insights

Finviz provides an extensive look into stock news, price updates, and expert analysis. Unlike many finance websites that discuss a broad spectrum of instruments and markets, finviz specializes in equities.

You can sort and locate shares based on performance, group, industry, market, and more with a few clicks to find the information you need as quickly as possible. The homepage offers a comprehensive view of the best stocks, heatmaps, indices performances, and recent price changes.

Additionally, you can find investors’ sentiments and top market charts to make informed decisions.

Stock Analysis

If you prefer in-depth analysis of charts, announcements, and economic events, you can scroll to the “News” tab, where you can find multiple blogs and articles from reliable sources. Check experts’ analytics, earn gainful insights, and find the most recent insider trading transactions to improve your own analysis and market knowledge.

Search and select any stock you want to track, and you can analyze market events, financial statements, historical stock data, and event timelines to understand current trends.

Real-time Updates

The platform retrieves live market data and shows the timestamp for communicated news and releases. This real-time stream makes it suitable for making timely decisions and monitoring the most recent price action.

Nevertheless, it is crucial to be mindful of any possible lags and delays that could affect your decisions. Since finviz works as a third-party provider after receiving data from marketplaces and sources, locating these updates from the main sources could be more reliable.

Interactive Charts

You can display and adjust charts after selecting the stock ticker you want to track. You can find five different chart patterns: Candle, Line, OHLC, Heikin Ashi, and Hollow Candles to improve price visualization.

You can toggle technical analysis, extend the chart timeline, and set the refresh rate to monitor price changes more accurately.

Notification System

Finviz stock screener elite members can utilize the alerts and notification feature to receive a heads-up for selected stock movements and price action. The alert system offers e-mail communications and push notifications for news, announcements, ratings, and new stocks that match the user’s preferences.

User-Friendly Layouts

Finviz makes it easy for users to have a clear understanding of the stock market and price performances without overwhelming charts, congested graphs, and confusing figures.

The basic layouts with a theme selector suit different user preferences. The homepage compresses information from different tabs, giving viewers the headlines on stock, crypto, ETF, indices, heat maps, best/worst performance, and other website categories.

What Can You Find on The finviz Stock Screener?

The finviz free stock screener is a comprehensive website with multiple sections and pages where you can find what you are looking for, whether a specific stock, ETF, or crypto token, or if you want to track the overall market movement.

Let’s review the website’s tabs and what you can find on its web pages.

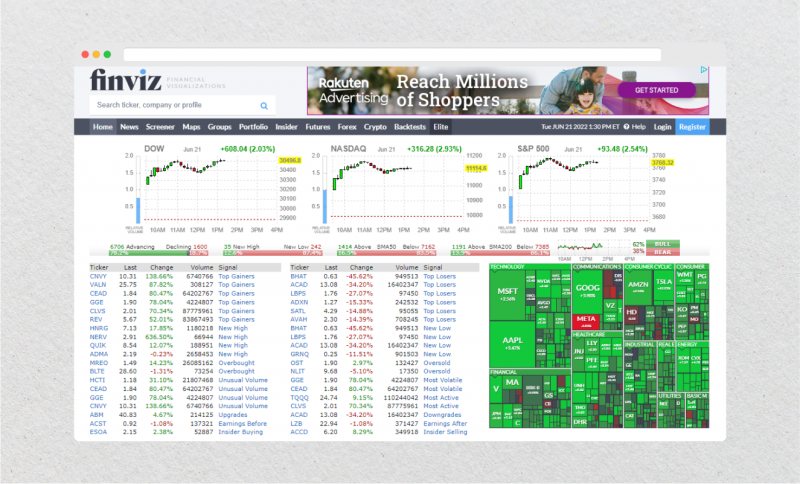

Homepage

The main page provides an overview of the platform’s pages, giving viewers insights into the top 3 indices charts, traders’ sentiment across various markets, gaining and losing stocks over different timelines, and major stock news for Google, Nvidia, Apple, and other blue-chip firms.

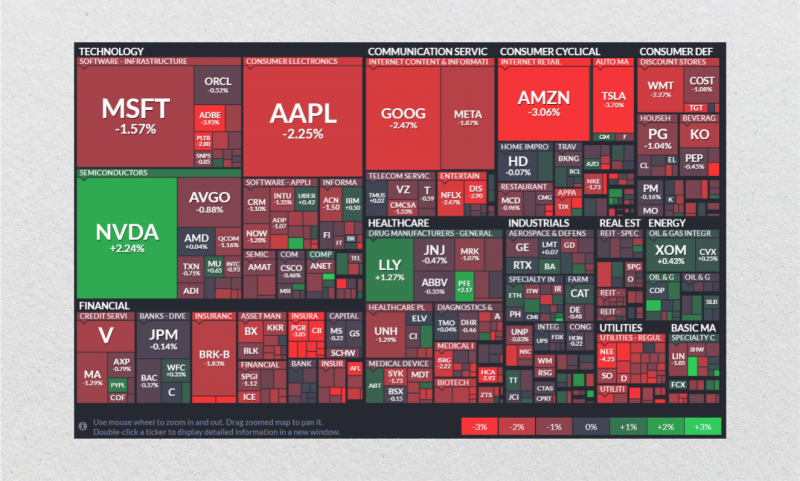

You can also get a quick glance at overall market performance using the heatmap, displaying position liquidation and changes in industries like technology, telecommunications, energy, financial services, etc.

You can also access top blogs and reading material for financial news, top Forex pairs prices, futures contracts, and economic calendars.

News

This section spans all the reading material necessary to understand stock movements, price action, financial announcements, and their impact on markets. You can switch between market, stock, ETF, and crypto news to find what you are looking for.

Each sub-topic has blogs and news articles from reliable sources like Yahoo Finance, Bloomberg, and Reuters, where experts and analysts express their opinions and speculations on particular market events.

Professional traders use such materials to catch up with recent updates and understand the overall sentiment when buying or selling securities.

Screener

The screener tab is the ultimate search engine, with over 9,700 stocks organized across 480+ pages. This tool allows you to sort and filter your search with a vast number of presets and technical criteria like finviz screener settings for penny stocks or high dividend-yield equities.

You can order the results by ticker’s alphabetical order, index, average volume, country, market cap, earnings, gaining %, losing %, dividends, and tens of other inputs. You can couple your research with trading signals to optimize your results.

The platform allows you to choose and change the data outcome, whether descriptive, fundamental, or technical analysis and cross-filter your search with many conditions and statuses.

You can save your finviz stock screener setup with your preferred parameters to speed up your process without having to redo your selections every time.

Maps

The finviz.com screener website displays a heatmap of stock movements and price changes. These maps show markets in different industries with a colored visualization of their price performance.

The green heats show 1-3% price growth while red zones represent 1-3% decreases. This approach makes it faster to find which sectors are over/underperforming and which stocks are currently growing.

This finviz screener for growth stocks is helpful in locating short-term trends and gains. However, it is worth noting that these price changes reflect 1-day activities, which may not be reliable for long-term investing strategies.

The filters on the left-hand side of the page allow you to change the tracking timeline, marketplaces, and locations to customize the heatmap accordingly.

Groups

This section orders stocks in the top 11 industries, including basic materials, real estate companies, communication services, consumer products, financial firms, and energy stocks.

This feature allows you to understand which sector is doing and how you shall allocate your investment portfolio. You can adjust the information representation between financial status, charts, bar charts, and spectrum diagrams on different timelines to analyze stocks more accurately.

Insider

This section displays the top and most recent insider trading activities. Although insider trading is illegal and company-associated personnel cannot use non-public data to make trades, owners and affiliates can execute trading activities.

For example, if PayPal’s CEO executes a market order to buy or sell shares in another company while publicly declaring the activity, it is legal.

This section of the stock screener finviz shows the latest insider trading transactions, their impact on the company’s own stock value, and the connection between the conductor and the organization. Speculators track these activities to make predictions about price changes and stock valuations.

Futures

This section allows you to find futures contracts in various markets and industries. It quotes prices for indices, energy, bonds, softs, metals, meats, grains, and currencies contracts across different timelines.

The data is represented in heatmaps and diagrams and shows 1-day price performance and quick insights. You can also switch the view to interactive charts and find the best-performing futures contracts.

Forex/Crypto

Crypto and fiat currencies are crucial financial instruments that you can follow and track updates using the finviz stock screener platform. You can view the price index of leading global currencies: USD, GBP, EUR, JPY, AUD, CAD, CHF, and NZD.

You can also track charts of the top 10 FX pairs and analyze price changes per pips, minutes, hours, days, and up to multiple years.

Similarly, you can find top crypto coins like BTC, ETH, XRP, BCH, and LTC and track 15 pairs against other crypto or fiat currencies.

Portfolio and backtesting

The portfolio builder and tester are sub-only features that allow users to create an account, add stocks to the watchlist, track their preferred investments, and make the right decisions.

Investors can opt-in to receive tailored notifications, announcements, and market updates to optimize their experience and research. Backtesting allows users to evaluate their trading models across different scenarios and historical price data.

Experienced traders rigorously test their strategies before executing market orders to minimize risks and make calculated decisions.

Finviz Subscription Models

Finviz stock screener comes with different pricing models. Although the free model seems sufficiently good for novice traders, the paid membership offers additional value.

Free Memberships

The finviz free stock screener gives users access to most stock prices, analyses, charts, and trading signals. However, price updates and charts are subject to delays.

The free membership does not require signing up and offers historical price data and reports, rooted in three years maximum, with simple chart layouts and display. This approach may suit beginners and or if you want to find quick insights about some securities.

The registered model offers features similar to those of the free plan. However, it provides access to portfolio-building tools, where users can create up to 50 portfolios, with 50 tickers and presets per each.

Paid-Subscription

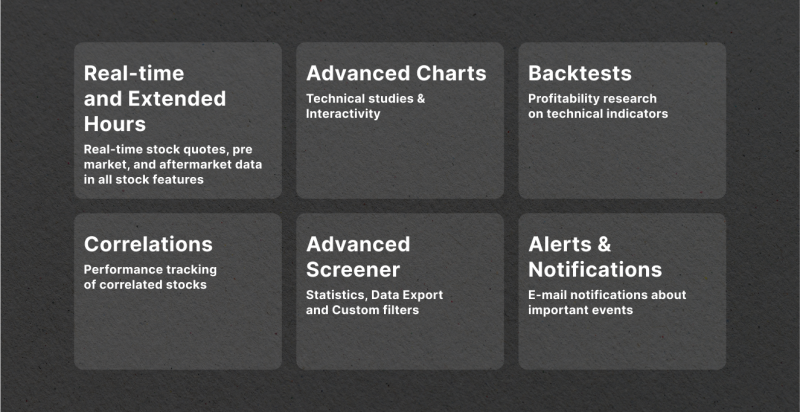

The Elite model offers far more sophisticated functionalities. It provides real-time price updates and market news, with advanced intraday and technical charts. You can track data and statements for up to eight years and increase your portfolio count to 100, 500 tickers, and 200 presets.

Finviz Stock Screener Review: Our Thoughts

In a nutshell, the finviz stock screener is a valuable source for stock analysis, price updates, and chart visualization. It offers sophisticated functions for searching and sorting publicly traded shares among a wide selection of industries, financial markets, and indices.

However, its free subscription plan does not provide real-time traction and instead uses lagged data to offer prices and updates. Therefore, the presented market information can be outdated in minutes. However, it is a great platform to find stocks and charts in one dashboard rather than scrolling through multiple websites and articles.

Thus, it is better to use finviz as a starting point for your stock investment portfolio in combination with other reliable sources, such as stock exchange websites and popular investing platforms.

Conclusion

The finviz is a stock visualizer that allows you to find, track, and analyze over 9,000 publicly traded shares across multiple markets and sectors. You can find best/worst-performing stocks on the finviz stock screener and monitor the heatmap for quick insights into day-session price actions.

The platform offers adequate data visualization and reading materials to check out trade ideas and explore experts’ takes. However, it is not the ultimate source for stock trading as you can only get live updates in the Elite paid subscription, while free plans provide delayed data.

FAQ

What does the finviz stock screener do?

Finviz offers insights and monitoring for stock price updates, news, economic calendars, and announcements, allowing investors to find the most recent and relevant stock news in one platform.

How much does the finviz screener membership cost?

The free plan provides essential utilities and price update accessibility without having to sign up. The registered model offers similar free finviz features with elevated benefits in portfolio building. However, the Elite subscription costs $39.50 monthly or $299.50 yearly.

Why do I need stock screeners?

A stock screener helps organize the overwhelming approach of most investing platforms and financial websites into a single source that focuses on the stock market.

Does finviz offer real-time price updates?

Real-time market updates are only available in the paid Elite membership, while free and registered access provide delayed data.