Why and How to Start a Forex Brokerage in 2024

May 31, 2024

The Forex sector has shown impressive resilience in recovering from global crises, thanks in part to the backing of governments around the world. These governments recognize the importance of the Forex market in today’s interconnected global economy and are quick to implement necessary measures to ensure stability when needed.

The rise of online retail Forex trading has turned into a trend in recent times, with expectations of continued growth due to its ease of use and availability. As a result, there has been a significant increase in the demand for online FX brokerage firms, making them a highly profitable business opportunity within the Forex industry.

This article will guide the world of Forex and tell you what a Forex broker is and its main business models today. You will also learn how to create your own Forex brokerage company and what advantages it brings.

Key Takeaways:

- A forex broker is an ecosystem that combines many elements whose task is to provide comfortable and easy access for clients to trade financial instruments.

- Among all existing models of FX brokers, the main ones are ECN and STP.

- Among all the advantages of the FX brokerage business, the main one is the generation of passive income based on investment activities.

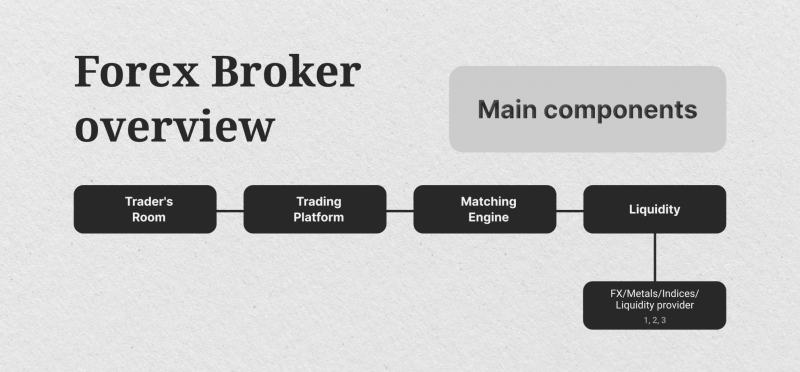

What Is a Forex Broker?

A Forex broker, also known as a currency trading broker or retail Forex broker, is a trusted financial institution or company. They act as a reliable intermediary between individual traders and the foreign exchange market, a decentralized global market where currencies are bought and sold. This role of a broker ensures the security and reliability of the trading process.

Forex brokers provide traders access to the Forex market by offering trading platforms allowing clients to buy and sell currencies. They facilitate the execution of trades and provide various services and tools to help traders analyze the market, place orders, and manage their trading activities.

Forex brokers earn profits through spreads, which are the differences between currency pairs’ buying and selling prices. They may also charge additional fees or commissions on trades. Some brokers offer additional services such as educational resources, market research, and customer support.

Fast Fact:

Today, the vast majority of startups are based on a hybrid Forex brokerage business model or use White Label solutions to get to market quickly.

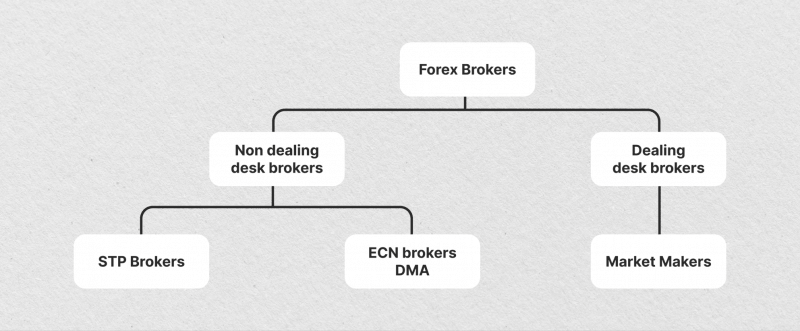

Major Types and Models of Forex Brokers

Today, the FX brokerage sector is highly developed due to progressive technologies, as well as the strong influence of related areas where the products and services of such businesses are used. As a result, several forms and models of FX brokerage companies have emerged, among which the following can be highlighted:

1. Electronic Communication Network (ECN) Brokers

ECN brokers operate by connecting traders directly to the interbank market or other participants in the network. They aggregate buy and sell orders from various market participants and display the best available bid/ask prices to their clients. ECN brokers typically charge a commission on trades and provide access to a more transparent and competitive trading environment.

2. Straight Through Processing (STP) Brokers

STP brokers, also known as no dealing desk (NDD) brokers, route client orders directly to liquidity providers, such as banks or other brokers, without intervention or manual execution. They act as intermediaries and do not take the other side of the trade. STP brokers can offer faster trade execution and potentially tighter spreads.

3. Hybrid Brokers

Some brokerage solutions combine elements of both market-making and STP/ECN models. They may provide a dealing desk for certain types of trades or clients while offering direct market access for others. This hybrid model allows brokers to manage risk and provide different types of services to their clients.

4. Forex White Label Brokers

White-Label brokers are companies that use another established broker’s trading infrastructure and technology but operate under their own brand name. They rebrand the services of the parent broker and focus on marketing and customer acquisition. The best white-Label brokerage firms can provide a quick entry into the Forex market for companies or individuals without the need to build their own trading infrastructure.

5. Introducing Brokers (IBs)

Introducing brokers are individuals or companies that refer clients to a Forex broker in exchange for a commission or rebate. They act as intermediaries between the client and the broker and may provide additional services such as education or support. Introducing brokers do not execute trades directly but earn commissions based on the trading activity of the clients they refer.

6. Market Makers

Market maker brokers, also known as dealing desk brokers, act as counterparties to their clients’ trades. They create a market for their clients by quoting both the buy and sell prices for currency pairs. In this model, the broker effectively takes the opposite side of the client’s trade. Market makers earn profits through spreads and may also use hedging strategies to manage risk exposure.

Selling Points of Starting a Forex Trading Company

Starting a Forex brokerage business can offer several advantages, including:

Lucrative Market Opportunity

The Forex market is the largest financial market globally, with a daily trading volume exceeding trillions of dollars. The high liquidity and constant market activity present significant profit potential for FX brokerage houses. As the intermediary between traders and the market, Forex brokers can earn revenue from spreads, commissions, and trade fees.

Diversification of Revenue Streams

In addition to Forex trading, it’s possible to diversify the revenue streams by offering other financial instruments, such as CFDs (contracts for difference) on stocks, commodities, indices, and cryptocurrencies. This allows catering to a broader range of clients and attracting traders with different preferences and strategies.

Global Market Reach

The Forex market operates 24 hours a day, five days a week, providing access to traders worldwide. By starting a Forex brokerage, it’s possible to tap into this global market and attract clients from different countries and regions. This offers the opportunity to build a diverse client base and expand your business internationally.

Scalability and Growth Potential

A Forex brokerage business can scale and proliferate with effective marketing and client acquisition strategies. As you attract more clients, your trading volume and revenue can increase substantially without significant additional costs. This scalability allows for the potential for substantial profitability and business expansion.

Technology and Innovation

Starting a Forex brokerage allows you to leverage cutting-edge technology to offer clients advanced trading platforms, tools, and features. By investing in a robust trading infrastructure, you can provide a seamless trading experience, fast trade execution, and access to real-time market data. Technological advancements can enhance your competitiveness and attract tech-savvy traders.

Regulatory Control

As a Forex brokerage business owner, you have control over regulatory compliance. By obtaining the necessary licenses and operating within regulatory frameworks, you can enhance the credibility and trustworthiness of the business. This can attract clients who prioritize working with regulated brokers and foster long-term client relationships.

Entrepreneurial Freedom

Starting a Forex brokerage business allows you to be your own boss and exercise entrepreneurial freedom. You can build and shape the brand, set your business strategies, and make critical decisions. This level of independence and autonomy can be fulfilling and rewarding for individuals with an entrepreneurial mindset.

How to Start a Forex Brokerage in 2024 — The Ultimate Guide

Opening a brokerage firm in 2024 is a profitable, albeit challenging adventure on the way to establishing your own vision of the Forex business space, which includes a number of important and time-tested principles on the basis of which it becomes possible to create a unique solution that meets the requirements of modern clientele and meets the latest standards of quality and security.

So, to launch a brokerage platform, it’s necessary to consider and analyze each of the following points carefully:

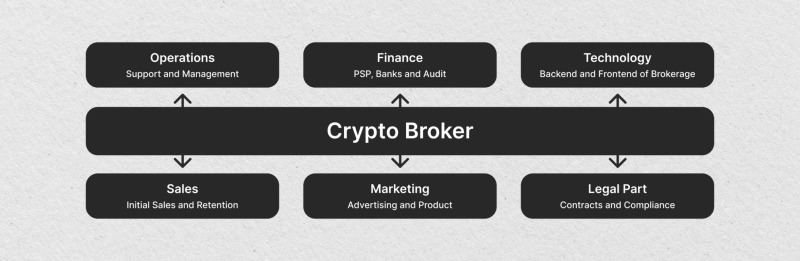

1. Business Structure and Licensing

The establishment of a legal and regulatory-compliant structure is of paramount importance in order to start a Forex brokerage. This necessitates the acquisition of the requisite licenses and registrations from the relevant regulatory authorities to enable the operation of a financial services provider.

Compliance with regulatory requirements is critical to ensure the safety and protection of clients’ funds, as well as the preservation of the integrity of the financial system. On the other hand, non-compliance with existing regulations can result in legal and financial liabilities, which can negatively affect the Forex broker startup reputation and viability. Therefore, it is essential to adhere to regulatory guidelines and standards strictly.

2. Technology Infrastructure

A robust and dependable technology infrastructure is necessary to open a Forex brokerage business. This infrastructure encompasses trading platforms, servers, data feeds, and connectivity to ensure uninterrupted trade execution, real-time market data, and secure client information.

The reliability and efficiency of these technologies are vital to the success of the brokerage business. Therefore, it is essential to carefully select and maintain these systems to ensure that client needs are met and business objectives are achieved.

3. Liquidity Providers and Pricing

In order to start your own Forex brokerage, you must build strong partnerships with liquidity providers like banks or other brokers. This is done to ensure they have access to competitive pricing and sufficient liquidity required to execute client orders without any hassle. Providing top-notch execution quality and competitive spreads is essential to attract and retain clients.

4. Risk Management

If you think to start a Forex brokerage firm, you need to know how to safeguard the brokerage business from financial instability and client default risks. Here is where efficient risk management practices come in play. This necessitates setting suitable leverage limits, closely monitoring client positions, and adopting effective risk mitigation strategies.

By doing so, the business can ensure that it is well-prepared to handle any potential market turbulence and protect itself from unnecessary financial losses.

5. Compliance and Legal Framework

Foreign exchange brokers are responsible for ensuring they operate fairly and safely. One of the most significant aspects of their role is to comply with various regulatory requirements and legal obligations.

These obligations include implementing robust anti-money laundering (AML) procedures, conducting thorough Know Your Customer (KYC) processes to verify the identity of their clients, segregating client funds to protect them from being mixed with the broker’s operational funds, adhering to strict privacy policies, and implementing effective data protection measures to safeguard sensitive client information.

By taking these measures, Forex brokers can provide their clients with a secure and transparent trading environment where they can confidently and safely trade the financial markets.

6. Client Onboarding and Support

Designing streamlined and efficient procedures for onboarding clients that involve opening accounts, verifying identities, and collecting necessary documentation is crucial to ensuring a smooth and hassle-free customer experience. Equally important is providing responsive and dependable customer support through multiple channels, which enables timely resolution of client queries and concerns.

7. Marketing and Client Acquisition

For a Forex brokerage business to succeed and flourish, it is imperative to create and implement result-oriented marketing strategies to attract and retain clients. These strategies may include various techniques such as digital marketing, targeted advertising, strategic partnerships, incentivized referral programs, and educational content that effectively highlights the brokerage’s unique value proposition and quality services.

By leveraging these marketing approaches, a Forex brokerage can establish a solid and trustworthy reputation in the market, build a loyal customer base, and achieve sustained growth and profitability.

8. Risk Warning and Education

It’s crucial to provide clients with risk warnings and access to educational resources to ensure responsible trading behavior and effectively manage client expectations. These resources can take various forms, such as educational materials, webinars, tutorials, and market analyses, which can help clients make well-informed trading decisions and improve their trading skills over time.

Equipping clients with the necessary knowledge and tools makes them more likely to succeed in the trading world while minimising potential risks.

9. Reporting and Analytics

For brokers, it is crucial to implement reporting and analytics systems that can withstand the rigors of the fast-paced trading environment. These systems should be able to track and analyze various business metrics such as trading activity, client performance, and financials.

By doing so, brokers can gain deeper insights into their operations and use this information to make better decisions, optimize their business processes, and comply with regulatory requirements.

10. Reputation and Trust

In the Forex industry, a brokerage business’s success hinges significantly on building a robust reputation and establishing trust with clients. Achieving this requires an unwavering commitment to transparent and ethical business practices, prioritizing the security of client funds, and providing unmatched customer service that ensures clients feel valued and well-cared for.

By aligning themselves with these principles, brokerage businesses can establish long-term, profitable relationships with clients and cement their position as trusted players in the Forex industry.

Conclusion

The rise in popularity of the Forex industry has made establishing a brokerage firm a significant issue in today’s era. This has led to the development of new technologies and strategies in market trading, attracting a steady stream of investors and traders.

Starting your Forex brokerage venture offers a chance to gain valuable expertise in business planning, marketing, trading systems, and programming. This can help you create a competitive and reliable FX company to succeed in the ever-changing Forex market.

Wondering how these solutions can boost your business?

Leave a request, and let our experienced team guide you towards unparalleled success and growth.

FAQs:

What capital do I need to start a Forex broker?

The required capital can vary depending on the jurisdiction and regulatory requirements. It is advisable to consult with legal and financial professionals to determine the specific capital requirements for your chosen jurisdiction.

How long does it take to obtain the necessary licenses?

The time frame for obtaining licenses can vary significantly depending on the jurisdiction and regulatory processes. Completing the licensing procedures, including document preparation, submission, and review by regulatory authorities, can take several months.

Do I need to have prior experience in the FX industry to become a Forex broker?

While prior experience in the Forex industry can be beneficial, it is not mandatory. However, having a team with relevant industry experience and expertise is highly recommended to navigate the complexities of the Forex market and regulatory environment.

How can I attract clients to my brokerage?

Effective marketing strategies, such as digital marketing, content creation, partnerships, and referral programs, can help attract clients. Providing competitive trading conditions, reliable customer support, and educational resources can contribute to customer acquisition and retention.

How can I ensure regulatory compliance?

To ensure regulatory compliance, thoroughly understand the regulations applicable to Forex brokers in your target jurisdiction(s). Engage legal and compliance professionals to guide you through the compliance process, implement robust AML and KYC procedures, and regularly monitor and update your compliance practices.