B2Broker’s Next-Gen Copy Trading Platform Introduces Technology Breakthrough

June 11, 2024

The copy trading market is exponentially growing, and according to The Insight Partners reports, it is expected to grow from $2.2 billion to $4 billion by the end of the decade. This means that brokers can seize outstanding opportunities by catering to traders’ demands.

B2Broker, in continuation of its advanced technology introductions, has released a new generation of B2Copy platform to solidify its market position, offering advanced customisation capabilities, growth-based master trader profiles, elevated UX and other features that traders demand.

B2Broker expands on its various MT4 and MT5 solutions by becoming the first company, after Spotware, to offer enterprise-grade copy trading solutions and the first ever to integrate PAMM trading for cTrader. Here are some highlights of the newly revamped B2Copy features.

New 3-in-1 Approach: PAMM, MAM and Copy Trading

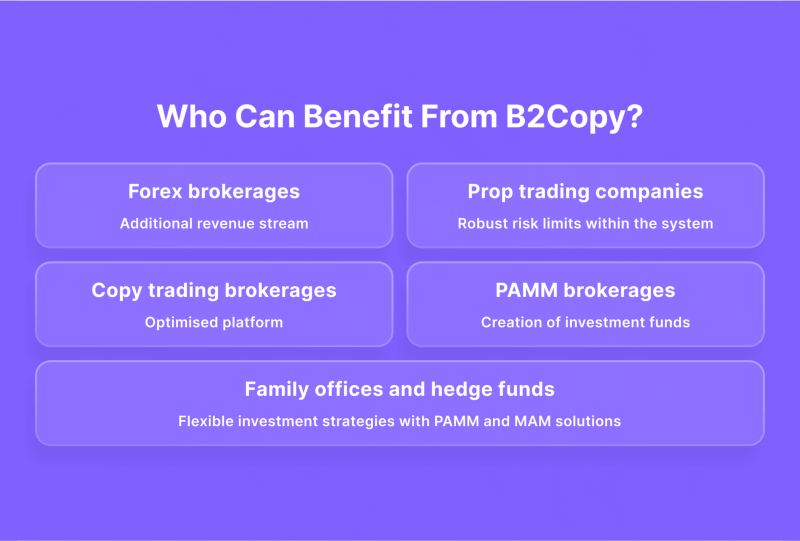

B2Copy offers an unmatched trading software experience, combining copy trading, PAMM and MAM features. This approach allows copy-trading brokerage platforms to land more investors willing to follow the steps of successful investors’ strategies, besides enabling brokers to refresh inactive accounts and introduce copy trading as a new source of income.

The high flexibility B2Copy offers allows PAMM brokers to create investment funds, while hedge funds and family businesses can benefit from advanced PAMM and MAM solutions. Additionally, it helps prop trading firms improve their risk portfolio and boost their business potential.

B2Copy offers customised investment opportunities that accept various strategies by incorporating seamless collaboration with regulated funds.

Introducing B2Copy Updates

This comprehensive update across B2Copy functionalities includes various performance metrics, user interaction, and other features that focus on customisation.

Enhanced Performance

B2Copy equips brokers with the necessary tools to expand their reach and explore new revenue streams. Powered by outstanding performance and outcomes, B2Copy is a proven asset for brokers and their traders.

Rapid Execution Across a Broad User Base

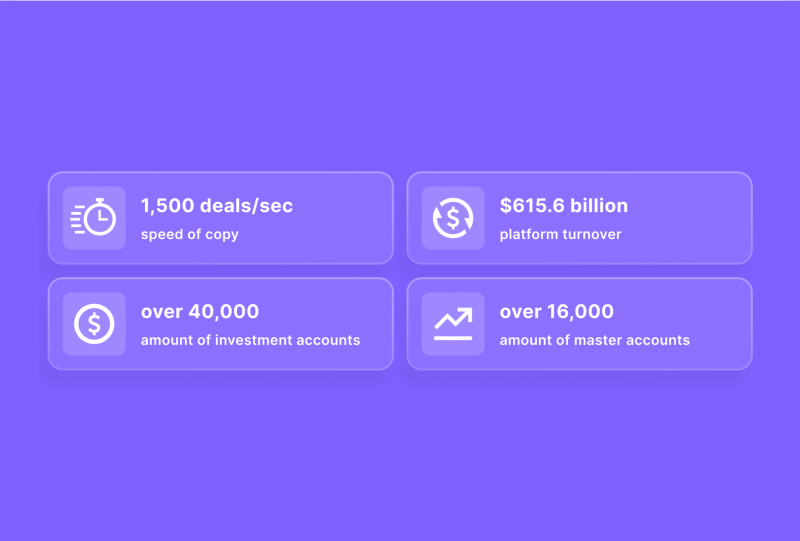

The B2Copy updates focused on platform performance and efficiency, allowing it to execute over 1,500 requests per second, ensuring that all investors, regardless of their number, can connect to one master account and receive the best trading conditions without delays.

The newly revamped platform is capable of linking one copy master to 5,000+ investors, and one PAMM master to 1,000+ investors.

Turnover Snapshot

Currently, B2Copy serves 65 active brokers, 16,000+ copy master accounts and around 40,000 investment accounts. These numbers are projected to grow rapidly, given the broad scalability of B2Copy and the vast experience of B2Broker as a leading technology developer and provider.

The platform handled a total turnover of $615.6 billion between May 2023 and April 2024, highlighting B2Copy’s ability to process massive volumes at higher efficiencies and proving its role in the global trading market.

UI/UX Upgrades

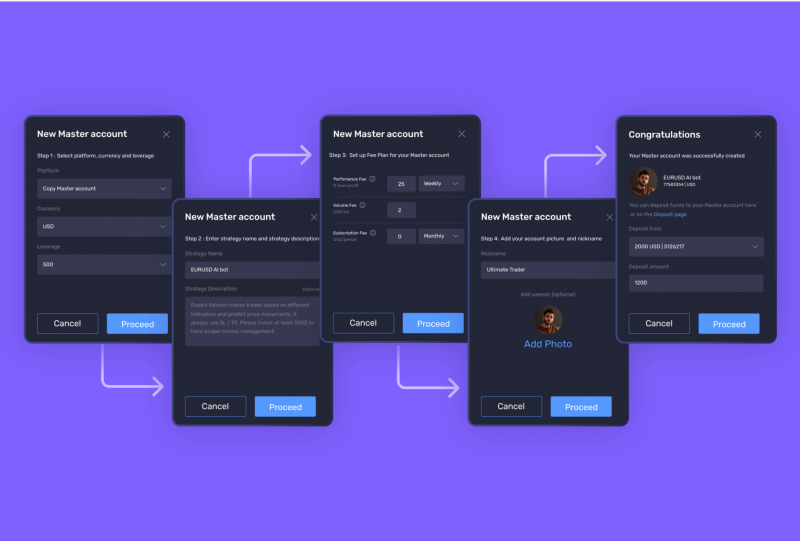

Aesthetics are part of the new B2Copy update with the reworked UI that is more visually appealing and user-friendly. The introduction of guided wizards simplifies user flow by splitting complex processes. Now, users can complete tasks in 5 simple steps with 2-3 options each instead of going through length forms with 20-30 fields.

The update also automated certain processes to reduce the work of newly created master accounts or newly registered investors. B2Copy also introduced built-in trading bots, which can be harnessed to scale trading activities and give users a more dynamic trading experience.

Tailor-Made Features

New personalisation options were also introduced in this update. Now, master traders can customise their profiles with nicknames/aliases, profile pictures and descriptions, creating a sense of individuality and professionalism. These tailor-made upgrades include:

Revamped Price Structure

The new price structure now offers six fees: performance fee, trade fee, subscription fee, profit fee, management fee, and joining fee. Also, there are six options for performance fee calculations and two options for management fees. This structure enables master traders to put their preferred fee system in exchange for trading signals in PAMM accounts.

Adjusted Minimum Investment Requirements

Master traders can now set a minimum investment amount, incorporating flexibility between trading strategies and account size. This adjustment is vital as some strategies require a deposit of at least $1,000 or $10,000 to work effectively. This way, master traders can ensure that suitable investments are made to increase performance and satisfaction.

Introducing New Widgets

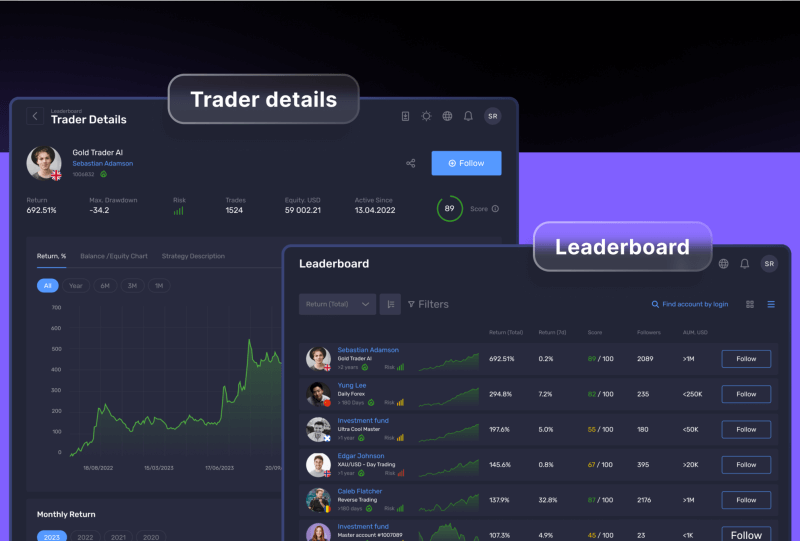

New widgets are introduced in brokers’ websites to separate the leaderboard and statistics pages. Direct links can be generated and shared for statistics pages, allowing users to showcase their performance on social platforms.

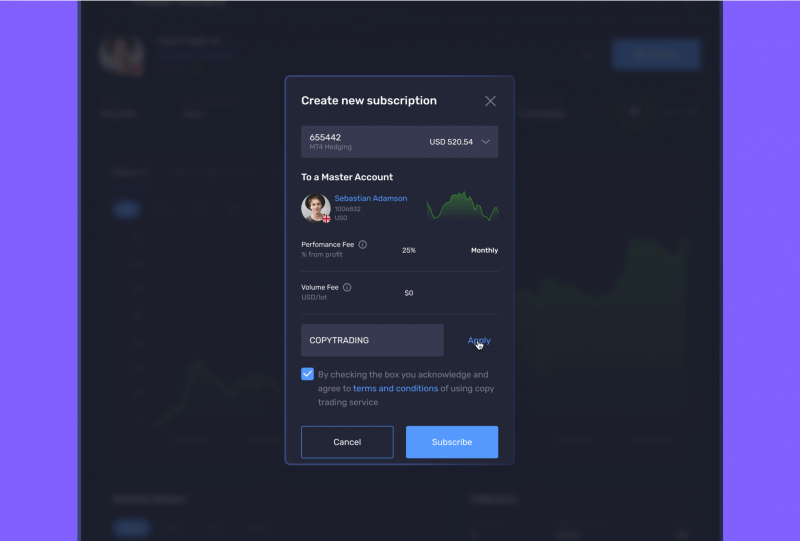

Incorporating Promo Codes and Subscription Model

Subscriptions and promo codes are powerful market tools for master traders. Promo codes allow masters to create unique features for their investors, design marketing campaigns and offer discounts for their services.

Subscription codes better serve professional master traders who have their own websites and investors. This allows them to advertise their strategies independently and create exclusive strategies secured with passwords.

Only clients with these special codes can view detailed stats or subscribe, and their accounts will be listed in a leaderboard. This gives masters more control and targeting for their investors and strategies.

Transparent Leaderboard and Analytics

The leaderboard now has a scoring system that factors multiple parameters, making it easier for new investors to find top master accounts. 29 statistical parameters are available for investors to evaluate strategies and make informed choices before investing.

Brokers can utilise over 250 customisation settings that meet their specific needs, allowing them to offer a customised user experience.

Ongoing Developments

Plans are in place for more features to further improve the platform, incorporate more flexibility and improve user experience, such as:

Cross-Server Trade Copiers

B2Broker serves large brokerage firms, and most of them run multiple trading servers for cTrader, MT4 and MT5 software. Cross-server copy trading is being developed to accommodate these growing needs.

This way, brokers can copy trading positions from one MT4 server to another and the same across MT5 and cTrader servers.

Cross-Platform Functionality

Cross-platform functionality is being developed for brokerage firms using multiple trading platforms: MT4, MT5, and cTrader. This option increases flexibility in choosing a trading platform for copying positions, as brokers won’t need to force traders to change platforms.

For example, a master trader might be trading from MT5, while investors can use MT4 or cTrader.

More Integrations For Improved Functionality

B2Copy is seamlessly integrated with cTrader, MT4 and MT5. This enables master traders to link their previous accounts and allows investors to continue trading using existing investment accounts. This makes user adoption between platforms easier for everyone.

B2Copy also supports B2Core, B2Broker’s branded CRM and back-office management solution. This makes all B2Core functionalities, including e-wallets, IB modules, referral programs, account transfer capabilities and other functionalities compatible with B2Copy. This results in a unified platform that leverage all the tools of B2Core’s outstanding CRM suite.

Moreover, B2Copy can be integrated with other prop trading broker CRMs, boosting B2Copy broker functionality, whether used independently or together with B2Core.

Final Thoughts

The newly revamped B2Copy solution offers an unrivalled investment experience, characterised by its speed, scalability and innovative features. With a major trading market impact and sophisticated structure, B2Copy is the ideal choice for brokers around the world.

Contacts: