Binance Delisting 14 Tokens From Its Trading Desk Causes Massive Sell-Offs

Apr 8, 2025

After announcing comprehensive plans to improve compliance, the crypto exchange leader, Binance, delists more DeFi assets on regulatory and transparency grounds.

This time, 14 more tokens are being removed from the exchange, including some with a $20 million to $40 million market cap, such as BADGER DAO and BALANCER.

Why is Binance delisting more crypto tokens? How will this news affect the overall market? Let’s review this in more detail.

Binance Delisting 14 Cryptocurrencies: What Happened?

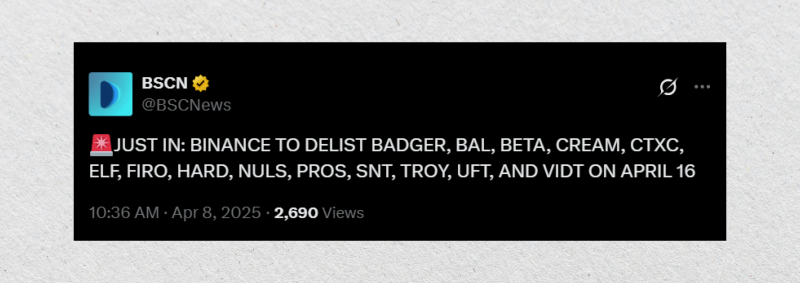

On April 8th, Binance announced it would remove 14 cryptocurrencies from its exchange after a community vote. This news comes a few days after Binance delists USDT from its European spot trading platform.

However, this time, the decision was made following the platform’s Vote to Delist initiative — A new campaign where the community plays a role in determining which tokens should be removed. This represents a shift from purely internal reviews to a more transparent and participatory model.

Earlier this month, Binance delisted Tether from its EEA spot trading exchange desk. This move was due to the implementation of the European MiCA crypto regulations, which impose strict oversight on digital assets, token minting, and stablecoins’ backings.

Non-MiCA-compliant tokens, such as USDT, TUSD, and UST, were removed from leading exchanges, including Binance and Kraken.

Voting Process

The Binance new token listing update will take place on April 16th at 03:00 UTC. Spot trading positions will be closed, futures contracts will be terminated, and other financial activities associated with the mentioned tokens will be stopped.

In a detailed report shared by Binance, the voting involved 24,141 participants and accumulated 103,942 votes. The voted tokens are BADGER, BAL, BETA, CREAM, CTXC, ELF, FIRO, HARD, NULS, PROS, SNT, TROY, UFT, and VIDT.

The exchange implemented a comprehensive evaluation of multiple factors, including asset development activity, trading volume, network stability, and community engagement. Binance also considered responsiveness to due diligence, any signs of unethical behaviour, regulatory concerns, and tokenomics changes.

Impact on Market Prices

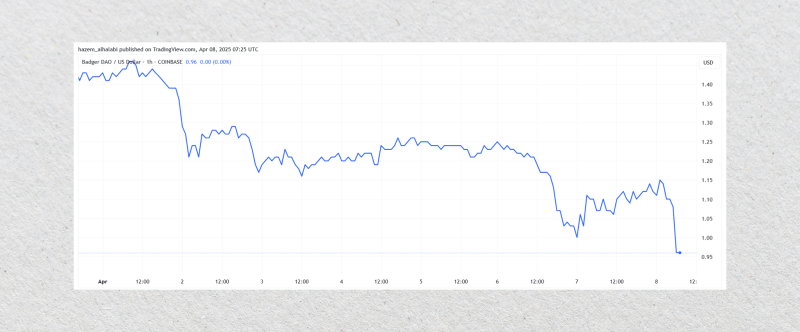

The announcement quickly struck crypto markets, massively plummeting the prices of the specified tokens.

BADGER and BAL saw immediate declines of over 10% and 20%, respectively, while tokens like UFT, TROY, and PROS experienced sharp pullbacks due to reduced liquidity and panic selling.

Investors responded with caution, with some reallocating funds to more established tokens and others earning from selling right before the news.

Binance cryptocurrency delisting spurred frustration among token holders, especially those in the market for 5+ years. However, the company emphasized its commitment to regulatory compliance and that poor token performance carries real consequences.

Conclusion

Binance delisting 14 tokens reflects a maturing blockchain landscape shaped by stricter compliance and community involvement. While the move shook market order trading portfolios, it underscores sustainability and the focus on practical and reliable tokenomics.

Starting from April 16th, BADGER, BAL, CREAM, CTXC, and 10 other tokens will be removed from Binance’s exchange and spot trading desks.