How to Use TradingView for Intraday Trading?

Jun 17, 2024

Intraday trading refers to the act of buying and selling financial instruments on the same day with the aim of exploiting short-term price movements. It is a very fast activity that requires quick action or response.

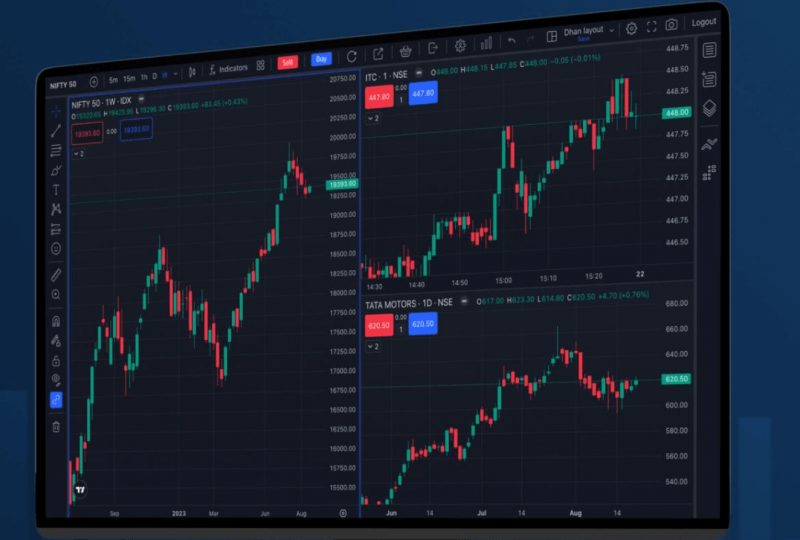

TradingView is a valuable resource for intraday traders since it provides them with advanced charting tools, real-time data, and an active community that offers insights and strategies.

With an easy-to-use interface and great features, TradingView simplifies the process of intraday trading with its ability to allow for analysis of markets, setting alerts, executing trades, etc. more efficiently.

This article will show you how to make good use of TradingView in intraday trade with success.

Using TradingView for Intraday Trading

TradingView Desktop has customizable charts, which makes it great for intraday trading, technical analysis tools, and real-time data. Here are steps on how to use it:

1. Sign Up and Log In

Sign up and log into your TradingView account to start intraday trading. You can access various features for market analysis and executing trades once you have logged in.

TradingView has customizable charts and tools suitable for both free users and those on a paid plan.

With your account set up, you’re ready to explore various markets like stocks, forex, or cryptocurrencies and tailor your workspace to track the assets you’re interested in trading.

2. Customize Your Workspace

Customizing your workspace on TradingView involves arranging charts, indicators, and watchlists to suit your preferences and trading style.

You can have multiple charts for various assets, change the look of every chart, and also include technical indicators that analyze price movements. Organize watchlists to monitor your favorite assets and keep track of important market data.

Personalization of your working space allows you to create an effective intraday trading environment.

3. Select a Market

Choose the market you want to trade on TradingView, like buy stocks, forex, etc. TradingView offers a variety of markets so that you can choose one that best suits your trading objectives and strategies.

Upon selecting a specific market, you may begin assessing price movements as well as find out about prospective trading chances through the application of charts, technical indicators, and other tools provided by TradingView for this particular market.

4. Choose a Timeframe

When using TradingView for intraday trading, choose a timeframe that suits your trading strategy, such as 1-minute, 5-minute, 15-minute, or 30-minute charts.

This timeframe determines how each candlestick or bar on the chart represents price movement over a specific period.

Shorter timeframes, like 1-minute or 5-minute charts, provide more detailed information for quick trades, while longer timeframes, like 15-minute or 30-minute charts, offer a broader perspective for analysis.

5. Add Technical Indicators

In TradingView, after selecting your market and timeframe, add technical indicators to analyze price movements. These indicators, like moving averages or RSI, help spot potential trade opportunities. Simply click on “Indicators” and choose from a wide range available.

Once added, these indicators display on your chart, providing insights into market trends and momentum. Experiment with different indicators to find what works best for your trading strategy.

6. Draw Trendlines and Support/Resistance Levels

Drawing tools let you mark important levels on your charts like trendlines, support, and resistance.

Trendlines help you spot the direction of price movements, while support and resistance levels indicate areas where prices might reverse. These visual cues assist in identifying potential entry and exit points for trades.

Simply use the drawing tools to draw lines on your charts, helping you make informed decisions based on key price levels.

Conclusion

TradingView offers a comprehensive toolkit for successful intraday trading, allowing you to analyze markets, execute trades, and interact with a vibrant community. Remember, practice and continuous learning are key to mastering intraday trading.