Inflation Is Running Hot. 15 Stocks to Help Tame It

Jan 12, 2022

Inflation has become severe enough to worry consumers, the Fed, and shareholders. Traders anticipate interest rates to climb as the central bank combats increasing prices, which has resulted in an equity market sell-off earlier this year.

However, there is no reason to wait and panic as share prices drop. Investors may prepare their portfolios for this inflationary climate, although avoiding any consequences is likely to be difficult. Inflation rates have not been this strong in decades.

The consumer price index, or CPI, increased by 7% year-over-year in December, rising from November's 6.8%. Inflation has reached its record levels since 1982.

With inflation on the rise, investors may want to look back in history to see what succeeded in previous times of high inflation. Sean Markowicz, a Hartford Funds analyst, has discovered that five categories typically yield good returns during periods of inflation: utilities, real estate investment trusts, energy, basic consumer goods, and health care.

Because of rising prices, REITs and energy may outperform. Property and energy prices may grow in tandem with the expense of everything else. At the same time, utilities, basic consumer goods, and healthcare are crucially important. Even if costs for power or morning cereal have to increase to enable corporations to save their profits, demand in such areas does not fall.

Those five categories seem logical places to begin when constructing a portfolio that will be protected from inflation effects, but selecting the finest companies in those areas is another matter. This is where Wall Street can assist.

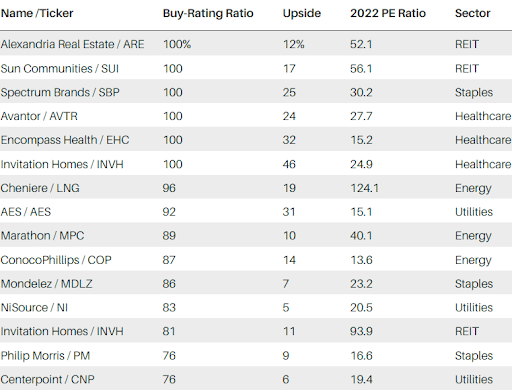

Based on experts' recommendations, the three most attractive companies in each of the five categories were selected in the Russell 1000 index field of high cap stocks. The 15 firms are listed below in no specific order. Consider them a jumping-off point for more study instead of a completely constructed portfolio.

REITs: Alexandria Real Estate Equities (ARE), Sun Communities (SUI), and Invitation Homes (INVH).

Energy: Cheniere Energy (LNG), Marathon Petroleum (MPC), and ConocoPhilips (COP).

Utilities: AES (AES), CenterPoint Energy (CNP), and NiSource (NI).

Consumer Staples: Spectrum Brands (SPB), Mondelez International (MDLZ), and Philip Morris International (PM).

Healthcare: Avantor (AVTR), Encompass Health (EHC), and Sotera Health (SHC).

Collectively, about 90% of experts monitoring the 15 businesses rate the stocks as Buy, whereas the median Buy-rating proportion for companies in the Russell 1000 index is around 60%.

According to expert target prices, the median perceived benefit for the 15 companies is about 20%. This is in line with the Russell 1000 average, although the potential profits within the index vary greatly per sector.

The 15 equities have done well, with an average return of roughly 27% over the last year. The Russell 1000 index has risen almost 20%. The S&P 500 and Dow Jones Industrial Average climbed 23% and 16%, correspondingly.

Twelve of the 15 companies have increased in value during 2021. Encompass Health, Sotera, and AES have all fallen in price.

Of course, there is no guarantee that companies that have performed effectively before will remain to perform effectively in the future. There is no assurance that industries that have easily weathered previous times of rampant inflation would do well again. Nevertheless, the 15 are an excellent place to begin for anybody in need of refuge.