Inflation Threatens to Turn 2022 Into ‘Annus Horribilis’ for Powell, Biden

Jan 13, 2022

"Annus horribilis," a Latin phrase meaning "terrible year," was famously used by the Queen of England to characterize 1992, a turbulent year she said she would never forget.

According to present trends, the same designation may still apply in 2022, when inflationary pressures burn US consumers at a rate not seen in decades, sabotaging the electoral prospects of a US president only a year into his tenure. Additionally, it is conspiring to make an already difficult job much more difficult for the Federal Reserve chairman.

On Wednesday, figures revealed that December's headline consumer inflation accelerated to a blistering 7% year over year, while core prices increased by 5.5 percent – the highest annual rate since 1991 and the fastest 12-month increase since 1982. While Wall Street took the news in stride, sending indices on an improbable climb as investors did what investors do best — look beyond the bad news — at least two things were evident.

To begin, it's past time to bid farewell to the low-inflation environment that investors and consumers formerly took for granted. Second, companies have grown accustomed to demanding greater prices, but customers have grown accustomed to them as well (ideas the Morning Brief warned readers about late last year).

"Once you have inflation, as soon as inflation subsides, goods do not have to get cheaper," Tendayi Kapfidze, the US Bank's senior economist, told Yahoo Finance Live on Wednesday. "They just need to halt their growth," he continued.

Although bond king Jeff Gundlach — who has taken over from Noriel Roubini as Wall Street's "Dr. Doom" — stated this week that he sees "recessionary pressure" building, even as strong demand inflates prices, a tight labor market and higher wages are far more likely than not to continue supporting insatiable demand.

That is why analysts are constantly reassessing the Fed's potential for aggressiveness as it begins its first tightening campaign since 2018.

Capital Economics' senior US economist Paul Ashworth said on Wednesday that December's pricing statistics were "every bit as awful as we anticipated." We anticipate the Fed to begin raising interest rates in March, with four 25 basis point increases this year and four more in 2023."

This puts him solidly in the camp of JPMorgan Chase CEO Jamie Dimon, who predicted this week that the central bank would be obliged to increase more aggressively if growth and prices continued to rise.

Which leads us to the two persons most at risk from the aforementioned "annus horribilis" - Fed Chairman Jerome Powell and Vice President Joe Biden. The latter's hallmark legislation is stuck in Congress (which is probably for the best, since further government spending would almost likely exacerbate the inflation situation), and he is already facing criticism for increasing prices and empty shelves caused by port backlogs.

As loyal readers may recall, the Morning Brief reported last year that Powell's presidential renomination practically means that both men now own the present inflationary climate. I previously stated that the Powell-led central bank's next phase will be determined by its response to increasing prices. And President Joe Biden — who reappointed Powell on Monday despite pressure to reverse course — will suddenly find his political fortunes intimately linked to Fed policy in a manner that his previous predecessors did not.

That is one reason why Biden is already taking steps to mitigate inflation's impact on consumers by tackling increases in food and energy prices, as Yahoo Finance's Ben Werschkul reported on Wednesday.

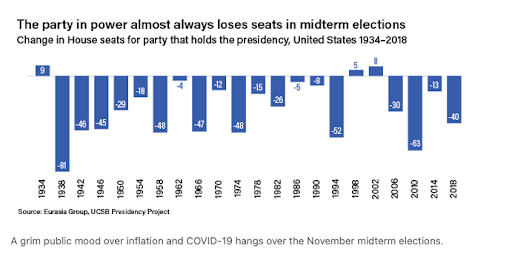

However, the shockwaves created by high prices are already resonating throughout the political landscape, with people in an increasingly negative attitude. According to a study by the Eurasia Group's Jon Lieber, anti-Biden sentiment has only grown stronger in recent months, and his policy efforts are "either unpopular or have been lost behind the ongoing epidemic and rising inflation."

Wait a minute, the situation is about to deteriorate more. Lieber said, "as a result of the reaction, we've increased our probability of Republicans retaking the House to 90%, up from 80% earlier.

"This is an unusually high level of confidence this far out from an election," Lieber added. "However, the party in power's historical median 30 seat loss in midterm elections, the current narrow House margin, redistricting patterns, 26 Democratic retirements from the House, and Biden's persistently low approval ratings all support the view."

It's worth noting that President George H.W. Bush was the previous president to preside over such elevated core inflation numbers in 1991. Furthermore, we are all aware of what happened next year.