Oil Prices Jump 10%. Neither OPEC Nor Biden Is Coming To The Rescue.

Mar 01, 2022

On Tuesday, oil prices soared to record highs as pressure mounted across the globe to isolate Russia. However, the present energy dynamics may soon become much more unstable and lead to even steeper price increases.

Conferences and statements over the next 24 hours might dictate if oil prices rise more. The trading activity on Tuesday shows that traders do not anticipate an instant and pain-free resolution to the Ukraine crisis.

Even news that the United States and other oil-consuming countries of the International Energy Agency would discharge 60 million barrels of oil from strategic reserves Tuesday morning did not dampen the price rise. While the group stated that it would send a united and powerful signal to world oil markets that there would be no supply shortage as a consequence of Russia's attack on Ukraine, the market believes differently. It just isn't enough to make a meaningful impact on oil prices.

The U.S. Strategic Petroleum Reserve will hold 30 million barrels or less than 5% of total inventories. Japan and the U.K. are among the other countries involved. Worldwide, over 100 million barrels of oil are produced every day.

Brent oil futures, the worldwide benchmark, rose 9% to $106.75 a barrel on Tuesday. The U.S. benchmark, West Texas Intermediate crude, rose 10% to $105.64 a barrel.

Oil stocks climbed, but only with shaky confidence. ExxonMobil was up 1.2%, while producer EOG Resources increased 0.7%. Chevron was up 2.8% after raising its repurchase forecast on its investor day.

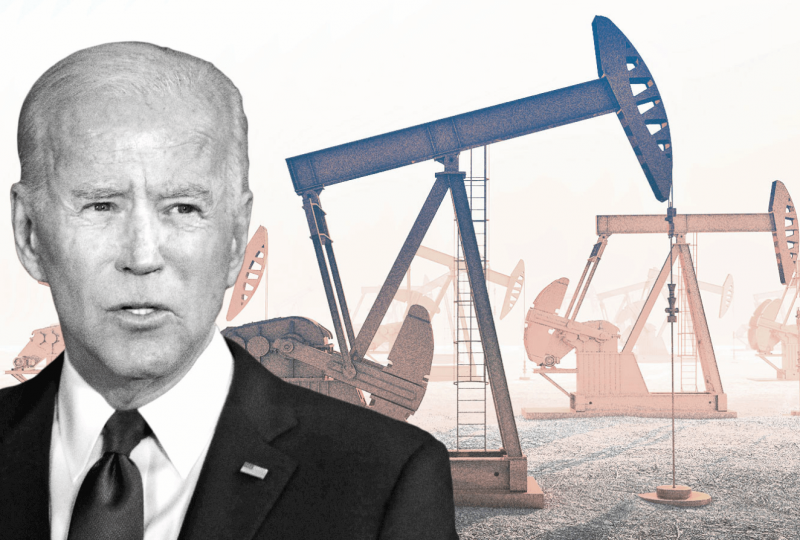

One of the major unknowns in the market right now is if OPEC and its partners, including Russia, would raise output to try to keep prices low. The extended group, known as OPEC+, will meet on Wednesday to debate whether to proceed with its plans to restore 400,000 barrels of oil output to the market. The Biden administration has requested Saudi Arabia to raise output to keep prices down, but there is no sign so far that the message is affecting the kingdom's policy. Furthermore, economists are skeptical that most OPEC countries would be able to raise output since they have not spent enough money on locating new deposits or expanding existing projects.

According to Reuters, OPEC+ fell short of its output allotment by 972,000 daily barrels in January, as a report from OPEC's Joint Technical Committee showed. Because of the output gap, it is evident that OPEC is unlikely to support the market by increasing supplies.

"They have suddenly changed a market control mechanism intended to manage prices from a bearish to a bullish position," commented Robert Yawger, director of energy futures at Mizuho Securities.

In the United States, President Biden is due to deliver his State of the Union address on Tuesday, during which he may unveil more sanctions against Russia, potentially targeting its energy export markets.

On the other hand, experts suspect that Biden would address energy in his message, mainly because he will be concentrating on reducing inflationary pressures on commodities such as gasoline. That isn't to say that energy sanctions aren't a possibility; however, they may come eventually, depending on if Russia escalates the battle further.

For the time being, the existing sanctions seem to be limiting Russian energy exports, even though the United States and other nations have specifically removed energy from penalties.

"Key European financiers to commodity trading firms have already started to reduce funding for commodity deals, and Chinese banks are also pushing back," J.P. Morgan analyst Natasha Kaneva said. "Right now, oil price differences indicate a clear refusal to accept Russian crude."

The decision to impose a complete Russian oil embargo will be heavily influenced by the severity of the battle in the following days. Oil prices are expected to rise if a full embargo is imposed.

"Regardless, in the case of a complete ban on Russian oil, possible sources of additive supply in the following months (Strategic Petroleum Reserve, Iran, increased U.S. output) isn't enough to balance the long-term loss of Russian volumes," Kaneva added. "In such a situation, demand destruction would most likely serve as a last-resort balancing mechanism."

Experts predict that prices will grow to $120 and beyond, possibly reaching $150.