The Top Financial Trends to Watch in the Crypto Market

Oct 11, 2024

The crypto market changes faster than almost any other. Cryptocurrencies have shown they react to events that change how traders and investors interact with digital assets. This includes shifts in DeFi apps or new regulations. So, everyone in the crypto world needs to keep an eye on new trends. Any investor, from seasoned pros to complete crypto novices, may benefit from this.

Decentralized Finance Infrastructure

The crypto world has been profoundly affected by decentralized finance. Financial services may be provided to all users via an open-source financial system, eliminating the need for conventional intermediaries such as banks. This has led to revolutionizing lending, borrowing, and trading while enabling users to have more control over their money.

The DeFi platforms in 2023 had their total lock value surpassing $100 billion. There is a growing trend where people are increasingly realizing the advantages of utilizing these decentralized systems which explains their growing popularity. DeFi opens doors for all kinds of investors big and small. It gives them ways to earn interest on digital money and to provide liquidity in decentralized exchanges. As this trend keeps going, experts think that new DeFi services will create more demand for tools in this area of finance.

Crypto Adoption by Institutions

Institutional cryptocurrency investment has evolved beyond its origins as a Wild West pursuit. Capital markets such as hedge funds, asset managers, pension funds, and other major financial institutions are increasingly recognizing digital currencies as feasible investment instruments. Two factors propelling this shift are stablecoins, which provide a more stable investment option, and the growing acknowledgment of Bitcoin as a reputable asset.

Regulatory Developments and Their Impact

Although there is still a great demand for clear regulations governing the crypto market in some jurisdictions, financial organizations and governments all around the world are working to create more precise guidelines. To provide a secure trading environment and protect investors from fraud and market manipulation, strict regulatory control is required.

Nevertheless, differences in regulations exist from one area to another. For example, in the US, the SEC has moved toward regulation of crypto assets and exchanges. On the contrary, some nations like El Salvador have adopted cryptocurrencies by acknowledging Bitcoin as a form of money. Such transformations will influence how the market operates in future years especially due to greater openness and protection.

The Importance of Trading Tools in Crypto Markets

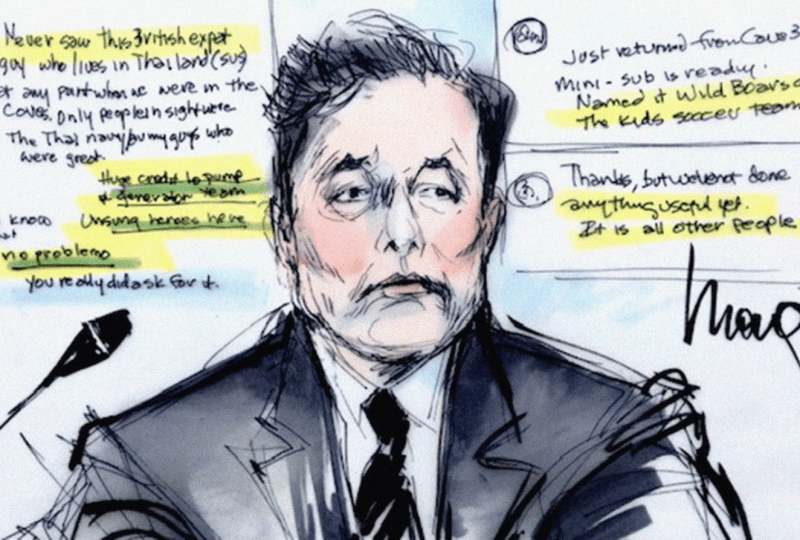

Given the increasing complexity of the digital currency sector, having the appropriate tools is essential for success. This is where professionals such as Andre Witzel are useful. Andre has practiced trading for more than 15 years, so he is aware of the particular difficulties that both novice and seasoned traders have.

For those looking to gain an edge in the market, having access to advanced tools is crucial. You are welcome to check this expert guide about must-have trading tools, created by Andre Witzel. His insights will help traders overcome common challenges such as managing emotions, executing trades at the right time, and navigating complex market analysis.

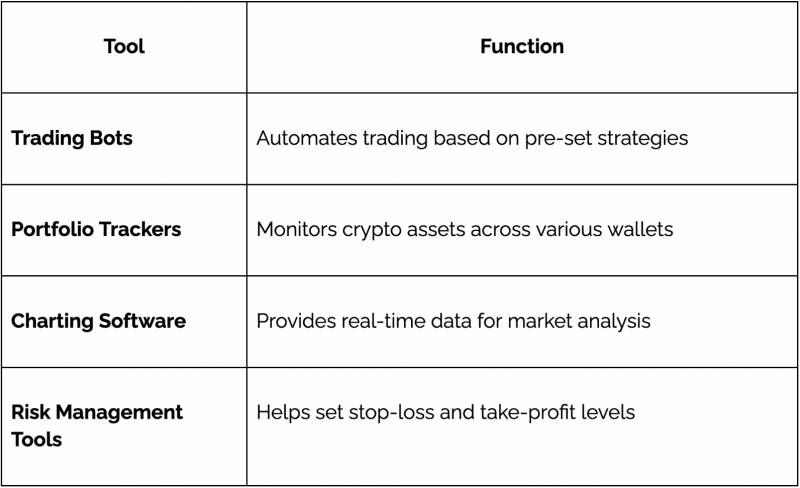

Key Trading Tools for Crypto Investors

Traders must arm themselves with the necessary tools in order to successfully navigate the volatile cryptocurrency market. The following table lists several vital resources that each trader should think about:

Every tool has a specific function in helping traders stay informed, minimize risks, and make well-informed decisions. A trader’s success may be greatly enhanced by having a strong toolkit, particularly in a market as volatile as cryptocurrency.

Key Insights for Crypto Traders

- Regularly follow industry news and regulatory updates to anticipate market shifts.

- Do not rely solely on Bitcoin or Ethereum; explore other promising altcoins.

- Always use stop-loss mechanisms and calculate potential losses before entering trades.

- Earn passive income by participating in decentralized lending, staking, or yield farming.

- Follow expert traders like Andre Witzel to refine your trading strategy and adapt to market changes.

The Future of Cryptocurrency Markets

Several aspects will affect the future growth of cryptocurrency markets. One of the most important developments that we should closely monitor is Central Bank Digital Currencies (CBDCs). All over the world, governments are thinking about launching their own virtual currencies that may either rival decentralized cryptocurrencies or exist alongside them.

Moreover, an expansive array of blockchain technology is likely to arise through its incorporation into other areas like art, gambling, and real estate in cryptocurrency market expansions according to observations from experts in this field. With more people embracing NFTs as time goes by, investors will have numerous options for diversifying their portfolios.