Will Tesla Stock Go Up? Investors Expectations.

Apr 26, 2023

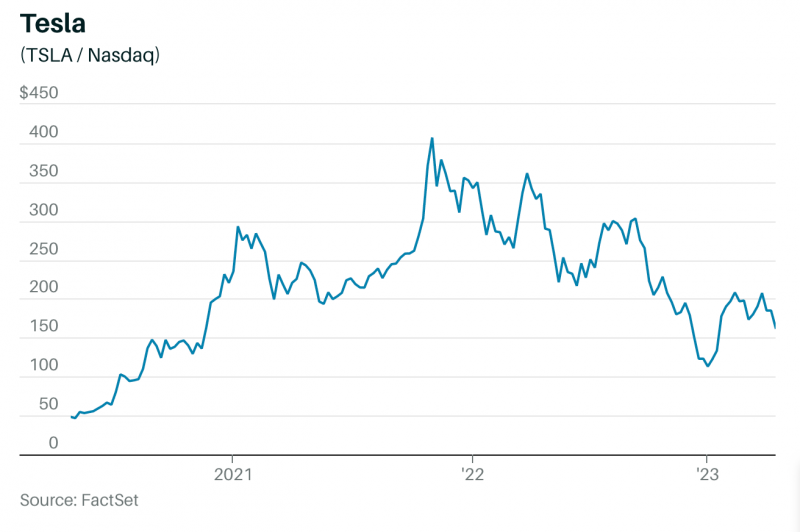

Tesla makes a lot of noise for a company that makes almost quiet electric automobiles. A barrage of EV price cuts, dismal profits, Wall Street downgrades, and stock volatility is enough to make you dizzy. The stats, however, indicate that Tesla stock is still worthwhile to acquire.

Tesla is the low-cost leader in a segment of the auto industry that is expected to increase fourfold between now and the end of the decade — and growth is what matters. The business controls around one-fifth of the worldwide EV market. Although competition is increasing, Tesla could retain at least a 10% market share by 2030, implying selling four to five million vehicles per year and generating an annual revenue growth rate of about 20% on average for over eight years.

Between the fourth and first quarters, gasoline-powered automobile sales remained unchanged, while EV sales increased by almost 15%. However, in the first quarter of 2018, sales of all-electric cars in the United States increased by 45% year on year. According to CEO Pat Ryan, nothing in CoPilot’s analytics, which helps customers search for cars, shows Americans’ enthusiasm for EVs has dropped. The greatest difficulty, he says, is available, with some customers waiting for new models to arrive.

But will Tesla stock go up? What should Tesla shareholders do with their stock? Nothing at the time. The stock is very volatile. Tesla provides chances for investors to purchase when the stock is too cheap, as we suggested when it was under $100 — it’s currently just over $160 — and to sell when it climbs, as we advised in early February when it reached $200.

In the long run, the economy will recover, EVs will improve, and charging infrastructure will improve. However, Tesla is still the EV future, and its stock is one we want to hold. Investors considering buying the stock may wish to wait for a better entry opportunity. We recommend you purchase more if Tesla returned to $100, at $150 or $160.