Top Most Popular Trading Strategies

Feb 19, 2024

Today, trading on capital markets is more than just a popular way to earn passive income and increase personal capital. Having become widespread and developed and undergone digital transformation, electronic trading embodies a concept that combines the classic model of buying and selling assets based on different trading strategies, including modern innovative technologies based on blockchain technologies, machine learning, and artificial intelligence.

This article will explain what a trading strategy is and what you should consider when developing one. In addition, you will also learn about a number of best trading strategies that you should consider for diversifying your experience in the financial markets.

Key Takeaways:

- A trading strategy is a clear plan of action expressed in the form of a set of planned actions aimed at achieving a certain trading result.

- Some of the most popular trading approaches include swing trading, scalping, and arbitrage.

What is a Trading Strategy?

A trading strategy (or system) serves as a comprehensive framework that enables traders to systemize their trading activities, offering them a sound understanding of the optimal moments to enter or exit a trade, as well as when it is advisable to abstain from trading altogether.

Moreover, this systematic approach also guides traders on the most opportune time frames and currency pairs to engage with while also determining the appropriate lot size for their transactions.

By adhering to a well-defined trading strategy, traders are able to detach themselves from emotional influences and safeguard their trading endeavors from their potentially detrimental effects.

Prior to engaging in trading activities, traders establish a trading model that encompasses various financial objectives, such as risk tolerance level, long-term and short-term financial requirements, tax considerations, and time horizon.

Consequently, traders conduct meticulous market research to analyze prevailing market trends and patterns, ensuring they comprehensively understand the current market landscape.

This diligent approach allows traders to make deliberate decisions based on reliable data, enhancing their chances of achieving favorable outcomes in their trading endeavors.

Fast Fact:

A well-planned trading strategy allows you not only to gain profit in the process of trading but also to study the laws of building market trends and patterns of price pattern movement.

What to Consider for Developing a Trading Strategy?

Trading styles can be categorized into different varieties, with the two main categories being technical and fundamental. Both strategies rely on measurable information that can be tested for accuracy.

Technical strategies utilize technical indicators to generate trading signals, with the belief that all relevant information about a security is reflected in its price and that it follows trends. An example of a technical strategy trading is the moving average crossover, where a short-term moving average crosses above or below a long-term moving average.

On the other hand, fundamental strategies consider fundamental factors when making trading decisions. Investors using this approach may establish screening criteria to find potential opportunities. These criteria are developed by analyzing revenue growth and profitability, which provide insights into a company’s financial health and prospects.

In addition to technical and fundamental approaches, there is a third type known as quantitative trading system. This strategy has recently gained prominence and shares similarities with technical trading. Notwithstanding, it considers a much larger matrix of factors to make purchase or sale decisions compared to traditional technical analysis.

A quantitative trader utilizes various data points, including regression analysis of trading ratios, technical data, and price, to identify market inefficiencies and execute rapid trades using advanced technology. This approach leverages a vast amount of data to uncover patterns and exploit opportunities in the market.

Top Most Prevailing and Popular Trading Techniques

Today, the market is full of a great variety of trading methods, each of which has its advantages and disadvantages, as well as features that make it possible to conduct effective trading in each individual situation. Nonetheless, the following best trading strategy examples have gained exceptional popularity among traders.

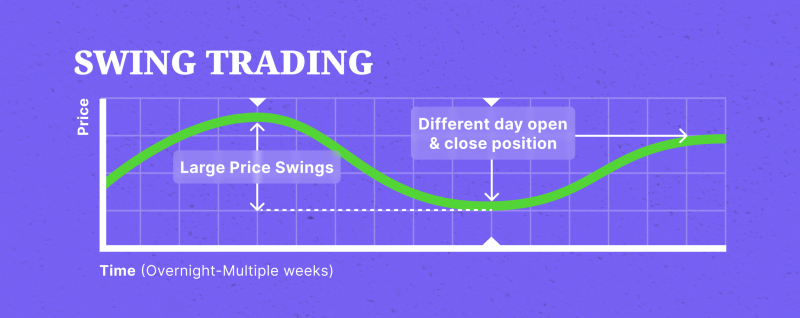

1. Swing Trading

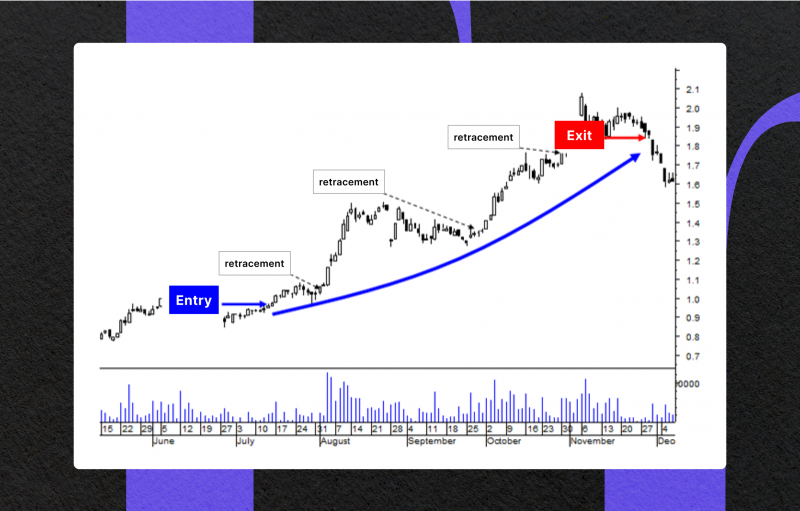

Swing trading is a medium-term trading style based on the cyclicality of price movements. The main idea of this method is to recognize the beginning of the cycle early and use its dynamics as effectively as possible.

The success of a trader using this style depends on how subtly he/she feels the beginning and end points of a separate trend movement. The greater the volume of directional price movement the trader utilizes, the greater the profit.

2. News Trading

The implementation of a news trade strategy revolves around making trades based on news updates and market predictions, both prior to and after the release of the news.

Engaging in trading activities upon news announcements demands a sharp and discerning mindset, considering the rapid dissemination of news through digital platforms. Traders must promptly evaluate the news upon its release and swiftly determine the appropriate trading approach.

3. End-of-Day Trading

The end-of-day trading approach involves conducting trades close to the market’s closing time. Traders who employ this strategy become active when it becomes evident that the price is about to “settle” or conclude. To effectively implement this approach, traders must analyze the price action concerning the previous day’s price movements.

By studying the price action, end-of-day traders are able to make informed speculations about the potential movement of prices. They can also determine which indicators to incorporate into their trading system.

To mitigate any risks that may arise overnight, traders should establish a set of risk management orders, including a limit order, a stop-loss order, and a take-profit order. These measures minimize potential losses and ensure a more secure trading experience.

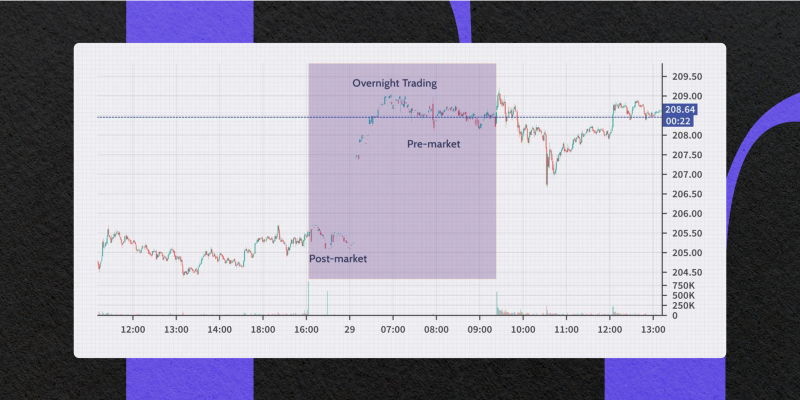

4. Overnight Trading

Overnight trading, as its name implies, pertains to transactions that occur after an exchange’s closing and before the market reopens. In contrast to regular market hours, overnight positions provide an exclusive opportunity for financial professionals to respond to news events and market fluctuations that transpire outside of the usual operational sessions.

One of the main advantages of overnight trading is the capability to react to news events outside of regular market hours. This could include economic data releases, corporate income announcements, geopolitical developments, or any other event that could impact the financial markets. By trading overnight, professionals can analyze and interpret these events and adjust their positions accordingly, potentially taking advantage of any market movements that occur as a result.

5. Day Trading

Day trading (or Intraday trading) is one of the most popular types of trading, in which a trader opens and closes trades within one trading day. Thus, the trader manages his open positions within the framework of intraday trading strategy and does not carry trades to the next day. Intraday trading is actively used by traders in the Forex, futures, and stock markets.

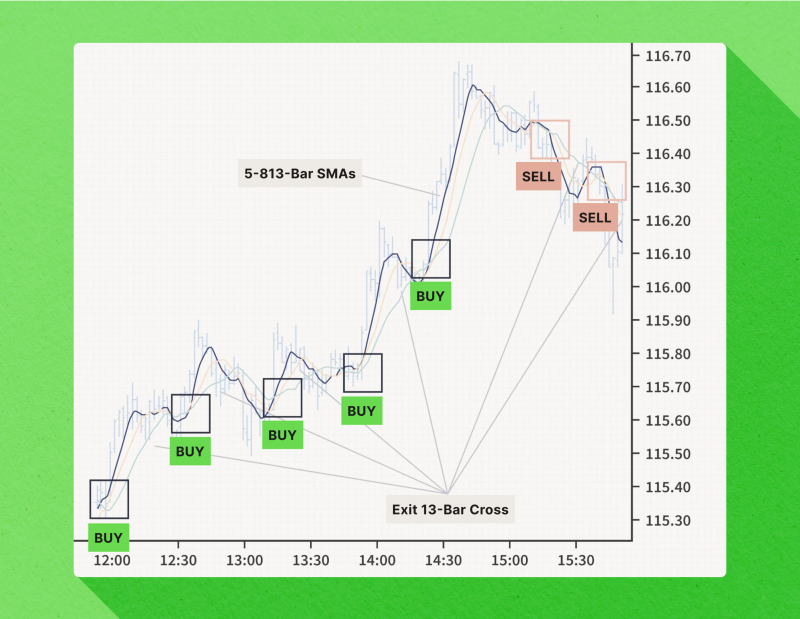

6. Scalping Trading

Scalping is an intraday speculative trading strategy based on making many short-term trades for small profits that add up to a desired return percentage.

When engaging in scalping, profitability depends on many factors: the size of the deposit, the level of take profit and stop loss, the trader’s goal for the day, and, most importantly, the psychological stability of the trader.

This trading strategy is one of the riskiest strategies in trading, as this approach requires maximum focus and attention from the trader.

7. Position Trading

Position trading is a strategy that requires traders to hold their positions open for extended periods, often weeks to months. The primary objective of position trading is to turn to a good account of long-term price variations in the market.

One of the critical characteristics of position trading is the need for patience and discipline. Traders must be willing to wait for the market to move in their favor, as a position may take weeks or even months to reach its target price. This requires a strong mental fortitude and the ability to withstand short-term variations without panicking or making impulsive decisions.

8. Momentum Trading

Momentum trading implies opening transactions during the period when strong market movements are observed. For example, an asset’s volume growth can be observed against the background of a certain news release, update of annual maximums, and other events.

Such positions can be held for several seconds or even during the trading day. This determines the strength of the impulse and the presence of prerequisites for a reversal.

9. Arbitrage

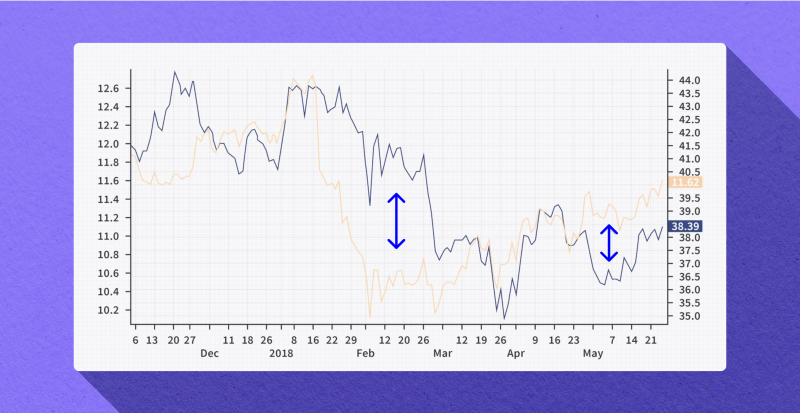

Arbitrage is one of the best types of trading strategies that involves simultaneously opening opposing trades on either the same exchange instrument or different instruments or markets that exhibit a mutual correlation.

This strategy aims to capitalize on price discrepancies or imbalances between these assets, allowing traders to profit from the market inefficiencies. By executing these trades simultaneously, arbitrageurs can take advantage of the price differentials and generate profits with minimal risk exposure.

Conclusion

Trading on the financial markets is a popular way to exaggerate capital, which has wide opportunities for experimentation thanks to an impressive list of trading strategies, each of which is capable of becoming a powerful and effective tool for earning money in skillful hands.