What Is a Designated Market Maker (DMM)?

Nov 27, 2024

In the on-the-go world of financial markets, stability and order are essential — but not guaranteed. In this environment, a designated market maker (DMM) plays a quiet yet powerful role, working behind the scenes to keep markets fluid, stable, and accessible.

Often considered the backbone of exchanges, DMMs ensure that trades can occur even when the natural balance of buyers and sellers tilts. By maintaining constant buy and sell quotes, managing large orders, and stepping in during periods of volatility, DMMs create a seamless environment where participants can trade with confidence.

This article aims to explain the concept of a designated market maker and its role in the structure of financial markets. You will also learn about the responsibilities of such a business model and what future prospects await it.

Key Takeaways

- The exchange selects a designated market maker for a specific security to serve as the primary market maker.

- A DMM is tasked with maintaining bid and ask quotes and coordinating buy and sell transactions to ensure smooth market operations.

- Market makers often manage trading for several hundred listed stocks simultaneously.

What is a Designated Market Maker (DMM)?

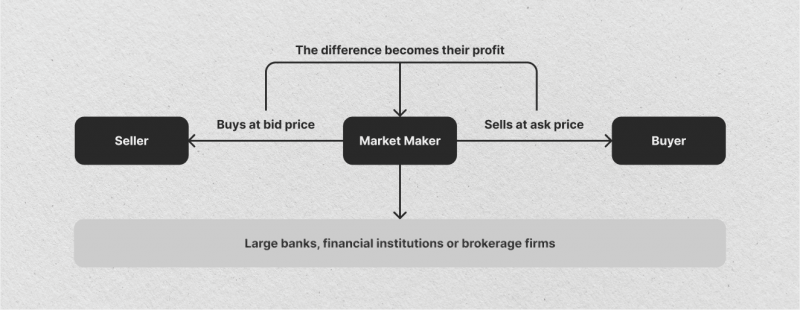

A DMM is a specialized financial professional or firm that maintains fair, orderly, and efficient trading for specific stocks on an exchange. DMMs have direct involvement in ensuring market stability by providing liquidity, meaning they buy and sell securities to keep trading smooth and consistent, even during heightened volatility.

DMMs, often considered the backbone of exchange markets, are responsible for stepping in as buyers or sellers to manage supply and demand imbalances in their designated stocks. By consistently placing bids (offers to buy) and asks (offers to sell) for the stocks they cover, they foster an orderly flow of transactions and reduce the risk of extreme price fluctuations.

This proactive approach is particularly crucial during periods of high volatility or market stress, where rapid, unmoderated price changes could otherwise destabilize the market. By actively engaging in trades to fill the gaps between buyers and sellers, DMMs ensure that trading remains accessible and efficient, which builds investor confidence and enhances the exchange’s reliability.

DMMs are integral to the functioning of many exchanges, particularly those that still rely on human oversight and expertise alongside electronic trading, like the New York Stock Exchange (NYSE). Their main role centers around maintaining an orderly market for specific stocks, which involves buying and selling shares to fill in gaps between natural buyers and sellers.

This “liquidity provision” is crucial for creating a stable and predictable environment, as it ensures that buyers and sellers can execute trades at reasonable prices without excessive delays or extreme price fluctuations.

Fast Fact

DMMs often work with supplemental liquidity providers (SLPs) because they are both essential to market liquidity, though operating differently, and serve unique roles within the exchange ecosystem.

Key Responsibilities of a Designated Market Maker

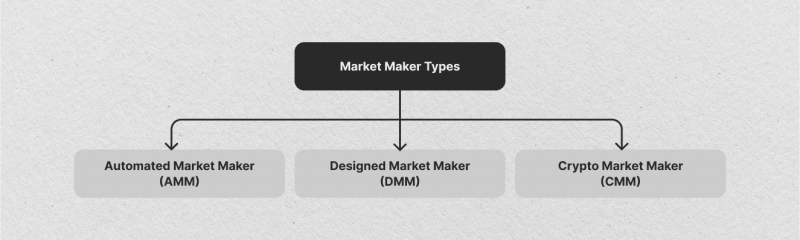

DMMs are a complex business model within the financial markets, ensuring its stability, the functions of which are in some respects similar to the functionality of liquidity providers. At the same time, it is an independent model with its own responsibilities and features, presented below:

Providing Liquidity

A primary responsibility of a DMM is to ensure that there is always an available market for stocks they oversee. By consistently placing bid (buy) and ask (sell) quotes, DMMs create a two-sided market, which means there’s always an opportunity for traders to buy or sell.

During low trading periods — such as mid-day or in times of low market interest — DMMs buy or sell shares from their own inventory. This ensures that trading can continue uninterrupted, preventing “gaps” in the market where no trades occur.

By providing this liquidity, DMMs reduce the risk of drastic price changes between trades and allow investors to execute their trades more quickly and at predictable prices.

Maintaining Orderly Market Conditions

DMMs help to stabilize prices by reducing the bid-ask spread, or the difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept. A narrower spread makes it easier for buyers and sellers to agree on a price, which leads to smoother transactions.

DMMs monitor and manage large buy and sell orders that could cause price imbalances. By filling orders from their inventory, they absorb temporary demand or supply shocks, preventing sudden and erratic price movements.

This stability is particularly valuable during earnings announcements or other high-impact events when prices become volatile. By moderating these fluctuations, DMMs protect investors from abrupt price changes and create a more predictable market environment.

Facilitating Price Discovery

DMMs play a critical role in setting stock opening and closing prices by balancing buy and sell orders received during pre-market and after-hours trading. This balance reflects the stock’s fair value as it opens or closes for the day.

Throughout the trading day, DMMs actively participate in transactions to ensure prices remain consistent with overall supply and demand. They reinforce pricing transparency and accuracy by stepping in and making trades themselves.

Accurate price discovery offers investors and analysts clear benchmarks for decision-making. It is especially important for investors who rely on opening and closing prices to assess a stock’s performance, particularly in volatile or uncertain market conditions.

Managing Large and Complex Orders

Institutional investors (like mutual funds and pension funds) may need to buy or sell large volumes of shares, which can overwhelm the market if not handled carefully. DMMs help these institutions execute large orders by using their own inventory to fulfill the trade or by finding offsetting orders and balancing the transaction to avoid market disruption.

Large trades can create a significant market impact if executed simultaneously, unnaturally driving the stock price up or down. By spreading out the trade or filling it with their inventory, DMMs prevent sudden, artificial price changes.

This support helps maintain orderly market conditions, especially during times of high demand, like major financial announcements or when institutional investors are rebalancing their portfolios.

Acting as a Market Backstop

In periods of market stress or rapid fluctuations — like economic shocks, geopolitical events, or a major sell-off — natural buyers and sellers might withdraw from the market due to increased uncertainty. In these cases, DMMs increase their trading activity to keep the market functional.

As a backstop, DMMs use their inventory to absorb high selling pressure or fill gaps in buying interest. This intervention helps to prevent price crashes or extreme volatility during these high-stress periods.

By stabilizing the market during uncertain times, DMMs give investors confidence that they can still execute trades, which supports the broader goal of a resilient and reliable market.

Adhering to Regulatory and Compliance Standards

DMMs must comply with regulations that promote fair and transparent trading. They establish detailed audit trails for each transaction, report trades accurately, and disclose any conflicts of interest to ensure a fair playing field for all investors.

They are subject to oversight by financial regulatory bodies, who ensure that DMMs adhere to practices that avoid price arbitrage or unfair advantage. These requirements are designed to protect investor interests and maintain market integrity.

This accountability fosters trust among market participants, as investors can have confidence that DMMs operate transparently and are held to high ethical standards.

Supporting Market Technology and Innovations

With the advent of high-frequency and algorithmic trading, DMMs have incorporated advanced technology into their operations to stay competitive. They leverage real-time data, predictive algorithms, and automated systems to maintain efficient and timely market-making activities.

By integrating real-time analytics, DMMs can react to market changes more accurately, helping them uphold their liquidity and stabilization duties even in fast-moving, electronic trading environments.

As trading technology evolves, DMMs are poised to play a role in more sophisticated digital asset markets, like cryptocurrencies or tokenized assets. They ensure they are prepared to extend their services into emerging financial landscapes by remaining technologically adaptive.

The Future of Designated Market Maker Business Model

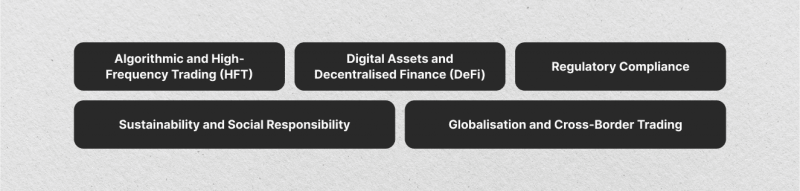

The future of DMMs is shaped by a rapidly evolving financial landscape characterized by technological advancements, shifts toward digital assets, and increasing regulatory expectations. As the trading environment becomes more complex and technology-driven, DMMs are likely to adapt their traditional roles and embrace new opportunities in the market.

Algorithmic and High-Frequency Trading (HFT)

One key trend influencing the future of DMMs is the rise of algorithmic and high-frequency trading. These technologies have transformed how liquidity is provided in the market, with algorithms capable of executing trades in milliseconds, often faster than traditional human-driven DMM operations.

As a result, DMMs are increasingly incorporating advanced technology into their practices, adopting high-speed algorithms, predictive analytics, and AI-driven trading models to compete effectively in this fast-paced landscape.

In the future, DMMs may rely even more on artificial intelligence to optimize their bid and ask strategies, improving their ability to predict and respond to market fluctuations with unprecedented precision.

Digital Assets and Decentralised Finance (DeFi)

The shift toward digital assets and DeFi also presents new opportunities and challenges for DMMs. As cryptocurrencies, tokenized assets, and other digital securities are popular, traditional stock exchanges are exploring ways to incorporate these assets into their platforms. DMMs, with their experience in managing liquidity and stabilizing markets, are well-positioned to play a crucial role in these emerging markets.

However, digital assets come with high volatility and unique trading behaviors that differ from traditional stocks. To operate effectively, DMMs must develop new strategies, leveraging blockchain technology and decentralized platforms to extend their market-making expertise into digital asset exchanges. In doing so, DMMs could become key players in supporting liquidity and stability in DeFi ecosystems.

Regulatory Compliance

Regulatory compliance will remain a focal point for DMMs, primarily as regulators work to keep pace with technological advances and the risks associated with digital assets. Increasingly, regulators are imposing stricter guidelines to ensure fair trading practices, transparency, and ethical conduct, especially in areas like algorithmic trading and market manipulation.

For DMMs, this means operating within more defined compliance frameworks and maintaining rigorous audit trails. DMMs may need to adapt to additional regulatory scrutiny as the financial landscape evolves, particularly when operating in hybrid environments that blend traditional securities with digital assets.

This added layer of accountability may increase operational complexity, but it will also help bolster market stability and investor confidence in an era of technological disruption.

Sustainability and Social Responsibility

Another key element shaping the future of DMMs is sustainability and social responsibility. As investors and stakeholders increasingly prioritize environmental, social, and governance (ESG) factors, DMMs may integrate ESG considerations into their trading practices and strategies.

For example, they may prioritize liquidity provision for companies with strong ESG performance or play a role in the price discovery process for newly emerging ESG-focused financial products.

By incorporating ESG factors into their operations, DMMs could contribute to a broader shift toward sustainable investing and encourage greater transparency and responsibility within financial markets.

Globalization and Cross-Border Trading

Globalization and cross-border trading are also likely to impact the future of DMMs. As financial markets become increasingly interconnected, DMMs may find opportunities in global exchanges and cross-border trading. This expansion into international markets could help DMMs diversify their portfolios and increase their impact on a broader array of assets.

However, global operations have unique challenges, such as navigating diverse regulatory environments and managing currency risks. To thrive in a globalized market, DMMs may need to build expertise in international compliance and enhance their technology infrastructure to handle the complexities of cross-border trades seamlessly.

Conclusion

DMMs ensure liquidity, stability, and fairness in capital markets. As technology advances, they adapt by integrating AI, high-frequency trading, and blockchain to handle new asset classes like digital securities.

Looking forward, DMMs will continue to uphold market integrity, meeting the demands of a globalized digital economy. Their commitment to regulatory standards, investor trust, and possibly ESG principles positions them well for the future, reinforcing their vital role in a resilient and transparent financial ecosystem.

FAQ

How do designated market makers manage large orders?

DMMs help manage large trades for institutional investors by using their inventory or finding offsetting orders to avoid market disruptions.

Are designated market makers subject to regulations?

Yes, DMMs operate under strict regulatory guidelines to assure transparency and fairness in the market. They carry out audit trails, report trades accurately, and avoid conflicts of interest.

How do DMMs use technology?

DMMs use advanced technologies like real-time data, predictive algorithms, and AI-driven trading models to stay top-of-the-line in a high-frequency trading environment.