TRUMP Coin Enters The Top 20 Cryptos – Is It Legit?

Jan 20, 2025

Ever since Donald Trump announced his presidential run and pro-Bitcoin stance, most of the crypto market news has been linked to him. With promised policies to improve the DeFi industry and blockchain developments in the US, most cryptocurrencies surged after Trump won the elections.

The hype continued, and a few days before the presidential inauguration, the official TRUMP meme coin was launched, taking the crypto market boom to another level.

Between doubters and believers, the TRUMP coin surged tremendously, reaching as high as $75 in one day. Will this trend continue? Or will it be another crashing memecoin? Let’s find out.

What is $TRUMP Memecoin?

On 18 January, the US president-elect, Donald Trump, announced his official cryptocurrency, a memecoin developed on the Solana blockchain.

OFFICIAL TRUMP, or simply, TRUMP, will be managed by CIC Digital, an affiliate of the Trump Organization and the company that previously monitored Trump sneakers, NFTs, and other relevant merchandise, besides a CIC co-owned entity called Fight Fight Fight LLC.

TRUMP memecoin is capped at 1 billion coins in total supply, from which only 200 million are initially available, with a three-year unlocking schedule to preserve value and scarcity.

Is $TRUMP Coin Legitimate?

Yes. Despite the doubt in the few hours following the launch, when many suspected that Trump’s X account was hacked to be used to promote some illegitimate coin. However, since no announcement was made denying the news, users became more confident of the coin’s legitimacy.

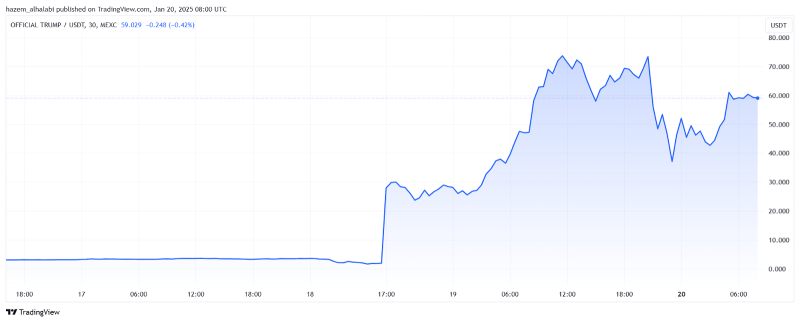

The memecoin attracted massive speculation and attention from market participants. TRUMP coin price increased from $2 to $30 in one day, with another surge that skyrocketed to $75 on 19 January.

However, late on 19 January, the coin faced correction, dropping to $43 before a slight jump to $58 on 20 January.

This increased inflow was accompanied by massive growth in market capitalization, gathering over $15 billion on the second day before retracting to $11.7 billion on 20 January, putting $TRUMP as the 18th best cryptocurrency.

Trading $TRUMP and $MELANIA

Soon after the release, a few exchanges, such as MEXC, ByBit, and Bitget, listed the $TRUMP coin for trading, while the renowned Binance announced TRUMPUSDT perpetual future contracts with 25x leverage, which can potentially boost the Trump coin price prediction and investor inflow.

The upcoming first lady, Melania Trump, also announced her own memecoin, feeding the market craze. The announcement was made in an official X post, driving more users to the memecoin hype and boosting the Melania coin to a nearly $2 billion market cap.

Conclusion

The crypto market is buzzing with the newly released TRUMP coin, which is fueling the promised pro-DeFi regulations and Bitcoin-oriented strategies to restore the US leadership in blockchain and technology.

The memecoin grew by over 3,600% in a couple of days before correcting its value to around $60 on 20 January. Nevertheless, multiple exchange platforms added $TRUMP to their offerings, pulling more market participants and crypto traders, despite the risks associated with memecoins.

Disclaimer: This article is for informational purposes only. It is not finance advice and should not be relied upon for investment decisions. Always do your own research and consult a financial advisor before investing.