What is FIX API Liquidity Connection and How Does it Power Institutional Trading?

Aug 15, 2025

Trading platforms involve complicated technologies that make order placement, market access, and trade execution seamless and swift. For traders, all it takes is a few clicks here and there to find assets and open a position.

However, from the platform’s point of view, there is a sophisticated structure that handles communication with trading venues, connection with liquidity providers, real-time price streaming, and other instances necessary for the end-user experience.

FIX API is a vital protocol in this environment, connecting trading platforms and liquidity providers to ensure favored prices, settlements, and filling logic. Let’s explain how this messaging standard works in institutional trading and how to find a FIX API trading provider.

Key Takeaways

- Financial Information Exchange Application Programming Interface – or FIX API – is a messaging protocol used in trading platforms.

- FIX API is used to connect brokers with liquidity providers, trading engines, and financial markets.

- In institutional trading, FIX API connections can achieve single-digit milliseconds or sub-millisecond message turnaround.

- Brokerage firms use a FIX protocol to access real-time quoting and offer direct market access.

Understanding FIX API

Financial Information Exchange (FIX) API is a globally recognized protocol that enables seamless, low-latency communication between trading systems and liquidity providers.

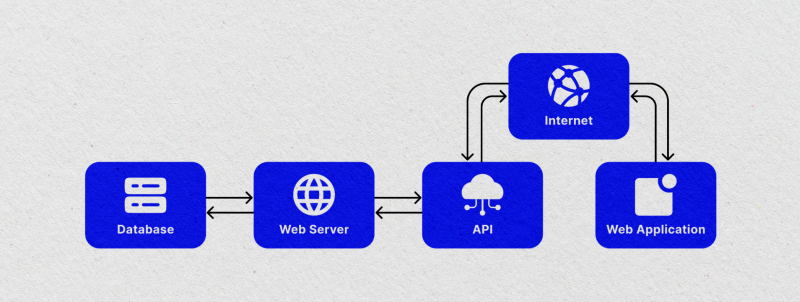

Since trading involves intricate server operations, including receiving users’ positions, fetching market prices, and placing orders, such a process needs a messaging standard to simplify communication and reduce friction.

FIX API is designed for speed, stability, and transparency, eliminating manual processes, allowing institutional participants to execute trades, access market data, and manage orders in real time.

This system operates on a direct, point-to-point basis to reduce delays and slippage, contributing to more accurate quoting and appropriate order filling.

Moreover, it is highly customizable, making it ideal for advanced trading strategies, such as high-frequency and algorithmic trading strategies.

FIX API Role in Financial Markets

In today’s competitive financial landscape, FIX API has become the gold standard for institutional-grade infrastructure. Its advanced technology enables ultra-fast transmission and order execution, giving operators a competitive edge because every millisecond matters for profitability.

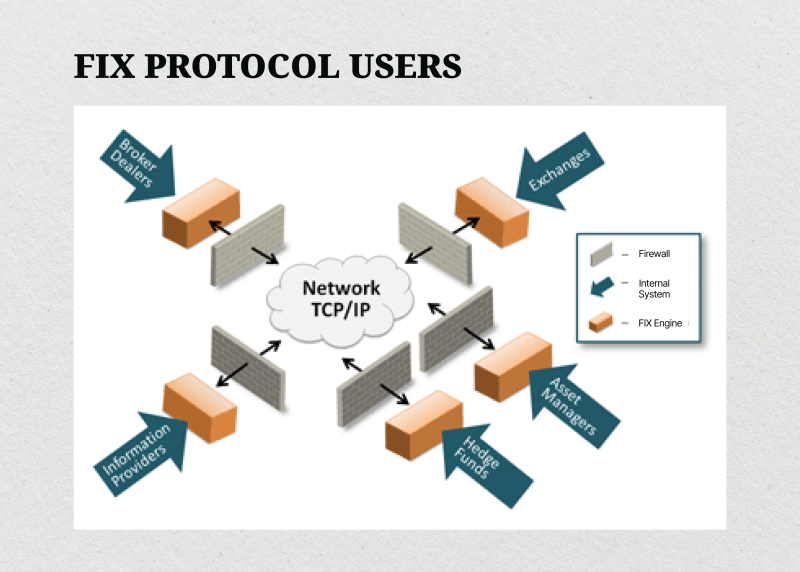

FIX Protocol acts as a bridge between market participants and liquidity pools, ensuring that orders are matched and processed with optimal speed and accuracy, reducing the impact of broker-dealer or counterparty risk.

The widespread adoption of this standard across banks, brokers, exchanges, and market makers fosters global trading interoperability, especially for multi-asset trading platforms, offering Forex, crypto, stocks, CFDs, and other securities.

It is the backbone of institutional trading due to reduced reliance on manual intervention and minimized operational risk.

Fast Fact

FIX Protocol was born in 1992 when Salomon Brothers and Fidelity Investments needed a faster, error-free alternative to phoned and faxed equities trading. Its performance soon spurred growth across Forex, derivatives, fixed income, and international markets.

Key Use Cases of FIX Protocol in Institutional Trading

FIX API liquidity serves diverse institutional players, enabling brokerage firms to offer unparalleled execution speed and market access. Whether for complex algorithmic trading or large-scale order flows, FIX connections highlight stability and performance.

Hedge Funds & Algorithmic Trading Firms

Hedge funds and operators that support algorithmic trading use FIX messages to ensure low-latency order execution for advanced automated strategies. It enables bulk order management, systematic risk controls, and precise processing timing.

These capabilities make brokerage firms highly demanded, processing data accurately, reacting instantly, and capitalising on ongoing trends with minimal slippage.

Brokers & Prime Brokers

For retail brokers, FIX API liquidity enables aggregation from multiple providers and pools to deliver tighter spreads and greater market depth to clients. Prime brokers, on the other hand, benefit from enriched order routing logic and advanced risk management techniques.

Reliable providers connect your platform to top-tier providers, such as B2CONNECT, oneZero, and Match-Trade, to expand your users’ choices and offer better trading conditions.

Banks & Market Makers

Banks, financial institutions, and market makers rely on the FIX API to consolidate and distribute liquidity to institutional clients. This enables them to deliver rapid order processing and consistent asset quoting, contributing to a better trading experience.

Its reliability supports high transaction volumes and facilitates market-making activities across asset classes, from FX to equities, empowering financial firms to offer competitive prices in highly dynamic market conditions.

Prop Trading Firms

Proprietary trading firms employ FIX API standards to allocate the corporate capital across multiple venues, managed by the prop trader.

By leveraging real-time market data and direct routing channels, prop firms can manage risk more effectively while capitalising on arbitrage opportunities and ongoing trends.

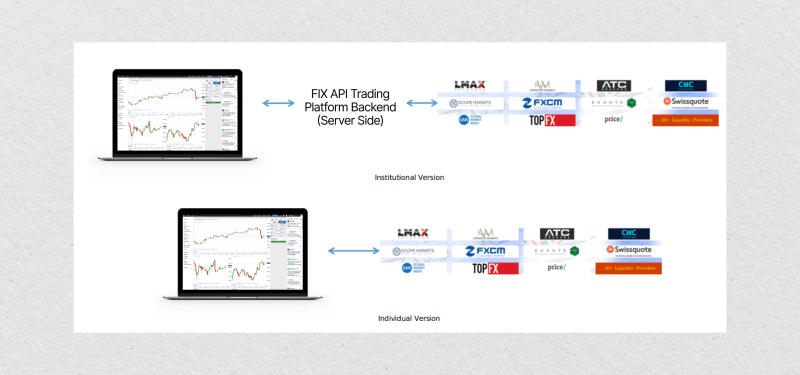

Integration with Institutional Trading Liquidity

FIX API protocols link up brokerage institutions to provide institutional trading liquidity, which helps brokers to trade through deep order books and competitive pools. It results in minimized bid-ask spreads, improved fills, and better trading performance.

FIX integration supports multi-asset trading, which can be customized to the broker’s requirements, aligning with their business models, electronic trading networks, and internal matching engines.

Check out our list of the best liquidity providers that you can integrate with to improve your market access and offer minimum trading latency.

How FIX API Trading Works

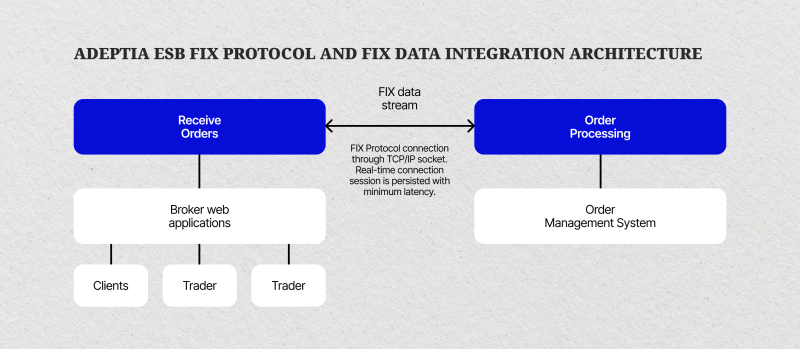

FIX API liquidity connections function through a streamlined communication protocol that transmits structured messages between two parties, for example, a trading platform and a liquidity provider.

The process starts when an end-user executes a market position. The client system sends an order message to the liquidity provider, stating details like instrument, quantity, price, and order type. All these instances are formatted in a uniform FIX standard.

Then, the liquidity provider’s server responds in real time to the request, confirming receipt and executing or rejecting the order. If approved, the execution report is sent back, detailing price, fill quantity, and trade ID.

What’s so special about FIX API is that throughout the session, the protocol keeps transmitting market data messages, ensuring the client’s system is always updated with bid/ask quotes, market depth, and trade ticks. This happens because the connection operates via a persistent TCP/IP session, which enables continuous two-way communication with low latency.

This direction connectivity bypasses web interfaces, massively accelerating order processing and reducing the risk of price slippage.

In addition, FIX API liquidity also aggregates feeds from a number of providers, which gives brokers yet more pricing choices to accommodate the trader’s requirements.

That in turn makes it highly attractive for institutional trading liquidity environments that require reliability, openness, and high-volume transaction processing without any loss of performance.

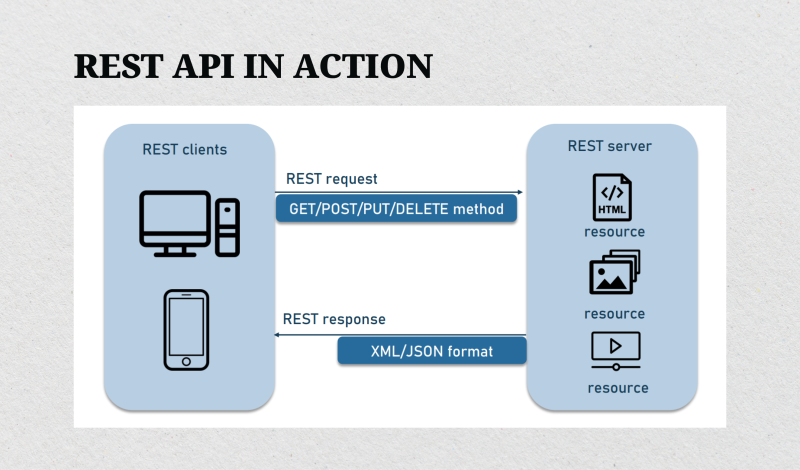

FIX API vs REST API

REST, or Representational State Transfer, APIs are messaging protocols used to access market data, send trade orders, and manage accounts. While they are versatile and serve the purpose of processing trading orders, they are not optimized for the millisecond-sensitive nature of institutional trading.

REST API uses request-response methodology, which can result in slight latency with every request. Therefore, they are better suited for administrative tasks, such as account queries or trade history retrieval.

In contrast, FIX API trading maintains an always-on session, supporting instant message exchange without having to authenticate every single request. This protocol is ideal to establish live market connectivity, deliver accurate quote updates, and streamline market data more efficiently.

FIX API vs WebSocket

WebSocket APIs offer real-time data streaming through a single TCP connection, which are usually employed in retail trading platforms and basic live market feeds.

WebSocket connections are suitable for lightweight, browser-based trading tools because they lack the institutional-grade standardisation and message structure of the Financial Information Exchange protocol.

In contrast, FIX API supports complex order types, risk management techniques, and post-trade reporting, making it ideal for banks, brokers, and institutional liquidity providers.

Types of Data Exchanged with FIX Messages

FIX trading protocols cover a wide range of message categories that facilitate the entire trade lifecycle, from order placement to post-settlement. Let’s review the type of data this method handles.

Market Data Messages

Market data messages deliver real-time bids, offers, last prices, and depth-of-book updates, allowing institutions to calculate slippage and price risk before validating any order.

FIX supports consolidated and specific feeds, request limits, and message sequencing, resulting in consistent, low-latency streams and reliable order flow.

Order Routing Messages

These messages instruct servers to place, modify, or cancel submitted orders against the instrument, market side, quantity, price, time-in-force, and execution restrictions.

This way, FIX tags standardize order logic across venues, which simplifies request handling, audit trails, and acknowledgement for latency-sensitive workflows.

Execution Reports

Execution reports summarize each order event’s outcomes—new, partial-fill, full-fill, cancel, replace, or reject. Each of these event reports includes trade IDs, prices, quantities, timestamps, and venue identifiers.

By streamlining deterministic sequencing and identifiers, brokers can access detailed post-trade analytics and comply with audit trail requirements, boosting user confidence and retention.

Post-Trade Messages

Post-trade messages manage allocations, confirmations, settlement instructions, and clearing workflows. They link executions to accounts and give counterparties matched details for timely affirmation.

FIX supports multi-party workflows, regulatory reporting fields, and status updates, reducing operational risk and breaks while streamlining between front office, middle office, liquidity providers, and brokers.

Session & Administrative Messages

These messages manage the FIX API connection itself, ensuring both sides stay connected and synchronized based on the following metrics:

- Logon: the initial step to authenticate the connection and settings.

- Heartbeat: regular signals to confirm the link is alive.

- Test Request: a prompt to check responsiveness.

- Resend Request: a way to recover lost messages.

- Logout: the orderly closing procedure of the session.

They also manage IDs for each message and negotiate capabilities so both sides know what message types are supported. It keeps communication orderly, speeds recovery from faults, and ensures trading workflows remain synchronized and resilient under high-load conditions.

Advantages and Disadvantages for Institutional Trading

FIX API offers great advantages, such as unmatched speed and flexibility for institutional trading liquidity. However, it comes with a few shortcomings, including operational demands and cost considerations.

Let’s review some of these benefits and drawbacks to decide whether this protocol aligns with your execution, compliance, and infrastructure goals.

Pros

- Ultra-low latency execution: FIX API provides direct, high-speed communication with liquidity providers, essential for algorithmic and high-frequency strategies where milliseconds matter.

- Customizable trading logic: Institutions can design fully tailored execution strategies, order types, and routing rules to match specific business and compliance needs.

- Deep liquidity access: FIX API liquidity connections grant brokers and hedge funds access to multiple top-tier liquidity pools for better pricing and reduced market impact.

- Operational transparency: Rich execution reports and real-time monitoring allow for precise trade auditing, performance optimisation, and client reporting.

- Scalability for growth: FIX infrastructure supports increasing trade volumes and multi-asset class expansion without compromising performance.

Learn how to build a brokerage platform and ensure reliable FIX API connectivity with a leading liquidity provider.

Cons

- Higher costs: Implementing FIX APIs requires technical expertise, robust infrastructure, and ongoing support, which can be costly for smaller firms or brokerage startups.

- Complex requirements: Integrating liquidity providers via FIX API streams requires skilled developers who are trained specifically in the FIX protocol specification.

- Operational risk exposure: Direct market access means that poor coding, faulty algorithms, or misconfigured risk controls can result in significant financial losses.

- Not beginner-friendly: FIX API trading is designed for professional, institutional use. As such, inexperienced teams may struggle to leverage its full potential.

Conclusion

FIX API liquidity is the backbone of institutional trading, providing unmatched execution speed, reliability, and access to deep global markets.

It is a messaging protocol between trading servers, including brokerage platforms, liquidity providers, and trading venues, which transmits routing logic, real-time market data, and order processing rules.

This consolidated system ensures smooth execution of orders across multiple brokers, hedge funds, and online trading sites, in search of a competitive edge. Though installation and maintenance require expertise, long-term performance benefits outweigh problems for mature players in markets.

Thus, obtaining expert assistance in order to install your liquidity bridge and trading engine is paramount to taking advantage of all that the FIX API has to offer. Explore B2BROKER’s solutions and launch your trading platform today!

FAQ

What is FIX used for?

FIX (Financial Information Exchange) is used to transmit trading instructions, order confirmations, and market data between financial institutions. It standardizes communication, enabling seamless, high-speed interaction between brokers, exchanges, liquidity providers, and institutional traders across global markets.

What is the difference between REST API and FIX API?

REST API is designed for general web-based data exchange, suitable for lower-frequency trading, while FIX API is a financial industry standard built for high-speed, low-latency order routing and real-time market data that suits institutional and algorithmic trading.

Can brokers access the FIX API for free?

Brokers often need to integrate with a liquidity provider or technology vendor to access the FIX API infrastructure. They might also need to meet minimum trading volume requirements or pay recurring fees, as it involves specialized configuration, dedicated connectivity, and ongoing technical support.

Why use FIX API in a brokerage platform?

FIX API enables ultra-fast order execution, direct connectivity to liquidity providers, and standardized electronic communication. This supports institutional-grade performance, improves pricing through aggregated liquidity, and allows integration with advanced trading systems.