8 Biotech Stocks So Cheap That Their Technology Is Effectively Free

Feb 17, 2022

It is mid-February, and the troubled biotechnology sector shows little sign of revival. This may be an opportunity for some stocks.

As of Tuesday's close, the SPDR S&P Biotech exchange-traded fund was still down 14.6 percent for the year, albeit it had risen 2.4 percent in the first two weeks of the month. In February, the iShares Biotechnology ETF, which also covers the sector, fell 1.4 percent in February.

Investor opinion toward the biotech sector has deteriorated to the point where a number of biotechs' market valuations are less than their cash on hand. That has been the case for a long period of time: In December, Barron's stock screen identified eight biotechs selling at a discount to cash.

Two months later, the sector's performance has not improved. It's astonishing that a large number of biotechs, some of them quite substantial, continue to exist in that state. This reflects both the depths of investor apathy toward biotech companies this year and the chances that await investors who are less pessimistic about the industry.

When a company's stock trades on its level or below the value of its cash value, it indicates that investors have little value in its drug pipelines or technologies. An investor who purchases the shares receives such value for free.

Normally, we would not do a repeat screen after only a few months, but the persistent terrible position of the biotech sector and the possibility for profits appear noteworthy.

Barron's examined only biotechnology firms on Wednesday in the SPDR S&P Biotech ETF (XBI) and the iShares Biotechnology ETF (IBB) with a market capitalization of more than $250 million on Wednesday. Among those stocks, we searched for those that reported cash and short-term investments that were more than their most recent market value in the most recent quarter.

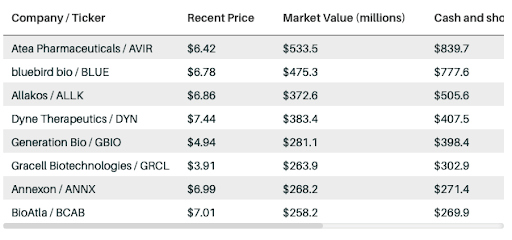

Our analysis found eight equities, all of which have witnessed at least a 28% decline in value this year alone. Atea Pharmaceuticals (AVIR), bluebird bio (BLUE), Allakos (ALLK), Dyne Therapeutics (DYN), Generation Bio (GBIO), Gracell Biotechnologies (GRCL), Annexon (ANNX), and BioAtla (BCAB).

8 Biotech Stocks Trading Cheaper to Cash

Selected biotech stocks in the IBB or XBI that trade at a discount to their most recent cash and short-term investments

Probably the most well-known member of the group is the bluebird, a former high-flying gene-therapy pioneer. Its share price has fallen by 64% in the last year and by 89 percent in the last two years.

However, as a result of a recent spinoff, bluebird is not trading as far below cash as it looks. While the stock's current market value of $475.3 million is significantly less than the $777.6 million in cash and short-term investments revealed in late September, the business has since split out its oncology activities into a new company named 2seventy bio (TVST).

Bluebird stated in a November press statement that the company had "restricted cash, cash and cash equivalents, and marketable securities balance of approximately $518.5 million" following the split. That is far closer to the stock's actual market value, implying that sentiment toward it is not as gloomy as sentiment toward the other companies on the screen.

Another well-known name that surfaced was Atea, which created the Covid-19 antiviral that had dismal Phase 2 results this autumn. Although the firm recently declared a renewed emphasis on the hepatitis C virus, experts believe the corporation still has a long way to go.

"As Atea restructures its 2022 plan, the numerous moving pieces may make engagement difficult for investors, and a long catalyst path might exacerbate matters; consequently, we maintain our Market Perform rating," SVB Leerink analyst Roanna Ruiz said in a Jan. 12 note.