Fed To Start Rate Hikes With License To Turn Aggressive Later

Mar 13, 2022

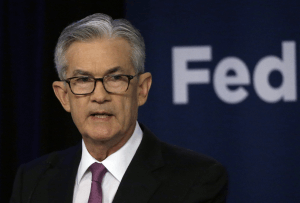

The Federal Reserve will launch a multi-month campaign to combat inflation this week, with Chairman Jerome Powell likely to act even more hawkish after the start of the Ukraine conflict.

Already on the verge of tightening monetary policy in the face of the sharpest consumer price increases since 1982, Powell and central bankers now face the economic impact from the conflict, which promises to strike a double blow of slower growth and even faster inflation.

With a near-certainty of a 25 basis-point raise on Wednesday after Powell's uncommon public endorsement of such a move, futures markets anticipate this year's rate hike will be about 165 basis points, which is comparable to at least six quarter-point hikes.

There is clearly a cause to be concerned about inflation since Russia's intervention exacerbates the pandemic's effects. Since the conflict started, costs of various products, oil, gas, and metals have risen dramatically, with gasoline alone reaching historic highs, while pricing for many services was already elevated.

Powell has been granted permission to be aggressive by President Joe Biden, congressmen from across the political spectrum, and a number of other Fed authorities as firms and people become more concerned about the damage caused by 1970s-style price volatility that constrains their spending power.

"Powell cannot risk being dovish at this moment; it would be incongruous with what constitutes sound policy and the direction that policy should take," noted Derek Tang, an analyst at Monetary Policy Analytics in Washington.

While Powell has emphasized that the Federal Reserve would remain nimble, his post-decision press briefing on Wednesday will be scrutinized for hints about how high-interest rates may eventually rise from near zero today and how fast policymakers may act to get there. According to Goldman Sachs Group Inc., policymakers will finally cease hiking interest rates at 3% in the next year.

A critical indicator will be the Federal Reserve's dot plot of rate estimates through 2024 and the extent to which Powell approves them.

The European Central Bank's conference last week demonstrated the possibility of aggressive moves when President Christine Lagarde proposed a faster rollback of monetary support. The Bank of England is likewise expected to raise interest rates this week for the third time in a row.

The Fed's officials begin their tightening program with real interest rates — nominal interest rates accounting for inflation — at their lowest point since the 1970s. If long-term inflationary pressures rise, there is still a long way to go to bring policy towards a more neutral position that neither boosts nor lowers growth, even though the war makes that path more difficult.

"This is a complete disaster," commented Tim Duy, chief US strategist at SGH Macro Advisors, who believes the risks associated with higher inflation outweigh those associated with slower GDP. "Powell wants to thread the needle in such a way that we sustain high growth while bringing inflation down to a more manageable level," Duy explained. "If he is able to do something like this, he is indeed a legend."

As a result, what will be watched closely is whether Powell suggests an easy path or a more hawkish stance on tightening, or if he keeps options open by discussing the need for flexibility during an uncertain period.

This is not an easy decision to make. Analysts predict the economy to stall in 2022 as fiscal expenditure declines, and a University of Michigan poll released Friday revealed public optimism plunging to its lowest level since 2011 as a result of the jump in gasoline prices and inflation, which bodes poorly for consumer purchasing power.

"The Fed's gradualism comes at a price: Future inflation is best anticipated using lagged values of previous inflation, and a more gradual Fed today will almost certainly result in a more hawkish Fed tomorrow," states Anna Wong, Bloomberg's Chief Economist for the US.

Central bankers will also evaluate how their plans to shrink the balance sheet will affect financial conditions, which have been tighter in the aftermath of the conflict in Europe. Officials are likely to reveal the speed at which they want to cut the balance sheet during this conference, although they have not yet set a timeframe.

A significant downturn in hiring would argue for a slower rate of tightening.

"Powell has said unequivocally that they would go progressively toward neutral," noted Julia Coronado, head of MacroPolicy Perspectives. "The sustainability of demand will serve as the main signal of how rapidly they go."

Simultaneously, the Federal Reserve's objective is to maintain price stability, and tensions are rising both within and beyond the central bank.

Powell heard earlier this month from politicians on both sides of the aisle that their supporters demand clear actions on inflation. Additionally, his own committee has adopted a more aggressive stance.

St. Louis Federal Reserve President James Bullard, who will participate in voting on policy this year, has called for a "quick removal of policy accommodation," whereas Governor Christopher Waller has stated that he needs at least 100 basis points of tightening by the middle of this year, with the potential of a half-point rise. Governor Michelle Bowman has said that she is willing to take "aggressive measures" to reduce inflation.

No central bank representatives are discussing the possibility of pushing down economic growth in order to contain inflation. However, their patience is constrained only by public faith in their competency to restore inflation to around 2% a year.

"With energy prices surging, inflationary pressures are now at a dangerous point," commented Sarah House, senior economist at Wells Fargo & Co. "They are not yet over the Federal Reserve's goal, but they are dangerously near. This will keep the Fed's rate rise strategy on track."