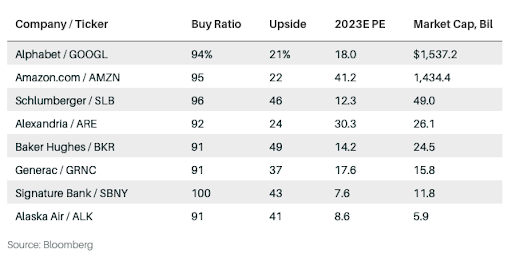

Alphabet, Baker Hughes, and More Stocks the Street Loves That Aren’t Too Pricey

Aug 09, 2022

Normally, investors must pay high prices to obtain high-quality equities, but this is not always the case.

Barron's most recent investment screen, which looked for the most popular companies in the S&P 500 with big potential gains based on the average of analysts' price predictions, delivered a surprise. Six of the eight businesses we discovered had values that were comparable to or higher than the general market.

Of all, a screen is just a beginning point, a step in the investment research process, and this one had a specific message. Quality firms are not overly pricey.

Amazon.com (AMZN), Alphabet (GOOGL), energy service companies Baker Hughes (BKR) and Schlumberger (SLB), Signature Bank (SBNY), Alaska Air (ALK), Generac (GNRC), and Alexandria Real Estate Equities are all on the list, in no particular order (ARE).

Low Cost Quality

Eight equities with more than 20% upside potential and Buy ratings of 90% or higher.

Still, studies have discovered that Buy-rated equities perform somewhat better than Sell-rated ones. We characterized the most popular stocks as having Buy-rating ratios of more than 90%, compared to the S&P 500 average of roughly 58 percent. It is reasonable to wonder whether Buy ratings are a good predictor of whether a company is going to increase.

That does make sense. Analysts are compensated for understanding sectors and selecting firms that they feel are better positioned than others.

Analysts' price predictions might represent the level a stock will reach in the next 12 months, or they can represent a "reasonable" price to pay for a company in order to make a fair return in the future. Based on the average price estimates of analysts, each stock had to be able to rise by more than 20%. According to that metric, the average upside for equities in the S&P 500 is currently at 15%.

Six of the eight equities are trading at less than 18 times the expected profits per share in 2023. Meanwhile, the S&P 500 trades at approximately 17 times earnings.

Amazon and Alexandria are the exceptions. They are valued at around 41 and 30 times expected 2023 profits. Alexandria, however, is designated as a real estate investment trust, or REIT. The S&P 500 REITs sell at roughly 37 times expected 2023 profits, indicating that Alexandria is inexpensive in comparison to its rivals.

Signature Bank is selling at around eight times the expected earnings in 2023. Banks in the S&P 500 are valued at around nine times their book value.

v

Baker Hughes and Schlumberger are valued at around 14 and 12 times expected 2022 earnings, respectively. On an absolute basis, that isn't too pricey, but energy-services businesses in the S&P 500 sell more than ten times that. They are slightly more pricey than the norm.

So far in 2022, the eight are down approximately 16 percent on average. Schlumberger is the only stock that has increased significantly, with a gain of nearly 16 percent. Signature Bank shares have suffered the most, dropping more than 40%.

Except for Amazon and Alexandria, the remaining six trade at around 13 times the expected 2023 earnings.