10 Best AI Stocks To Invest In 2024

Mar 16, 2024

Investors seek innovation that generates new markets, boosts economic growth, and offers high returns, with many believing AI will play a crucial role in achieving this goal.

AI innovation rapidly transforms our lives and work, bringing new experiences to reality. The release of ChatGPT and similar apps in late 2022 brought AI into focus, causing a surge in AI-related stocks that have performed well over the past years.

The stock market’s rise in 2023 has further fueled AI’s prominence in 2024, becoming a testament to its potential for enhancing organisational operations.

In this article, we will find out the benefits and downsides of investing in AI companies and discuss the best AI stocks to buy in 2024.

Key Takeaways

- Artificial intelligence technology is used in various industries and sectors, like healthcare, finance, education, etc.

- AI stocks are shares in companies that provide artificial intelligence services.

- Investing in AI stocks might be lucrative, but it has its drawbacks, such as limited regulations and ethical concerns.

- Nvidia and Adobe are examples of the best AI companies to invest in 2024.

How Companies Use AI

Artificial Intelligence (AI) is a technology that aims to replicate human intelligence in machines with faster speed and accuracy. Companies like Microsoft and Google use AI to program machines to solve problems and perform tasks.

AI is being developed across various industries, including manufacturing, healthcare, finance, marketing, education, and resources. For example, the transportation industry is transforming with electric and autonomous vehicles, while the banking industry uses AI to improve decision-making, automate processes, and reduce costs.

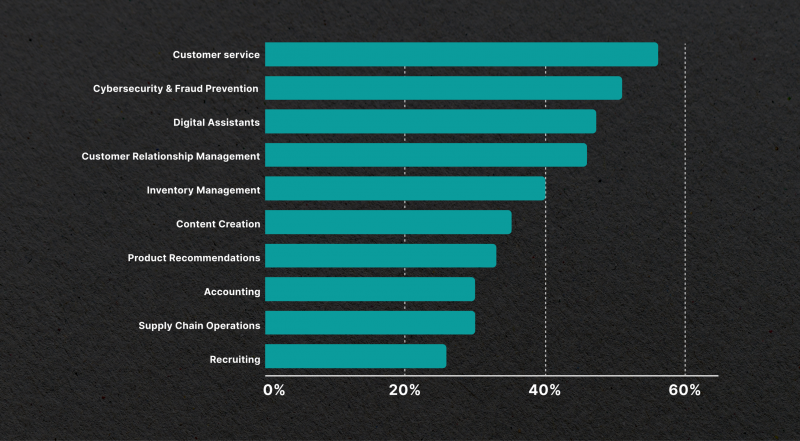

Organizations increasingly use AI to inform critical business decisions, such as prioritizing medical care, enhancing recruitment practices, and determining eligibility for credit, housing, and other essential services.

AI can save time by automating repetitive tasks, maximizing productivity, reducing human error, and driving team member engagement. Tools like chatbots for customer service, applicant tracking systems for recruiting, and payroll platforms for accounting can automate tasks.

Enhanced data analytics can also be achieved through AI, which can process vast amounts of data at speeds and scales beyond human capabilities. This can help identify patterns, behaviors, and trends that may not be immediately visible to human analysts, predicting future outcomes based on historical data.

Fast Fact

A survey of over 350 AI researchers by the University of Oxford and Yale University in 2015 suggests that machines could outperform humans in all tasks by 2060.

Artificial Intelligence Stocks Explained

AI stocks are shares in companies that offer artificial intelligence services, products, or applications or provide components for AI models.

The economic impact of AI is expected to grow as more businesses embed AI in their operations.

AI-driven stock investing offers a more efficient and objective approach to investment, utilizing advanced algorithms to process vast amounts of data from various sources.

This eliminates human biases and time-consuming human analysis, allowing for more objective analysis. AI-driven stock investing operates faster, capitalizing on short-term trading opportunities and responding swiftly to market fluctuations. It incorporates sophisticated risk management techniques like portfolio optimization, diversification, and hedging strategies to minimize risk and maximize returns.

AI stocks are divided into blue-chip technology companies that have invested in or partnered with AI developers, and small, experimental companies focused on AI space development.

Small AI developers may seem like the most direct investments, but they may not be the best due to the high data and capital required for large language models. Small companies may develop innovative models independently but eventually need to partner with larger companies for commercial-scale operations.

AI in the stock market offers investors vast financial information, enabling wise investments. AI trading strategies involve data collection, preprocessing, feature extraction, model training, decision-making, execution, and continuous monitoring. Machine learning algorithms identify relationships between extracted features and stock price movements.

However, AI stock trading systems present both opportunities and hazards, including unpredictable market fluctuations and discrepancies in data accuracy.

How to Invest in AI: Pros and Cons

AI trading software uses machine learning to identify patterns, predict future price movements, and identify risks. It collects large amounts of financial and market data, making it accessible for order execution, technical indicators, and algorithmic trading.

Retail investors may already be exposed to AI due to large U.S. companies using or investing in AI. Exchange-traded funds (ETFs) offer broader exposure to AI stocks by holding publicly traded companies involved in AI development and implementation.

To invest in AI stock, open a brokerage account and consider the benefits and potential hazards.

Advantages

AI trading offers numerous advantages for traders seeking to enhance their trading strategies or gain a deeper market understanding, such as the following.

Improved Accuracy and Less Research Time

AI-powered algorithms can save time and provide expert advice, increasing productivity by up to 10%. Historical financial figures enhance guidance quality, improving accuracy and reducing errors due to human involvement. This technology can also improve the accuracy of trade executions.

Reduced Costs

AI solutions can save traditional investment organizations overhead by automating repetitive tasks for brokers, analysts, and advisors. Despite initial costs and maintenance, AI algorithms ensure 24/7 market monitoring, making them cost-effective over time and consistently working without breaks.

Forecast Patterns

AI-powered stock trading uses sentiment analysis to identify patterns in objective material, analyzing news outlets and social media platforms to determine market swings and fluctuations.

Improved Efficiency

AI can improve traders’ decision-making, allowing them to capitalize on market opportunities before human traders, respond quickly to market changes, automate trade execution, and become independent systems. It can also adjust entry and exit points using machine learning, reducing the need for algorithmic traders.

Scalability

AI trading is ideal for managing large and diverse portfolios due to its ability to handle large-scale data analysis and trading operations, while high-frequency trading uses powerful computer programs to conduct large trades in milliseconds.

Enhanced Risk Control

Machine intelligence reduces risks and errors in trading by identifying trade anomalies and comparing them to historical patterns. It also helps reduce emotional decision-making, fatigue, and cognitive biases, leading to more rational trading decisions. AI also enhances security and market integrity by observing trends.

Disadvantages

The AI industry also has some drawbacks and is only reliable to a certain extent due to the following factors.

Limited Regulations

The current limits on AI trading regulation and data usage pose a significant risk. Regulators struggle to maintain accountability in AI-powered trades as new systems develop rapidly. As machine learning engines make mistakes and develop independently, new regulations may be needed to capture the affected engines’ development. This raises the question of whether AI can be used to regulate AI.

Ethical Сoncerns

AI-driven trading platforms raise ethical concerns about income inequality, transparency, privacy, and accountability. High initial costs may increase information concentration, while limited regulation may lead to a perceived lack of transparency. Privacy can result in data protection violations, impacting millions globally. Accountability is a challenge due to AI’s complexity and constant change.

Possibility of Over-Optimisation

Due to their lagging system nature, AI-driven trading systems may be overly optimized, focusing on historical data but not real-time trading. This makes them less adaptable to new situations and unpredictable market conditions. AI systems may not perform well in volatile conditions due to sudden changes that don’t align with past analyses. Additionally, AI and machine learning systems may create risk and market volatility instead of mitigating it.

Depending on The Data Quality

AI trading systems are only as good as the data they are trained on, which can be biased or incorrect. If the data set doesn’t adapt to market conditions, AI engines may develop strategies that are not aligned with the current market, resulting in poor trading performance. Human biases, stemming from personal beliefs or unconscious biases, can also affect AI systems.

Top 10 AI Stocks to Invest in 2024

Despite possible drawbacks, many AI stocks remain an appealing investment for many market players. Here is an AI stocks list comprising the 10 best AI stocks you can invest in 2024.

1. Alphabet

Alphabet, Google’s parent company, is focusing on improving Google Search results using AI. The company plans to use advanced analytics tools to inform search results and advertising placement, aiming to increase user engagement and advertising inventory. Alphabet will also develop AI capabilities within Google Cloud, which offers scalable resources for building and training AI models. As more enterprises adopt cloud computing for AI, Alphabet joins other top AI stocks.

2. Nvidia

Nvidia, a leading AI company, produces microchips for autonomous driving cars and AI applications. Following its first-quarter earnings report, Nvidia has surged past the $1 trillion market cap mark. The company, which invented the graphics processing unit (GPU), is known for its applications in gaming, cryptocurrency mining, and autonomous vehicle operations. Management plans to increase production in the second half of the year to meet the growing demand.

3. Microsoft

Microsoft, a global leader in AI, is developing its own AI chip and a more intuitive search engine. The company increased its investment in OpenAI from $1 billion in 2019 to $13 billion in 2023, integrating ChatGPT into its Bing search engine. In September 2023, Microsoft announced the integration of AI copilots into Microsoft Copilot. AI accounted for 30% growth in Azure and cloud services in Q4, making Microsoft the premier business technology company.

The company’s earnings growth over the last five years has been impressive, with analysts expecting 13.5% EPS growth next year. The company paid a 0.8% dividend and bought back 0.9% of shares in the last year.

4. Accenture

Accenture has invested $3 billion in its AI division to assist clients in adopting AI technology for improved business productivity. With 1,450 AI patents and numerous applications, Accenture focuses on personalization in generative AI, allowing enterprises to modify foundational models as needed.

The company’s switchboard technology combines various generative AI models to fit unique operational needs. With $450 million in bookings, Accenture plans to double its AI specialists to 80,000, playing a significant role in disrupting the global business landscape through generative AI.

5. Amazon

Amazon is a leading cloud computing and data storage company that offers AI-powered software and products like Alexa and Echo. Amazon has integrated AI into its business, offering targeted advertisements, marketplace search algorithms, and AWS cloud services. The company also introduced an AI tool to answer shoppers’ questions about products.

Amazon Web Services offers AI and machine learning services, allowing businesses to adopt these technologies without in-house resources. As AI capabilities expand, Amazon’s stock is likely to skyrocket in 2024, making it one of the best AI stocks to buy now.

6. Symbotic

Symbotic, a US-based robotics company, offers an AI-powered system for warehouse logistics automation. The company’s main customer base is large retailers like Walmart and Target, who have used its products to streamline operations and reduce labor costs.

Symbotic’s revenue growth is 98%, making it a great investment opportunity. As automation becomes increasingly important for big box retailers, Symbotic will be a key player in the conversation. At a current price of around $41, Symbotic falls on the cheaper end of AI stocks but outranks most others in revenue growth.

7. Meta Platforms

Meta Platforms, the owner of Facebook and Instagram, is developing an AI system similar to OpenAI’s. The company supports advertising-supported social applications and virtual reality hardware and software. With a market capitalization of $834 billion, Meta focuses on user engagement, AI analytics, and personalized experiences in virtual reality. It plans to optimize efficiency and improve features.

8. Taiwan Semiconductor

This world’s largest chip foundry is a top pick due to its significant market capitalization and the growing demand for AI and machine learning applications. With a projected sales growth outlook of 19.5%, the company is at the forefront of this growth, owning over half of the global semiconductor foundry market. Research from McKinsey estimates AI is contributing $5 billion to $8 billion annually to semiconductor companies.

Taiwan Semiconductor Manufacturing is expected to see a 20% revenue growth in 2024 due to demand for high-end AI chips. The stock is attractively valued due to its long-term growth prospects.

9. Adobe

Adobe, a leading provider of creative content software and marketing applications, is transitioning from a software company to AI related companies. The company’s Firefly generative machine learning model is attracting customer interest across platforms like Photoshop and Illustrator.

Adobe plans to continue investing in generative AI features, targeting individuals and corporate marketing teams. The company has already introduced generative AI features in its Photoshop application and is beta-testing a tool for creating images and color palettes from text prompts.

10.Arista Networks

Arista Networks provides cloud networking solutions for internet companies, cloud service providers, and enterprise data centers. Their high-performance solutions and high-throughput data center switches are crucial for AI workloads.

With the increasing complexity of data centers and cloud services, Arista Networks’ portfolio enhancements, like their CloudVision platform, are gaining traction, indicating impressive growth in 2024. The company aims to reach $750 million in annual AI networking revenue by 2025, making it one of the top AI companies.

Final Thoughts

AI is revolutionizing stock markets with accurate predictions and efficiency. AI investments offer potential for growth, innovation, and disruption in sectors like healthcare, finance, and e-commerce. AI can enhance operational efficiency, increase profitability, and drive transformation, giving companies a competitive edge.

Investing in AI stocks requires thorough research and an understanding of the industry. In 2024, AI sector advancements will be significant, with experts predicting AI will drive innovation and reshape various industries, making it a fundamental technological shift offering sustained growth potential for investors.

FAQ

Is AI stock worth investing in?

It might be a very lucrative endeavor since the AI market is predicted to grow 800% globally by the end of the decade.

What are the cheap stocks to buy now?

In 2024, Advanced Micro Devices, Rekor Systems, Symbotic, and AeroVironment are some of the best cheap stocks to buy now.

Where can I buy AI Stocks?

AI stocks are publicly traded companies on major stock exchanges like Nasdaq and NYSE. To purchase a listed stock, use a broker. If the company is traded OTC, do due diligence and purchase directly through your broker.