How to Choose the Right Liquidity Provider for Your Brokerage

Aug 27, 2025

In dynamic new financial markets, the right liquidity provider is not just a supplier — but the savvy counterpart who can chart the course of your brokerage’s growth, stability, and competitiveness.

With traders demanding instant execution, deep access to markets, and the ability to have multiple asset classes under one platform, the decision goes beyond spreading the bid.

Making the right call is finding alignment with a counterpart who can deliver performance, technology, and stability in any environment.

Key Takeaways

- Regulatory compliance and reputation are non-negotiable when selecting the right liquidity provider.

- Execution speed, liquidity depth, and integration abilities are no less important than pricing.

- Real-world testing is required to avoid costly execution surprises.

Do Liquidity Providers Play a Significant Role in 2025?

In no sense can liquidity providers not qualify as one of the prerequisites of the world trading environment in 2025. As markets are faster, more global, and even multi-asset ones, the value of a reputable liquidity partner has evolved from a back-office requirement to a competitiveness and growth factor for a brokerage.

The modern trading environment requires more than competitively priced spreads. Execution velocity, depth of market, and stability of pricing are no longer negotiables, particularly with clients demanding immediate access to FX, crypto, CFDs, commodities, and other asset classes — from one platform alone.

Here, a first-class liquidity provider is not merely filling books; it’s providing a frictionless client experience and underwriting a broker’s operational resilience.

Just as a key factor is the development of the service model, top liquidity providers in 2025 are no longer providing mere raw liquidity — they’re providing comprehensive market access solutions complete with next-generation APIs, low-latency connectivity, real-time risk management, and multi-venue aggregated liquidity.

This makes them not merely the facilitators of the markets but strategic infrastructure providers who assist the brokers in widening the range of products, optimizing the cost structure, and speeding up the time-to-market.

Fast Fact

Certain leading liquidity providers combine prices from more than 20 venues simultaneously and build ultra-deep liquidity pools for smooth execution.

Things to Keep in Mind While Choosing a Liquidity Provider

Selecting the right liquidity provider is no longer about comparing spreads or execution speed — but about finding a partner for the stability and future development of your brokerage. Your choice has a direct effect on your access to the market, pricing stability, levels of client satisfaction, and even the level of your regulatory adherence.

Before you put pen to paper, you have to look beyond shallow promises and delve into the underlying metrics characterizing the suitability and stability of an LP.

Regulatory Compliance and Reputation

Having a regulated liquidity provider is not optional in the current financial environment. Whether looking for the right liquidity provider in Forex, crypto, or multi-assets, regulation helps ensure the partner you engage with has strict oversight, adequate capital, and transparent business methods. Both your brokerage and your clients’ trust are thereby protected.

In order to confirm the legitimacy of the right liquidity provider, confirm licensing information with reputable authorities, such as the FCA (UK), CySEC (Cyprus), ASIC (Australia), or the CFTC/NFA (US). Ask for official documents and verify with the public register of the regulator at all times.

Red flags are vague corporate structures, no presence in regulated locations, unsubstantiated claims of licensing, and a history of fines or disputes. In a world where reputation equals money, your final defence is proper due diligence.

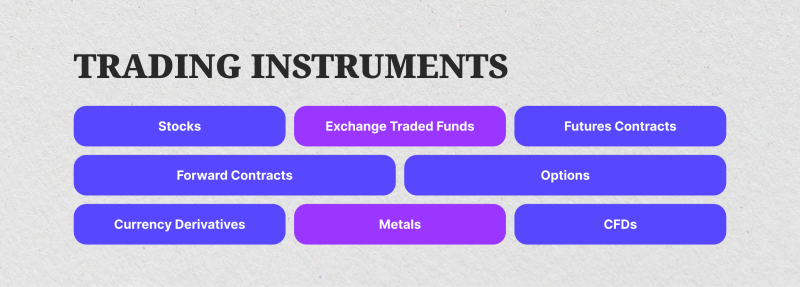

Range of Instruments and Market Coverage

The right partner should function as a multi-asset liquidity provider, giving you access to a broad range of products that align with your business model — from FX majors, minors, and exotic currency pairs to cryptocurrencies, CFDs, commodities, and equities.

Depth of liquidity in your target markets is essential. Whether you’re working with an institutional, a crypto, or a Forex liquidity provider, deep and consistent market access ensures smooth order execution without price disruption.

Pricing and Spreads

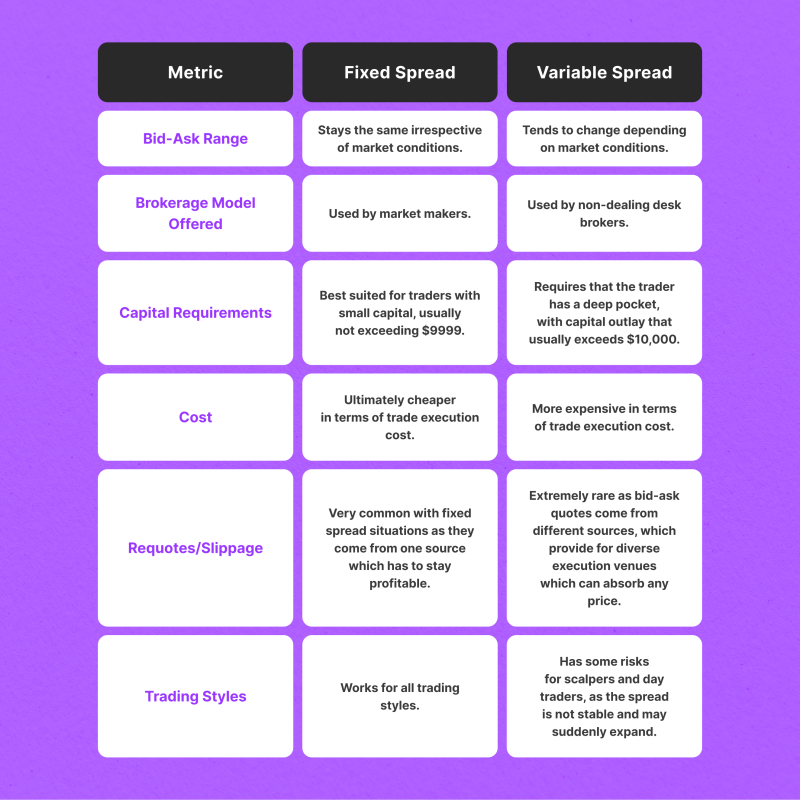

Pricing is a competitive lever. Fixed spreads offer predictability and appeal to entry-level traders, while variable spreads — often tighter under normal conditions — can expand during market volatility.

Evaluate how the LP’s pricing model aligns with your target audience and business strategy. Even a fractional pip difference can significantly impact profits when scaled over thousands of trades. The right liquidity providers maintain transparent, competitive pricing that supports both your margin and client retention.

Execution Speed and Reliability

For brokers working with market makers like tier-1 liquidity providers or prime-of-prime liquidity providers, low-latency execution is a major performance differentiator. Your LP should operate a high-performance infrastructure capable of processing large trade volumes with precision, even during volatile conditions.

Assess slippage rates and request historical execution data to evaluate fulfillment quality before committing. Fast, reliable execution is not a luxury — it’s the backbone of client trust.

Technology and Integration

the right liquidity provider’s technological capabilities determine how efficiently you can scale. Look for seamless integration options, such as FIX API, MT4/MT5, and cTrader bridge solutions, as well as compatibility with your risk management systems.

A strong matching engine and redundancy measures help minimize downtime, ensuring uninterrupted access to liquidity pools — whether from a Forex, crypto, or multi-asset liquidity provider.

Capital Requirements and Credit Terms

Understand your LP’s margin policies, leverage options, and financing terms. Prime-of-prime liquidity providers often offer more flexible arrangements, giving smaller brokers access to tier-1 liquidity providers without excessive capital requirements.

Transparent, fair terms without hidden costs help you optimize capital efficiency while maintaining the ability to scale.

Liquidity Depth and Stability

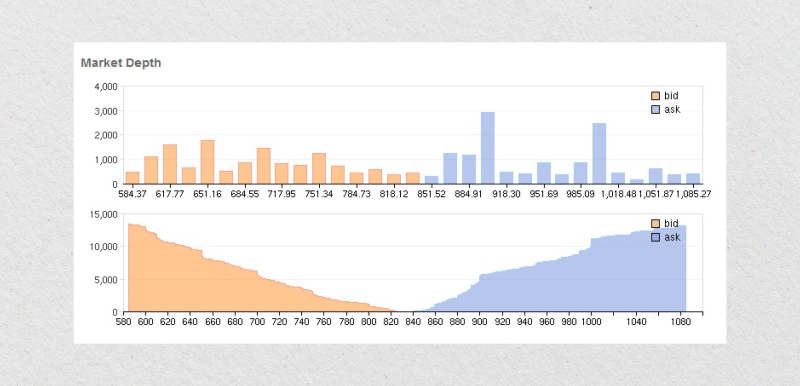

Market depth is vital for executing large trades without adverse price movement. This is especially true when partnering with an institutional liquidity provider during high-impact events such as economic releases or geopolitical developments.

Review historical quote consistency and test execution during both calm and volatile market conditions. The best providers maintain stable liquidity flows under all circumstances.

Support and Customer Service

Even the most advanced multi-asset liquidity providers are only as strong as their support infrastructure. Ensure your LP offers a 24/7 dealing desk and technical assistance, ideally with multilingual teams for global coverage.

Proactive, responsive support isn’t just a service feature — it’s a safeguard for your brokerage’s business continuity and client satisfaction.

Comparing Different Liquidity Providers Models

Brokers have multiple methods of handling order flow and accessing liquidity, but A-book, B-book, and hybrid are the most prevalent methods.

Each has respective operational mechanics, revenue opportunities, and risk implications, so the decision is a strategic one with ramifications for client experience and profitability.

A-Book (STP/ECN)

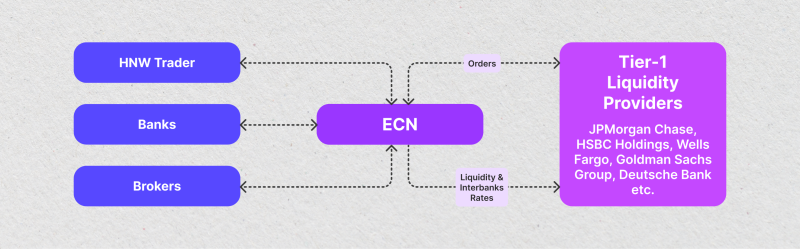

With the A-book strategy, all client transactions are forwarded directly to external counterparties, like liquidity providers, ECNs, or prime-of-prime brokers.

This strategy keeps the market risk away from the broker’s balance sheet, with profits largely derived from commissions or minimal markups on spreads.

It’s extremely transparent, commonly preferred by active traders and authorities, yet highly dependent on upstream execution quality and can lead to narrower margin levels.

B-Book (Market Making)

In the B-book model, the broker becomes the counterpart to client transactions and internalizes order flows. When executed properly, this can provide for wider profit margins, efficient trade execution, and flexibility in pricing.

But the broker is also subject to the principal risk and requires effective risk management practices to avoid significant losses, particularly during highly volatile market events.

Hybrid Model

A hybrid arrangement combines the two methods by directing some transactions to the external liquidity providers and internalizing others for reasons of trade size, market conditions, or client profile.

This approach can strike the right balance of risk, profit potential, and execution quality but needs complex technology, explicit routing policies, and close monitoring to prevent operational or compliance risks.

Common Mistakes to Avoid When Selecting a Liquidity Provider

Choosing the right liquidity provider can determine the success of your brokerage in terms of performance, client satisfaction, and sustainability over the long term. But even retail and institutional brokers tend to fall into preventable pitfalls when assessing future partners.

Recognizing the most prevalent of such errors can assist in picking the right provider of reliable and consistent liquidity with sustainable business development for you.

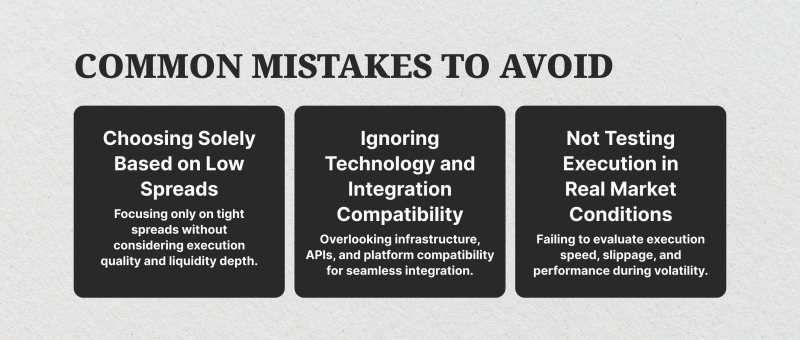

Choosing Solely Based on Low Spreads

Many retail brokers, institutional clients, and even hedge funds are tempted to choose a partner based purely on ultra-tight spreads. While spreads can affect trading costs, they are only one part of the equation.

Some providers offer attractive pricing upfront but fail to deliver on execution speed, deep liquidity, or consistent trade execution during volatile periods in the financial markets.

The right liquidity providers — whether a Forex or crypto liquidity partner — balance competitive pricing with deep market pools, stable trading solutions, and reliable access to multiple asset classes.

Sometimes, a slightly wider spread with stable fills from tier-1 liquidity providers leads to lower overall transaction costs and better client retention.

Ignoring Technology and Integration Compatibility

Not all liquidity providers have the technology infrastructure to support seamless integration. Overlooking this can cause serious problems for institutional traders, asset managers, and proprietary trading firms that depend on speed and precision.

A reliable liquidity provider should offer direct market access, FIX API, and bridge integration for trading platforms like MT4/MT5 or cTrader, as well as support for risk management tools. This ensures smooth connectivity to liquidity pools, other financial institutions, and even prime brokerage services.

A leading liquidity provider will also maintain robust data centers, redundancy systems, and a high-performance matching engine to deliver uninterrupted access to deep order books and tailored liquidity services.

Not Testing Execution in Real Market Conditions

It is a significant oversight when brokers, institutional investors, or retail traders sign up with a provider without putting trade execution to the test under real-market conditions.

Trading in regular trading sessions can significantly vary from that in high-impact events, where volume tends to surge and liquidity pools become smaller.

What’s most relevant is the degree to which the LP maintains deep liquidity in the face of volatility events, slippage remains low, and the speed of execution is respectable.

This applies equally to Forex liquidity and crypto liquidity provider setups, especially when handling institutional-grade clients or multi-asset order flows. Testing across quiet and volatile sessions ensures your partner can handle both standard operations and market stress.

Steps to Evaluate and Onboard a Liquidity Provider

Onboarding the right liquidity provider is more than a transactional deal — the start of a strategic partnership upon which your brokerage’s pricing, quality of execution, and overall competitiveness in the marketplace will rely.

A thorough evaluation process provides you with the guarantee of bringing on board a partner who can consistently offer liquidity, state-of-the-art technology, and effective support.

With well-defined, step-by-step procedures, you can reduce the risk, confirm abilities, and create the foundation of a sustainable, win/win relationship in the future.

Performing Due Diligence and Background Checks

Before engaging in any deal, a proper due diligence process must be conducted. Check the liquidity provider’s regulatory presence, examine their corporate structure, and validate their history of operations.

Check for licenses issued by respectable authorities like the FCA, CySEC, ASIC, or NFA, and validate them directly by the regulator’s public register.

Aside from checks for compliance, research their reputation in the business. Talking to current clients, going through independent reviews, and evaluating their performance in months of volatility can help assess reliability.

The objective here is for you to align with a service provider who is not only fiscally sound but also operationally reliable.

Asking for a Trial/Demo Period

A live trial or demonstration phase is the most effective method to test the real-world performance of a liquidity provider. At this stage, test for aspects such as execution speed, consistency of spreads, depth of market, and slippage under regular market conditions and extreme volatility occurrences.

This hands-on testing will indicate how the LP handles order flow, ensures price stability, and integrates with your trading platform. A credible provider will not mind offering this trial since it reflects faith in their tech and service quality.

Reviewing Service Level Agreements (SLAs)

Your working relationship begins with the SLA. It must clearly define performance expectations such as uptime assurances, implementation milestones, conflict resolution processes, and information security measures.

Pay particular attention to any pricing clauses, clauses addressing latency, and rejection of orders. The SLA must cover both parties, but also ensure the right liquidity provider is responsible for providing the agreed level of service.

Negotiating Flexible Terms

Brokerages vary in their needs, so there must be flexibility in contract terms. That may include variable margin needs, leverage selection, volume-based pricing levels, or access to multiple asset classes as the business grows larger.

Negotiating the terms ahead of time allows the partnership to adjust with shifts in your trading volume, target markets, and tech stack. Liquidity providers worth their salt are flexible about crafting agreements for your combined growth, not for casting you in inflexible, one-size-fits-all terms.

Conclusion

Choosing the right liquidity provider in 2025 is a decision-making process with an impact on every aspect of your brokerage — from the quality of trade execution to the satisfaction of clients and the sustainability of the business in the long run.

Effective brokers consider their LP as the essential business infrastructure with in-depth liquidity, state-of-the-art technology, and clear practices.

To find a partner who not only fulfills the requirements of the day but also prepares you for the future, you can understand the available models, sidestep the most common mistakes, and undergo the proper onboarding process.

FAQ

What is a liquidity provider in brokerage?

A liquidity provider provides access to the market and prices that enable the brokers to process client orders easily and competitively.

What is the difference between tier-1 and prime-of-prime liquidity providers?

Tier-1 LPs are the large banks with direct access to the markets; the prime-of-primes connect smaller brokers with tier-1 liquidity but with diminished capital demands.

Should I choose a multi-asset liquidity provider?

Yes — providing liquidity across various asset classes, such as crypto, CFDs, and Forex markets, can attract more clients and diversify the revenue streams of your brokerage.

How long should I test an LP before committing?

A minimum of two to four weeks of real-time or demo testing under variable market conditions is recommended in evaluating performance and reliability.