How Does Swan Bitcoin Work? Detailed Guide

Aug 21, 2024

Unlike many other highly unstable cryptos, Bitcoin offers exceptional returns, peace of mind, and security for individual hodlers and businesses over the long term.

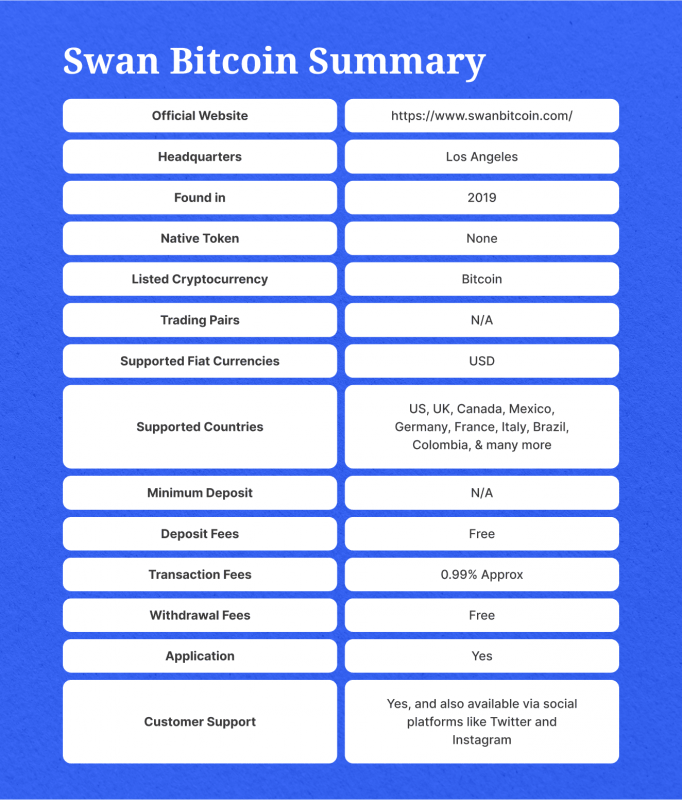

Bitcoin buyers often use cryptocurrency exchanges, with newbies buying on any exchange they find. However, most exchanges function as centralized entities, often serving as custodians of crypto assets. Swan Bitcoin is a platform that automates BTC purchasing, acting as a savings account. It aims to become the most accessible and user-friendly way to acquire BTC, allowing users to sign up for recurring purchases with competitive fees.

In this article, we will explore what Swan Bitcoin is, how it works, and its benefits.

Key Takeaways:

- Swan Bitcoin is a BTC-only investment app that allows easy converting fiat into Bitcoin.

- The platform is available on iPhone and Android or through a web browser.

- Bitcoin Swan is secure. However, there are risks associated with the BTC network.

- The Swan Personal solution is not available in Europe.

What is Swan Bitcoin?

Swan Bitcoin is a BTC investment platform that aims to help people save value in Bitcoin, which is expected to become increasingly valuable in the coming years. The platform offers easy, affordable, and transparent purchasing of BTC for public use, aiming to capitalize on its long-term growth potential.

The company automatically buys Bitcoin for customers, reducing volatility from price swings. Swan Bitcoin streamlines Bitcoin investing by offering a simple platform for converting fiat into Bitcoin, which allows you to purchase Bitcoin at an affordable price on a daily, weekly, bi-weekly, or monthly basis.

Bitcoin buying is facilitated by Prime Trust, an institutional-grade custodian. After purchases, customers can withdraw Bitcoin manually or set up an auto-withdrawal plan. Swan plans can be paused or canceled at any time, and any Bitcoin stored with them is stored in the customer’s name at a licensed and regulated trust company in the United States.

The platform incentivizes saving over spending by using dollar-cost averaging to acquire Bitcoin. Dollar-cost averaging is a strategy of investing a fixed dollar amount at regular intervals to spread out purchases and reduce the average cost of each share. This helps develop a disciplined investing habit and reduces costs.

Swan Bitcoin Fees and Limits

The platform charges a fee for free deposits and offers various deposit methods, including bank transfer, cryptocurrency, wire transfer, Osko, SEPA, and SWFT.

The Swan Bitcoin app offers an affordable way to accumulate Bitcoin, charging fees based on the amount converted to Bitcoin and eliminating storage and performance fees. Swan Bitcoin offers a reasonable fee structure for Bitcoin acquisition, with a 0.99% commission for buys and a free withdrawal, despite not offering ultra-minimal commissions.

Depending on the recurring plan size, Swan Bitcoin’s trading fees are 23%-80% cheaper than those of other leading platforms. Fees are based on weekly amounts saved. Traders can choose the fee payment schedule for recurring purchases, either prepaying annually or paying as you go.

Prepay rates range from 1.99% for $5-$24/week, 1.49% for $25-$49/week, and 0.99% for $50/week or above. Pay-as-you-go rates charge a flat rate of 2.29% for $5-$24/week, 1.79% for $25-$49/week, and 1.19% for $50/week or above.

How Does it Work?

Swan Bitcoin works as an app for iPhone and Android or through a web browser. The platform does not have altcoins and stands out due to its robust security, user-friendly interface, and commitment to Bitcoin-only services. Swan BTC caters to a wide range of users with varying needs.

To sign up for the platform, users need to provide basic personal information, such as name and email address. They must then connect their bank account to the platform to facilitate recurring purchases.

Once connected, users can set up an automatic savings plan, choosing the frequency of purchases, the amount saved, and the specific Bitcoin wallet. Swan Bitcoin will automatically make purchases at the current market price, and users receive notifications each time a purchase is made.

They can track their Bitcoin savings, including the total amount, market value, and transaction history. Swan Bitcoin is a trusted and user-friendly platform for anyone looking to save Bitcoin.

Traders can make one-time purchases through wire transfers, instant ACH, or sign up for the recurring plan ‘Swan Bitcoin automatic.’ The app converts users’ money into BTC savings and acquires more when the price drops.

Swan allows auto-withdrawal to self-custody addresses or keep the Bitcoin with Swan’s custodian for free. This allows users to set up a dollar-cost average plan that automatically buys Bitcoin regularly and sends it to their hardware wallet or other custody solution. Swan also offers Swan Private and Swan Business for high-net-worth individuals, family offices, and businesses.

Adviser services facilitate the integration of Bitcoin into client portfolios, including reporting and rebalancing. Swan also provides an open-source product suite for Bitcoin custody and usage, along with multi-signature software.

Swan exchange takes into account bear markets, unlike the prevalent approach to cryptocurrency investments, which helps flatten possible shocks when the coin is on a downward spiral.

As a Bitcoin-only platform, Swan eliminates steep hardware, bandwidth, and human resource expenses, allowing users to save money on fees they would typically incur when making a string of small Bitcoin purchases. Multi-coin platforms also have to run a large compliance department, complicating the security situation and resulting in higher trading fees.

Swan’s business model provides a significant advantage for those who want to have bitcoin exposure in a straightforward way. However, it is not suitable for those who want to buy other coins or trade frequently.

Key Features

Swan offers various services, including Bitcoin purchases, private client services for high-net-worth investors, advisor services for financial advisors, active management of systematic trading and private equity strategies, and many others. Let’s focus on the platform’s key features: Personal, IRA, Private, Business, and Vault.

Personal

Swan Personal is a popular solution to buy Bitcoin using ACH transfers, offering daily limits ranging from $10 to $50,000. It features a Recurring Purchases component, allowing regular investments, especially during bear markets, or to avoid Bitcoin’s volatility. Despite competitive fees of 0.99%, Swan Personal may not be the lowest in the industry. Withdrawals are free, as Swan encourages self-custody.

IRA

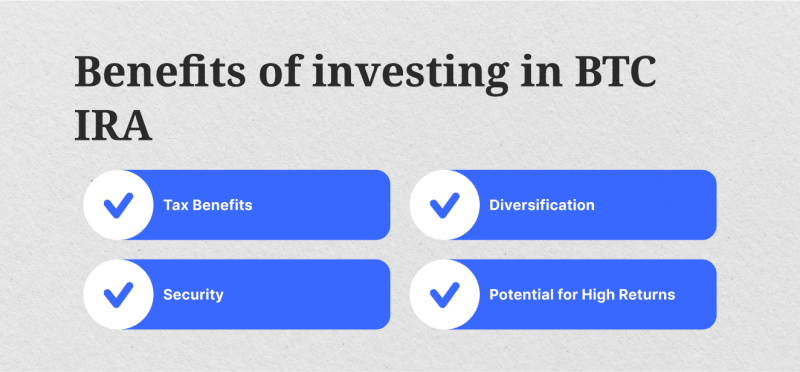

Swan Retirement, or IRA, offers a flexible solution for securing your legacy with Bitcoin. The Swan Bitcoin IRA allows you to hold actual Bitcoin, not proxy representations, within a tax-advantaged account. Your assets are securely held with a qualified custodian and have insurance coverage of up to $250 million.

Swan Retirement accommodates traditional and Roth IRAs, allowing transfers from various accounts. The onboarding process is quick and straightforward, and the fees are simple and transparent. With a 20% Bitcoin allocation, your Bitcoin holdings could significantly contribute to your retirement savings.

Private

Swan Private is a specialized investment platform for high-net-worth individuals, family offices, businesses, and trusts. It offers a Concierge OTC Service, professional trading, tax-loss harvesting practices, and Bitcoin integration into trust, estate, and inheritance plans.

Swan Private has achieved remarkable success with over $1 billion worth of Bitcoin stored in cold storage for over 3,000 clients. The platform is available in over 120 countries, catering to a global clientele, and residents in the United States are not required to use it. Swan Private has amassed over $1 billion worth of Bitcoin in cold storage in just a few years.

Business

Swan Business is a Bitcoin-focused solution for organizations, offering easy onboarding within 1-2 days. It automates Bitcoin investments, custody, and management, providing expert guidance. Swan also offers a Bitcoin Benefit Plan to attract, reward, and retain top talent. The solution includes direct access to Bitcoin experts, a Bitcoin-friendly community, research reports, and expert guidance on asset custody options.

Vault

Swan Vault is a self-custody system with multi-signature security, backed by Swan’s expertise and a collaboration with Blockstream. It features three keys: two for Bitcoin movement and the third for recovery. This adds an extra layer of security, reducing the risk of losing funds. Swan Private clients can also benefit from inheritance planning, transferring Bitcoin holdings to beneficiaries in case of unforeseen circumstances, and enhancing their wealth management services.

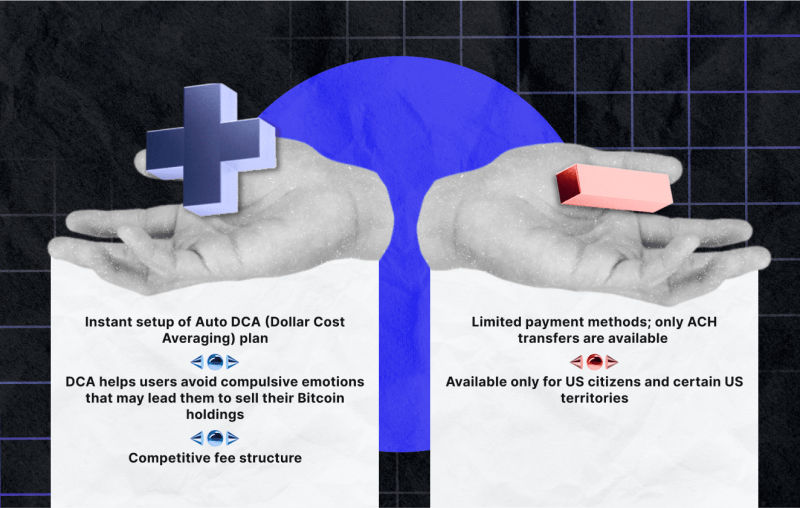

Pros and Cons of Using Swan Bitcoin

Swan is a platform that offers lower fees, better usability, and outstanding customer service. Its unique approach to being bitcoin-only reduces expenses, allowing it to pass lower costs onto users and invest in better customer service.

Swan has expanded its services from retail investors to private and institutional clients, family offices, businesses, and governments. It also offers advisor services, retirement accounts, collaborative vault custody, liquidity services, and bitcoin private equity investment opportunities.

Swan Bitcoin is a user-friendly platform catering to savers and individuals looking to hold Bitcoin as a long-term investment. The platform’s user-friendliness is reflected in its streamlined interface, which does not include a “sell” button.

Swan also organizes private events called Swan Salons, exclusively for Swan Private members, held in vibrant cities like Los Angeles or Miami. These events offer a unique opportunity for networking, making valuable connections, and forming friendships with fellow high-net-worth individuals.

However, there are risks associated with the Bitcoin network, such as price fluctuations and counterparty risks. Swan encourages self-custody of Bitcoin when comfortable with it, but they use an institutional-grade qualified custodian with separate trust accounts.

While the Swan team manages security well, it is crucial to ensure good security practices on your end to avoid potential phishing or other security risks that could affect you, Swan, or any other business in the ecosystem.

Also, the Swan Personal solution is not available in Europe, making it a drawback rather than an advantage.

Is Swan Bitcoin Safe?

Swan offers a unique purchasing experience, with the user being the sole legal owner of the cryptocurrency stored in offline cold-storage wallets. Swan uses one-time passcodes for account security and maintains minimal user data to comply with regulations. Transactions of Bitcoin and fiat require explicit authorization, ensuring robust security and efficiency.

Swan Bitcoin uses clear custodian services, ensuring regulated and top-class protection of funds. It collaborates with reputable custodians like Fortress Trust and Bakkt, as well as BitGo for cold storage. Clients are encouraged to take custody of their Bitcoin, and withdrawals are free and automatic.

Alternatives to Swan Bitcoin

Swan Bitcoin is a popular choice for US residents, but larger exchanges like Coinbase may not cater to Bitcoin enthusiasts who prefer a broader crypto market.

Thus, Relai, a European/Swiss-based option, offers a user-friendly Bitcoin trading app with a soft-KYC approach, simplifying the Know Your Customer process. It allows users to engage in lump sum and recurring Bitcoin purchases and sell BTC when needed. Relai also offers compatibility with additional payment methods like Apple Pay and credit cards, providing added flexibility.

Users can link their bank accounts to facilitate transactions, and Relai’s simplicity makes it a great option for those unable to access Swan Private’s European offering.

Bottom Line

Swan Bitcoin is a user-friendly platform for long-term Bitcoin accumulation and holding, offering self-custody for clients. A finite supply of 21 million BTC provides an attractive option for inflation hedges. Swan can act as a trustworthy custodian through partnerships with reputable institutions. Despite limited availability in some regions, its dedication to Bitcoin-focused savings and strong community make it an attractive choice for Bitcoin enthusiasts.

FAQs:

How secure is Swan Bitcoin?

Swan data and traffic are encrypted using military-grade AES-256 and TLSv1. 2 protocols, and Bitcoin private keys stored with custodial partners are not accessible.

What are Swan Bitcoin fees?

Swan Bitcoin charges a 0.99% fee for Bitcoin purchases, offers free withdrawals, and covers the Bitcoin network fee for its users.

Where is Swan Bitcoin located?

Swan Bitcoin’s headquarters is based in Los Angeles, California.

Does Swan Bitcoin offer margin trading?

Swan Bitcoin currently prohibits margin trading, limiting traders from buying BTC on margin or leverage and preventing them from purchasing derivative products like futures or options.