How to Start a White Label Brokerage?

June 09, 2025

Did you ever wish to own your own trading platform, without the inconvenience of having to code or go through years of development? In today’s fast-paced global finance, starting your own white label brokerage firm is not only feasible — it’s more manageable than ever before.

Thanks to white label brokerage solutions, you can plug into a fully established infrastructure, rebrand it, and start providing trading services to clients within weeks.

This guide takes you through each critical step — from determining your niche and choosing the appropriate provider to managing compliance, marketing, and growing your white-label online brokerage.

Key Takeaways:

- A white-label brokerage service can help you go live in weeks, not months, with significantly lower startup costs.

- Even though you use existing infrastructure, you maintain full control over branding, user experience, and pricing models.

- As your client base grows, your white label online brokerage can easily scale — adding new assets, integrations, or jurisdictions.

What is a White Label Brokerage?

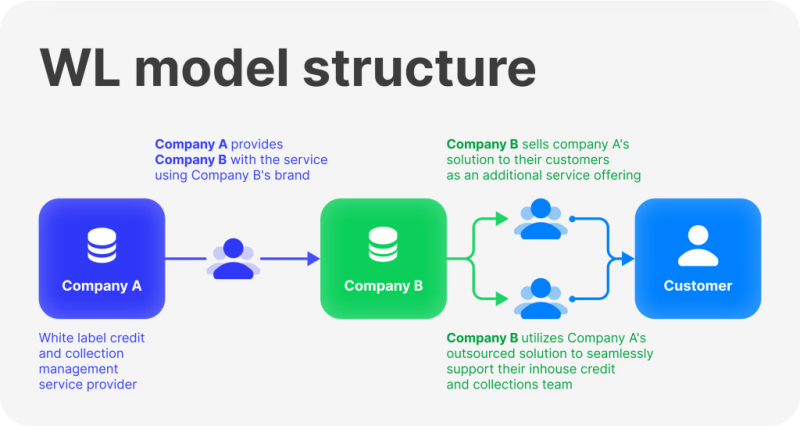

A white-label brokerage is a ready-made trading business solution that allows entrepreneurs and companies to launch their branded brokerage without building everything from scratch.

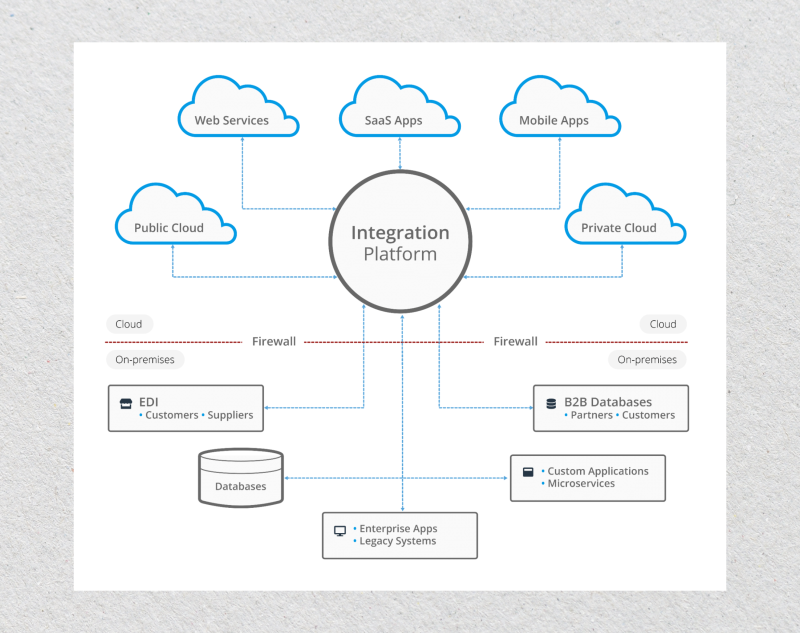

Instead of developing a proprietary trading platform, back-office systems, and infrastructure, you “lease” a complete brokerage framework from an established technology provider.

The provider handles all the technical, regulatory, and operational components while you focus on branding, client acquisition, and business development.

Think of it as buying a fully assembled sports car and simply putting your logo on the hood. You don’t need to be a mechanic to race; you just need to know how to drive and manage your pit crew. That’s what a white-label solution does—it gives you the engine, the wheels, and the fuel to hit the ground running.

These turnkey solutions typically include everything from MetaTrader 4 or MetaTrader 5 platforms (or other platforms like cTrader), liquidity aggregation, client onboarding systems, risk management tools, and compliance modules. Some providers also include a CRM (Customer Relationship Management) system and pre-integrated payment gateways.

White-label brokerages are particularly favored in the Forex, crypto, and CFD industry because of the complexity and investment needed to establish a brokerage from scratch.

Through white-label, you can go into business within weeks rather than several years or months without having to spend hundreds of thousands on the development process.

Fast Fact

A typical white-label brokerage can be up and running with startup funds of less than $50,000 — much lower than creating a brokerage business from the ground up.

Key Advantages of Starting a White Label Brokerage

Beginning a white-label brokerage provides you with a shrewd and cost-effective means to get involved in the business of buying and selling—even if you do not wish to undertake the long and costly process of developing a brokerage from scratch.

Some of the strongest reasons why the white-label idea is so appealing in 2025 are as follows:

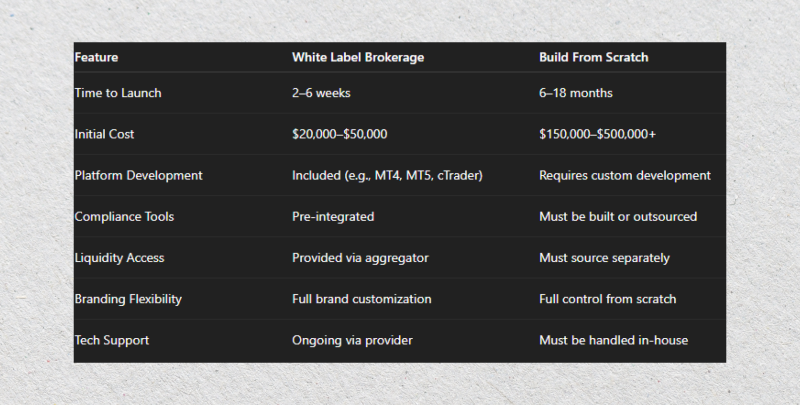

Faster Time to Market

One of the biggest advantages of using a white-label brokerage is how quickly you can get started. Instead of investing years (or longer) developing trading software, rolling out infrastructure and performing integrations, a white-label solution gives you a live, functioning brokerage platform within weeks. With this kind of speed, you can attract clients and generate revenue much quicker.

Lower Startup Costs

Building your brokerage from the ground up can easily cost hundreds of thousands of dollars. With a white-label model, most heavy lifting—like platform development, hosting, and compliance tools—is already done.

You pay a setup fee and ongoing licensing costs, but the investment is significantly lower. This makes it an ideal choice for startups and entrepreneurs with a limited budget but big ambitions.

Access to Proven Technology

White-label providers offer established platforms, such as MetaTrader 4, MetaTrader 5, or cTrader, which have years of market trust and user recognition behind them.

The provider also constantly updates and maintains these sites, providing your customers with a secure and feature-filled experience without any concerns about bugs or downtimes.

Professional Back-End Infrastructure

Running a brokerage is more than just offering a trading platform. You also need a solid back office, risk management tools, reporting systems, CRM, payment integration, and liquidity aggregation.

A good white-label provider includes all of these in their offering, giving you access to a robust operational backbone that would be expensive and complex to build.

Full Branding Control

Even though you’re licensing someone else’s technology, the brokerage will look and feel like your own. You get to use your brand name, logo, design, and domain, giving you complete control over how your company is presented to the market. This allows you to build trust and brand equity right from day one.

Regulatory Support

Handling the legal and regulatory environment is complex and can prove daunting to new brokers. Most white-label providers include legal support or partnerships with jurisdictions with more beneficial terms for licensing. This can assist you with adhering to KYC/AML regulations and prevent expensive legal blunders.

Ongoing Technical Support and Updates

A reputable white-label provider doesn’t just hand over the keys and walk away. You will usually get continuous assistance, notifications, and training as well.

That means you’ll have access to new features and improvements constantly and expert assistance when things don’t work out—enabling you to focus your attention and energy on expanding your client list rather than debugging the software.

Scalable Business Model

White-label solutions are intended to get your business growing. The more clients you get, the more you can upgrade your system, introduce new asset classes (such as crypto or commodities), and even customise the platform further. A number of brokers begin with a white-label configuration and later migrate to a full-license or custom-built platform when they achieve enough traction.

Step-by-Step Guide to Launching a White Label Brokerage

Beginning a white-label brokerage can seem daunting at first, but it is actually doable with proper planning and the right approach and can take as little as a couple of weeks to get up and running if you do it in the right way.

Step 1 — Conduct Market Research and Define Your Niche

Before doing anything technical, it’s crucial to understand the market you’re entering. Are you aiming to attract forex traders, crypto enthusiasts, or CFD investors? Maybe a combination? Study your competition and find the gaps—those unmet needs or overlooked regions.

That’s where your opportunity lies. Define who your brokerage will serve: retail beginners, seasoned professionals, or institutional clients. Ask yourself what will make your offer stand out. Will it be ultra-tight spreads, lightning-fast execution, robust educational resources, or something else? This foundation will shape all your decisions moving forward.

Step 2 — Choose the Right White Label Provider

Your white-label partner is the core of your entire brokerage business, so take your time with this process. What you need is a reputable partner with comprehensive solutions to encompass the trading platforms such as MT4 or MT5, risk and liquidity management, back-office services, CRM, and technical services.

Search for flexibility in the brand, open prices, and uptime and system reliability commitments. Most critically, speak directly to providers—ask hard questions, get live demonstrations, and if you can, speak with other brokers who have used their service.

Step 3 — Address Legal and Regulatory Requirements

No brokerage can function without a legal foundation. Depending on your intentions and target clients, you will need to decide on a jurisdiction—one being onshore if you require a regulated setup or offshore if you require a faster and more cost-effective setup.

Regardless, you will have to handle company registration and compose important legal documents, including Terms and Conditions, AML/KYC policies, and risk disclosures. Although the need to obtain a licence might not apply in every case, and especially in the case of working offshore, being in compliance is essential. Referring a legal expert with financial services experience is well advised.

Step 4 — Brand Your Brokerage and Build a Website

With your legal foundation and provider established, it’s time to build your brand and online presence. This is not about a logo—it’s about sharing a narrative that creates trust.

Your trading platform, client portal, and site all need to reflect your brand image. Have a modern and mobile-friendly site that reflects a high level of both professionalism and trustworthiness.

Have user-friendly onboarding processes, educational content, and access to support available. Keep in mind, your website is usually your first impression—make the first impression count.

Step 5 — Integrate Liquidity and Payment Solutions

You need strong liquidity and seamless payment processing for your brokerage to function smoothly. Your provider should help you connect with reputable liquidity partners to ensure tight spreads and fast execution.

Offer various payment methods—credit cards and wire transfers, cryptocurrency, and e-wallets—to meet a variety of client needs. It is also important to ensure that transactions are safe, compliant, and underpinned by anti-fraud controls.

Step 6 — Set Up CRM and Client Management Tools

Once your clients arrive, you’ll need something to handle them effectively. An integrated CRM makes it possible to segment clients, track behaviour, automate interactions, and provide personalized service.

Most white-label solutions have or incorporate CRMs, which may feature dashboards, email automation, live chat capabilities, and analytics.

These systems assist you in sustaining strong client relationships and providing them with timely, personalised service throughout every step of their journey

Step 7 — Launch Your Marketing Campaigns

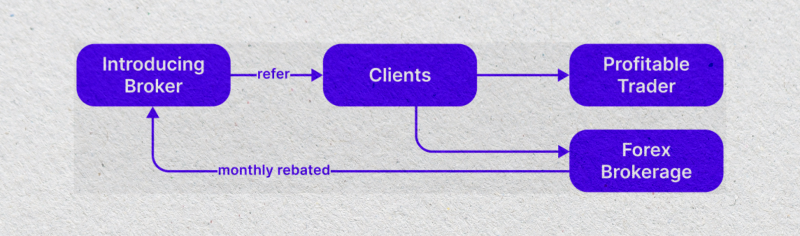

Now, it’s time to head to market. A combination of SEO, content marketing, social media, and paid advertising will drive visibility. You can also establish trust and reach through affiliate and introducing broker partnerships.

Focus on delivering real value through educational content like webinars, blogs, and YouTube videos. Transparency, consistency, and a clear value proposition will help you stand out in a crowded field.

Step 8 — Go Live and Scale Gradually

With everything in place and thoroughly tested, you’re ready to launch. Start with a soft rollout to a limited group of users. Collect their feedback, fine-tune your service, and make sure your support team is ready. Once confident, scale up your operations and begin marketing more aggressively.

Monitor platform performance, customer feedback, and key metrics like trading volume and deposit flow. Over time, you can expand into new markets, add more instruments, or introduce custom features to elevate your offering.

Estimated Costs and Profitability of Starting a White Label Brokerage

Beginning a white label broker is not free, but considerably more economically sound than creating a fully-fledged brokerage from the ground up.

The overall investment will depend on your provider, location, and expansion goals, but here is a straightforward outline of what you can expect and how your brokerage can become profitable.

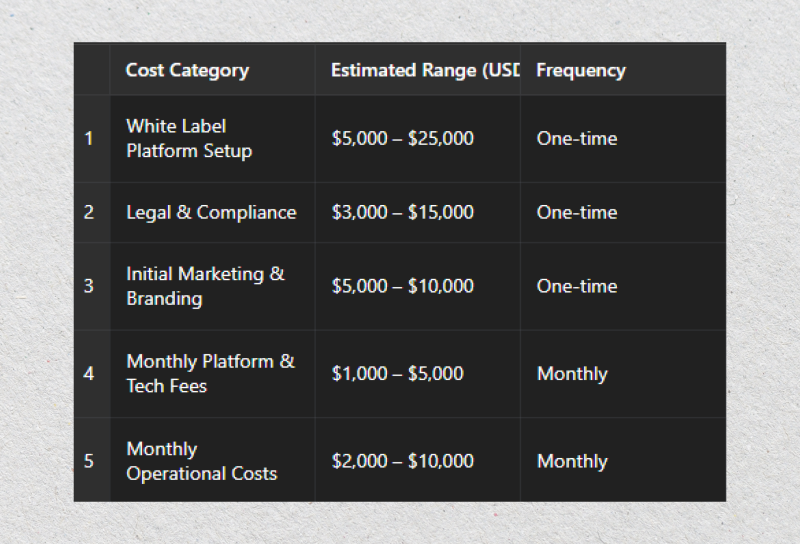

Initial Setup Costs

Your initial investment will primarily be in setting up the white-label platform, addressing legal compliance, and starting marketing efforts. White label providers generally charge one-time setup fees, usually between $5,000 and $25,000, depending on the platform (for instance, MT4, MT5, or cTrader) as well as services and branding options.

You’ll also have to account for legal and compliance expenses, such as company registration, preparation of legal documents (such as Terms & Conditions and AML/KYC policies), and—if necessary—obtaining licenses. Legal services can cost anywhere between $3,000 and $15,000, depending on the jurisdiction in which you operate.

And marketing, of course, is necessary in order to get clients from the very beginning. Digital marketing, site construction, and branding can cost another $5,000 to $10,000 in launch finances. A professional and lean launch can be accomplished for between $20,000 and $50,000.

Ongoing Operational Costs

Once your brokerage business is operational, your monthly costs will move towards support, marketing, technology, and compliance. White-label providers typically require a monthly payment for their platform updating and maintenance, and hosting costs anywhere from $1,000 to $5,000.

You will also pay liquidity provider fees, whether commission-based or spread-based, and subject to your volumes and agreements. There are other recurring expenses such as CRM and e-mail services, salaries for employees (sales reps, support staff, and compliance officers), server hosting, and customer service software.

Expect to spend an additional $2,000 to $10,000 monthly, depending on your operation’s lean or expansive. As your brokerage grows, these costs may increase — but ideally, so will your revenue.

Profitability Outlook

Most white-label brokerages can break even within 6 to 12 months if they manage costs and attract active clients. Profitability depends on trading volume, client retention, and operational efficiency.

If you’re acquiring traders efficiently and offering competitive conditions, monthly profits can scale from a few thousand dollars to six figures per month as your user base grows.

Finally, although starting up a white-label brokerage entails strategic investment, the reward — particularly in the midst of a booming trading market — can prove significant. Proper planning, further assistance, and execution should see your brokerage emerge as a sustainable and revenue-generating business.

Case Study — Launching a White Label Brokerage with B2BROKER

To understand how a white-label brokerage launch works, look at how a new broker could approach the process using B2BROKER, a well-established provider.

Suppose you’re an entrepreneur aiming to enter the forex and crypto trading markets. Your priority is to get a fully branded, functional trading environment up and running with minimal delays, while ensuring the technology behind it is reliable and scalable.

Instead of developing everything in-house, you choose a white-label route and partner with B2BROKER.

Selecting the Right Stack

One of your first decisions is choosing a trading platform. Suppose your audience leans toward advanced forex traders. In that case, you might opt for MetaTrader 4 or 5, or if you’re targeting modern UI enthusiasts or multi-asset brokers, cTrader White Label — offered by B2BROKER — becomes a strong candidate. This platform is known for its sleek interface, fast execution, and algorithmic trading features.

In parallel, you need liquidity and order execution technology. This is where B2TRADER, B2BROKER’s proprietary matching engine, fits in. Designed for crypto and multi-asset exchanges, it supports high-speed order routing, advanced risk management, and a customisable order book.

Paired with deep liquidity aggregation from B2BROKER’s liquidity arm (via B2PRIME), you can deliver institutional-grade execution to your clients.

Covering Compliance and Onboarding

For regulatory needs, B2BROKER doesn’t offer licensing directly but can advise on setting up in jurisdictions where white-label brokers commonly register, such as Seychelles, Labuan, or Mauritius. Their client onboarding system includes built-in KYC/AML workflows to help you meet compliance standards from day one.

Technical Support and Integration

Once your platforms are selected, the integration process begins. With B2BROKER, this includes the trading front-end, back-office systems, client portals, a complete CRM, and technical support infrastructure. A dedicated team will guide you through each setup phase, ensuring everything is configured correctly before launch.

Going Live

With everything in place—platforms branded, liquidity connected, and compliance covered—you’re ready to go live. Thanks to the modular design of B2BROKER’s infrastructure, you can scale easily by adding new instruments, launching mobile apps, or expanding into new regions.

Conclusion

Building a successful white-label brokerage platform doesn’t have to be complex. With the right strategy and a trusted partner like B2BROKER, you can skip years of development and launch in just weeks—fully branded, liquid, and ready to scale.

Whether it’s your first venture or expanding into new markets, a white label brokerage service gives you the speed, flexibility, and control to thrive. In today’s fast-paced trading world, your brokerage could be the next big name—all it takes is the first step.

FAQ

Do I need a license to run a white-label brokerage?

Not always. Some jurisdictions allow operation without a license, but staying compliant with KYC/AML standards is recommended.

How much does a white label brokerage cost to start?

Typical setup costs range from $20,000 to $50,000, depending on the provider and features included.

Can I offer crypto trading with a white label brokerage platform?

Yes. Many providers support multi-asset setups, including crypto, Forex, and CFDs.

How long does it take to launch a white label trading platform?

If you’re organised and prepared, you can be up and running in as little as 3 to 6 weeks.