Pi Network: Scam or Groundbreaking Crypto? The Full Analysis

May 20, 2025

Pi Network is a cryptocurrency project that has attracted tens of millions worldwide. Earlier this year, it launched its Open Mainnet, which expanded opportunities for developers to build and integrate applications on the network.

Nonetheless, the project continues to be a subject of vigorous discussion within the crypto community. A core question persists: Is this a legitimate effort, or are there fundamental problems?

This article will explore what the Pi Network is about, its history, its coin’s performance in the market, and ultimately address whether or not it can be considered a scam.

Key Takeaways:

- A core goal for Pi Network is letting people mine crypto on their smartphones, sidestepping hefty energy demands.

- The journey of Pi Coin’s price, from a $2.99 peak down to $0.58, paints a picture of sharp market swings and prevailing uncertainty.

- Despite significant adoption, Pi Network faces criticism over transparency, token control, and legitimacy.

What is Pi Network?

The Pi Network launch date was a notable one — March 14, 2019, also known as Pi Day. Behind the network are Dr. Nicolas Kokkalis and Dr. Chengdiao Fan, both of whom earned their Ph.D.s at Stanford University.

Their vision for the project was to open up cryptocurrency mining to just about anyone. The idea is to get rid of the usual hurdles – expensive gear or substantial electricity energy demands of conventional crypto mining.

- Dr. Kokkalis, a Computer Science Ph.D., has a background in distributed systems and previously taught Stanford’s first class on decentralized applications.

- Dr. Fan, with a Ph.D. in Anthropological Sciences, brought expertise in social computing.

Core Concept: Mobile-First Mining

So, how does the Pi Network approach mining? It introduces a distinct method where users, called “Pioneers,” can mine Pi Coins using a mobile application. A key design goal here is to be significantly less energy-intensive than older mining processes.

Instead of utilizing Proof-of-Work systems, Pi Network uses the Stellar Consensus Protocol (SCP), a mechanism based on the Federated Byzantine Agreement (FBA).

Practically, SCP operates through a system reliant on trust. It allows users to create ‘Security Circles’—defined as small, trusted groups—which then participate in transaction validation and network security. User participation generally involves a daily tap of a button within the application.

User Base

Since its launch, Pi Network has indicated substantial expansion in its user base. Communications from the project in early 2025 suggested a global user count surpassing 60 million.

More than 19 million were said to have completed the Know Your Customer (KYC) verification. Additionally, according to the, over 12 million users had migrated their mined Pi to the Mainnet.

It was reported that over 19 million individuals completed the KYC process. Furthermore, the project’s official website stated that more than 12 million users successfully migrated their mined Pi to the Mainnet.

Development Timeline & Key Milestones

The Pi Network cryptocurrency project has evolved through several distinct phases, each with specific objectives and achievements.

- Beta Phase (March 2019 – March 2020)

This initial stage saw the launch of the Pi Network mobile application. Key objectives included user acquisition through a referral mechanism and validation of the smartphone-based mining concept.

- Testnet Phase (March 2020 – December 2021)

March 2020 saw the network step into its Testnet phase. This period was dedicated to putting the blockchain’s capabilities and its potential to scale through their paces. A notable development here was getting community members to run network nodes, a move aimed at bolstering decentralization.

- Enclosed Mainnet Phase (December 2021 – February 2025)

December 2021 marked the move to the Enclosed Mainnet. During this period, external network connectivity was restricted, allowing the team to concentrate on ecosystem development and user Know Your Customer verification.

- Open Mainnet Launch (February 20, 2025)

Then, on February 20, 2025, Pi Network made its official move to the Open Mainnet. This change lifted the prior restrictions on external connections, opening the door for potential interactions with other blockchains and exchanges.

Pi Coin (PI) Value and Market Performance

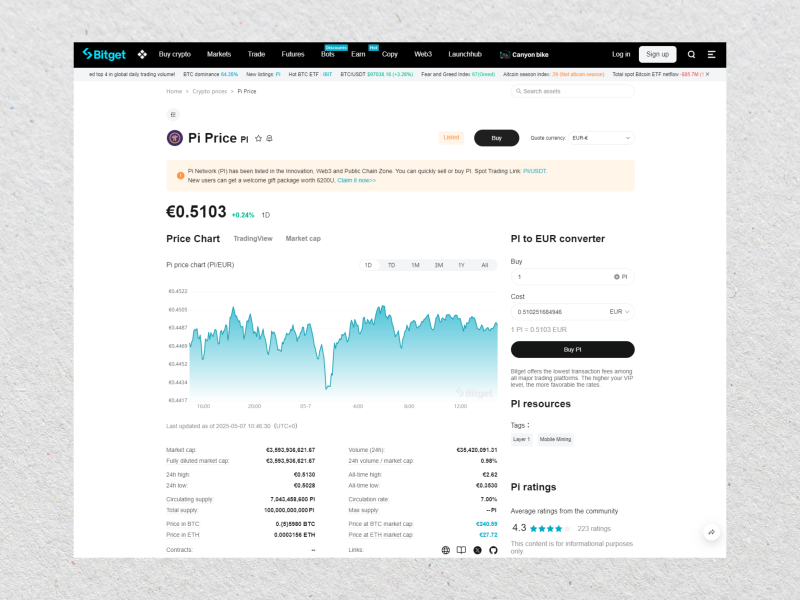

As of May 6, 2025, Pi Coin (PI) was trading at approximately $0.58. The 24-hour trading volume approached $54.9 million, with its market capitalization at about $4.14 billion. The coin ranks within the top 30 cryptocurrencies by market size.

Price History and Volatility

Pi Coin value has dramatically increased since the Open Mainnet went live on February 20, 2025. Within six days, the token reached an all-time high of $2.99, largely attributed to initial investor enthusiasm and speculative market activity.

However, this upward trend was short-lived. By April 5, the price had retracted to approximately $0.41, representing an 86% decrease from its historical high.

Subsequently, the coin stabilized around the $0.58 level. Then, a period of comparative stability has followed. The market, often reacting to fresh Pi Coin news and broader trends, takes a step back to reassess its long-term potential.

How to Sell Pi Coin

Now that the Pi Network’s Open Mainnet has launched, many are wondering how to sell Pi Coin. Here’s what the process involves:

Complete Your KYC Verification

First off, selling Pi Coins requires completing your KYC verification. This is a mandatory step handled within the official Pi Network app.

Set Up and Secure Your Pi Wallet

Once KYC is sorted, you’ll need to establish your Pi Wallet using the Pi Browser app. Download the official Pi Browser, then head to the “wallet.pi” page inside it. Follow the instructions provided there to get your wallet created.

Pay close attention during this setup: you’ll receive a 24-word seed phrase. This phrase is your ultimate key to your wallet. Write it down immediately and store it somewhere safe, completely offline. If you lose this seed phrase, you lose access to your Pi Coins, and there’s no way to recover them.

Choose a Cryptocurrency Exchange

With your wallet set up, the next step is finding a reputable cryptocurrency exchange that lists Pi Coin for trading. As of May 2025, notable exchanges supporting PI trading include:

- OKX: Offers various trading pairs such as PI/USDT, PI/TRY, PI/USD, PI/EUR, and PI/BRL.

- Gate.io: Supports the PI/USDT trading pair.

- Bitget: Provides trading pairs like PI/USDT and PI/BTC.

Always do your own checks to confirm current listings and choose an exchange that you trust and feel comfortable using.

Transfer Pi Coins to the Exchange

To move your Pi Coins to an exchange, you’ll start in your Pi Wallet within the Pi Network app. Look for an option like “Pay / Request,” then choose to “Manually Add Wallet Address.”

Separately, log into your chosen exchange, go to its deposit section, select PI, and copy your unique Pi deposit address.

Carefully paste this exchange deposit address into your Pi Wallet and initiate the transfer for the amount of Pi you want to send. Keep in mind that these transfers aren’t always instant; they can take anywhere from 10 to 30 minutes, or longer if the network is busy. Wait for the exchange to confirm your deposit.

Sell Pi Coins on the Exchange

After your Pi Coins are confirmed in your exchange wallet, you’re ready to sell. Head to the exchange’s spot trading section and find the Pi trading pair.

You’ll then choose how you want to sell.

- A “Market Order” sells your Pi immediately at the current best price.

- A “Limit Order” lets you set a specific price target; your Pi will only sell if the market hits that price.

Enter the quantity of Pi you’re selling and confirm the order.

Withdraw Your Funds

Once your Pi is sold (likely for USDT or another crypto), you’ll need to decide how to access these funds. You could transfer the resulting cryptocurrency to a personal external wallet like Trust Wallet or MetaMask.

Alternatively, many exchanges offer P2P (Peer-to-Peer) services, which can allow you to convert your crypto to local currency and withdraw it to your bank account. Explore the options on your specific exchange.

Controversies and Criticisms

Any project in the crypto space attracting significant attention, like the Pi Network, inevitably faces scrutiny. Alongside its ambitious goals and large user base, several controversies and criticisms, often amplified by Pi Network news, have surfaced, prompting questions about its operational practices.

Pyramid Scheme Allegations

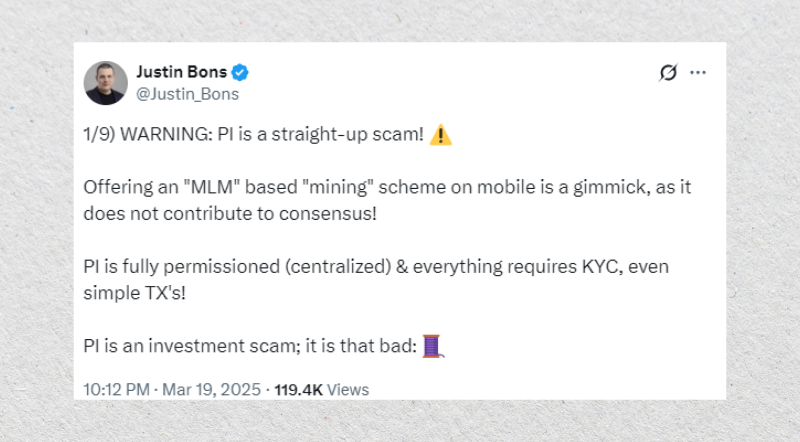

A recurring question mark hangs over Pi Network’s referral-driven growth. Critics often compare its user acquisition strategy to multi-level marketing (MLM), where the structure might unduly favor those who joined early.

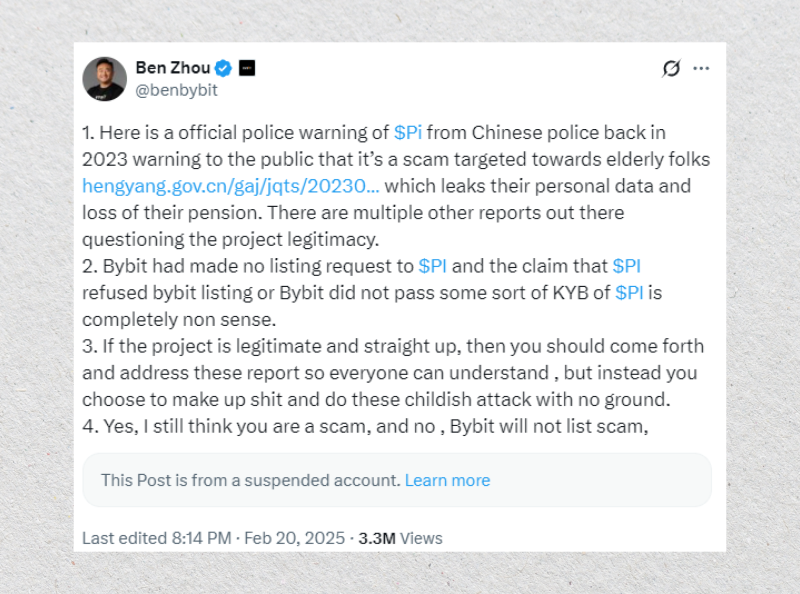

These concerns have had official echoes. In July 2023, authorities in Hengyang City, China, reportedly identified Pi Coin as a pyramid scheme. Industry voices, such as Justin Bons from CyberCapital, have also pointed out structural similarities to systems that benefit early participants at the expense of newer ones.

Transparency and Centralization Concerns

Token distribution is a core issue. Reports indicate the Pi Core Team holds a vast majority of tokens, potentially over 93 billion of 100 billion. Such centralized control fuels market manipulation fears and directly conflicts with DeFi principles.

Multiple Mainnet delays also bred user and analyst skepticism. Post Open Mainnet, the continued absence of a clear, updated public roadmap leaves many in the community uncertain about the project’s definite future direction.

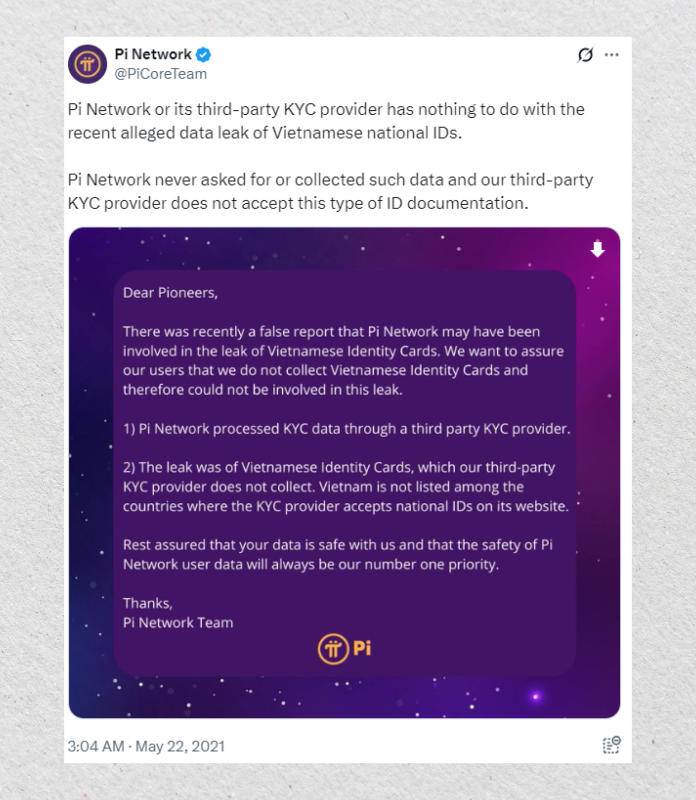

Data Privacy Incidents

In May 2021, Pi Network found itself connected to an alleged data breach involving the personal details of thousands of Vietnamese users. However, Pi Network pointed to a third-party KYC provider, Yoti, which in turn refuted direct blame.

Market Skepticism & Exchange Listings

Gaining acceptance on major crypto exchanges hasn’t been a smooth ride for Pi Network, with some industry leaders openly skeptical. Ben Zhou, CEO of the Bybit exchange, publicly called Pi Network a scam, flagging issues with its operational model and transparency.

Is Pi Network a Scam?

The crypto world is sharply split on Pi Network. Is it a genuine attempt to innovate, or just a scam? Supporters see promise; critics are wary of its methods. Let’s look at what fuels both views.

Why Some Trust Pi Network

The project’s foundation, built by Stanford graduates with solid tech and social science credentials, lends it an air of academic seriousness. One founder, Dr. Nicolas Kokkalis, is a recognized name in blockchain education.

Then there’s the sheer size of its community. Millions worldwide have signed up, with a large number reportedly KYC-verified. This massive adoption, plus a functioning Open Mainnet and app development, suggests a project with real traction.

Unlike purely speculative tokens, Pi Network also has a working mobile app, a browser, and a wallet. Its choice of the Stellar Consensus Protocol points to an energy-efficient design, a contrast to older, power-hungry cryptocurrencies.

Why Others Are Skeptical

Pi Network’s primary growth engine—its referral system—is a major red flag for many. Critics argue it closely mirrors multi-level marketing (MLM), potentially disadvantaging those who join later and raising sustainability concerns.

The control over Pi Coins is another big issue. A huge majority of tokens are reportedly held by the Core Team. Such centralization is at odds with DeFi ideals and sparks fears of market manipulation. Clear details on tokenomics remain elusive.

Conclusion: Cautious Optimism or Warning Sign?

Pi Network certainly stands out in the crowded crypto field. It boasts massive grassroots support and a bold vision for democratizing digital currency. However, this ambition is shadowed by persistent, serious concerns regarding transparency, token control, and its overall operational model.

So, is it a scam? Legally, there’s no definitive judgment labeling it as such. Yet, Pi Network undeniably remains a high-risk endeavor with a highly speculative value.

The best approach? Extreme caution. Any decisions should stem from your own thorough research and understanding, not from hype or referral-driven excitement.

Disclaimer: This article is for informational purposes only. It is not financial advice and should not be relied upon for investment decisions. Always do your own research and consult a financial advisor before investing.