Low-Latency Trading Defined: Speed, Strategy and Technology

Aug 25, 2025

In today’s high-wire world of financial markets, speed isn’t a plus – it’s a lifeline. Low-latency trading has revolutionized how competitors in this arena, known as traders, execute their orders in microseconds and seize opportunities that disappear almost instantly.

Behind this arms race for speed is an advanced combination of infrastructure, hardware, algorithms, and marketplace strategy, all designed to outpace, by fractions of a second, their counterparts in this Battle Royale of real time.

Key Takeaways

- Low-latency trading relies on cutting-edge infrastructure, from co-location servers to microwave transmission.

- Speed is a must for arbitrage, market making, and scalping approaches within highly volatile markets.

- Even milliseconds count — reducing latency can mean winning out over competitors to lucrative trades.

What is Low-Latency Trading?

Low-latency trading in financial markets means placing trades and processing market data as quickly as humanly possible, often in very small fractions of a second.

It’s no bragging right; in super-competitive markets where prices can change several hundred times in an instant, speed can mean the difference between seizing a profitable opportunity and missing out.

To achieve this, corporations throw money liberally on special-purpose infrastructure, very high-speed networking, and highly optimized algorithms, all to strip out every conceivable microsecond from the cycle of a trade.

Latency vs. Low-Latency

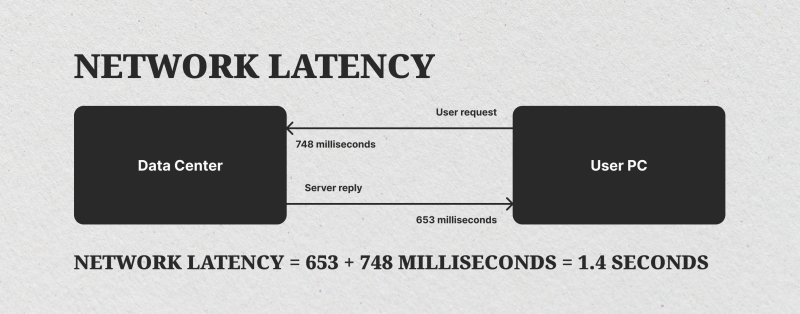

Latency is just the time lag between an action and its matching response — that is, in terms of trading, from clicking an order to hearing back from an exchange. All systems possess latency; the point is how much.

Classic setups for buying and selling may lag by tens or even hundreds of milliseconds, which is tolerable for long-term investors yet unacceptable for high-speed traders.

Low-latency systems look to minimize this lag to its bare minimum — frequently to several milliseconds, even microseconds — which provides traders with an advantage in being first to react to information changes in markets.

Latency in Perspective

To put these numbers into context, a millisecond is one-thousandth of a second. A microsecond is one-millionth of a second. In that time, modern exchanges can process enormous volumes of orders.

For example, a trading firm might go to great lengths to reduce round-trip latency from 1.2 milliseconds to 0.8 milliseconds — a change most people wouldn’t notice, but in the high-speed world of algorithmic trading, that improvement can mean beating a competitor to the best price.

Every fraction of a second counts, and in low-latency trading, those fractions are measured with surgical precision.

Fast Fact

The fastest transatlantic trading cable can transmit market data between London and New York in under 60 milliseconds — faster than a human blink.

How Latency Affects Trading Performance?

Trading latency, in today’s financial markets, is an important factor that directly affects an institution’s profitability. For active trading companies and high-frequency trading desks, the execution speed of a trade can mean all the difference between taking a position at the desired price and losing out on it completely.

In a fiercely competitive marketplace where stock prices can change within a matter of several milliseconds, success and failure are often dependent on how efficiently a low-latency trading system performs.

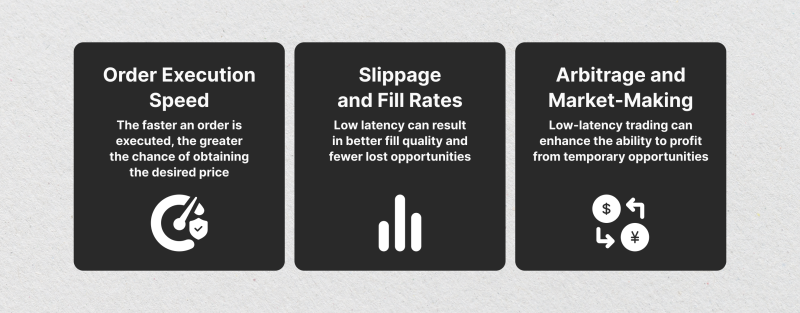

Impact on Order Execution Speed

The speed of execution of an order is the heartbeat of low-latency trading. The faster an order is sent out from a trader’s electronic platform to an exchange and back, the greater is the chance of obtaining the desired price.

High latency can introduce lags that make trades miss their targets, particularly in algorithmic trading and electronic trading, where algorithms respond to market changes in real time.

Ultra-low latency execution utilizes low-latency infrastructure such as direct access to markets, co-location within the same data center as an exchange, and high-speed data transmission to provide minimum delay.

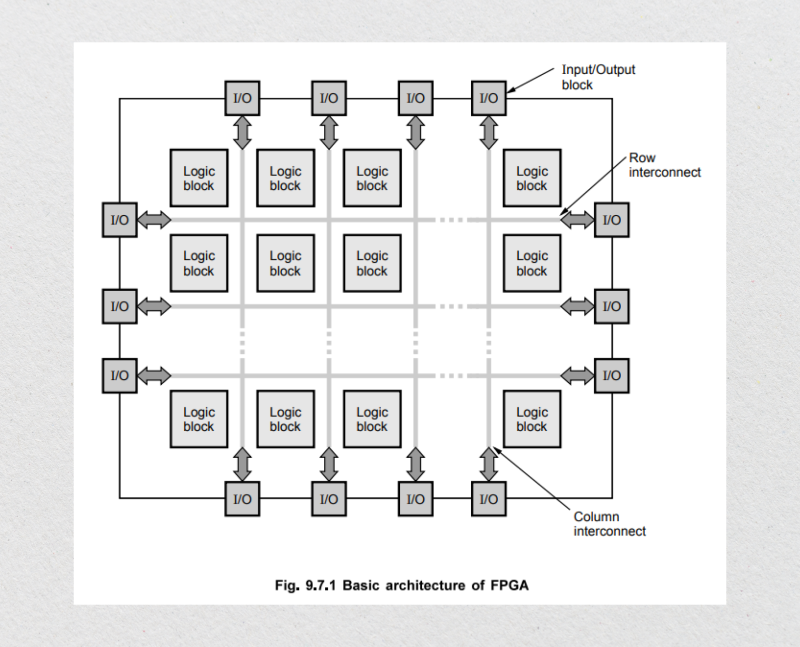

These are generally followed up with field programmable gate arrays (FPGAs) and high-performance servers to eliminate processing delays and fast execution.

Impact on Slippage and Fill Rates

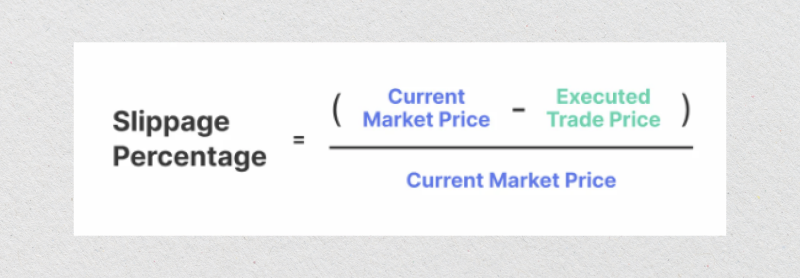

Slippage — the spread between the expected execution price of a trade and the actual fill — is significantly affected by market latency and liquidity latency. In rapidly changing markets, even milliseconds can make a difference in available liquidity, causing increased slippage and decreased fill rates.

Low-latency systems, therefore, try to bring this risk down with decreased latency in data transmission as well as order routing, so traders can react to their latest market information.

The outcome is better quality fill, fewer lost opportunities, and overall better trading performance. For high-frequency traders, minimizing slippage is essential, as inefficiencies multiply quickly across thousands of trades.

Impact on Arbitrage and Market-Making Opportunities

Opportunities, low-latency facilities are needed for strategies like latency trading, arbitrage, and market-making. Arbitrage strategies frequently rely on identifying price differences across venues and taking action before other traders fill the gap.

In ultra-low latency trading, orders are transmitted and verified within microseconds, allowing high frequency trading companies an edge in taking advantage of transitory opportunities.

Market makers, however, use low-latency trading to make real-time changes in quotes as market changes occur, keeping spreads profitable and competitive.

In both instances, low-latency trading systems are aided through highly tuned trading system architecture, optimized IT infrastructure, and high speed pathways for data transmission that are aimed at introducing minimum latency.

Technologies Behind Low-Latency Trading

In today’s marketplace, being competitively fast isn’t just about a quicker internet — it’s a careful mixture of protocol, hardware, and infrastructure, all combining to reduce network latency and provide smooth data transmission.

For high frequency traders, the IT stack of low latency trading is frequently the difference between taking advantage of an opportunity during a chaotic market environment, and losing out on one altogether.

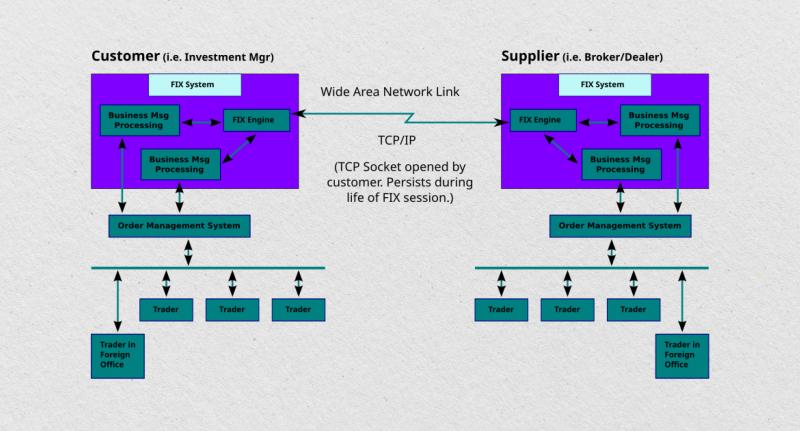

FIX Protocol and Binary Protocols

The FIX (Financial Information eXchange) protocol has been the industry standard for decades, enabling universal communication between exchanges and trading systems. Even though FIX is tried and true, high frequency trading businesses often choose binary protocols when searching for latency reduction.

Binary protocols reject all unnecessary overhead, which allows for quicker parsing and expeditious data transmission. In low latency trading, each microsecond counts, and choosing an optimal communications protocol can greatly determine how quickly a system responds to an event within the markets.

FPGA (Field-Programmable Gate Array) Usage

FPGAs are a foundation technology for minimizing latency in direct market access configurations. In contrast to conventional CPUs, which execute jobs in sequence, FPGAs can be coded to perform extremely specific tasks concurrently, allowing for near-real-time processing of inbound market information.

For high frequency traders, this hardware acceleration allows their orders to be processed and sent with much less network latency. In highly turbulent markets, an FPGA-enabled system can react to price moves before competitors recognize them.

Ultra-Low-Latency Switches and Routers

Switches and routers are seemingly insignificant elements within the overall infrastructure of a trading environment, yet in an ultra low latency environment, they become essential. Ultra-low-latency networking hardware is designed to forward packets with negligible delay, frequently in the tens of nanoseconds.

Ultra-low latency devices are designed to process data efficiently, allowing market data and order messages to traverse the network without hindrances. For high frequency trading companies, this can be the determining factor between being front-runners or back-runners in a highly competitive marketplace.

Cloud vs. On-Premises Considerations

With low latency trading, geography is everything. Although cloud deployments provide scalability and cost advantages, they bring additional network latency purely due to geographical distance from exchanges.

On-premises infrastructure, especially that which is housed in the same data center as the trading venue, provides round-trip times that are minimized.

Co-location provides direct market access, via complete elimination of the public internet, and minimizing latency to an absolute minimum. In strategies where reacting to market action within microseconds is paramount, high-frequency trading shops still prefer tightly managed, on-premises deployments over cloud-based equivalents.

Applications of Low-Latency Trading

Low latency trading value isn’t just in its associated technology, but how it’s utilized within practical trading strategies in real-world environments. In an environment where market competition causes opportunities to disappear within microseconds, being faster than one’s competitors is a winning advantage.

From high frequency through scalping, these uses prove how profit can be transformed from speed.

High-Frequency Trading (HFT) Strategies

High-frequency methods of trading employ rapid-fire execution of trades, often in microseconds, to capture even minuscule inefficiencies in markets. For high-frequency traders, low-latency trading is the foundation that allows algorithms to process data about markets, search for patterns, and respond immediately to changes in markets.

Through a combination of direct market access, optimized trading infrastructure, and high performance data transmission, HFT methods are capable of generating thousands of trades per second, extracting profit that would be imperceptible to a human trader, but worth something when magnified.

Arbitrage Trading

Low latency trading remains one of its highest-profile uses. From statistical arbitrage to latency trading to cross-exchange arbitrage, however, the methodology never varies: identify price differentials across markets and profit before they disappear.

In statistical arbitrage, algorithms compare history and real-world data to search for differences from normal pricing correlations. In latency trading, the advantage is in seeing and acting against information markets before competitors, often because of superior low latency connectivity.

Ultra-low latency execution, in turn, is what cross-exchange arbitrage depends upon in its attempt to reduce network latency between venues.

Market Making

Market makers create liquidity by actively quoting bid and offer prices, taking the spread between them. In highly turbulent markets, low latency systems help market makers rapidly change quotes in response to changing markets.

A delay in networks or processing, however, can see a market maker being “picked off” — selling for an insufficient amount or buying at an excessive cost once prices move.

Lower latency through co-location, high-performance servers, and field programmable gate arrays assists market makers in competing, facilitating markets, and coping with their exposure to risk.

Scalping in Volatile Markets

Scalping consists of executing dozens, even hundreds, of tiny trades per session, seeking profit from minuscule changes in stock prices. In rapidly changing markets, opportunities can only be present for milliseconds.

Scalpers rely on low latency trading infrastructure and quick information transmission to quickly enter and close positions. Through the integration of ultra low latency trading technology and exact trading techniques, scalpers can hold their advantage even within extremely volatile market conditions.

Key Components of Low-Latency Systems

Building a truly competitive low-latency trading setup is a careful balance of infrastructure, hardware, software, and data flow. Each element is designed with one goal in mind — to shave microseconds from the path between decision and execution.

Network Infrastructure

A robust network is the backbone of any low-latency trading system. Every step in the data journey, from the trader’s desk to the exchange and back, must be optimised for speed and efficient data transmission.

Direct market access (DMA) allows orders to bypass intermediaries and go straight to the exchange, removing unnecessary hops that could add network latency.

Many trading firms also employ fibre-optic and microwave transmission lines to connect directly with exchanges, the latter offering a shorter path — and therefore faster delivery — than conventional routes. In a world where opportunities may only exist for a few milliseconds, this infrastructure is not a luxury, but a necessity.

Hardware

Physical equipment plays a critical role in reducing latency. Co-location servers — placed in the same data centre as the exchange — cut transmission times dramatically by eliminating long-distance travel for market data and orders.

Inside those servers, high-performance CPUs, GPUs, and field-programmable gate arrays (FPGAs) provide the processing muscle needed for instant analysis and trade execution. FPGAs, in particular, excel at handling highly specific instructions in parallel, making them ideal for processing tick-by-tick data with minimal delay.

Software Optimisation

Even the best hardware will underperform if the software isn’t equally tuned for speed. Ultra-fast trading algorithms are designed to process market events in microseconds, scanning for price discrepancies, analyzing order books, and placing trades before other traders can react.

Many firms favour low-level programming languages like C++ or Rust, which offer fine control over memory usage and execution speed, further reducing latency. This kind of optimization often extends to every layer of the trading system architecture, ensuring there are no bottlenecks that could slow down decision-making.

Data Feeds

In low-latency trading, the quality and speed of market data are just as important as order execution. Real-time feeds ensure that traders are reacting to the most up-to-date information, rather than stale signals.

Advanced setups process tick-by-tick updates, capturing every single change in the order book and allowing for precise latency trading strategies.

For high-frequency trading firms, having access to clean, unfiltered market data at the lowest possible delay is often the deciding factor in whether a strategy succeeds or fails.

Conclusion

Low-latency trading is no longer a specialist niche of high-end high-frequency trading groups — it is an identifying characteristic of today’s market arena.

Through direct market access, FPGA acceleration, or extremely quick trading algorithms, whatever the method, only one thing matters: minimize latency, respond more quickly, seize opportunities before your competitors.

In an era where changes in markets flash by in an instant, learning about and dealing with the technology and strategy of low latency is how you stay in contention.

FAQ

What is low-latency trading?

Programmed trading that processes order data and transaction information in the least amount of time, which is often in microseconds.

Why is low latency significant?

In highly competitive markets, even a tiny lapse can be expensive due to losing fruitful trades.

How do traders minimize latency?

By using direct market access, co-location, optimized code, and ultra-fast networking hardware.

Is low-latency trading only for large companies?

Although big companies control, high-tech is increasingly within reach of even tiny traders.