5 Reasons Traders Are Switching to Perpetual Futures

July 31, 2025

Financial markets are changing all the time, and what’s hot today can be totally unlike what dominated recently or a month prior. So always stay one step ahead of news and updates in your industry, and perpetual futures are the key nowadays!

These instruments are perpetual agreements, unlike traditional futures contracts and forwards, which are settled only on their respective fixed expiration dates, implying that the trade occurs.

With increased interest by traders and appropriate regulations, here’s why perpetual futures markets are your best bet and how to take advantage of such trends.

Key Takeaways

- Perpetual futures are derivative contracts that do not expire and enable traders to speculate on markets almost indefinitely.

- Perpetual futures are more flexible and can be traded on any market and at any time.

- Traders are increasingly switching to perpetuals due to their favorable conditions and ease of use.

Understanding Perpetual Futures

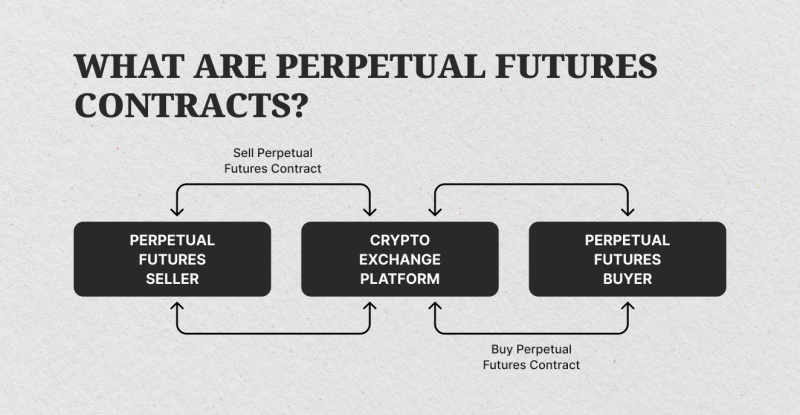

Perpetual futures are derivative contracts that allow one to speculate on the price of an instrument but own no instrument and have no defined expiration date. As compared to regular futures, perpetuals can, in theory, be held indefinitely, which makes them highly attractive to institutional and retail traders.

Such tools are quite familiar in the cryptocurrency market. Their mechanism makes them operate somewhat like spot markets, where their price is near that of respective assets, but with a twist. Such a distinctive twist gives brokers more kinetic trading options in the ever-changing digital assets space.

Key Principle: Funding Rate Mechanism

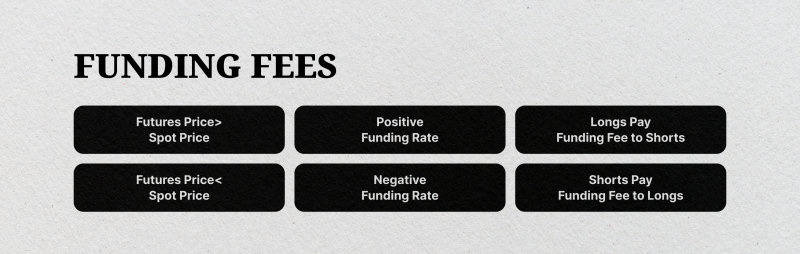

The funding rate is a pivotal element in perpetual futures price fixing. It is a periodic payment exchanged between long and short position holders to maintain the contract price and keep it close to the underlying asset’s spot price.

For example, when the contract’s value is higher than the spot price, the long position holder pays the short position holder. On the flip side, if the contract’s value is lower than the spot price, the short position holder pays their counterparty.

This mechanism ensures equilibrium and inhibits significant price divergence, offering a fair trading opportunity for all parties involved.

For brokers, communicating internal funding rates transparently is crucial to gain the trader’s trust and ensure smooth execution, especially in volatile markets.

Regulations and Industry Trends

Perpetual futures have surged in popularity as regulators provide clearer guidelines around digital asset derivatives. With these growing demands, leading brokerage platforms, like B2TRADER and Coinbase, are integrating these derivatives into their offerings, supporting businesses with more scalable solutions that attract and retain users.

Learn How to Add Perpetual Futures in Your Brokerage

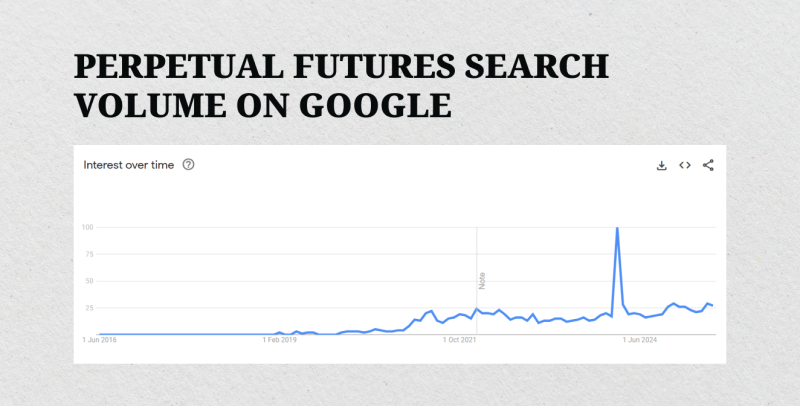

Following this growing popularity, search engines have recorded an increasing interest in the term “Perpetual Futures”, especially compared to a couple of years ago.

More importantly, after years of deregulation, perpetual future contracts are undergoing comprehensive regulatory reforms, being slowly discussed by key financial authorities.

In the US, the Commodity Futures Trading Commission (CFTC) governs digital asset derivatives, including swaps, options, and perpetual futures. The Markets in Financial Instruments Directive II governs perpetuals in Europe if the underlying asset is regulated by the MiFID II framework.

5 Reasons Traders Are Switching to Perpetual Futures

Traders tend to gravitate towards financial instruments that offer flexibility, value creation, and ease of use. These three elements make perpetual futures highly attractive in today’s dynamic financial markets.

These contracts offer features that suit both short-term speculators and long-term position holders, incorporating speed and sufficient liquidity. Here are the top benefits of perpetual futures that motivate traders to choose these contracts, and why you should also consider the switch!

No Expiration Dates

Perpetual futures contracts remove contract rollover pressure. As perpetuals have no expiration dates, position holding can occur for as long as a trader wishes, and calendar restrictions are avoided.

That equates to better engagement and user retention for brokers since clients are more inclined toward convenient and open positioning.

Access to Leverage

Leverage forms part of the fundamentals of perpetual futures trading that enable clients to hold larger positions based on smaller capital. However, pursuing this course comes with risks if the market conditions change unexpectedly.

For brokers, margin trading also boosts traffic and volume by enticing experienced professionals and traders who utilize high-risk, high-reward approaches.

However, you should provide adequate risk management instruments to enable customers to manage their exposure instead of profiting from their losses to establish a durable reputation.

Flexible Pricing

Thanks to the funding rate mechanism, perpetual future contracts closely mirror spot prices. This dynamic pricing system provides traders with similar exposure to real-time market values, minimizing significant price discrepancies.

For brokers, this provides win-win scenarios, boosting trading volumes and retention rates while offering end-users precise trade execution.

24/7 Trading Access

Perpetual futures, unlike other markets, operate throughout because they are cryptocurrency-related markets. It draws more people who are keenly interested in trading, regardless of their location, and they can easily react to news and changes in the market.

For brokers, this also allows them worldwide access to potential customers outside of work hours or when markets are closed, which enhances user activity.

Deep Liquidity

Perpetual futures are established instruments that have broad liquidity venues. This offers traders competitive spreads and seamless execution even for high-volume orders.

For brokers, this supports lower slippage, faster processing, and better client satisfaction. However, you must select a reliable liquidity provider to ensure a smooth perpetual futures trading environment.

Connect with a liquidity provider now

Combine Perpetual Futures and Spot Trading

Spot trading and perpetual futures are fundamentally distinct, each with its unique features, advantages, and markets. Let’s compare spot vs perpetual futures.

Spot trading involves buying or selling an asset with immediate delivery at the current market price. It is a straightforward transaction between two parties who prefer outright ownership of the underlying security. In the crypto space, spot markets enable users to own cryptocurrencies and store them in their corresponding wallets.

Also, spot trading has no leverage, and hence, all trades are settled by utilizing only available funds, reducing the likelihood of liquidation.

Perpetual futures allow traders to speculate on price movements and earn from market action without owning the underlying asset and without an expiration date. These derivatives support leverage trading, short-selling, and 24/7 trading, making them ideal for active traders and institutional clients looking for capital efficiency and flexibility.

They enable investors to profit in uptrending and downtrending markets, thus becoming more competitive than spot markets. This accessibility means increases in volumes of trades, diversified income flows, and attractiveness to more market players.

You can combine both markets in one platform to maximize your potential further, just as B2TRADER combines Spots, CFDs, and perpetuals to exploit market trends and provide a complete trading infrastructure.

You can contact their team to learn how to offer perpetual futures, spots, and CFDs on one platform.

Advantages and Disadvantages

Perpetuals come with multiple advantages for traders and brokers. However, they also present a few challenges that make integrating them require careful planning. Here are some perpetual future pros and cons.

Pros

- No expiration dates: Traders can hold positions indefinitely, offering flexibility for different perpetual futures trading strategies.

- Leverage capabilities: Traders can leverage their positions to amplify their gains using borrowed funds.

- Profit in both directions: Perpetual futures support trade execution in long and short positions.

- 24/7 market access: Global users can trade perpetual futures at any time to execute their unique trading strategies.

- Price stability: The funding rate mechanism ensures futures prices are closely aligned with the spot price.

- High liquidity: Their popularity garnered deep liquidity and tight spreads from various liquidity providers, ensuring smooth trading.

Cons

- Leverage risk: Leveraged positions boost potential gains but also amplify losses if markets move unexpectedly.

- Volatility exposure: Crypto markets are highly volatile, resulting in rapid changes in funding rates and frequent liquidations.

- Regulatory changes: Jurisdictions are tentatively expanding to perpetuals, and not all regulators have clear guidelines yet.

- Maintenance requirements: Brokers must offer robust monitoring and risk management tools to handle market volatility and leverage changes.

Integrating Perpetual Futures into Your Brokerage

Adding perpetual futures to your brokerage company isn’t just a technical enhancement—it’s also a strategic investment for business development. Integration includes choosing a reliable provider, ensuring compliance, integrating trading infrastructure, and measuring performance metrics.

It can attract new revenue, boost user engagement, and guarantee your spot in tomorrow’s market. Here’s how you can start.

Find a Reliable Provider

Seek out proven providers that have a history of success, high liquidity pools, and strong security features. Providers such as B2TRADER and Bybit have scalability-designed and compliance-ready APIs and infrastructures.

Make sure they offer clear fee structures, 24/7 support, and advanced risk management tools. A good platform will not only make technical integration easy but also support users’ onboarding, regulatory documentation, and back-office operations.

Check your vendor’s reputation, technology stack, and business alignment. Remember, your provider is one of the most valuable extensions of your brand and has a direct effect on your client’s experience.

Verify Regulatory Compliance

Perpetual futures are traded in a constantly changing regulatory environment. Make certain your broker complies with local law standards and international standards, such as licensing, KYC/AML, and derivatives reporting.

Engage lawyers and compliance officers to bring your offering into compliance and security, lowering your risk of enforcement action or potential fines.

Integrate Trading Capabilities

After choosing a provider and verifying compliance, the next thing to do is to incorporate trading functionality.

Such involves incorporating a trading platform and developing order entry, real-time charts, funding rate indicators, and risk management consoles.

Ensure that your platform includes margin accounts, stop-loss orders, and cross-collateralization, which are key to consumer versatility. Choose a smooth, low-latency trading process and high uptime to avoid consumer drop-offs or customer attrition.

Also, look at incorporating educational material and onboarding tutorials to walk people through perpetual future trading techniques. The more user-friendly and powerful your trading platform, the more likely people will take part and linger long-term.

Track Performance and Risks

There will also be a requirement for risk management and performance tracking when one is supplying leveraged products, such as perpetual futures. You will need to keep close tabs on key indicators such as open interest, liquidation rates, funding rates, and margin utilization.

Generate timely alerts for high-risk activities, high leverage, or market anomalies in order to initiate timely intervention. Employ data analytics to evaluate customers’ profitability, platform health, and clients’ retention.

Stress tests and frequent audits are valuable in assisting to identify and control risks and also to ensure compliance with specific regulatory requirements, which can also enhance your platform’s robustness.

Lastly, you are required to deliver specially designed risk instruments to your customers, enabling them to make informed decisions at the appropriate time. This not only shields your business but also helps to establish long-term trust amongst your clients.

Conclusion

The future of trading is here, and perpetual futures are at the forefront. These innovative contracts offer unmatched flexibility, leverage, and 24/7 access—attributes that today’s traders demand.

Its advantages for brokers are just as strong: increased trading volume, broader product offerings, and enhanced interaction with end-users. Perpetual futures are about staying one step ahead of a trend, not just following one.

By ensuring that your brokerage has the correct provider, a compliant strategy, and the necessary infrastructure, your business will thrive in this changing world. Don’t wait for your competitors to take action. Make the move now and position your business for the next generation of financial trading.