What is a Quitclaim Deed? How Does it Work?

Oct 04, 2024

The real estate market has a complex structure and many legal aspects concerning the right of ownership of a particular object. Within the framework of ownership of the right of ownership, sometimes a situation arises in which it passes from one person to another without guarantees that the grantor owns the property or that the title is free from any problems, such as liens or lawsuits. So, there is a document regulating this issue, and it is called a quitclaim deed.

This article will explain a quitclaim deed, the main types of deeds, and what they are used for. You will also learn the main differences between quitclaim deeds and warranty deeds.

Key Takeaways

- A quitclaim deed is a legal agreement that grants a person’s interest in a property without specifying the nature or extent of that interest and without providing any guarantees about the person’s ownership rights.

- It offers no assurance that the grantor (the person transferring the interest) holds a valid ownership stake in the property. Instead, it simply states that if the grantor has any interest, they relinquish it.

- Quitclaim deeds are commonly used in non-sale transactions, such as property remittances between family members or divorce settlements.

What is a Quitclaim Deed?

A quitclaim deed is a legal instrument for transferring ownership or control in real estate from one individual, known as the grantor, to another, referred to as the grantee. In contrast to a warranty deed, this type of deed does not provide any assurances or guarantees regarding the property’s title.

Instead, it simply conveys whatever interest the grantor possesses in the property, if any exists, without considering any existing liens, claims, or encumbrances.

The primary function of a quitclaim deed is to facilitate a swift and uncomplicated conveyance of legal title to property. This method is beneficial when the parties involved have a high level of trust, as it does not require the grantor to affirm the validity of the title.

However, this lack of warranty means that the grantee assumes a greater risk, as they may inherit unresolved issues related to the property’s title.

While a quitclaim deed can expedite transferring property rights, the grantee needs to understand the implications of such a transfer. The absence of guarantees means the grantee may be left vulnerable to potential legal challenges or financial liabilities associated with the property.

Therefore, it is advisable for individuals considering this type of deed to conduct thorough due diligence or seek legal counsel to mitigate any risks involved.

Fast Fact

The concept of quitclaim in common law dates back to medieval England. Its purpose was to allow a tenant or occupant of land to obtain additional rights from another party simply and directly.

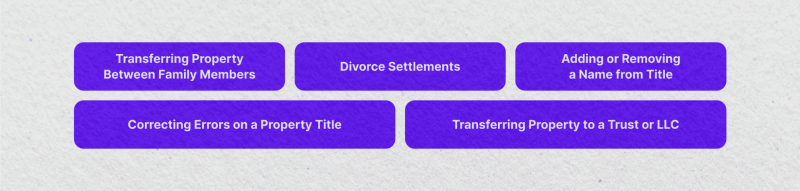

Common Situations for Using Quitclaim Deeds

Quitclaim is a multi-purpose document that can be used in different life situations, depending on a number of aspects and nuances related to the legal force it gives. Thus, such a document can be used in the following arses:

Transferring Property Between Family Members

Quitclaim deeds are often used to dispose of property within families. For example, parents may deed the property to their children, or siblings may transfer interest between each other. This informal process is common because the parties typically trust each other and do not require the protection of warranties.

Divorce Settlements

During a divorce, one spouse may transfer their share of a jointly-owned property to the other through a quitclaim deed. This allows one party to fully own the property without needing a formal sale, simplifying the process.

Adding or Removing a Name from Title

A quitclaim deed can be used to add a new spouse to a property’s title or to remove a spouse after a divorce. It’s also used when co-owners want to change the structure of ownership.

Correcting Errors on a Property Title

If a property deed contains a mistake, such as a misspelled name or wrong legal description, a quitclaim deed can be used to correct the error without a lengthy legal process.

Transferring Property to a Trust or LLC

Property owners often use quitclaim deeds to transfer ownership to a living trust or an LLC, simplifying estate planning or protecting personal assets by placing them under an entity’s name.

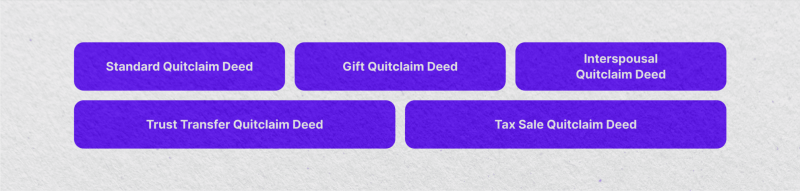

Major Types of Quitclaim Deeds

Today, in legal practice, there are many types of quitdeed claims, each of which has certain features that determine the expediency and practicality of its use in specific circumstances. The following can be distinguished among them:

Standard Quitclaim Deed

This is the most common type of quitclaim deed, used to convey a proprietorship or interest in a property without making any warranties or guarantees about the title. The grantor (person transferring the property) simply relinquishes whatever interest they have in the property to the grantee (person receiving the property).

Gift Quitclaim Deed

This type transfers the property as a gift, typically between family members. The grantor gives up all rights to the property without receiving any payment in return. Tax implications may apply since it’s a gift, so parties should consider consulting with tax professionals.

Interspousal Quitclaim Deed

This type of quitclaim deed is explicitly used between married couples. It can transfer property interest between spouses, often for estate planning or divorce. For example, one spouse may relinquish their share of a jointly-owned home to another.

Trust Transfer Quitclaim Deed

This is used when an individual wishes to transfer property into a living trust. It allows property owners to move assets under the trust’s name, often as part of estate planning. It’s common when individuals want to avoid probate.

Tax Sale Quitclaim Deed

A tax sale quitclaim deed occurs when a property is sold at a tax lien auction. The buyer receives a quitclaim deed but does not guarantee the title, meaning they assume the risk of any outstanding claims or liens against the property.

Each type of quitclaim deed serves a specific purpose but shares the same essential characteristic: it transfers interest in the property without title warranties. This makes it useful in limited scenarios where trust between parties exists or other legal tools are in place to verify ownership.

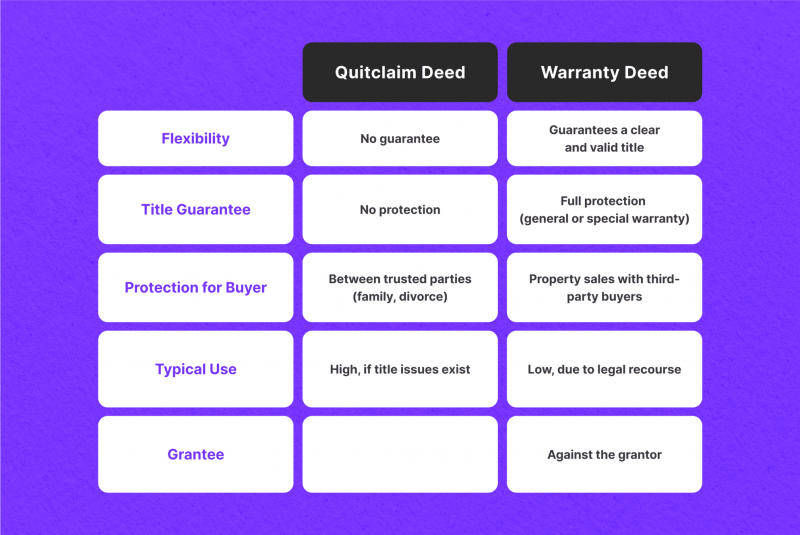

Quitclaim vs. Warranty Deeds: What’s the Difference?

When transferring property, it’s important to understand the differences between a quitclaim deed and a warranty deed, as they serve distinct purposes and offer varying levels of protection to the buyer.

Quitclaim Deed

A quitclaim deed transfers the selling party’s interest in the property without providing any guarantees regarding the validity of the title or the selling party’s actual ownership of the property.

It’s important to note that no warranties are provided in a quitclaim deed. The selling party does not assure the title is free of liens, encumbrances, or other claims, emphasizing the need for caution in such transactions.

This type of deed is typically used in low-risk transactions, such as transfers between family members, in divorce settlements, or to resolve title issues. It is most useful when there is a high level of trust between the selling party and the buyer.

The buyer assumes all the risk regarding the property’s title. The buyer receives nothing if the selling party does not have legal ownership.

Warranty Deed

A warranty deed ensures that the person transferring the property has the legal right to do so and that there are no liens, claims, or other issues with the title. This protects the buyer by guaranteeing that the title is clear.

There are two types of warranties in a warranty deed. The first is the general warranty, when the person transferring the property guarantees the title for the entire history of the property, providing the highest level of protection. The second one is a special warranty when the person transferring the property only guarantees the title for the period during which they owned the property, not prior owners.

This type of deed is commonly used in real estate dealings to give buyers confidence that they are receiving a clear property proprietorship. It helps reduce the risk of future disputes over proprietorship and provides security. There is minimal risk to the buyer. If issues with the title arise, the person transferring the property may be held responsible for breaching the warranties, which protects the buyer.

Conclusion

A quitclaim deed is a legal instrument primarily used to convey property rights without guaranteeing the title’s validity. While it is commonly employed in situations involving trust, such as between family members or during divorce settlements, it carries inherent risks for the recipient due to the lack of title protection.

Understanding the limitations of a quitclaim deed is essential, as it does not provide the same level of assurance or security as a warranty deed, which guarantees a clear and valid title. Therefore, anyone considering a quitclaim deed should carefully evaluate the context and potential risks.

FAQ

What is a quitclaim deed?

A quitclaim deed is a legal document that confers real estate rights from one person (grantor) to another (grantee) without any guarantees or warranties about the property title.

What are the common uses of a quitclaim deed?

Quitclaim deeds are typically used for property conveyances between family members, during divorce settlements, or to remove or add someone’s name from the title, such as in estate planning.

Does a quitclaim deed provide any protection to the buyer?

No. A quitclaim deed only transfers whatever interest the grantor may have in the property. It does not guarantee that the grantor owns the property or that the title is free of liens or other issues.

Can a quitclaim deed be used to transfer a mortgage?

No. A quitclaim deed confers property ownership but does not affect existing mortgages. The grantee may still be responsible for the mortgage unless refinanced or assumed.

Is a quitclaim deed valid without consideration (payment)?

Yes. A quitclaim deed can be used even if no money changes hands, as is often the case in family transfers or gifts of property.