What Is the Martingale Strategy in Trading

Jan 23, 2024

Most of the strategies in trading rely on technical analysis and patterns to identify opportunities for profitable deals. However, some traders believe it is possible to make profits without investing time and effort in understanding markets and developing skills. The strategy that has gained popularity among these traders is called Martingale.

Originally a gambling technique, the Martingale strategy has found its way into trading as a high-risk, high-reward method. It involves increasing the size of investments after every loss, with the aim of recovering previous losses and making a profit in the process. In this article, we will try to understand the nuances of this strategy, its potential benefits and pitfalls.

Key Takeaways:

- The Martingale strategy involves doubling the position size after a losing trade.

- This strategy is highly debated among analysts, with many considering it risky due to its potential for large losses and the need for an infinite amount of capital.

- The strategy’s effectiveness depends on market conditions, capital requirements, risk tolerance, and individual trading goals.

- It is not advisable for beginner traders.

What Is the Martingale Strategy?

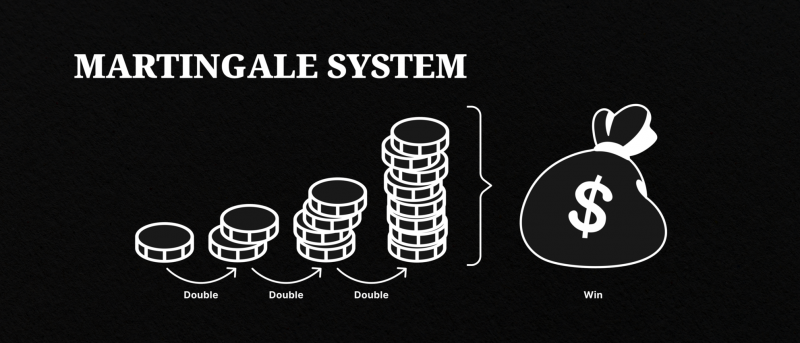

The Martingale strategy is based on the premise that, statistically, you cannot lose all the time, and eventually, a winning trade will occur. The strategy involves doubling the investment size after each loss, with the expectation that a single winning trade will recoup all previous losses and result in a profit.

This approach is similar to how gamblers double their bets after each loss, which is no wonder since the strategy originates in the gambling world.

The strategy was first introduced by the French mathematician Paul Pierre Levy in the 18th century and was initially used as a betting system. Its name is derived from the word “martingale,” a piece of tack used in horse racing that prevents horses from moving their heads too far up.

The Mechanics of the Martingale Strategy

The basic concept of the Martingale strategy is straightforward:

An individual selects a game or trade with an equal probability of the outcome, such as betting on red-black at the roulette table or choosing between two directions of a currency price in Forex trading. An initial bet is made on one of the outcomes.

If the trade results in a loss, the strategy dictates that the trader should double their investment size and repeat the trade. This process continues until a winning trade occurs, at which point all previous losses are recovered.

Is This Strategy Effective?

The effectiveness of the Martingale strategy has been debated among analysts, most of whom believe it is risky and can lead to significant losses.

The main criticism of this strategy is that it requires an infinite amount of capital to be successful. In reality, traders have limited resources and may be unable to sustain multiple consecutive losses while doubling their investment size.

Moreover, financial markets are unpredictable, and the chances of a winning trade occurring are not always 50%. Market conditions, news events, and other factors can significantly impact the success rate of this method.

Examples of Using the Strategy

Let’s consider several examples to understand the mechanics of the Martingale strategy better.

First Example:

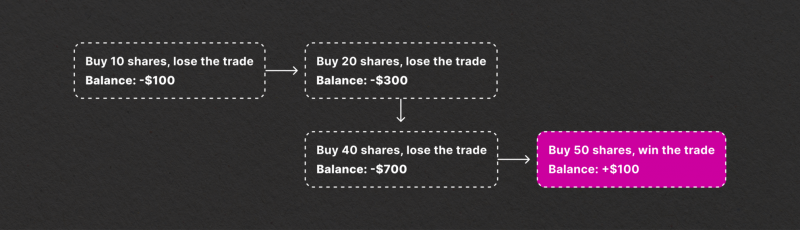

Let’s assume the trader invests in stocks at $100 per unit and buys ten shares for $1000. With an expected profit of $100, the trader sets take profit at $110 and stop loss at $90. Unfortunately, the stock market takes a downturn, and the stop order is triggered, resulting in a loss of $100.

According to the Martingale strategy, the trader must double their position size to compensate for the previous loss and achieve their desired profit of $100. So, they buy 20 shares at $90 each, making their total investment $1800. To reach the $100 profit target and cover the loss from the previous transaction, the trader must now set take profit at $100 and stop the loss at $80.

The cycle continues as the market fluctuates. If the price drops to $80, 40 shares need to be purchased for a total of $3200 to achieve a cumulative profit of $100. The take profit and stop loss levels must be adjusted accordingly to maintain the desired profit.

Even if the market experiences a series of downturns, the trader will eventually reach their desired profit target and recoup their losses. However, the same trader can easily lose all their capital if the market continues to fluctuate in undesirable directions.

Second Example:

Another variation of using the strategy is not to set a stop loss but instead buy an additional volume of assets equal to the open position when it reaches the intended stop-loss level.

For instance, in the previous example, where ten shares were bought at $100 per unit, and the price dropped to $90, the trader would purchase ten additional shares. In this scenario, the losses are not fixed, and the trader has more flexibility in adjusting their position size.

The Flows of the Martingale Strategy

While the Martingale strategy may seem attractive for traders looking to make quick profits, it has several major flaws that must be considered.

The first flaw is that in order to achieve even a small profit, the trader must continually increase their position size, so they require a significant reserve of funds on their brokerage account to sustain this strategy. And, as the number of trades increases, the overall profitability goes down. For instance, if the first trade yielded a profit of 10%, then the second might only yield 5.55%, and so on.

The other major disadvantage is that in a series of unsuccessful trades, such as ten in a row, a trader attempting to make a $100 profit could end up losing over $100,000. This level of risk is not feasible for most traders and could result in a complete loss of capital.

The use of leverage in trading only amplifies these problems. While it may seem that using leverage can enable traders to achieve higher profits with a smaller amount of capital, it also increases their potential losses exponentially. This is especially true in the margin or futures trading, where there are no limits on losses other than the size of the initial deposit or trader’s account balance.

Even in binary options trading, where the potential profits can be significantly higher, Martingale is not a viable strategy. This is because, in case of failure, the trader loses 100% of their investment while only earning a fraction of that amount in case of success.

As such, to compensate for these losses and fulfil the conditions of the Martingale method, traders would need to increase their position size even further, leading to an even faster depletion of their funds.

Fast Fact

Trends in the Forex and other markets can last for a long time, making it difficult to predict or manage risks when using strategies such as Martingale.

Pros and Cons of the Martingale Strategy

Let’s review the advantages and disadvantages of Martingale trading.

Pros:

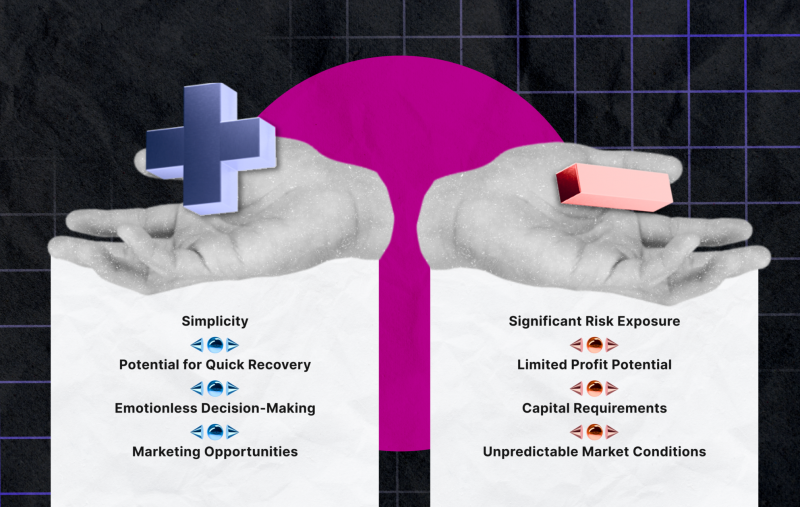

- Simplicity: One of the primary advantages of the Martingale strategy is its simplicity. The concept is easy to grasp, making it partially accessible to anybody.

- Potential for Quick Recovery: The strategy is designed to recover losses quickly. With each doubling of the investment, the potential profit from a single winning trade can compensate for all the previous trades.

- Emotionless Decision-Making: By adhering to a systematic approach of doubling the investment after each loss, traders can remove emotions from their decision-making process. This can help prevent impulsive and irrational trading decisions that are often driven by fear or greed.

Cons:

- Significant Risk Exposure: The Martingale system involves a substantial increase in risk exposure with each doubling of the investment size. A series of consecutive losses can lead to significant drawdowns and potential account depletion if sufficient capital is not available.

- Limited Profit Potential: While the strategy offers the potential for quick recovery, the profit potential is limited compared to the risk involved. Traders may experience long losing streaks that require a significant number of winning trades to recoup losses and generate a profit.

- Capital Requirements: Implementing the Martingale strategy requires a significant amount of capital. Traders must be prepared to allocate larger amounts of funds to sustain an extended losing streak and continue doubling their investments.

- Unpredictable Market Conditions: Martingale trading assumes that market conditions will eventually revert to a profitable state. However, the timing and duration of market reversals are unpredictable. Markets often experience prolonged periods of unfavourable conditions that can lead to substantial losses for traders.

Is the Martingale Strategy Suitable for Trading?

The strategy’s effectiveness can vary depending on the market conditions, available capital, risk tolerance, and individual trading goals.

- Market Conditions: In highly volatile and unpredictable markets, the strategy may lead to significant losses as the investment size doubles with each loss. On the other hand, in more stable and predictable markets, the strategy may have a higher chance of success.

- Capital Requirements: Implementing the Martingale strategy effectively requires a substantial amount of capital. Traders must be prepared to allocate larger sums of money to sustain an extended losing streak and continue doubling their investments. Insufficient capital can lead to account depletion before a winning trade occurs.

- Risk Tolerance: The Martingale strategy is a high-risk approach that requires a high level of risk tolerance. Traders must be comfortable with the potential for substantial drawdowns and account volatility.

- Individual Trading Goals: Martingale trading may be more suitable for short-term traders who aim to capitalise on quick market reversals. Long-term investors with a focus on stable growth and capital preservation may find the strategy too risky and inconsistent with their objectives.

Fast Fact

The Forex market is considered to be one of the best for martingale trading. This is because, unlike stocks or crypto tokens, currencies rarely drop to zero.

Alternatives to the Martingale System

Here are a few alternatives to the Martingale System to consider:

- Technical Analysis: Utilising technical analysis tools and indicators can help identify potential entry and exit points with higher probabilities of success. By combining technical analysis with risk management techniques, traders can enhance their trading strategies and improve their overall performance.

- Trend Following: Instead of relying on quick market reversals, traders can adopt a trend-following approach. This method involves identifying and trading in the direction of prevailing market trends, potentially maximising profits during sustained price moves.

- Diversification: Diversifying investments across different assets, sectors, or even trading strategies can help mitigate risk and reduce the reliance on a single trading system.

Closing Thoughts

The Martingale strategy is an extremely dangerous and risky way of trading on the financial markets and is basically a form of gambling. Even with a large capital, the chances of completely losing all your funds are very high.

If you are a new trader, it is advisable to avoid this strategy and instead focus on developing a solid understanding of trading techniques, examining risk management strategies, and improving your analysis skills. Remember that no trading strategy is foolproof, and success in the markets requires a combination of knowledge, discipline, and sound decision-making.

Disclaimer: The content provided in this article is for educational purposes only and should not be considered financial advice. Trading on the financial markets involves high risks, and individuals should carefully consider their financial situation and risk tolerance before engaging in any trading activities.

FAQs

How profitable is the Martingale strategy?

While the strategy can be profitable in certain conditions, it requires a large initial investment and carries a high level of risk. In order to see any significant return, you may have to invest or trade substantial sums of money. Additionally, the system relies on consistently doubling your investment after each loss, which can quickly lead to significant losses if not carefully monitored.

Why does the Martingale strategy fail?

The Martingale strategy has inherent flaws that make it an unreliable method for long-term success. For one, most exchanges have limits on trade size, preventing traders from endlessly doubling their investment. Additionally, the potential for significant losses can quickly outweigh any small profits made.

What is an Anti-martingale system?

An anti-martingale strategy, also known as a reverse Martingale, is an alternative approach to the traditional Martingale strategy. Instead of doubling your bet after each loss, you double your bet after each win and decrease it after each loss. This tactic aims to capitalise on winning streaks and limit losses during losing streaks. However, like any strategy, it is not foolproof and requires careful risk management to be successful.