10 Cheap Stocks for Volatile Markets

Jan 26, 2022

Value investing is making a return and may outperform growth techniques if markets stay volatile. This is because low values might provide investors with a margin of safety.

There is no more straightforward method to find deals than by utilizing price-to-earnings ratios.

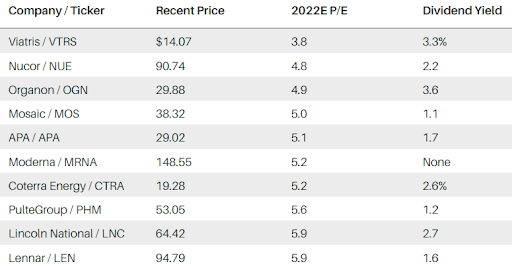

The S&P 500 index was screened using FactSet for the ten least expensive equities based on 2022 P/E ratios, yielding a diverse list that includes COVID-19 vaccine producer Moderna, real estate developers Lennar and PulteGroup, metal industry company Nucor, fertilizer manufacturer Mosaic, and energy firms APA, formerly Apache, and Coterra Energy.

Viatris and Organon, as well as life insurer Lincoln National, round out the list.

All ten are trading at six times earnings or less, and the majority pay above-market dividends, with Organan and Viatris paying more than 3%.

Several listed firms are in economically vulnerable industries, but given their low P/E ratios, some profits impact is already incorporated into their equities.

Assortment of Bargains

Based on price-to-earnings ratios, these are the ten cheapest companies in the S&P 500.

Nucor, whose shares have fallen to roughly $90 from a recent high of $120, currently trades for around five times estimated 2022 profits and yields more than 2%. Benchmark hot-rolled steel prices have fallen from a high of $1,900 per short ton in 2021 to approximately $1,400, and futures prices are expected to be around $900 per ton by mid-year.

Nucor's profits may suffer as a result, but the business should remain very profitable. Management believes the stock is undervalued since the company purchased back shares worth more than 10% of its current market value in 2021. The shares have a yield of more than 2%.

Moderna, whose shares are now trading at $148, is down almost 70% from their summer 2021 top of over $500 and trades for just five times predicted 2022 profits.

Investors are concerned about Moderna's profits forecast after the top of COVID-19 vaccine sales, as well as the robustness of its medical pipeline. However, COVID-19 revenues may be sustainable and continue to grow beyond 2023 and 2024.

With a current market cap of $60 billion, the business might have more than $20 billion in net cash and investments on its balance sheet by the end of 2022, implying that investors are paying a low price for its potent messenger RNA brand. If the stock price continues to fall, Moderna might become a takeover candidate.

Home-building companies have taken a blow recently as investors fear that the recent increase in 30-year mortgage rates to about 3.5% from 3% could harm sales. Higher rates may have an effect, but the sector is benefitting from favorable demographics and affordability, which may ensure years of solid sales.

At $95, Lennar is worth approximately six times its estimated profits of $16 per share for the fiscal year ending in November.

The firm has recently increased its stock buybacks, showing the industry's financial resilience. Investors may purchase the company's supervoting class B stock for roughly $80, a 15% discount to the more liquid A shares. According to analytics, the B shares are the greatest way to play Lennar.

Home-building optimist Evercore ISI analyst Stephen Kim believes the company will profit from a planned 2022 separation of non-core multifamily and single-family rental operations. He has a $179 price objective.

Pulte, whose shares trade about $53, is likewise inexpensive, selling at less than six times expected 2022 profits. In the first nine months of 2021, the firm utilized its substantial free cash flow to buy back 5% of its shares. Kim anticipates more substantial margins and revenues in 2022 and has set a price objective of $86 for the company.

APA, an exploration and production firm, has joined other companies in pledging to return significant funds to shareholders. APA, whose stock is now trading at $28, intends to distribute 60% of its 2022 free cash flow to shareholders in the form of share buybacks and dividends.

According to J.P. Morgan analyst Arun Jayaram, APA will generate more than $2 billion in free cash flow in 2022 for a free cash flow yield of over 20%.

Both Viatris and Organon are spinoffs: Viatris was spun off by Pfizer, while Organon was spun out by Merck.

Both have stagnated since achieving independence and trading at a low cost. At about 14, Viatris is valued at less than four times estimated 2022 profits, the lowest P/E ratio in the S&P 500. Organon is worth around five times the expected 2022 profits. Both have a lot of debt, which keeps their values low.

Cabot Oil & Gas and Cimarex Energy merged to establish Coterra in 2021. At roughly $19 per share, it trades for less than six times expected 2022 profits. This year, it intends to return half of its free cash flow via dividends and share buybacks.

Lincoln National, a supplier of annuities, life insurance, and other financial products, is now trading at approximately $64 and yields 2.7%. Mosaic, a manufacturer of phosphate and potash fertilizers, gets over $38 per share and trades at five times projected profits in 2022.