Bitcoin Mining Cost on The Rise – Meet The BTC Miners’ Dilemma

Nov 04, 2024

With the rising Bitcoin prices, you would expect miners to have similar payout increases. Not exactly!

Last week, BTC neared its all-time high price, but the Bitcoin mining cost has been a rising concern for individual and institutional miners. The direct costs have been increasing consistently throughout the year, with the total cost exceeding $95,000!

Miners had multiple attempts to integrate some AI-based capabilities to reduce costs. However, it has yet to prove its cost and operational worth. Let’s discuss what is happening in this sector.

Bitcoin Mining Cost Overview 2024

Mining for Bitcoin is a complex operation that requires highly advanced computing and processing capabilities. Some top-notch processing chips, application-specific integrated circuits (ASICs), and GPUs are used to earn 3.125 BTC per confirmed block.

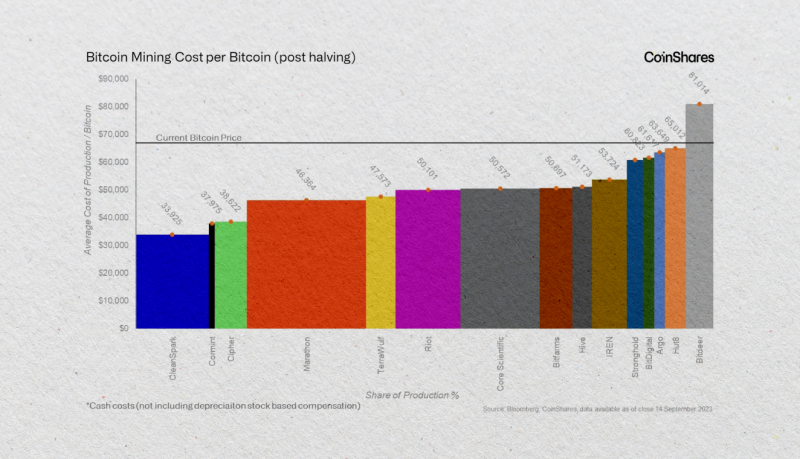

However, the cost of mining Bitcoin includes direct machinery payment and non-cash expenses like parts depreciation and stock-based compensation. Mining companies are experiencing a continuous cost increase, taking the total to $96,000 to produce one Bitcoin.

A CoinShares analyst reported that Q1 direct costs amounted to $47,200, which grew by almost 5% in the following quarter to $49,500. These costs only include Bitcoin mining rig costs, excluding the wear and tear and increasing employee expenses, which reflect negatively on firms’ balance sheets.

Bitcoin Hashrate and its Correlation

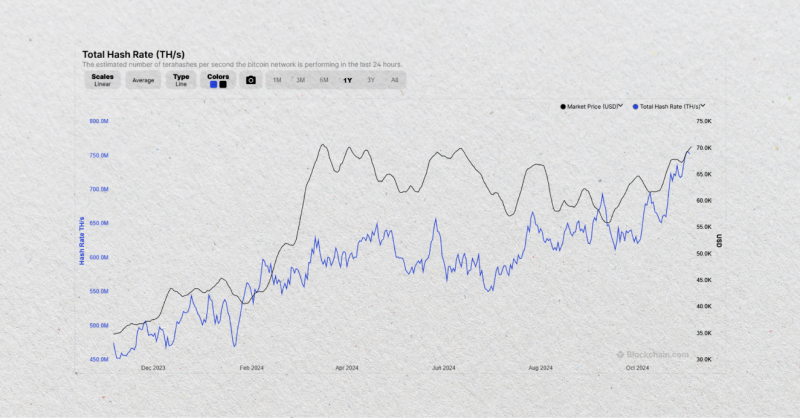

Another factor that surges the Bitcoin mining cost is the hashrate, which refers to the computational power needed to process transactions and maintain the blockchain.

Bitcoin hashrate is reaching all-time high records, currently estimated at 765 EH/s. The higher the rate is, the harder mining becomes, and more advanced rigs and workforce are required, which increases the overall cost.

Bitcoin Mining Dilemma: Today’s Costs or Future Profits?

The rising costs are pushing mining companies to make vital decisions.

Either carry out mining and processing with loss and wait for future price surges or make economic-saving decisions. The unpredictable market dynamic and crypto prices make this decision more difficult.

The integration of AI capabilities can potentially help reduce stock compensation and energy costs. However, only a few have tried and tested this, and the aftermath is still limited.

Moreover, investing in artificial intelligence models for mining requires a massive investment, which does not help the declining revenue, especially for startups and firms with limited budgets.

The only hope for miners to see profits is even higher market prices to offset these costs and yield more returns per block. However, this might take months or even years to achieve, which not everyone can afford.

Nevertheless, environmental expenses are another rising concern as tremendous noise levels, power consumption, and carbon emissions are the products of heavy machinery used to operate these mining rigs.

Conclusion

The increasing Bitcoin mining cost and dropping revenue are concerning mining and processing companies. With total expenses surging to $96,100 as the hashrate and stock compensation increase, businesses must make vital decisions to carry out their operations with profits.

Direct costs have been increasing for two consecutive quarters, and the recent coin price hike did not generate enough threshold for profit miners. Will this trend continue, or will mining rigs switch to more cost-efficient ways?