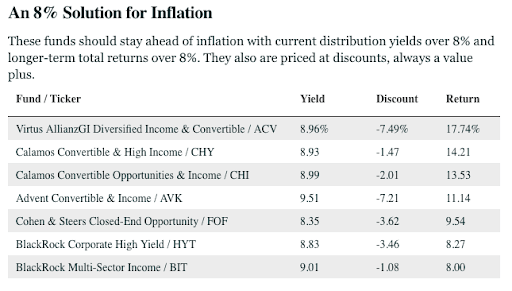

Want to Beat Inflation? These 7 Funds Have 8% Returns

Apr 14, 2022

With the consumer price index growing at the quickest rate in four decades, investors' primary objective is to hedge against inflation. And a powerful offensive is sometimes the best defense.

One strategy is to earn revenue that stays up with inflation.

For this approach, we sought closed-end funds that now pay out more than 8% and have returned more than 8% over the last five years. That should be in line with the CPI, which was up 8.5 percent from a year earlier in March, a level that many analysts believe marks the peak pace of price increases.

Another wise strategy during an inflationary period is to avoid overpaying. Therefore we remain with funds trading at a discount to the net asset value. Finally, we eliminated funds that had more than minor negative (less than 1%) returns over the previous turbulent year. During that time, most of the companies on the list generated positive returns.

We return to the closed-end fund market because it offers the highest returns, owing to its leverage. Borrowing money may be a double-edged sword, increasing rewards while also increasing risk, especially during rising interest rates, as we are currently seeing. Closed-end funds can also acquire assets at a discount, which can provide a margin of safety on the downside as well as the potential for appreciation if the discounts narrow.

To be sure, I bonds, which are U.S. savings bonds with inflation-indexed yields, are the cheapest and easiest method to keep up with inflation.

Based on the last six-month increase in the CPI, they are now yielding 7.12 percent and are expected to grow to 9.6 percent beginning in May.

However, there are certain caveats: In most cases, yearly purchases of I bonds are limited to $10,000 per individual, which would have little impact on a seven-figure portfolio, which is not uncommon among Barron's readers. You also can't redeem I bonds for a year, and if you do, you'll have to pay a penalty of one quarter's interest if you do so in fewer than five years.

Treasury Inflation-Protected Securities, their marketable counterparts, failed to safeguard investors from the impact of soaring inflation this year.TIPS was hit by the rise in real rates (what's left after inflation), with the 10-year maturity falling to a negative 0.15 percent yield from below minus 1 percent at the beginning of the year. Higher (or less negative) yields, like with any bond, translate into lower prices.

According to Morningstar, the iShares TIPS Bond exchange-traded fund (TIP) had a negative 4.8 percent return through April 8, while the Quadratic Interest Rate Volatility and Inflation Hedge ETF (IVOL) had a negative 4.2 percent year-to-date return.

We recommend these seven funds for a more aggressive strategy to stay ahead of inflation. They yield more than 8% presently and have returned at least that much over the last five years.

What stands out is that the first four names on the list are all funds that concentrate on convertible securities. Convertibles have hybrid characteristics, capturing much of the return potential of stocks with some risk cushion from bonds.

Topping the screen is the Virtus AllianzGI Diversified Income & Convertible Fund (ACV). It shares the same management team as the AllianzGI Convertible open-end mutual fund (ANZAX), which was featured last year in Barron's for having beaten the stock market for the previous 25 years.

Calamos, which specializes in convertibles, is the name shared by the next two funds. Last year, Barron's profiled the Advent Convertible & Income Fund. The Cohen & Steers Closed-End Opportunity Fund (FOF) is a fund of funds that tries to capitalize on opportunities across the industry. Finally, two BlackRock bond funds approach fixed-income investment differently. The BlackRock Corporate High Yield Fund (HYT) invests in below-investment-grade corporate securities, as the name suggests.

While high-yield corporates are the BlackRock Multi-Sector Income Trust's (BIT) biggest sector allocation, it also includes mortgages, other securitized assets, international developed and developing markets, investment-grade corporates, and floating-rate bank loans. In addition to sector diversity, the fund appears to have hedged the portfolio's risk of rising interest rates. BIT has an effective duration of minus 0.05 years, according to the fund's website; duration is a measure of a portfolio's susceptibility to interest-rate movements.

This list provides a variety of closed-end funds with high current income and a track record of providing high long-term returns. As with any screen, it serves as a jumping-off place for investors to dive further into them.