What Is a Gamma Squeeze, and How to Trade It?

Dec 07, 2023

In financial markets, there are situations when investors can both make thousands of dollars and suffer significant losses within a short period of time. Usually, these fluctuations are the result of shifts in the underlying fundamentals of a country, industry, or company. However, sometimes, it is the coordinated behaviour of market participants that drives these wild swings.

The sudden surge in the price of a seemingly doomed company is one such event that has shaken the market a couple of years ago. In January 2021, the video game retail giant GameStop experienced a remarkable increase in its stock valuation – from $147 to $347 in just one day – defying all predictions and causing hedge funds to lose millions in liquidations of short positions. In the world of investing, this phenomenon is known as gamma squeeze.

In this article, we will explore what gamma squeeze is, describe how it happens and discuss some real-life examples.

Key Takeaways:

- There are various types of squeezes, or rapid price movements in one direction, in financial markets.

- A gamma squeeze takes place when a large number of investors buy call options, causing market makers to buy the underlying shares and driving up the stock’s price.

- AMC and GME squeezes are two of the most notable gamma squeezes in recent years.

- Trading market squeezes can be risky and is not recommended for beginners.

Squeeze in Stocks

Let’s first understand what a squeeze in trading is.

A squeeze refers to a period of rapid price movement and extreme volatility driven by a large number of market participants taking similar-sized positions. This crowded market generates a chain reaction, propelling the stock price in a specific direction. Squeezes are typically short-lived but can extend for days or even weeks.

Some common types of squeezes in financial markets include:

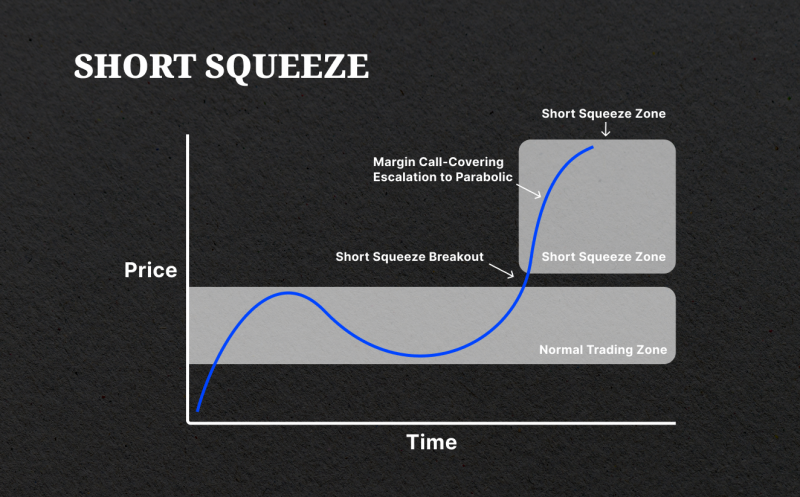

- Short Squeeze: What is a short squeeze? Typically, it occurs when the price of a stock rises rapidly due to a large number of short sellers closing their positions. As these short sellers buy back shares, the demand for the stock increases, causing further upward momentum in its price.

- Long Squeeze: On the contrary, a long squeeze happens when there is a sudden drop in the price of a stock in a bullish market. This can lead to panic selling by investors who are long on the stock as they try to limit their potential losses. As more and more investors sell, the downward pressure on the stock’s price increases.

- Bear Squeeze: A bear squeeze is a situation where traders are forced to buy back assets at a higher price than they sold for, typically due to a rapid rise in prices. This can occur during short squeezes when prices skyrocket, or it may be caused by other market events or investor psychology.

What is Gamma?

By its nature, a gamma squeeze is an event that occurs primarily in the options trading world. Let’s take a look at some basic concepts regarding options and their “Greeks.”

What Are Options?

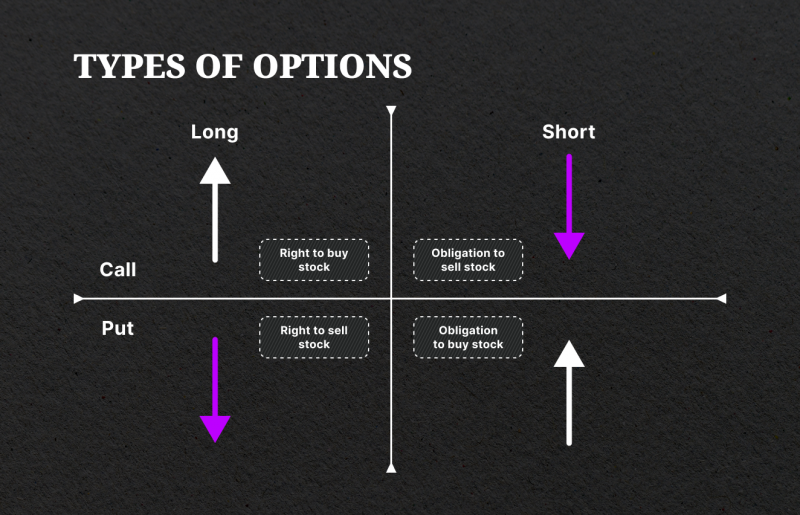

Options are financial contracts that provide the holder with the right, but not the obligation, to buy or sell an underlying security at a predetermined price within a specified time frame. These assets can range from stocks, currencies, commodities, or indexes.

There are two types of options – calls and puts. A call option gives the holder the right to buy the underlying asset, while a put option gives the holder the right to sell it.

So how do options work? Let’s say you believe that the stock price of a company will increase in the future. Instead of buying the stock outright, you can purchase a call option on that stock at a lower strike price. If the stock price does indeed rise, you can exercise your option and buy the stock at a lower price, making a profit. However, if the stock price decreases or stays the same, you are not obligated to buy the stock and can let the option expire.

These contracts allow you to buy or sell underlying assets at a set price, called the “strike price.”

The Greeks in Options

The Greeks refer to a set of mathematical calculations that help option traders assess and understand the various risk factors associated with options. These calculations are used to determine how changes in stock market conditions, such as price movements, time decay, and volatility, will impact the value of an option.

One of the most well-known Greek letters used in option trading is delta (Δ). Delta refers to the rate at which an option’s price changes relative to changes in the price of the underlying instrument. It ranges from 0 to 1 for call options and -1 to 0 for put options.

For example, a delta of 0.5 indicates that the option’s price will move approximately half as much as the underlying asset’s price. Traders use delta to determine the hedge ratio for creating a delta-neutral position and adjust their positions accordingly. To illustrate, to fully hedge an American call option with a delta of 0.30, you would have to sell 30 shares of this company’s stock.

Another important Greek is gamma (Γ), which measures the rate of change in delta relative to changes in the underlying asset’s price. Gamma helps traders understand how the delta will change as the underlying asset’s price changes.

A high gamma indicates that the delta is highly sensitive to changes in the underlying asset’s price, while a low gamma suggests that the delta will change more slowly. Gamma is particularly crucial for traders employing strategies like hedging or scalping.

The Greeks are an essential tool for option traders as they provide valuable insights into the potential risks and rewards of different trading strategies. Other Greeks include:

What Is a Gamma Squeeze?

A gamma squeeze is a sharp increase in an asset’s price caused by large players and market makers initiating a significant number of transactions to hedge their positions in options. This results in positive feedback, where the rising prices encourage more traders to buy the short squeeze stocks or options, further driving up the price.

A gamma squeeze is similar to a short squeeze, where the buying pressure from traders trying to cover their short positions causes a sharp increase in an asset’s price. However, the underlying mechanisms and players involved in both these phenomena are different.

How Gamma Squeeze Happens

To grasp how a gamma squeeze works, it requires understanding the sequence of events that cause it. The following steps outline the key elements of a gamma squeeze:

- Investors Start to Buy Call Options: A gamma squeeze begins with an initial purchase of call options by a group of investors. This purchase signifies the belief that the stock’s price will surpass its strike price before the option expires.

- Big Market Players Start to Hedge Their Positions: These call options are often bought from market makers, who then need to mitigate their risk by purchasing the underlying instrument. Market makers continue to buy more shares as more call options are purchased, causing the stock’s price to rise.

- The Role of Delta and Gamma: As the stock’s price increases, so does the delta of the option. This means that for every movement in the underlying stock’s price, the option’s price will also move by a larger amount. This results in an increase in the option’s gamma, which measures the change in delta.

- Underlying Stock Price Snowball: The continuous buying of shares by market makers creates a snowball effect, with the asset price increasing and causing further purchases from market makers.

- Expiration or Unwinding: Eventually, the gamma squeeze will reach its peak when either the options expire or if the stock’s momentum weakens. This may prompt market makers to get rid of their holdings, bringing the share price down again as the squeeze subsides.

Examples of Gamma Squeezes in Real Life

Two of the most famous examples of gamma squeezes in recent years are the AMC short squeeze and the GameStop short squeeze. In both cases, retail traders were able to create significant market volatility through coordinated buying activity.

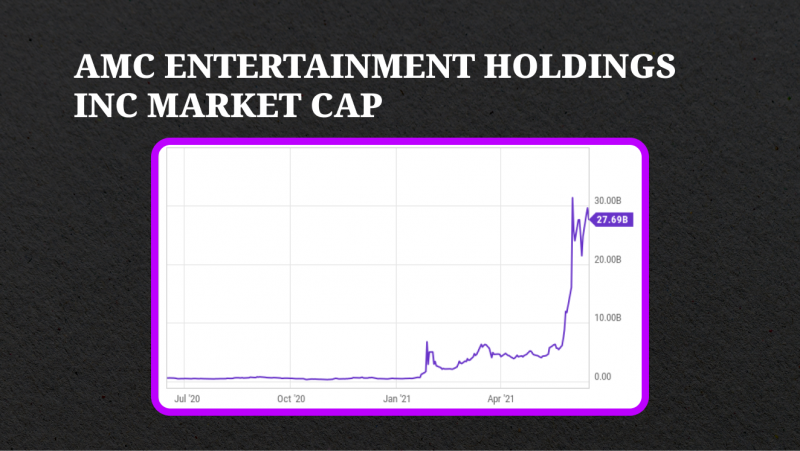

AMC Short Squeeze

The short squeeze of AMC Entertainment Holdings Inc. (AMC) stock occurred in early 2021 and was initiated by private investors on social media networks such as Reddit and Twitter. By targeting a stock that was heavily shorted, these individual investors were able to drive up the share price of the COVID-stricken US cinema chain and cause significant losses for the short sellers.

Their goal was not only to drive up the share price and prove it was undervalued but also to cause losses for large hedge funds that had taken short positions in the stock. As a result, the company’s price skyrocketed from $2.01 per share on 4 January to $72.62 per share on 2 June, an increase of over 3500%. The AMC short squeeze received widespread media attention and was seen as a symbolic victory for retail investors against Wall Street giants.

GameStop Short Squeeze

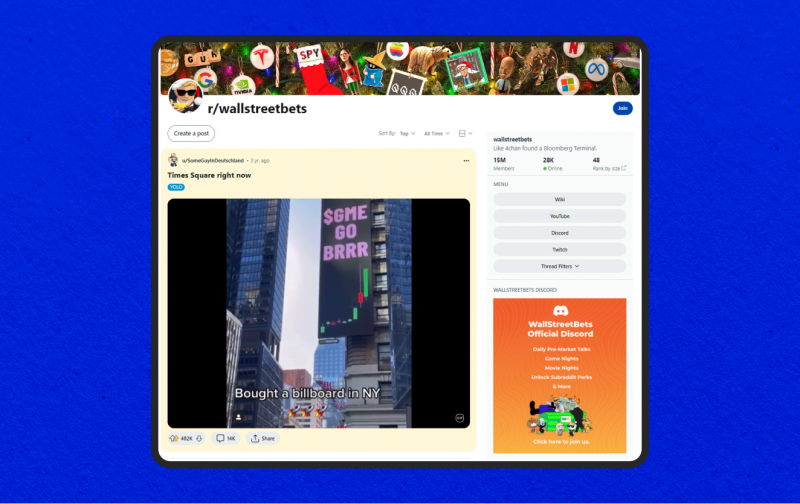

Similarly, the GameStop short squeeze that took place from 4 to 28 January 2021 was also initiated by retail investors on social media. Reddit’s WallStreetBets subreddit noticed that shares of US gaming retailer GameStop Corp. (GME) were heavily shorted and began buying them up en masse.

This created a gamma squeeze, as the increasing share price forced short sellers to close their positions at significant losses. The share price rose from $17.25 per share at the beginning of January to an intraday high of around $380 per unit. On January 28, GME reached a pre-market high of over $500, which is an increase of over 2700% compared to a month earlier.

Robinhood, a trading app favoured by GME’s army of retail investors (as well as other popular brokerages), even suspended the purchase of GameStop stock on this day, which frustrated investors at the time and raised suspicions of market manipulation. Moreover, the success of this squeeze led to the downfall of the hedge fund Melvin Capital Management LP.

How to Trade Gamma Squeeze?

While the potential profits of trading gamma squeezes may be enticing, it is important for inexperienced investors to understand the risks involved. The fast-paced nature of these trades can lead to significant losses if not executed properly. Additionally, there are other risks that investors should be aware of when attempting to trade in this market:

- Opening Deals Too Late: One of the biggest risks when trading gamma squeezes is opening deals too late. This can result in substantial losses of funds, as the market dynamics may have already shifted by the time the trade is executed.

- Third-Party Intervention: Another risk that investors may face when trading gamma squeezes is regulatory intervention. If the dynamics of quotations exceed certain boundary values, regulators or third parties may step in.

For those who still want to try their luck with gamma squeezes, here are some tips on how to approach this unique trading opportunity:

1. Monitor Short Positions and Purchased Options of Market Makers

The first step in identifying a potential gamma squeeze is to closely monitor the market activity of major players. Keep an eye on the volume of short positions held by these players, as well as the number and direction of purchased options. This data can provide insights into market sentiment and potential squeeze opportunities.

2. Look for Key Support or Resistance Breakdown

A key support or resistance level is a crucial price point that investors closely watch. If this level breaks down, it may indicate a potential gamma squeeze in progress. When identifying potential squeezes, it is important to analyse market trends and patterns to make informed trading decisions.

3. Consider Using Stop Orders

Trading gamma squeezes involves significant risks, so it is crucial to have a risk management strategy in place. One approach is to use stop orders just below the current price when opening a position. This way, if the squeeze does not materialise as expected, the trader can limit their losses and exit the trade.

4. Utilise Channel Indicators

In addition to monitoring key support and resistance levels, traders can also use channel indicators such as Bollinger Bands or Keltner channels. These indicators can help identify potential squeezes when a stock breaks through its boundaries.

5. Beware of the Risks

It is important to note that trading gamma squeezes carries significant risks and can be unpredictable. Trading gamma squeezes is not recommended for inexperienced traders, as it requires a deep understanding of market dynamics and risk management techniques.

Conclusion

Gamma squeezes can lead to significant price changes, a rise in volatility, and distorted market perceptions. Having a solid understanding of gamma squeezes is crucial for traders and investors who seek to navigate these situations effectively. While gamma squeezes can offer opportunities for profit, it is essential to approach them with caution and adhere to prudent investment practices.

Disclaimer: This document is for informational purposes only and should not be construed as investment advice. Trading and investing in financial markets carries risks, and individuals should seek professional advice from a licensed financial advisor before making any investment decisions.

FAQs

Gamma squeeze vs short squeeze: what is the difference?

The terms “gamma squeeze” and “short squeeze” are often used interchangeably, but they actually refer to two different types of market occurrences.

A short squeeze refers to a situation in which the price of an asset rises rapidly, causing those who have shorted the asset to cover their positions. On the other hand, the term gamma squeeze is closely associated with the options market, in which higher stock prices force option market makers to exit their short positions. So, while both types of squeezes may result in a price increase, they have different underlying causes.

How long does a short squeeze last?

In general, such squeezes tend to last somewhere between several days and several months. However, there is no set time frame for a short squeeze as each one is unique in its own way.

How do you detect a gamma squeeze?

To detect a potential gamma squeeze, an investor can monitor short positions and purchases of options by market makers, observe abnormal trading volume on out-of-the-money (OTM) options strikes, and analyse the delta of options. It should be noted that a gamma squeeze is a rare event and cannot be predicted with certainty.