What Is Spread Trading, and How Does It Work?

Mar 28, 2024

In today’s reality, any business can be at risk and end in failure and bankruptcy without implementing inadequate risk management methods. People working in the financial field should be especially careful in this regard.

Institutions and seasoned traders often turn to sophisticated strategies in the contemporary fiscal field, where risk control is a must for anyone. One such strategy that has gained prominence is spread trading. But what is spread trading in reality, and how does it differ from traditional trading approaches?

Key Takeaways:

- Spread trading involves simultaneously purchasing and selling related securities or derivatives to benefit from price differences, called spreads.

- Various forms of spread trading include bid-ask, zero, calendar, intermarket, intercommodity, and options spreads.

- Spread trading offers reduced monitoring, programmatic trading, and margin efficiency advantages.

The Essence of Spread Trades

Spread trading is a tested strategy used in financial markets. It involves the simultaneous purchase and sale of two related securities or derivatives. The strategy aims to profit from the difference in buy and sell prices between the two instruments, known as the spread.

In trading, a spread refers to the difference between the prices of two related assets. This difference can manifest in various forms depending on the type of assets being traded:

Price Spreads: These are the most common type of spread. They refer to the difference in prices between two similar assets, such as stocks, commodities, or currencies. For example, if the bid price for a stock is $10 and the ask price is $10.05, the spread is $0.05.

Yield Spreads: In bond trading, yield spreads refer to the difference in yields between two bonds with similar maturities but different credit ratings or risk levels. For instance, the yield spread between a corporate bond and a government bond of the same maturity reflects the additional yield investors demand for holding the riskier corporate bond.

Popular Types of Spread Trading

Spread trades encompass various forms, each tailored to suit different market conditions and trader preferences. These include:

Bid-Ask Spread Trading Strategies

The bid-ask spread is a crucial concept in financial markets. It represents the difference between the highest price a buyer is willing to pay (the bid price) and the lowest price a seller is willing to accept (the ask price) for a security or asset. The bid-ask spread is calculated as the difference between the bid and ask prices. It reflects the liquidity and trading activity in the market, with narrower spreads typically indicating higher liquidity and tighter trading conditions.

Zero Spread Trading

Zero-spread trade refers to a trading environment in which the bid-ask spread for a particular asset is minimal or non-existent. In such a scenario, the bid price and ask price are essentially the same, resulting in no spread between the buying and selling prices.

Since there is no spread between the bid and ask prices, traders can execute trades without incurring transaction costs. This could lead to higher profitability for traders, as they can buy and sell assets at the same price.

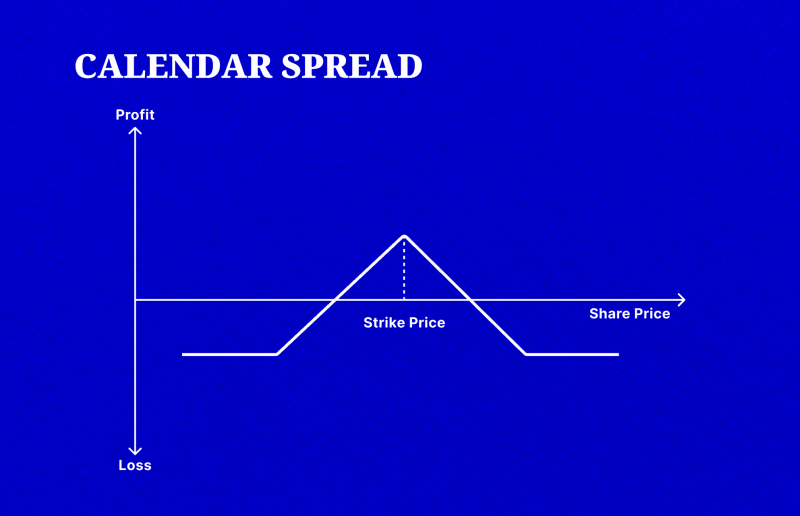

Calendar Spread Trades

This involves trading contracts with different expiration dates on the same underlying asset. For example, in commodities trading, a trader might buy a futures contract for gold that expires in three months and simultaneously sell a futures contract for gold that expires in six months.

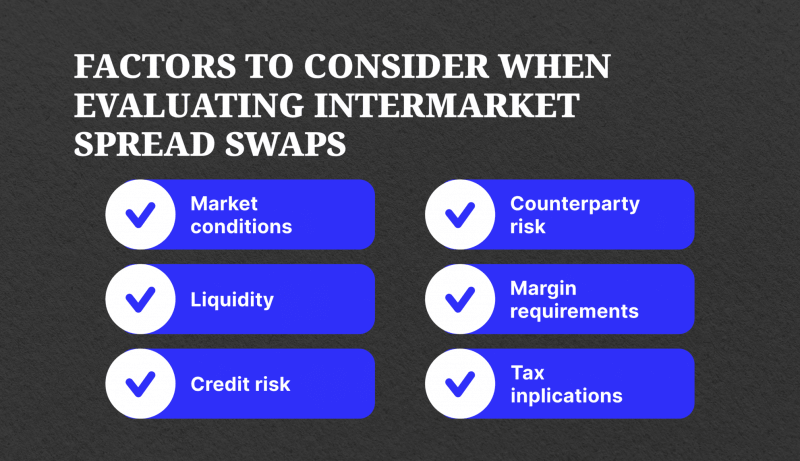

Intermarket Spread Version

Intermarket spread involves trading related assets in different markets. For instance, a trader might simultaneously buy and sell futures contracts on two different stock indices, such as the S&P 500 and the NASDAQ, in anticipation of the price relationship between the two indices narrowing or widening.

Intercommodity Spreads

This strategy involves trading related commodities in different markets. For instance, a trader might buy crude oil futures and simultaneously sell natural gas futures if they believe the spread between the strike prices of crude oil and natural gas will change.

Options Spreads

This strategy involves trading options contracts, which give the holder the right to buy or sell an underlying asset at a predetermined price. Options spreads can be constructed using different combinations of options contracts, such as vertical spreads, horizontal spreads, and diagonal spreads.

Fast Fact:

Each transaction in a spread trade is known as a ‘leg’. The idea behind trading spreads is to profit from the spread between the two legs.

Outstanding Benefits

Spread trading offers several advantages, making it an attractive proposition for both institutional and individual traders:

Reduced Monitoring: Unlike traditional trading, spread betting requires less monitoring, allowing traders to adopt a more long-term approach without constant scrutiny.

Programmatic Trading: Institutional traders use computational expertise to quickly identify and exploit spread opportunities, gaining an edge in the market.

Margin Efficiency: Spread trading typically requires lower margins than conventional trading, enabling traders to deploy larger positions while conserving capital.

Risk Management: With well-defined spreads and historical patterns, spread betting facilitates more accurate risk assessment, making it suitable for conservative traders and newcomers.

Resilience to Market Volatility: In volatile markets, where price fluctuations abound, spread trading offers a more stable alternative, minimising exposure to sudden market movements.

Arbitrage Opportunities: Spread trading often presents arbitrage opportunities, albeit with varying degrees of risk. Arbitrage entails capitalising on price differentials across markets to secure riskless profits. For instance, cash-futures arbitrage allows traders to exploit price disparities between cash stocks and corresponding futures contracts, locking in profits without assuming market risk.

Risks and Challenges

While spread trading offers various advantages, it also comes with certain risks and challenges that traders should be aware of. Here are some of the key risks and challenges associated with spread betting:

- Spread trading involves executing multiple trades simultaneously or in quick succession. This increases the risk of slippage, where the execution price differs from the expected price, especially in fast-moving markets or illiquid assets.

- Spread trading is subject to market risk, including price movements in the underlying assets. While spread betting strategies aim to profit from relative price movements between related assets, adverse movements in one or both assets can result in losses.

- Spread trade relies on the historical relationship between two assets remaining stable over time. However, correlations between assets can change due to shifts in market dynamics, economic factors, or other external events.

- Trading illiquid assets or markets can pose liquidity risks for spread traders. Low liquidity can result in wider bid-ask spreads, increased price volatility, and difficulty in executing trades at desired prices.

- Spread trading typically involves leveraged positions, which magnify both profits and losses. If the market moves against a trader’s position, they may be required to deposit additional margin to maintain their positions. Failure to meet margin requirements can result in margin calls, forcing traders to liquidate their positions at unfavourable prices.

- Spread trading often involves trading derivatives contracts, such as futures or options, which are traded on exchanges or over-the-counter (OTC). Traders are exposed to counterparty risk, where the counterparty fails to fulfil their contractual obligations. This risk can arise from defaults, bankruptcies, or operational failures of counterparties.

- Some spread trading strategies rely on quantitative models or algorithms. However, these models may be based on historical data or assumptions that do not accurately reflect future market conditions. Traders face the risk of model errors, discrepancies, or breakdowns, leading to unexpected losses.

- Spread trading activities are subject to regulatory oversight and compliance requirements imposed by relevant authorities. Changes in regulations, market rules, or tax laws can impact the profitability and legality of spread trading strategies.

How it Works in Distinct Markets

Spread trading can be applied to various asset classes, including equities, commodities, and Forex (foreign exchange), among others. Here’s how it can be implemented in each of these markets:

Spread Trading in Equities

In equities trading, spread trading typically involves pairs trading or correlated stocks. Traders identify pairs of stocks that historically move together or exhibit a mean-reverting relationship. The goal is to profit from the divergence or convergence of the price spread between the two stocks.

Pairs Trading: Traders simultaneously take long and short positions in two correlated stocks within the same sector or industry. When the spread between the two stocks deviates from its historical average, traders initiate positions to capitalise on the expected reversion to the mean.

Sector Rotation: Traders may also employ spread trading strategies based on sector rotation, where they simultaneously buy stocks in sectors expected to outperform and sell stocks in ones expected to underperform.

Spread Trading in Commodities

Commodities markets offer numerous opportunities for spread trades due to their interconnectedness and wide range of commodities. Here, trading-related contracts within the same commodity or across different commodities are involved.

Calendar Spreads: Traders can trade futures contracts with different expiration dates on the same commodity (e.g., buying a near-term contract and selling a longer-term contract). The spread widens or narrows over time between the contracts, allowing traders to profit from changes in supply-demand dynamics or seasonal patterns.

Intercommodity Spreads: Traders can trade related commodities in different markets (e.g., crude oil and natural gas). By simultaneously buying and selling futures contracts on correlated commodities, traders aim to profit from changes in price differentials between the commodities.

Spread Trades in Forex Trading

Given the vast number of currency pairs available, Forex markets offer ample opportunities for spread trading. Forex spread trading strategies involve trading currency pairs to profit from changes in exchange rates.

Cross-Currency Pairs: Traders can trade cross-currency pairs that do not involve the US dollar (e.g., EUR/JPY, GBP/AUD). By synchronously buying and selling different currency pairs, traders seek to capitalise on currencies’ relative strengths or weaknesses.

Interest Rate Spreads: Traders may also engage in spread trades based on interest rate differentials between currencies. For example, traders can trade the spread between two countries’ government bond yields, known as the yield spread, to profit from changes in interest rate differentials.

Final Remarks

To sum up, spread trading offers a compelling blend of risk control methods, margin efficiency, and profitability, making it a valuable tool in the arsenal of modern traders. Whether seeking stability in volatile markets or capitalising on arbitrage opportunities, mastering the art of spread trade can unlock myriad options of possibilities.