What is a Ripple? Analyzing XRP and Its Effect on Financial Transactions

May 14, 2024

Created to improve and accelerate transborder operations, Ripple uses a special digital protocol to make financial transfers easier and more affordable. The XRP Ledger powers XRP, the currency of the Ripple network. This technology is essential to network operations since it expedites transaction speed compared to conventional banks worldwide.

The debate is especially pertinent now since more and more organizations are incorporating blockchain technology. This integration will put XRP and Ripple at the forefront of innovation by streamlining procedures that have historically been time-consuming and expensive.

Understanding what is XRP and what is Ripple is essential for those involved in the financial and technological sectors. So, this article will try to shed some light on several essential factors.

Key Takeaways:

- Ripple Labs has improved transaction speed and reduced the minimum transaction cost required for cross-border transfers using the Ripple transaction protocol, improving the efficiency of currency exchange.

- The Ripple ecosystem supports XRP transactions that provide a more cost-effective and swift alternative to traditional systems.

- By forming strategic alliances with large institutions, Ripple has increased its visibility and impact while providing quick and affordable solutions for international transactions.

About Ripple

Technology startup Ripple offers a worldwide payment solution through its payment system. Enabling safe, quick, and almost free international financial transactions of any size without chargebacks is Ripple’s main goal. XRP, a digital currency used by Ripple’s network, enables the real-time transfer of value throughout the network.

xCurrent, xRapid, and xVia are three components that improve the capability of RippleNet, the foundation of Ripple’s solutions. Banks can immediately settle cross-border payments with end-to-end traceability thanks to xCurrent’s design. Where liquidity is a concern, xRapid employs XRP as a bridge currency to offer financial institutions transferring money internationally with liquidity. For businesses, payment processors, and banks seeking to move money over several networks with a uniform interface, xVia is a standard payment interface.

Another crucial technology created by Ripple is the interledger protocol, which connects different payment systems and improves transaction efficiency. This protocol facilitates smooth transitions between various networks and distributed ledger technology, accelerating financial institution integration and communication. It is a flexible instrument to oversee transactions across many financial environments since it facilitates the transfer of both fiat and digital assets.

The overall goals of Ripple’s technology are to increase transaction speeds, lower costs, and offer unmatched transparency for foreign payments. Through the integration of these technologies, Ripple improves the ability of global financial networks to communicate with one another more efficiently, which reduces the complexity that is typically involved with international payments.

XRP Meaning and Functionality

When it comes to what is XRP crypto it was created to make international transfers quick and affordable. By acting as a bridge currency in transactions, XRP links two different currencies, eliminating the need for additional middlemen and facilitating minimum transaction cost and delays. This feature is essential for improving financial institutions’ liquidity, particularly in cross-border transactions when conventional systems could be less effective.

The decentralized blockchain technology that powers XRP is called the XRP Ledger. Unlike many other cryptocurrencies operating on a mining-based paradigm, it runs on a consensus mechanism. This process avoids double-spending and secures transaction validations without the high energy costs of mining.

Pre-mining is the term for creating all 100 billion units of XRP at once, which makes its supply mechanics unique. The main ways that Ripple distributes XRP are through direct sales, incentives to liquidity providers, and business development agreements. To guarantee a consistent release into the market, the corporation retains a sizeable chunk of the entire supply in escrow. This helps manage supply and control notable price variations.

Ripple’s Impact on Global Financial Transactions

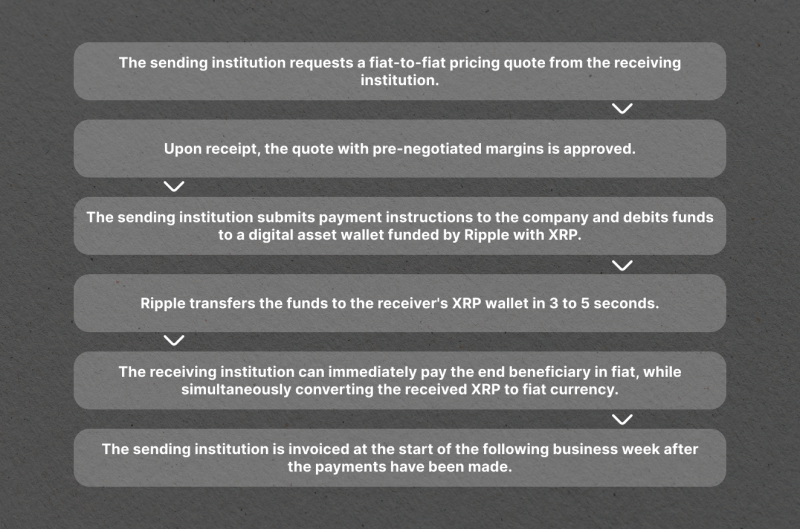

Ripple wants to improve cross-border transactions by using XRP and its RippleNet network. This strategy dramatically reduces transaction times and costs compared to traditional methods, which can take several days and require many middlemen.

Major financial institutions worldwide have partnered with Ripple, a sign of the technology’s rising acceptance and practicality. These collaborations frequently seek to investigate fresh approaches to transactional processes, emphasizing enhancing liquidity and lowering systemic frictions associated with international payments. Financial institutions have access to a wider network of international transactions, faster transaction speeds, and lower costs because of Ripple’s technology.

Organizations of the financial industry can improve their competitive edge by providing their consumers with more efficient services by utilizing XRP as a bridge currency and integrating Ripple’s cutting-edge blockchain technology. This synergy facilitates faster, more secure, and transparent transactions in an increasingly integrated global financial system.

Fast Fact:

In 2014, MIT Technology Review named Ripple Labs one of the “50 Smartest Companies” in recognition of its innovative approach.

XRP Ripple Price Analysis

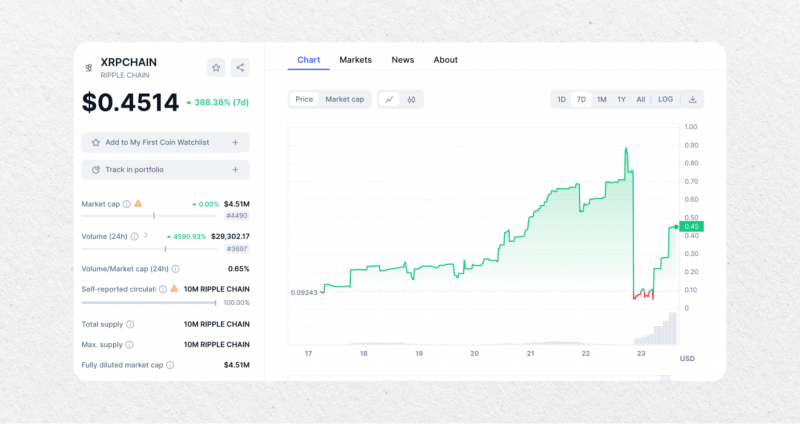

Through smart alliances with big banks like American Express, Santander, and MoneyGram, Ripple XRP has proven significant financial strength. These partnerships support Ripple’s ability to revolutionize cross-border payments by facilitating quicker and more affordable transactions worldwide. A recent court ruling that XRP is not a security has strengthened its position.

However, XRP also has drawbacks, notable among them being its persistently high price fluctuation in relation to fiat currencies. For XRP to continue to gain traction and become more useful, financial institutions must embrace RippleNet. The persistence of regulatory uncertainties is a noteworthy risk, impeding its extensive acceptance and assimilation.

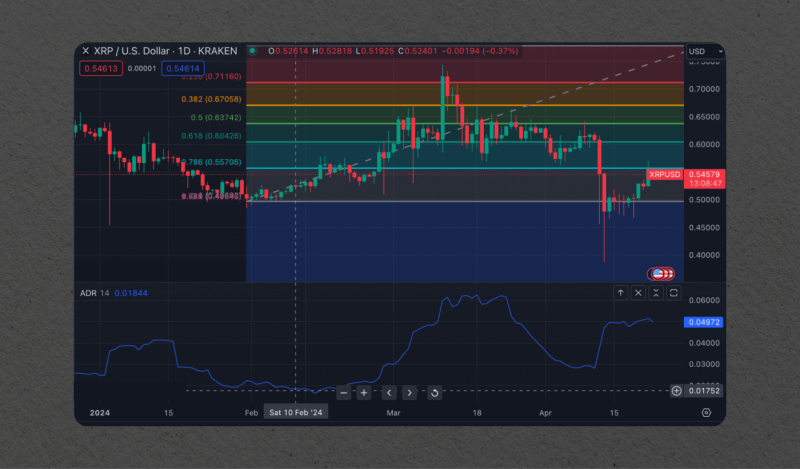

Regarding technical details, as of April 23, 2024, XRP is now trading at $0.4514. On January 4, 2018, it hit an all-time high of $3.84 but continued to fall in 2022. Recent analysis shows that XRP is currently situated on its monthly chart in what is known as the “zone of last hope” inside the Fibonacci retracements, signaling a crucial turning point for future price fluctuations.

Overall, sustained financial collaborations and wider usage of RippleNet are critical to the future success of XRP and Ripple. Although the new court decision offers hope, the technical analysis suggests caution given the current key price zone. Stakeholders should continue to exercise caution and knowledge in their investing plans as Ripple manages these technological and financial environments.

Final Thoughts

Ripple and XRP cryptocurrency continue to be essential in transforming finances. Ripple challenges established banking institutions by providing solutions that drastically cut transaction times and costs while facilitating cross-border payments. Alliances with well-known financial organizations highlight RippleNet’s potential and expanding acceptance for international financial operations.

Despite its advantages, XRP has to deal with issues like price volatility and ambiguous regulations, which may limit its wider acceptance. It is still vital that XRP be integrated into international finance while Ripple negotiates these challenges. By implementing sensible management practices and forging strategic alliances, Ripple aims to establish itself as a leader in financial technology and revolutionize how money moves around the world.

FAQs:

How does Ripple use XRP?

For its consumers, Ripple employs XRP as a bridge to facilitate the transfer of value between several fiat currencies. Additionally, anyone can transact XR.

How does Ripple authenticate payments?

The distributed consensus technique is distinct from the traditional mining method. Participating nodes do a poll to confirm the legitimacy of transactions and validate them.