How Meta Pay Works And Why You Should Use It

June 21, 2024

The internet revolutionized user acceptance of technology, allowing users to converse anytime and anywhere. Mobile technology, like smartphones, now brings a flood of services to the Metaverse, a three-dimensional virtual place that serves as a metaphor for the real world.

Meta Pay, formerly Facebook Pay, is a revolutionary digital transaction system offered by major tech companies to keep users within their ecosystem. It combines payment across Meta-owned platforms, ensuring a secure and efficient payment process, thereby fostering trust and security among its users.

In this article, we will answer the questions “What is Meta Pay, and how does it work?” and learn how to set it up on your Meta-related apps easily.

Key Takeaways:

- Meta Pay is a secure digital payment platform offered by Meta Platforms Inc. that facilitates transactions across the Meta ecosystem.

- Meta Pay via Facebook Messenger allows users to send money by opening a conversation with a friend and tapping the dollar sign icon.

- Meta Pay offers numerous benefits, such as security, cost-effectiveness, and increased conversions.

- You can set up Meta Pay on Facebook Messenger, Instagram, or Facebook.

What is Meta Pay?

Meta Pay, formerly Facebook Pay, is a secure digital payment platform by Meta Platforms Inc. that facilitates transactions across Meta’s ecosystem of platforms like Facebook, Instagram, WhatsApp, and Facebook Messenger. The platform enables quick transactions within these apps, as well as purchases from online stores.

It offers a convenient and secure payment experience by linking preferred payment methods like credit/debit cards or PayPal to Meta Pay accounts. Users can make purchases, send money, and donate to causes without switching between different payment systems. Meta Pay’s seamless integration with digital platforms like Facebook Marketplace, Instagram, and Messenger enhances user experience and promotes consistency and convenience in financial transactions.

With Meta Pay, users can also view their payment history and review payment methods. Although free, fees may apply for certain transactions using PayPal via Meta Pay, and additional fees may apply for personal fundraisers or Facebook item sales.

Meta Pay supports multiple cryptocurrencies like Bitcoin, Ethereum, and Litecoin, and plans to add more in the future. The company is also working on simplifying the buying and selling of cryptocurrencies using Meta Pay.

However, Meta Pay’s availability is limited. So, the Facebook option is available in most countries, while Instagram is only available in some of them; Messenger compatibility is possible in the US and Thailand. Currently, the WhatsApp payment feature is only available in Brazil.

Fast Fact

With 3 billion Facebook users, 2 billion Instagram users, and 2 billion WhatsApp users, Meta Pay allows businesses to reach a wider market and accept payments with just a click.

How Does This Work?

The Meta Pay project has developed a flexible, secure, and fast virtual payment system that supports institutional and peer-to-peer transactions, allowing users to conduct crypto and fiat-based purchases using dynamic virtual payment cards, and enabling metaverse payments and retail finance transactions.

Sending money via Meta Pay through Facebook Messenger is a simple process that requires storing your debit card information. The process involves opening a new or existing Facebook Messenger conversation with the friend you wish to send money to and then tapping the dollar sign icon at the bottom of the screen.

The app prompts you to enter the amount of money you wish to send and click the Next button. If you’re a first-time user, you’ll need to enter your payment information, which includes your card number, expiration date, validation code, and billing zip code.

The site stores your debit card information, so you don’t need to enter it each time. The app transfers the funds to your friend immediately, and if you use an online banking app, the money should be deducted from your available balance within minutes. Meta Pay provides an information page for those concerned about having financial information stored on a third-party server. Receiving money via Facebook Messenger is even easier than sending it, as you receive a Facebook notification when a friend sends you money.

This method is also suitable for small business owners, as it integrates with most payment processing and e-commerce platforms. Meta Pay is a free payment method that requires integration with a payment processor. However, it may incur transaction fees. If you don’t have a payment processor, consider options like Shopify, which accepts Meta Pay. Meta Pay also offers API integration and a JavaScript SDK for integration into websites, which are available to approved merchants and partners.

Why You Should Use It

Meta Pay is a secure and fast way to spend and donate money on Meta-owned apps, with merchants not charged additional fees. It is natively integrated into all Meta apps and services, making payments seamless and frictionless. Meta Pay offers several benefits, including encrypted card details, separate account information from payment details, anti-fraud technology, suspicious activity alerts, and biometric or PIN authentication.

The platform can be used for various activities within the Meta ecosystem, such as shopping, donations to charitable causes, peer-to-peer payments, in-app purchases, online subscriptions, and event ticket purchases. In the business world, companies and merchants can integrate Meta Pay into their websites and applications, facilitating hassle-free payments for customers using Meta platforms.

Meta Pay also enables fast checkout, increasing conversions by nearly 36%. It also enables social selling, making social media accounts more efficient. Meta Pay integrates with Shopify, making it a convenient payment option for customers.

The adoption of Meta Pay depends on factors such as target audience, digital presence, and product or service nature. If a customer base is actively engaged on these platforms, integrating Meta Pay could provide a competitive edge. However, businesses without customers using Meta Pay can still benefit from its convenience and cost-effectiveness. Individual sellers on Facebook or Instagram can benefit from Meta Pay’s ease of sending and receiving money within the platform.

However, it has some drawbacks, such as not all customers can use Meta Pay, and not all websites can integrate with Meta Pay. Additionally, Meta Pay is only available to businesses using one of Meta’s participating payment processors or platforms. Lastly, Meta Pay’s market share is not as robust as that of other payment services like Apple Pay.

Meta Pay offers convenience, security, and versatility for users, allowing seamless transactions across Meta’s platforms. It safeguards financial information and prevents fraud. Businesses can benefit from higher conversion rates, enhanced customer trust, and streamlined operations.

Users are more likely to complete transactions when presented with a familiar payment option, leading to repeat purchases and brand loyalty. Meta Pay also reduces administrative overhead, ensuring smoother transactions for businesses.

Is Meta Pay Safe?

Meta Pay prioritizes security in handling financial and payment information, implementing measures such as end-to-end encryption for credit/debit card numbers and bank account details, robust anti-fraud monitoring, multi-factor authentication, regular security audits, and local handling of device biometric data.

The company separates users’ payment information from other account data within Meta applications, storing it in isolation and encrypted. Users can view their transaction history, manage linked payment methods, and adjust privacy settings from a centralized control panel. If a user decides to stop using Meta Pay, they can securely delete all their financial data stored in the system.

Meta Pay also offers a highly trained customer support team available 24/7 to assist with security-related queries or issues. This ensures users’ peace of mind and prevents unauthorized access to sensitive data.

Meta Pay has daily and monthly limits to ensure security and comply with financial regulations. These limits include the amount of money sent or received in a single transaction, which can vary depending on location and payment method. Meta may also require additional verification of identity if users reach certain thresholds.

Account-specific limits may apply to new users or those with limited activity. Payment methods like debit cards or PayPal may have their own limits, which may affect Meta Pay’s limits. Geographic restrictions may also apply based on country or region. To understand your specific limits, refer to the “Payments” section within Facebook or Messenger settings.

How to Set Up Meta Pay

Meta Pay setup is straightforward, requiring login to Facebook, Instagram, or Messenger. Here’s a quick guide on how to set up Meta Pay on the mentioned apps.

Meta Pay can be set up via the Facebook app or website, allowing users to save payment information for purchases or money transfers via Meta apps, following specific steps on the Facebook webpage.

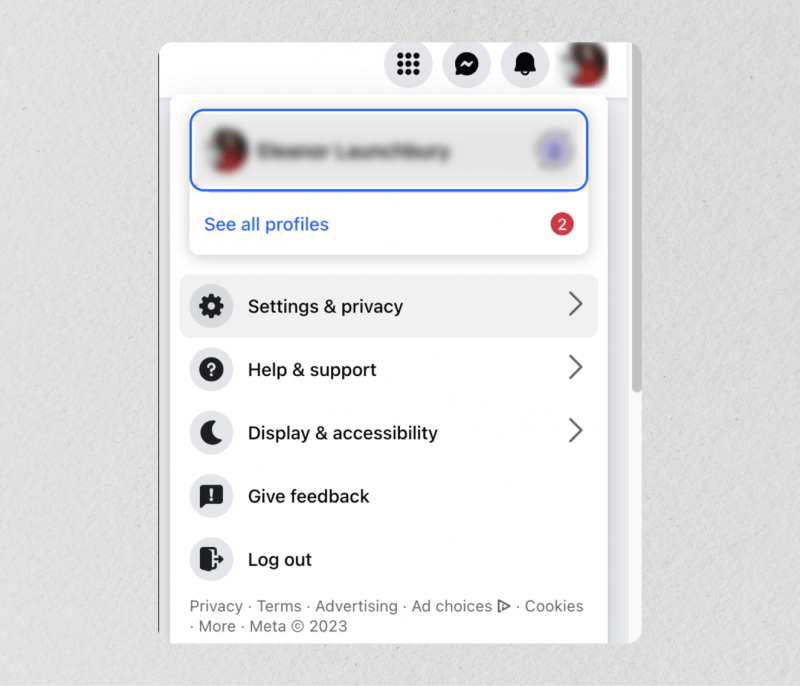

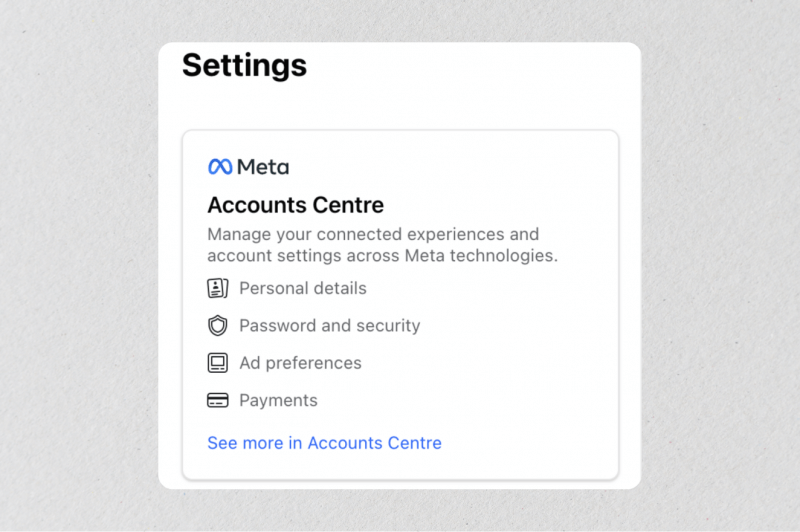

1. Access your profile settings by clicking on your profile picture in the top right corner and navigating to Settings and Privacy > Settings.

2. Then, access the Accounts Center by navigating to the top left of your screen and selecting Payments from the options list at the bottom.

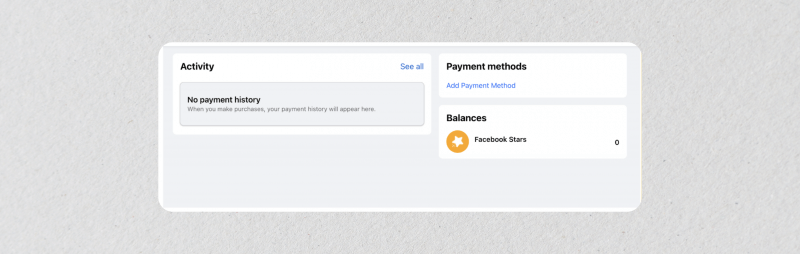

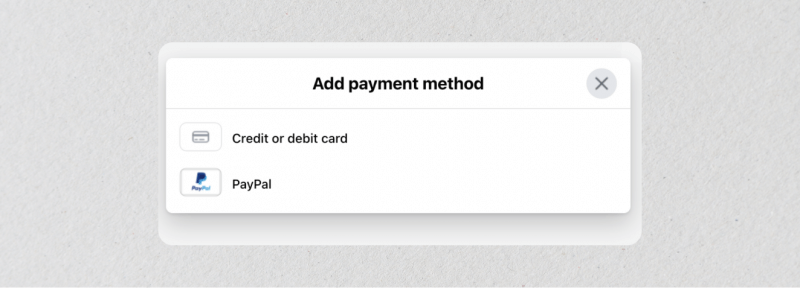

3. Select payments from the left-hand list and choose Add Payments or Meta Pay. Click on Meta Pay and choose ‘Add Payment Method.’

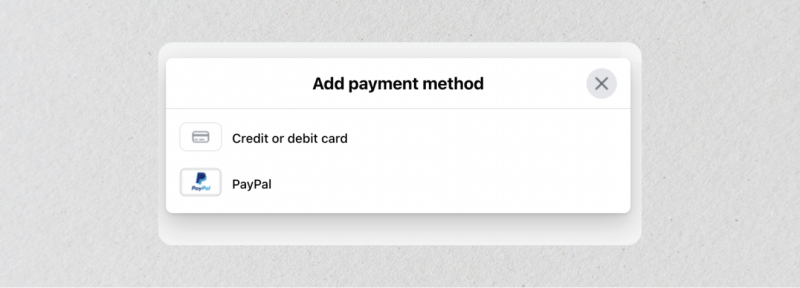

4. You can now select your preferred payment method, such as credit or debit card, or link your PayPal account.

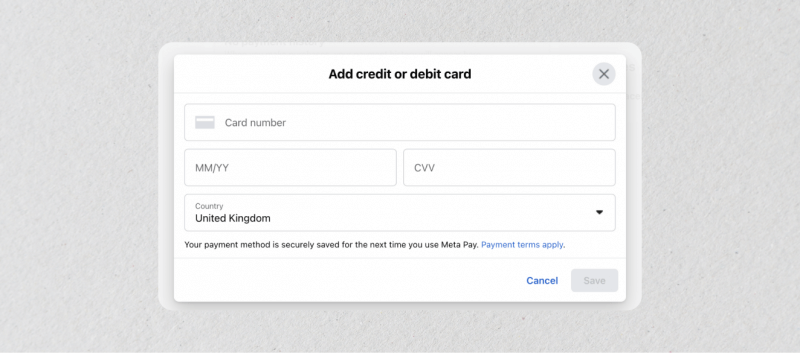

5. Finally, add card details, select country, and save changes. You’re ready to use Meta Pay.

Meta Pay can be set up on your Instagram app or webpage by following these steps to add payment methods.

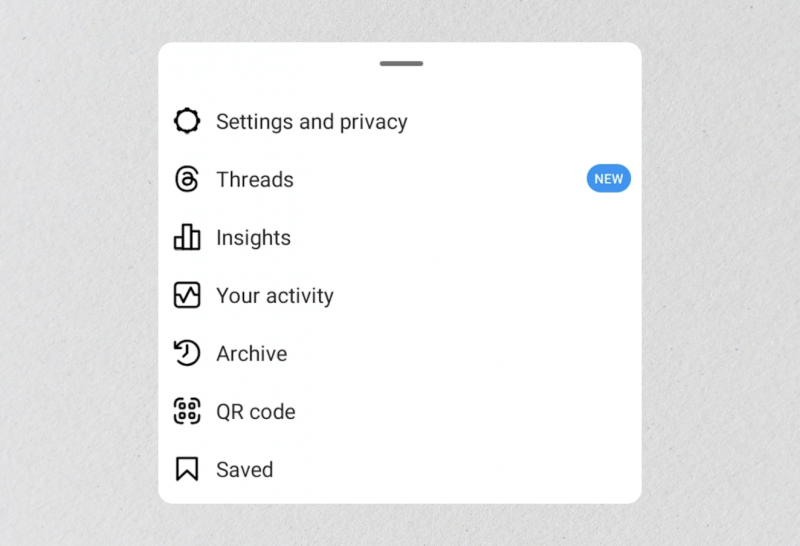

1. Access your profile page by tapping on the three lines in the top right corner and selecting Settings and Privacy from the list.

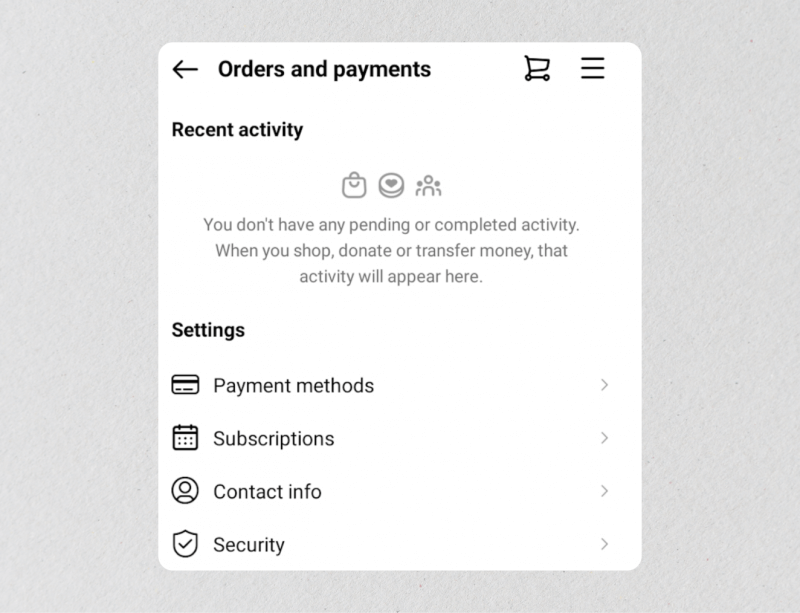

2. Navigate to the Orders and Payments section and select Payment Methods from the drop-down menu.

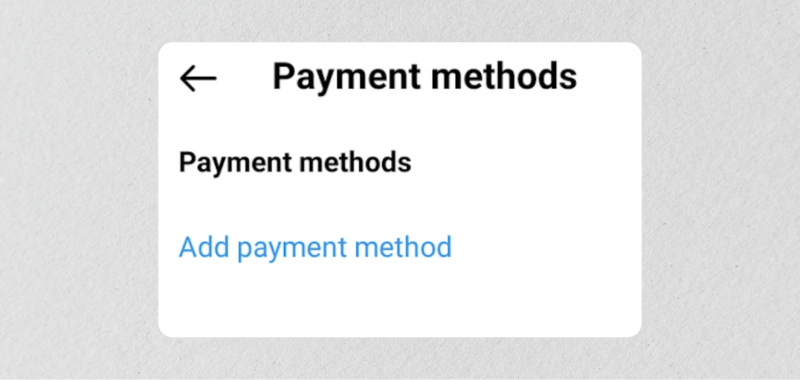

3. Tap Add Payment Method.

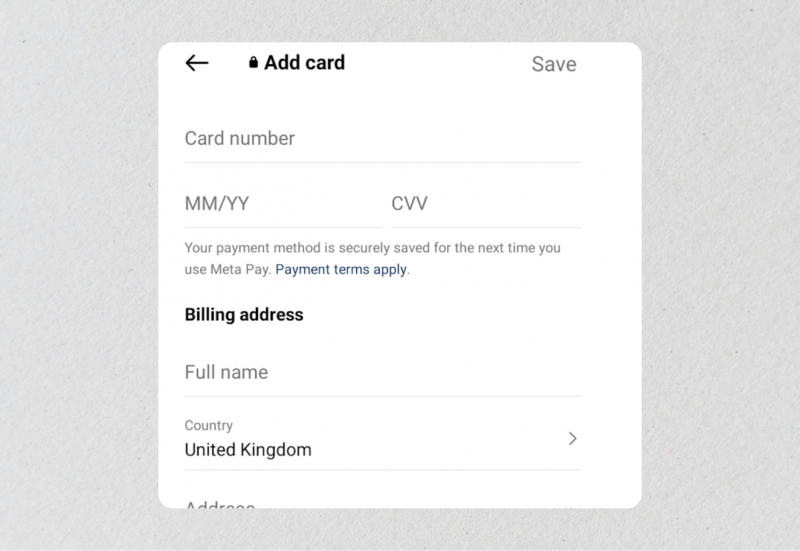

4. Connect your PayPal account or add card details and billing address to Meta Pay digital wallet. Save changes and use your new payment method.

Messenger

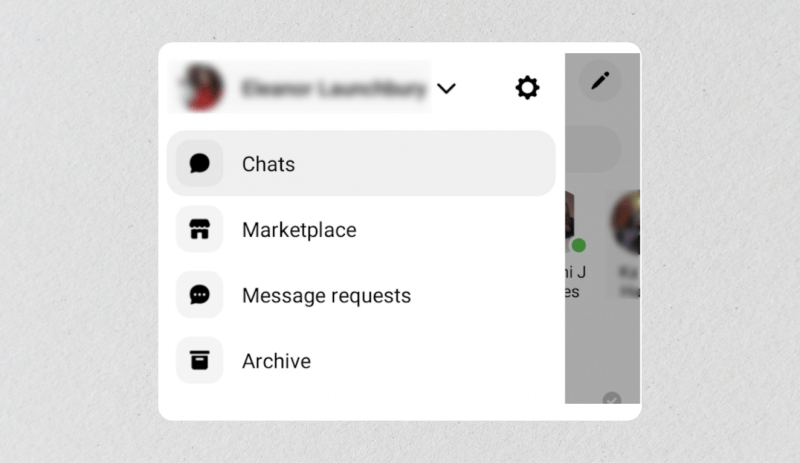

Meta Pay can be set up through the Messenger app, and adding payment methods can be done following the steps provided.

1. Access the Settings sections by tapping on the three lines in the top left corner of your screen and selecting the Settings cog icon.

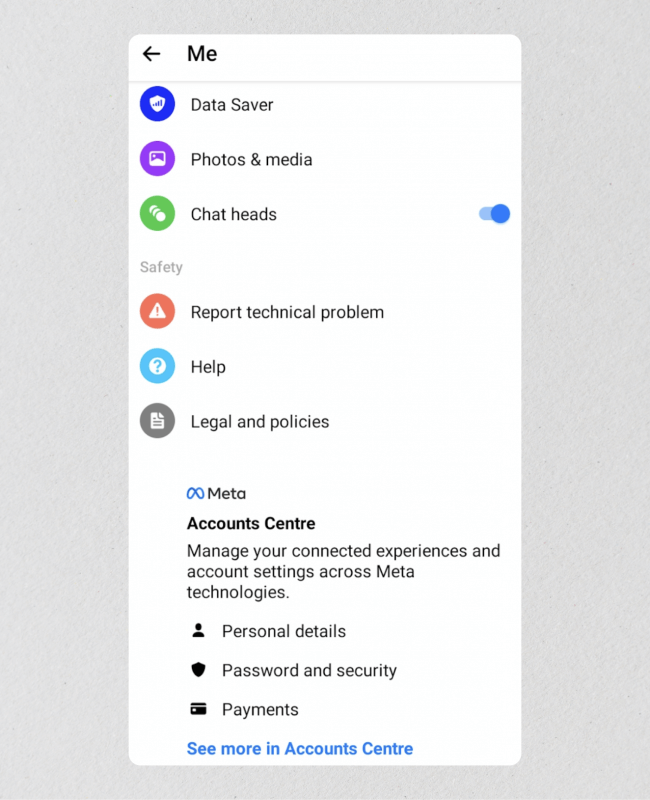

2. Navigate to the Meta Accounts Center at the bottom and select Payments. To access Meta Pay, navigate to the Payments section in the Meta Accounts Center at the bottom of your screen.

3. Add a credit or debit card or link your PayPal account to Meta Pay by entering your card and billing information. Then tap the Save button to add a new payment method to Meta Pay.

What Is The Future of Meta Pay?

Meta Pay is one of the dominant players in the payments industry, set to expand its global reach. The platform is currently present in over 160 countries, but some markets still lack implementation across all Meta applications. Meta plans to bring Meta Pay to these remaining markets in the coming years. The company is also exploring integrating Meta Pay into third-party platforms and services, potentially through partnerships with major online retailers and digital service providers.

This expansion could involve developing new partnerships with payment processors and finance institutions. Beyond basic payments, Meta plans to develop additional financial products and services, including digital banking tools, credit and loan solutions, investment management, digital currencies, and cryptocurrency capabilities.

The long-term vision is for Meta Pay to become a comprehensive financial super app, competing with major banks and fintech companies. Also, the company aims to become the go-to method for metaverse payments after the integration of a crypto payment option.

Final Takeaways

Meta Pay is a payment solution that enables businesses to use social media as transaction hubs, reducing checkout friction and increasing merchant reach. It is a valuable tool in the e-commerce landscape, offering a quick and convenient way for social media-savvy customers to purchase products and services.

Despite not being universally adopted, it capitalizes on mobile wallet demand and offers solid security and reach across social media channels, making it a valuable addition to other payment options. Incorporating Meta Pay into your online sales strategy can significantly boost sales and audience growth.

FAQs:

Does Meta Pay charge a fee?

Meta Pay does not charge fees, but PayPal may charge users for certain transactions, personal fundraisers, or businesses selling items on Facebook and may charge fees for certain types of transactions.

How long does a Meta Pay transaction take?

Meta Pay transfers funds instantly with debit cards or PayPal accounts. However, your bank may take up to five business days to make the funds available.

Where is Meta Pay Available?

Meta Pay, available globally in over 160 countries, may not be fully implemented across all Meta applications in some markets.

What is Meta Pay used for?

Meta Pay is a secure and convenient method for making payments on social media platforms like Facebook, Messenger, Instagram, and online stores, requiring only one payment card or account information.