Explaining Bitcoin Mempool And Its Role in Processing Transactions

Jul 18, 2024

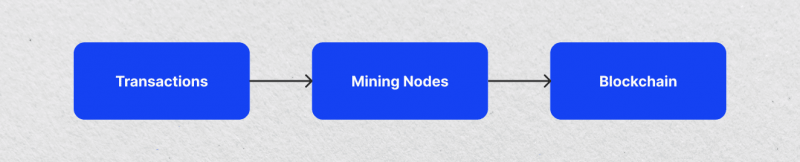

These days, Having a grasp of crypto is common knowledge, but not everyone knows the details required to process each transaction. As we know, blockchain revolutionises safe data recording and sharing over a computer network. The memory pool (mempool), the central component of this system, is essential to processing BTC transactions before being added to a block–It holds pending and unverified transactions.

Gaining insight into the mempool is crucial to understanding how the Bitcoin network controls transaction volume and fees. In this article, we will give an in-depth overview of the BTC mempool, outlining its formation, how it works, and the difficulties it encounters. By exploring these aspects, readers will understand how the mempool affects transaction confirmation times, network congestion, and user fees.

Key Takeaways

- Bitcoin mempool holds pending transactions until they are verified and inserted in a block.

- With upgrades like SegWit improving processing, the mempool has changed over time to meet rising payment volumes.

- Users can handle stuck transactions by increasing fees or waiting for better network circumstances.

- Anyone interested in blockchain transactions must understand the mempool since it affects user fees and confirmation times.

The Creation of the Mempool

With the introduction of Bitcoin, the mempool was presented to solve the requirement for a productive approach to handle pending transactions. When blockchain technology started, transactions needed to be queued up before being verified and included in a block. The inability of the Bitcoin network to process transactions instantly because it takes time to create new blocks gave birth to this demand.

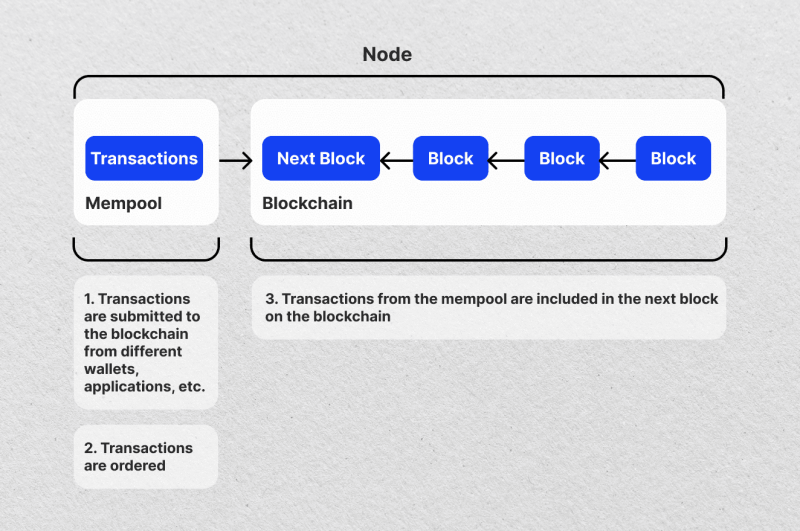

Until a miner incorporates them into a block, legitimate transactions are kept in the mempool as temporary storage. Every Bitcoin node keeps an independent mempool that aids in classifying transactions according to parameters like size and transaction fees. During heavy transaction volume, this approach helps manage network congestion by guaranteeing that transactions are completed orderly.

Evolution of Mempools Over Time

Significant changes were made to the mempool mechanism as blockchain technology advanced. Initially, the memory pool was just a simple queue mechanism. However, as the volume of transactions on the Bitcoin network grew, it became clear that it was required to handle more advanced pending and unconfirmed transactions.

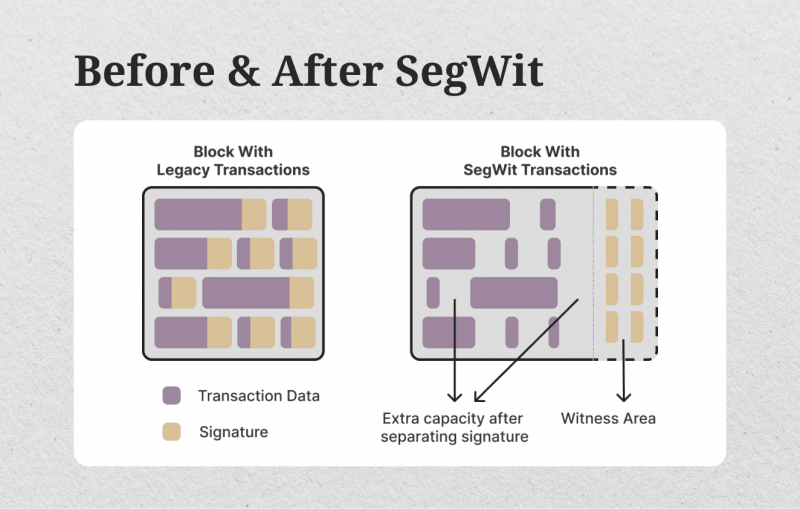

In 2017, SegWit was introduced as a significant improvement to the mempool mechanism. SegWit enhanced transaction processing and increased block capacity by segregating transaction signatures from transaction data. By lowering the size of transactions in the mempool, this modification helped to clear up network congestion and process more transactions in a single block.

Another significant blockchain, Ethereum, also saw modifications to its mempool system. Unlike Bitcoin, Ethereum transactions require a computational process known as “gas.” Ethereum’s mempool efficiently processes and confirms transactions by not just queuing them but also ranking them according to the gas fee.

The mempool has evolved to meet the needs of blockchain networks. Advancements in network protocols, fee estimating techniques, and transaction sorting algorithms have assisted its effective operation. Those improvements guarantee rapid processing, preserving the efficiency and integrity of blockchain networks such as ETH and BTC.

To sum it up, a mempool is part of a blockchain network where pending transactions are held until they are confirmed. The phrase refers to a section of a blockchain node’s memory for temporary storage. This storage holds valid transactions yet to be included in a block.

Role of Mempools in Blockchain Transactions

When a Bitcoin transaction is broadcast to the network, it initially joins the mempool. It remains here until a miner adds it to a freshly extracted block. Thanks to this method, every transaction is correctly checked before being uploaded to the blockchain.

The mempool’s capacity to prioritize transactions and control network congestion makes it essential for transaction approval. Higher-fee transactions are usually completed faster since miners prioritize them to make the most money. This system motivates users whose transactions are time-sensitive to pay higher transaction fees for faster confirmation.

The mempool additionally aids with transaction organization by classifying them according to parameters like size and transaction costs. By minimizing delays and guaranteeing effective processing of unconfirmed transactions, this sorting improves the general functionality of the Bitcoin network. The number of transactions and network activity can affect the size of the mempool, which can immediately affect single transaction confirmation times and costs.

Although every blockchain node manages its mempool, consistency is ensured by transactions being widely dispersed over the network. The transactions in a newly mined block are cleared from each node’s mempool, updating the blockchain and validating the transactions.

Lifecycle of Transactions in Mempool

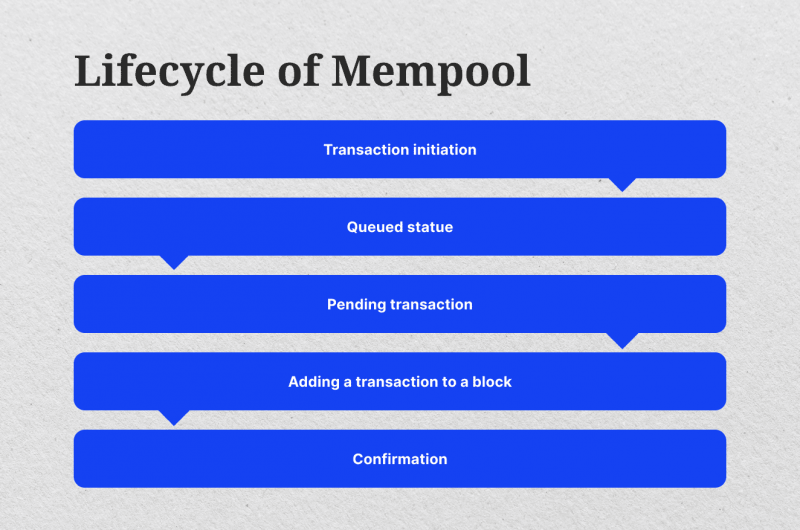

When the user initiates a transaction, it enters the blockchain and is placed in the mempool. Here is a detailed breakdown of the mempool’s transaction lifecycle:

- Transaction Initiation: It starts by a user and is notified to the network.

- Queued State: Upon receipt, the transaction enters the first node’s mempool. As it waits for validation, it is currently in a queued state.

- Pending Transaction: The transaction becomes pending and spreads to further nodes around the network after being verified by the original node.

- Adding a Transaction to a Block: Miners choose the transactions from the mempool to add to a fresh block. They usually consider transaction costs when making this decision.

- Confirmation: After a transaction is included in a block and that block is mined, it is confirmed and eliminated from the mempool of all nodes.

Node-Specific Mempools

Every blockchain node keeps up a separate mempool. A newly transmitted transaction is initially added to the receiving node’s mempool. After that, this node verifies the transaction and spreads it to more nodes. In turn, these nodes verify the transaction and add it to their mempools, guaranteeing that it is widely distributed throughout the network.

Nodes cooperate despite the network’s decentralized structure by exchanging and verifying transactions. This guarantees that miners on the network can always find valid transactions to include in future blocks.

Transaction Validation and Prioritisation

The mempool validates transactions to make sure they follow the Bitcoin protocol. Essential standards for validation consist of the following:

- Proper Syntax: Such a transaction needs to be appropriately formatted.

- Enough Money: The inputs must have sufficient funds for the transaction and output charges.

- Avoid double-spending: The transaction must not attempt to spend outputs already spent in other transactions.

Miners use transaction fees to determine priority. A higher transaction fee encourages miners to include certain transactions in a block first. This implies that customers, particularly during network congestion, can pay more significant fees in exchange for faster transaction confirmation.

Each miner chooses transactions from the mempool on their node to increase the fees in the upcoming block. This approach makes mining operations more profitable and efficient by prioritizing transactions with more significant fees.

In other words, the user initiates a Bitcoin transaction after entering the required information and submitting the transaction. The transaction then goes into a mempool and waits for approval. Miners prioritize transactions with more significant fees to be included in a Bitcoin block. Then, it is processed and finished after confirmation.

All things considered, the mempool’s operation is critical for maintaining network stability, handling pending transactions, and executing operations as efficiently as possible.

Fast Fact

The mempool may become overloaded during periods of high activity, which would delay processing. Because miners prioritise transactions with more significant fees, congestion causes slower confirmation times and greater costs.

Technical Aspects of the Mempool

The size of the mempool is not fixed; it can change based on node configurations and network activity. Nodes oversee mempool data by keeping transactions in a queue, usually arranged according to fees. Enough memory and storage space are needed for this data management.

Miners and validators use the mempool to choose which transactions to include in new blocks. Based on variables including fee rate, transaction size, and network congestion, they rank the transactions in order of priority. Validators try to preserve network security and efficiency, while miners frequently select transactions with higher fees.

Miners and validators gather transactions from the mempool and arrange them into blocks as part of the transaction selection process. This procedure requires coordination between network participants and processing power. A block is formed and added to the blockchain, and its transactions are confirmed.

Challenges and Issues with Mempool

When more transactions than can fit in the next block are pending confirmation, network congestion in the mempool results. High transaction volumes and constrained block sizes are frequently the root causes of this congestion, which drives up fees and extends confirmation times as users fight to get their transactions into the next block.

Because miners prioritize higher costs, transaction fees are essential in the mempool. Higher fee transactions are typically included in blocks first. In comparison, lesser fee transactions could be eliminated from the mempool or postponed if not confirmed over an extended period. Users with time-sensitive transactions or unwillingness to pay additional costs may become frustrated by this prioritization.

Technical constraints also make mempool administration and scaling difficult. As the volume of transactions rises, nodes must manage bigger mempools, requiring more memory and storage space. In addition, when transaction volumes increase, the existing mempool architecture might not scale well, which could result in jams and delays.

Researchers and developers are investigating several upgrades and methods to address these issues. These include introducing new technologies like layer-two scaling solutions, optimizing block size and frequency, and implementing more effective mempool management algorithms. By improving mempool scalability and performance, these initiatives hope to give users an even better transaction experience.

Are There Any Strategies to Manage Stuck Transactions?

Several factors, such as low transaction fees, network congestion, or technical difficulties, might cause Bitcoin transactions to become trapped in the mempool. Users can handle stopped transactions in a few different ways.

One way to replace the original transaction with a new one with the same inputs but a more significant charge is to broadcast a new transaction to cancel the current one. Wallets offering this capability can be used for this procedure, also called fee boosting. Users should consider the transaction’s expenses and urgency before proceeding, as additional fees are associated with transaction cancellations.

Increasing fees is another way to expedite the procedure. Most wallets enable users to manually or automatically change the transaction fee. Users can encourage miners to prioritise their transactions and include them in the next block by choosing a higher fee. Furthermore, certain third-party services charge a fee for fee-boosting services.

Mempool, however, prevents you from withdrawing from a transaction. It is not possible to manually stop processing after it has begun. As previously noted, one choice could be a higher charge. Though the system’s pay-and-win structure may make it seem unfair, there are currently no better solutions available.

Sometimes, it’s better to wait for the network conditions to improve. This can involve holding off until the number of transactions slows down or until miners clear the mempool. A transaction stalled now might be executed swiftly shortly because network circumstances are dynamic.

Final Thoughts

The mempool is crucial for controlling transaction volume and costs since it is a temporary storage location for pending transactions. As it has evolved, processing results and effectiveness have increased.

The two options for handling stalled BTC transactions are raising the fee or holding out for better network circumstances. These techniques can increase the likelihood that a process will be confirmed, even if it is impossible to cancel. To correctly manage their transactions, everybody involved in the system has to be aware of blockchain advancements and have a solid understanding of the mempool.

FAQ

How do I remove my funds from the mempool?

Users who wish to withdraw money from the mempool must contact the organization handling the transaction, such as wallet software or an exchange company.

How much time does it take to verify the mempool?

Confirmation periods might vary; they usually range from a minute to many hours. A transaction is often dropped, and the money is refunded to the user’s wallet if it is not confirmed in the mempool after 48 hours or maybe even 72.

What happens if a transaction is not confirmed?

The money will be restored to your wallet, and everything will be canceled if it is not included in a block after a predetermined period.