B2BROKER Fortifies B2CONNECT with Major FIX and Liquidity Engine Upgrade

June 16, 2025

B2BROKER, a liquidity and technology provider for brokerages and exchanges, has released a significant update for B2CONNECT, its crypto liquidity hub, bringing a suite of backend enhancements focused on improving platform stability and performance.

This release follows a previous update in April that introduced new integrations and key upgrades to the Coinbase API and Binance Futures Adapter. The latest version is designed to deliver further operational advantages and stability for brokerage clients.

The key updates are detailed below.

FIX Protocol Stability and Flexibility Enhancements

The update introduces two key enhancements to ensure resilient and standardized FIX protocol communication, enabling consistent connectivity even under edge-case scenarios.

A key change addresses the SecurityList FIX API endpoint, which now merges liquidity metadata from multiple providers. This system ensures trading parameters are compatible across all connected sources, enabling more seamless and reliable order routing.

The B2CONNECT FIX Server now also manages rapid subscribe/unsubscribe cycles from third-party aggregators. The server’s design ensures this resilience holds firm even if aggregators do not fully adhere to FIX standards, which helps to eliminate edge-case failures.

Liquidity Engine and Data Quality Upgrades

The recent update also reflects a focus on market data quality and order execution through several powerful upgrades to its liquidity engine.

A newly implemented, intelligent data processing logic now actively filters out Level 2 quotes with negative spreads. This feature, known as Advanced Negative Spread Filtering (V2), is crucial for ensuring cleaner liquidity distribution via FIX.

To bolster operational stability, the process for live API key replacement has been fortified. This enhancement ensures that when trading credentials are changed, the execution report feed remains in perfect sync with the order placement service, preventing any disruption to critical trade data.

Furthermore, the update enhances error handling from liquidity providers. The system no longer incorrectly qualifies messages from LPs as unknown errors, a fix that prevents redundant order placements and conserves API rate limits.

Upgrades to Exchange Connectivity

The new release accelerates the speed at which the system identifies connectivity issues by six times, allowing for quicker responses to potential disruptions and maintaining a smoother trading experience.

The platform also integrates a new intelligent rate limiter. This crucial feature ensures that reconnection attempts do not lead to IP bans from exchanges, safeguarding continuous access to liquidity.

Additionally, this improvement in authentication recovery prevents intermittent failures and bolsters overall connection stability by ensuring private API access authorisation attempts respect timeouts.

Web UI Control Enhancements

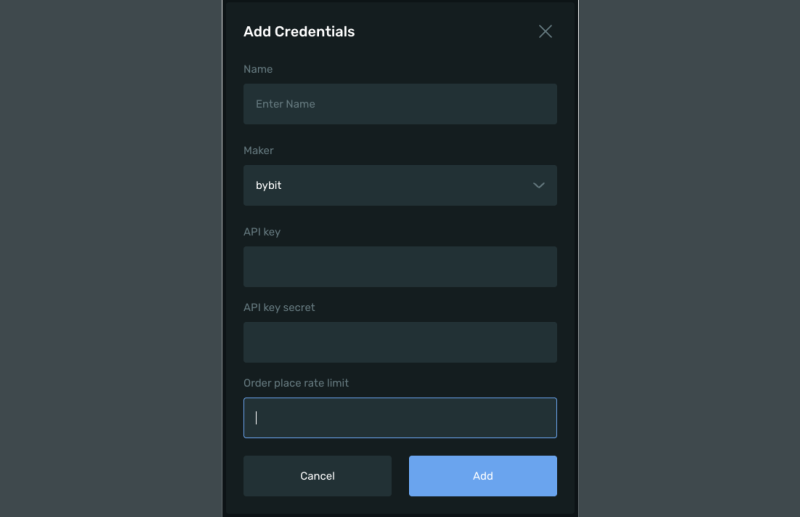

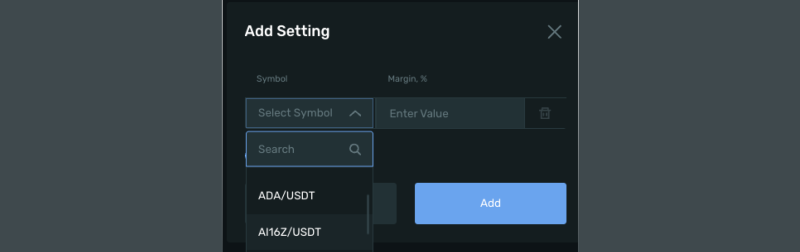

While the update heavily emphasizes backend improvements, it also includes Web UI enhancements for greater user control.

- Users can now configure Bybit adapter rate limits directly through the user interface, streamlining the setup process.

- Newly added symbols are also now automatically distributed to relevant profiles within the Account Management System (AMS), a change that simplifies symbol configuration. This crucial automation streamlines operations by removing manual steps, ultimately saving brokers significant time and minimizing potential human error.

Final Notes

The company’s announcement notes that beyond these headline features, the B2CONNECT update incorporates numerous minor fixes and crucial optimisations.

The collection of enhancements in this B2CONNECT release is designed to provide brokers with superior price feeds and more reliable order execution, ultimately enabling them to redefine their liquidity infrastructure.