What is OTC Trading? A Complete Guide for 2025

Aug 08, 2025

While headlines often focus on the staggering $7.5 trillion daily volume of the global foreign exchange market, few realize that the bulk of this activity doesn’t happen on public exchanges like the NYSE.

This massive, “hidden” arena belongs almost exclusively to large financial institutions, corporations, and high-net-worth individuals. It’s a world that runs on personal relationships and direct negotiation, fundamentally separate from the anonymous order books of the retail world.

So, what is OTC? And why does this “hidden” market matter more than ever in 2025?

Key Takeaways

- In the OTC market, deals are negotiated directly through a private network of dealers, which bypasses the central, anonymous order book of a public exchange.

- Institutions primarily use OTC trading to execute large “block” trades. This is done at a single, pre-agreed price to avoid the slippage and market impact that would occur on a public exchange.

- Counterparty risk is the primary risk in OTC trading. Without a central exchange to guarantee the trade, each party is directly exposed to the risk of the other side defaulting on the agreement.

OTC vs. an Exchange

The core difference between an OTC market and a centralized exchange lies in its structure. An exchange acts as a single, regulated hub. It matches all buy and sell orders using a central limit order book and provides complete price transparency to the public.

An OTC, or “over-the-counter,” market is different. It is a decentralized network of dealers and brokers. There is no central location or order book. Instead, trades are negotiated and executed privately between two counterparties.

- Order Matching

On an exchange, algorithms anonymously match buyers with sellers. The OTC market, however, is relationship-based. A buyer must actively seek out a seller, usually by contacting several OTC desks to request a direct quote for a specific asset.

- Transparency

Public exchanges are built on a foundation of total transparency, both before and after a trade. Anyone participating can view the live order book and see the exact price of all completed transactions. In contrast, OTC markets are opaque. The price and size of a trade are known only to the two parties involved.

- Regulation

Public exchanges are subject to heavy regulation, with strict rules for both participation and reporting. You’ll find the regulatory framework for the OTC market is less prescriptive, placing a heavy emphasis on the strength of the privately negotiated legal agreements between the professional firms involved.

- Contracts

This level of flexibility stands in stark contrast to the rigid standardization seen in exchange-traded futures. Think of an OTC contract, like a swap or a forward, as a blank canvas whose terms can be negotiated with precision to meet the exact needs of the parties involved.

Fast Fact

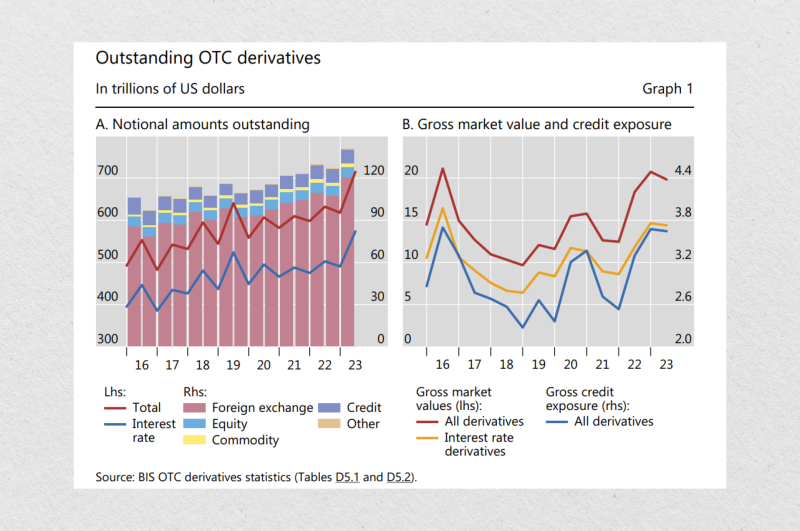

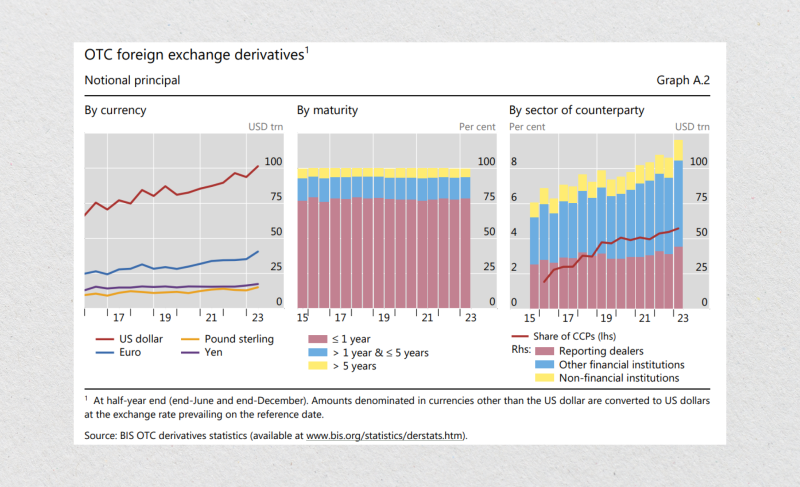

OTC activity has surged dramatically in recent years, with foreign exchange, derivatives, and crypto markets leading the charge. This trend is highlighted by BIS data, which showed the total notional value of just OTC derivatives climbing past the $667 trillion mark by the end of 2023.

Who Trades on OTC Markets and Why?

OTC trading is not for casual investors. The typical users are:

- Institutional Investors

Large players such as pension funds and mutual funds see the OTC market as the ideal venue for arranging bespoke hedges or executing massive bond and currency positions. Their ability to work directly with dealers gives them the power to craft instruments perfectly suited to their needs, like interest rate swaps or currency forwards.

- Hedge Funds

Hedge funds are frequent users of OTC trading. They use it to execute large positions privately. They also tap the OTC market to capitalize on arbitrage plays between different pricing venues or to construct highly complex derivative products.

- Corporations

For major corporations, the OTC market becomes an indispensable tool for handling operational risks, whether that means hedging foreign currency exposure or navigating a tricky interest rate environment.

- High-Net-Worth Individuals (HNWIs)

Within the crypto and forex arenas, HNW clients typically use OTC desks with a singular goal in mind: executing large block trades without sending shockwaves through the public markets.

Why Privacy Matters

Beyond size, the privacy of OTC trading is a major driver. On public exchanges, large orders can telegraph intent and cause adverse price movement.

Imagine a fund is planning a strategic acquisition and needs to accumulate equity in a target firm. Doing so openly on a public market would likely cause price spikes. An OTC arrangement allows them to buy the full position quietly, reducing information leakage and maintaining market efficiency.

In fact, OTC trading of U.S. equities remains significant. According to OTC Markets Group, thousands of securities trade on its platforms, such as OTCQX and OTCQB, often representing foreign issuers or small-cap stocks that don’t meet listing requirements for major exchanges.

Primary Instruments Traded OTC

The scale of the OTC market is vast, covering nearly every major asset class. Some of the largest financial markets in the world operate almost exclusively over-the-counter.

Forex (FX)

The foreign exchange market is the largest and most liquid OTC market in the world. More than $7.5 trillion is traded daily — most of it off-exchange, via interbank networks and institutional FX liquidity providers.

Key characteristics of these trades include:

- Execution: Trades are typically executed via a Request-for-Quote (RFQ) process directly between institutions.

- Settlement: Parties settle transactions bilaterally or through the CLS (Continuous Linked Settlement) system for risk reduction.

- Pricing: Contracts are priced based on either immediate (spot) or future date (forward) terms.

Bonds (Government and Corporate)

The fixed-income market, which covers all government and corporate debt, also operates primarily on the OTC market. A centralized exchange model is impractical for bonds. This is due to the vast diversity of bond issues, each having a unique issuer, maturity date, and credit rating.

Investors and institutions instead contact bond dealers directly. This allows them to:

- Buy or sell specific, often illiquid, bond issues.

- Access customized maturity dates tailored to their portfolio needs.

- Negotiate the purchase or sale of large block sizes without causing price volatility.

Derivatives

A massive portion of the global derivatives market is OTC. This is where financial institutions and large corporations create bespoke contracts to manage unique financial risks or express complex macroeconomic views.

The landscape of common OTC derivatives is diverse. It includes instruments like Interest Rate Swaps (IRS) for managing rate exposure and Currency Forwards for locking in a future exchange rate. You’ll also find Credit Default Swaps (CDS), which act much like insurance against a potential default, alongside highly customized Exotic Options designed with non-standard payout features.

Equities (OTC Stocks)

A vibrant over-the-counter ecosystem flourishes well beyond the world of major public exchanges, creating a marketplace for thousands of foreign, small-cap, or otherwise delisted companies. Through platforms like OTCQX, OTCQB, or the more speculative Pink Sheets, U.S. investors can gain access to firms that don’t meet the stringent listing requirements of the SEC.

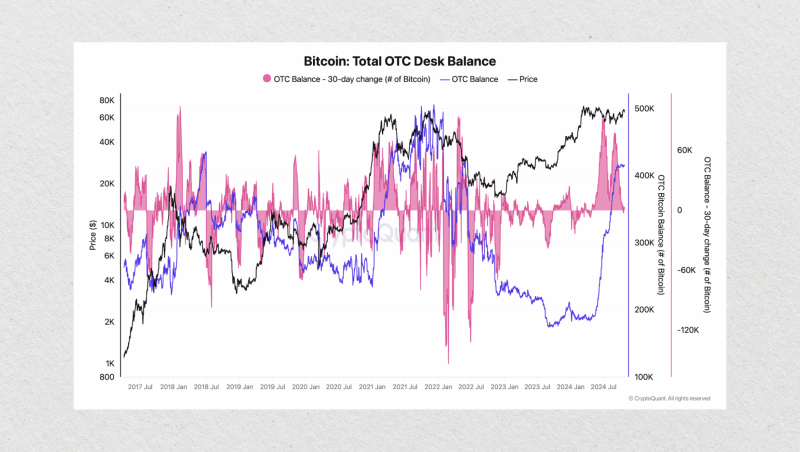

Cryptocurrencies

With the maturation of the crypto market, institutional players are now heavily utilizing OTC desks to execute high-volume trades in Bitcoin, Ethereum, and a wide array of stablecoins.

Benefits include:

- Private execution that avoids slippage;

- Custom settlement (fiat, stablecoin, cross-chain);

- High-trust counterparties with custodial services.

This segment is growing rapidly, with OTC crypto desks now offering multi-chain support, 24/7 execution, and access to deep stablecoin liquidity.

A Practical Guide to Executing an OTC Trade

An OTC trading transaction is typically a manual, high-touch process. It is built on negotiation and trust between two professional counterparties.

Step 1: The Request for Quote (RFQ)

The process for an OTC deal begins with a Request for Quote (RFQ). Imagine a hedge fund looking to purchase $25 million worth of 7-year U.S. Treasuries; placing that order on a public exchange is simply not an option.

Instead, their trader will contact several trusted bond dealers and request a firm price for the specific asset and size. Each dealer will then provide a private, two-sided quote (a bid and an ask price).

The entire process can unfold almost instantly via a secure chat application, an API hook, or a purpose-built execution platform.

Step 2: Negotiation and Agreement

The trader then evaluates the competing quotes. The decision is based not just on the tightest spread but also on other critical factors:

- Credit terms and any required margin.

- The exact timing of execution.

- Preferred settlement methods and timelines.

Once the terms are acceptable, the trade is agreed upon either verbally or electronically, followed by a formal confirmation. For a liquid crypto trade, this agreement can take less than a minute; for a complex derivative, it could take several hours.

Step 3: Execution

Execution in the OTC market is the binding confirmation of the trade between the two parties. There is no central order book or matching engine involved. This direct execution is a key advantage for:

- Large block sizes.

- Illiquid or hard-to-price instruments.

- Custom, non-standard contract structures.

It’s worth noting that for certain regulated OTC derivatives, such as interest rate swaps, U.S. rules mandate that this execution is either reported to or happens on a Swap Execution Facility (SEF) to ensure compliance.

Step 4: Settlement

After execution, the two parties move to the final and most critical phase: settlement. This is the formal process of exchanging the asset for payment. The exact method depends on the asset and the agreement:

- Assets and payments are exchanged directly (bilateral settlement).

- A central clearinghouse is used to mitigate risk (for cleared swaps).

- Bilateral netting and collateral agreements are used (for uncleared OTC).

The entire settlement process is governed by robust legal documentation, like ISDA Master Agreements for derivatives, GMRA for repo trades, and private bilateral contracts for spot crypto or FX trades.

Core OTC Trading Strategies

The unique structure of the OTC market enables specific strategies that are not possible on a public exchange.

- Block Trading

The most common OTC use case is block trading. Institutions routinely execute trades worth millions — sometimes hundreds of millions — of dollars without triggering price slippage.

In a public order book, placing such a large order would move the market significantly. OTC allows the trader to secure a single fill at a negotiated price, avoid revealing their intent to the broader market, and reduce volatility and implementation costs.

Example: A pension fund buying $100 million in long-dated bonds would contact several OTC dealers, collect private quotes, and agree to a price. The trade is then executed in full, often with T+1 or T+2 settlement.

- Arbitrage

Professional trading firms use OTC for inter-market arbitrage. Since OTC prices are not publicly visible and vary between dealers, traders can exploit inefficiencies.

These strategies can be as simple as dealer-to-dealer arbitrage, which involves exploiting small price differences by buying from one desk and selling to another. A more common approach is OTC vs. Exchange arbitrage, where traders capitalize on temporary dislocations between private OTC quotes and live public market prices.

These opportunities require speed, capital, and multiple OTC relationships.

- Trading Illiquid Assets

When it comes to trading niche or illiquid instruments, the OTC market is frequently the only practical venue available. We’re talking about assets like the sovereign bonds of some emerging nations, intricately designed structured notes, or the stock of small, unlisted companies.

For these types of instruments, OTC dealers effectively create a market. They do this by providing two-sided quotes and negotiating settlement terms on a case-by-case basis. This process gives institutional funds access to unique and often uncorrelated investment opportunities not found on public exchanges.

The Risks of OTC Trading

This flexibility is not without its own set of distinct risks. The decentralized, opaque nature of the OTC world can present formidable challenges, particularly for any firm lacking sophisticated infrastructure and due diligence protocols.

Counterparty Risk

Counterparty risk stands out as the most critical vulnerability in any OTC transaction. Because there is no central clearinghouse to guarantee performance, you are completely exposed to the possibility that the other party will fail to deliver on their promise. This danger is magnified in highly volatile markets, such as crypto.

To manage this exposure, seasoned traders rely on several layers of protection, starting with a foundation of ironclad legal paperwork like the ISDA or GMRA master agreements. On top of that, they use collateralization and margining, requiring both parties to post assets as security for the trade.

Lack of Price Transparency

There is no public order book in OTC markets. A trader has no single source of truth for the best available price. Quotes can and do differ significantly between dealers, and the true depth of the market is often unverifiable.

To address this, professional desks source multiple, competing quotes before executing a trade. A crypto desk might receive a quote of $42,000 / $42,100 for Bitcoin from one counterparty, while another quotes $41,950 / $42,050. Smart execution requires this market context.

The inherent opacity of OTC markets is a major focus for regulators. A recent rule change by the UK’s FCA, for example, aimed to improve market clarity by forcing more transparent reporting, which significantly reduced the volume of opaque trades in FTSE 100 stocks.

Wider Spreads as a Trade-Off

Since OTC pricing is based on dealer networks rather than a central, competitive order book, the bid-ask spreads can often be wider than on an exchange. This is particularly true for illiquid assets or during times of high market volatility.

This is the basic trade-off for the benefits of OTC trading. A trader may pay a slightly wider spread, but in return, they can execute a very large block trade with zero price slippage and complete privacy.

Conclusion: A Tool for a Specific Purpose

OTC trading is not a replacement for exchanges — it’s a complement. It exists to fill gaps that trading venues can’t address:

- Privacy;

- Customization;

- Access to illiquid assets;

- Execution of very large trades.

That said, OTC is a relationship-driven business. Success requires diligence, legal structure, and careful risk management. When used strategically, OTC offers unparalleled efficiency and access across global financial markets.

FAQ

Is OTC the same as P2P?

They are similar but different in scale. P2P (peer-to-peer) usually means direct trades between individuals. OTC trading is for large, institutional-level trades, typically handled by a professional dealer.

Are OTC markets legal?

Yes, OTC markets are perfectly legal and are a vital part of the global financial system. They operate with less formal regulation compared to public exchanges.

What is a “block trade”?

A “block trade” is a single, large order to buy or sell an asset. These trades are done on the OTC market to avoid causing a big price swing on a public exchange.