Best Crypto to Buy Now: Guide for Investors

Sep 05, 2025

The crypto marketplace never rests — and in 2025, it’s abuzz more than ever. From the post-halving momentum of Bitcoin to the dominance of DeFi in Ethereum and the emergence of AI-driven tokens, investors are living through one of the most thrilling periods of digital assets. However, amid thousands of coins out there, selecting the best crypto to buy now is daunting.

This article sorts the signal from the noise and reveals to you the highest-performing cryptocurrencies to invest in right now, things to consider before investing, and savvy ways to hold to support long-term growth.

Key Takeaways

- Invest in cryptos that have robust fundamentals, practical use cases, and continued improvement.

- Diversify into Bitcoin, Ethereum, prospective altcoins, and stablecoins to mitigate risk and achieve high growth.

- Use careful strategies such as DCA and secure storage to protect long-term investments.

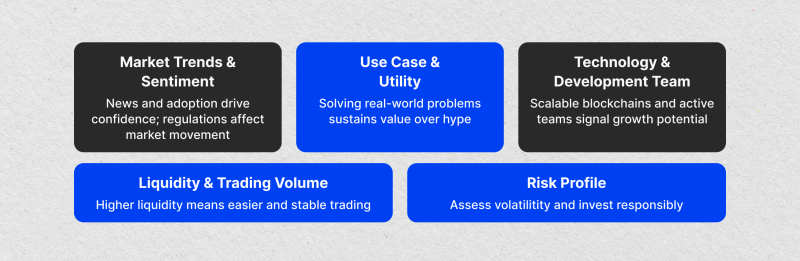

Key Factors to Consider Before Buying Crypto

Before investing in a crypto, more than hype and price charts should be considered. It is a vibrant and highly volatile space of cryptocurrencies, so prudent decisions are a result of diligent evaluation.

When considering market trends, practical application in the real world, technology, liquidity, and risk, investors are better equipped to differentiate projects having robust long-term potential and avoid losing ones.

Market Trends and Sentiment

The overall mood of the market has a significant impact on crypto prices. Good news, such as an essential partnership or a listing on a new exchange, frequently sends them upwards, but bad headlines may cause sell-offs.

Adoption is critical, too — when businesses, banks, or governments adopt a cryptocurrency, confidence usually improves. Ultimately, regulation cannot be discounted. State approvals, such as the U.S. Bitcoin ETF, may significantly alter the direction of the market.

Use Case and Utility

The value of a cryptocurrency in the long run depends on whether it brings actual solutions. Take, for example, the case of Ethereum, which facilitates the smart contracts behind DeFi and NFTs.

Projects are recalled because of particular strengths, such as the transaction speed upheld by Solana. Utility-less coins — typically meme coins — will unlikely sustain value when initial hype subsides.

Technology and Development Team

Strong tech and an active development team are crucial to a project’s sustenance. Scalable chains with low fees and fast speed are more likely to gain users. Projects that are regularly improving, such as Ethereum with its upscaling to ETH 2.0, demonstrate resilience and potential for growth.

No less important is the project team — seasoned, open teams are trustworthy, but nameless teams or inactive ones are cause for concern.

Liquidity and Trading Volume

Liquidity is defined as the ability to buy and sell a coin without affecting its value. More frequently traded coins per day are usually safer because more liquid coins are less susceptible to drastic cost changes.

Tokens listed on major exchanges, such as Binance or Coinbase, typically possess better liquidity and dependability than unknown coins.

Risk Profile

The cryptocurrency market is very volatile; thus, risk management is imperative. It can swing the prices either direction drastically, in the period of just a few hours, so invest an amount that you might very well be able to sacrifice.

Diversification into the likes of Bitcoin, Ethereum, altcoins, and stablecoins lowers exposure. Putting tough limits on the amount of funds that flow into crypto protects you against impulsive decisions when the markets fluctuate.

Fast Fact

After the 2024 Bitcoin halving, daily BTC issuance dropped to just 450 coins, making it scarcer than gold — and fueling investor demand.

Best Crypto to Buy Now — 2025 Picks

The 2025 cryptocurrency market is entering a new growth period that is fueled by the halving of Bitcoin, clearer regulation, and rising adoption in finance, DeFi, and NFTs.

Though there are thousands of cryptos out there, only a limited number impress due to robust fundamentals, practical real-world utility, and potential for long-term growth.

The following are the best cryptos to buy now, each offering a distinguished proposition to investors who are interested in balancing security, innovation, and potential future gains.

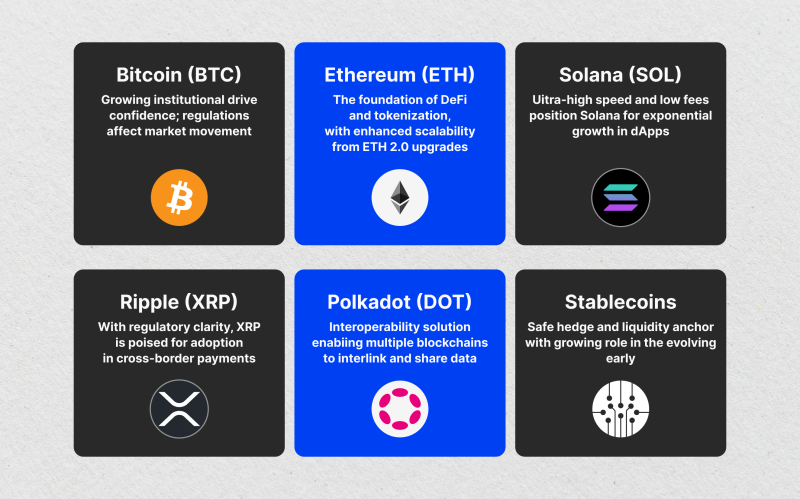

Bitcoin (BTC)

Bitcoin is still the uncontested champion of the cryptocurrency realm and has come to be dubbed “digital gold.” As the original and most secure distributed currency, it has become a store of value and an inflation hedge. When the halving of 2024 hit, the block reward was reduced, causing scarcity as institutional buying through Bitcoin ETFs and corporate holdings increased.

Now, BTC is no longer merely a speculative vehicle but a staple of financial holdings globally. When investors purchase Bitcoin now, it is a bet placed well in advance of a supply-driven equity bounce, with scarcity and growing institutional buying holding out promises of long-term growth.

Ethereum (ETH)

Ethereum is the backbone of decentralized finance (DeFi) and NFTs, powered by its groundbreaking smart contract technology. With Ethereum 2.0 upgrades, the network is now more scalable and energy-efficient, while staking has introduced new income opportunities.

Thousands of applications rely on Ethereum’s infrastructure, and innovations like rollups are further expanding its capacity. Investors buying ETH now are gaining exposure to the foundation of Web3, where demand for DeFi, tokenization, and decentralized apps continues to surge.

Its strong network effect makes Ethereum one of the best cryptos to buy now for engaging in long-term crypto investments.

Solana (SOL)

Solana has become one of the fastest and lowest-cost blockchains, generating interest among developers of DeFi, NFT, and gaming protocols. Although it faced early challenges with the network, the platform has become more stable and is experiencing exponential growth. Solana is making tremendous strides as a competitor to Ethereum in 2025, thanks to the scalability and cost efficiency it brings to the table.

SOL investors should consider investing in it today, as its ecosystem formation and usage by developers make it one of the high-performance decentralized app leaders, and prices remain relatively undervalued compared to Ethereum.

Ripple (XRP)

XRP is one of the best cryptos to buy now that has been made to enable cross-border transactions with velocity, as well as real-world usability for financial institutions. With years of uncertainty behind it, Ripple has achieved regulatory clarity, renewing excitement surrounding its native coin.

RippleNet also drives global settlement systems, allowing effortless transfers without the inconvenience of high gas prices or busy networks. As an investment, XRP offers early access to a blockchain-to-banking bridge, providing stability and future upside potential in the evolving landscape of cross-border finance.

Polkadot (DOT)

Polkadot is among the most innovative crypto coins, designed to solve interoperability through its parachain architecture. This decentralized platform allows multiple blockchains to interact, paving the way for the decentralized internet.

Its native token, DOT, secures governance and staking while supporting developer adoption. With increasing demand for cross-chain connectivity, Polkadot stands out for both long-term growth and future growth, making it one of the best cryptos to buy now.

Chainlink (LINK)

Chainlink drives the crypto economy by providing real-world data to smart contracts through decentralized oracles. Without its services, most DeFi platforms, insurance protocols, and tokenized asset solutions could not operate securely.

Chainlink is presently the market leader, broadly trusted and deployed. Purchasing LINK now offers investors access to an integral piece of blockchain infrastructure that will continue to become more critical as tokenization, DeFi, and smart contracts continue to grow throughout 2025 and beyond.

Avalanche (AVAX)

Avalanche is a scalable blockchain with near-instant finality of transactions and high throughput. It has emerged into prominence within DeFi, NFTs, games, and tokenizing real-world assets. As a result of its unique model of consensus, thousands of transactions occur per second, overcoming significant barriers to blockchain adoption.

As an investor, investment in AVAX today offers a chance to get onto a platform increasingly popular with institutions and developers because of its scalability, speed, and enterprise-grade infrastructure.

Stablecoins

Stablecoins are the backbone of the crypto economy, anchored to the U.S. dollar to minimize volatility. They are commonly employed in trading, payments, and hedging on market fluctuations and are now indispensable for liquidity across exchanges.

Stablecoins will sit at the center of connecting traditional and digital assets as the regulatory environment continues to evolve. Investors should own stablecoins today as a balanced component of a portfolio — providing safety amidst extreme volatility and the potential to quickly reposition to buy declines in other cryptos.

Emerging Altcoins Worth Watching

Whereas blue-chip coins such as Bitcoin and Ethereum hog the headlines as the best crypto to buy now, numerous low-cap altcoins are quietly gaining traction. Most of these projects are built around emerging technologies and new market niches, providing them greater growth potential—albeit at a higher risk.

Investors who are prepared to look below the top ten may want to consider the following categories of altcoins in 2025.

AI-Related Tokens

Blockchain and artificial intelligence are coming together to create robust Blockchain and artificial intelligence are converging to build resilient new ecosystems. Artificial intelligence tokens, like Fetch.ai (FET), SingularityNET (AGIX), and Ocean Protocol (OCEAN), are investigating deployments such as decentralized machine learning, AI exchanges, and commercialization of data.

As AI implementation keeps expanding globally, the integration of blockchain-AI decision-making projects may expand tremendously. Investors will be interested in keeping an eye on these tokens today because the demand for blockchain-driven AI implementations has only just started to emerge.

Gaming and Metaverse Coins

The metaverse and gaming industries continue to expand, converging entertainment and virtual ownership. Tokens like Axie Infinity (AXS), MANA, and The Sandbox (SAND) allow gamers to own game possessions, lands, and collectables in NFTs.

Even though metaverse mania was over in 2023, there has been renewed interest again in 2025, and most importantly, in mature gaming projects and mainstream acceptance. Early exposure to these tokens can prove to be worth it now that blockchain gaming is a multi-billion-dollar industry.

Real World Assets (RWA) Projects

Tokenizing real-world assets (RWA) such as property, bonds, or commodities has been one of the fastest innovations in crypto. Projects such as Centrifuge (CFG), MakerDAO (DAI), and Ondo Finance (ONDO) are leading the charge by interlinking conventional finance and blockchain-based ownership.

RWAs allow investors to trade otherwise traditionally non-liquid assets on-chain and offer global access to new investments. Investing in RWA-related tokens now offers investors early access to a potential trend that may transform the way assets are owned and traded around the world.

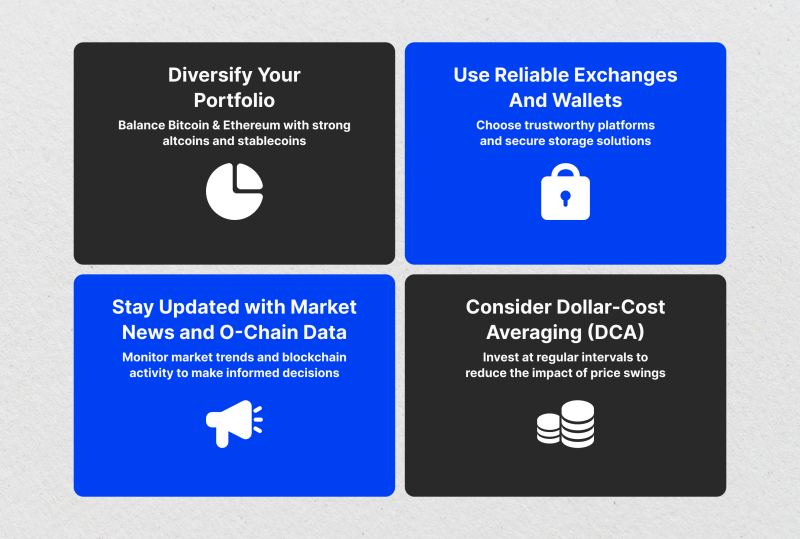

Tips for Buying and Holding Crypto

Purchasing crypto is just the beginning, while persistent holding is where long-term profitability lies. In such a volatile market, investors must balance opportunity with risk tolerance and use proven strategies that tie up funds securely while maximizing profits.

Strong knowledge of blockchain technology and evolving trends in the crypto sector is essential to navigate effectively.

The following are the guidelines to build a secure, diversified, and disciplined crypto investment strategy.

Diversify Your Portfolio

A secure approach begins with diversification. Allocating capital across blue-chip coins like Bitcoin and Ethereum, plus selected altcoins with high market cap growth potential, ensures exposure to both stability and innovation.

Adding stablecoins provides liquidity and protection. Including projects built on advanced smart contracts and decentralized applications helps capture upside in future blockchain platform adoption. This strategy reduces single-asset risk and identifies the best crypto to hold for long-term growth.

Utilize Reliable Exchanges and Wallets

Security is fundamental. Investors should rely on reputable crypto exchanges such as Binance, Coinbase, or Kraken, and store digital assets in trusted hardware wallets like Ledger or Trezor.

This ensures holdings in the best crypto are protected against fraud. Avoiding insecure platforms safeguards exposure to smart contract vulnerabilities while maintaining control over valuable coins.

Stay Updated with Market News and On-Chain Data

Blockchain infrastructure is robust, yet market momentum can swing rapidly with regulations, technology enhancements, and joint ventures. Keeping up with sound news, analytics, and trade data ensures timely moves.

On-chain examination of smart contracts, wallet flows, and volume of transactions illuminates which digital coins and top crypto projects are picking up steam. Through that realization, investors can predict the trend rather than arriving late on the scene.

Consider Dollar-Cost Averaging (DCA)

Timing markets is virtually impossible, even for pros. Dollar-cost averaging (DCA) allows for the gradual accumulation of superior cryptocurrencies by investing regular amounts over time, thereby lowering exposure and stress. It smooths out entry points, honors risk tolerance, and takes advantage of the smart contracts capabilities that lie at the basis of scalable ecosystems.

Focusing on long-term, disciplined accumulation, investors can secure investments in promising projects that offer low-cost transactions, innovation, and high market capitalization development potential.

Conclusion

The crypto market of 2025 is both up-and-coming and highly risky, and emphasizes the importance of planning and restraint more than ever. Ranking the best cryptos to buy now, all advocates for diversification and cite tried-and-true coins such as Bitcoin and Ether as foundational coins, along with high-potential tokens like Solana and Avalanche.

Remember, the actual prosperity of the sector depends on diversification, discipline, and ongoing research. Where the markets advance, the better investments will be those projects that combine security, creativity, and high opportunities for expansion.

To stay ahead of the curve, one must seek out these opportunities early and place one’s plan at the forefront of the widespread adoption that is reshaping the financial world.

FAQ

Which is the current best crypto to buy now in 2025?

Bitcoin and Ethereum are still first-choice investments, but Solana, XRP, and some altcoins are attractive alternatives.

Are altcoins riskier than Bitcoin?

Yes. Altcoins are usually more volatile but can potentially deliver greater growth when picked judiciously.

Should I buy crypto all at once or gradually?

Using dollar-cost averaging (DCA) is a safer way to invest steadily without timing the market.

Are stablecoins a good investment?

Stablecoins are not for growth but are critical for liquidity, security, and mitigating market volatility.

How do I secure my crypto investments?

Only use reputable exchanges, transfer funds to secure wallets, and always turn on two-factor authentication.