How to Get a Crypto Exchange License?

Sep 26, 2025

Launching a crypto exchange is more than writing code and enticing traders—it’s establishing trust and credibility. The source of that credibility is an appropriate crypto license. In the ever-fluid financial world of the present day, licensing is no longer a chore but a point of differentiation.

It earns you entrance into the banking system, investors, and foreign markets, and prevents your crypto business from fines and blemishes on your brand. To make it through the long run, obtaining the right license is not a luxury—it’s a necessity.

Key Takeaways

- Crypto license shields one from penalties and increases trust among investors.

- Forum selection affects costs, compliance, and market entry.

- Comprehensive AML/KYC policies and a clear business model are needed.

Why You Need a Crypto Exchange License?

Opening a crypto exchange without proper licensing can be seen as a shortcut, but it actually puts the company at great risk. Licensing is more than just a formality of regulation — it is a pillar of credibility, trust, and future-proof prosperity.

Below are several reasons why you should have a license for a crypto exchange:

Legal Protection and Penalty Avoidance

Licensing provides your exchange with a legitimate framework within which it can operate, detailing what you can and can’t do and under what conditions. This protects you from “unlicensed conduct” charges and lowers the probability you will find yourself subject to fines, forced closure, or even felony liability.

When you’re correctly licensed, you can demonstrate sufficient governance, compliance monitoring, and risk management, and there will be fewer grounds for the regulator to intervene. A license is both a safeguard against penalties and a beacon for compliance with the law.

Gaining Customer and Investor Trust

Trust is one of the crypto world’s most valuable commodities, and a license goes a significant way toward building it. Regulation tells both retail users and institutions that your exchange passed scrutiny for ownership, financial stability, and compliance methods.

Users are more willing to fund more and stay longer, and investors and partners see licensing as an indication of maturity and longevity potential. Showing your license and stand-alone audits proves credibility that can’t be bought with marketing dollars alone.

Bank and Liquidity Provider Collaborations

Not many banks, payment handlers, and sources of liquidity will even consider the possibility of signing up an unlicensed exchange. Licenses provide you with the lifeblood partnerships that allow you to offer frictionless fiat rails, card payments, and deep pools of liquidity.

Such connections are invaluable for maintaining healthy spreads, facilitating faster settlement, and ensuring stable marketplace operations. Without proper licensing, your exchange is at risk of being left out of the financial architecture for growth.

Long-term Sustainability and Global Recognition

Licensed exchanges are far better positioned to ride through law change, make incursions into new jurisdictions, and establish themselves over the longer term with repeat customers.

Having the right compliance foundation also enables acquisition offers or investment financing, since the investors view the businesses as lower risk. In the longer term, your license is your competitive advantage that gives you the ability to grow consistently and make your impact felt across global markets.

Fast Fact

Estonia once issued thousands of cryptocurrency licenses, but since it strengthened its regulations in 2023, it has revoked nearly 90% of them.

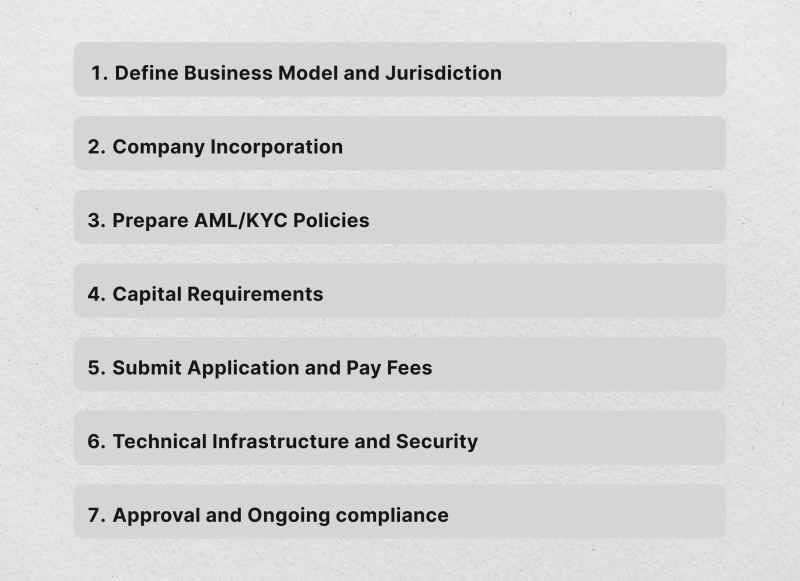

Steps to Obtain a Crypto Exchange License

Acquiring a crypto license is a process fundamental to any crypto company that wishes to do business legally and garner credibility. It’s more than just the paperwork; it is the clear business model, sound compliance policies, and the proper jurisdiction selection.

Below are the basic steps any crypto company should undergo to be licensed and compliant with global regulations.

Step 1 – Define Business Model and Jurisdiction

Any crypto firm’s beginning point is a simple business model. You first need to decide if your platform will be a decentralized or a hybrid model, or a centralized crypto exchange, before you apply for a crypto exchange license. Will you allow fiat on/off ramps, or only crypto asset activities such as spot trading, derivatives, or security tokens?

Also, decide where you wish to procure a license. There are different opportunities available within the other financial sector jurisdictions. The United Kingdom is becoming desirable due to its systematic framework and the potential for a United Kingdom crypto license.

Lithuania and Estonia, European Union members, are also becoming desirable due to their potential to reach the European Union market and attractive corporate tax rates. Alternative hubs, such as Dubai, Singapore, or Hong Kong, offer promising options for cryptocurrency companies.

Choosing the proper jurisdiction dictates your future compliance needs, your corporate income tax risk, and your ability to promote your services globally.

Step 2 – Company Incorporation

When you’ve decided upon the jurisdiction, you need to complete company registration and form a legal entity. You draft corporate document preparation kits, such as Articles of Association, shareholder agreements, and director details.

The controlling body will scrutinize your registered legal company address, conduct executive background checks (criminal record checks), and verify that your crypto company is stable and sound on the legal framework side.

A valid legal address shall make the exchange, duly formed as a crypto license company, eligible to provide crypto services within the limits of the law.

Step 3 – Prepare AML/KYC Policies

A prerequisite for the licensing process is the development of detailed anti-money laundering (AML) and counter-terrorist financing (CTF) policies. Worldwide regulating entities expect stringent compliance with anti-money laundering regulations and the FATF recommendations.

Part of your business plan should be information regarding how you verify customer identity, monitor crypto transactions, and prevent terrorist financing. Taking on the recruitment of a compliance officer or the employment of a Money Laundering Reporting Officer (MLRO) is often required.

This ensures your exchange maintains ongoing regulation compliance by ensuring the platform is not used for unlawful cryptocurrency transactions.

Step 4 – Capital Requirements

To remain solvent, the vast majority of jurisdictions require a minimum amount of paid-up capital gains tax. In the country, the figure can be a small amount or a substantial amount of reserves, ranging from a few thousand dollars to hundreds of thousands of dollars.

Proof of funds is carried out at the time of licensing, and evidence of the availability of your crypto business for prudent operation, settlement of significant amounts of crypto transactions, and adequate protection for the consumers.

Step 5 – Submit Application and Pay Fees

Having completed your company registration, AML/CTF policies, and your business plan, the final step is formally presenting the application to the regulatory authorities.

The application provides comprehensive support for full corporate documents, accounts, and company model information. The scrutiny of applications by the regulatory authorities normally takes three to twelve months, depending on the jurisdiction where you are starting your crypto company.

Filing fees for the application and government fees should also be remitted. A UK crypto exchange license, for example, is associated with stringent compliance with regulatory standards under the Financial Conduct Authority, which is responsible for crypto regulation within the United Kingdom.

Step 6 – Technical Infrastructure and Security

Technology is one of the players involved in the approval process. You need to demonstrate to the regulators that your crypto exchange operates on stable, dependable infrastructure.

This entails separate security audits, crypto asset custody solutions, and monitoring/reporting solutions that can detect and notify suspicious crypto asset use. Most jurisdictions also require enterprise-grade cold storage use, insurance coverage, and compliance software use for the safeguarding of cryptocurrency businesses from scams and hacks.

Demonstrating an ability to support cryptocurrencies with proper payment services integration, an electronic money institution license, or an electronic money handling ability strengthens the argument for approval.

Step 7 – Approval and Ongoing Compliance

The acquisition of the license is not the endpoint, but the beginning of the process of constant monitoring. Licensed exchanges are governed as virtual asset service providers and are monitored for their ongoing alignment with the standards of the framework of regulation.

This entails conducting systematic checks, utilizing the latest AML/KYC efficiency reports, and ensuring compliance with changes in the regulatory landscape. Licensed companies are obliged to submit regular compliance reports, pay for renewal, and be compatible with evolving crypto regulation policy.

Regular compliance for a crypto-licensed company affords it banking access, scalability beyond borders, and the status of an established operator within crypto markets.

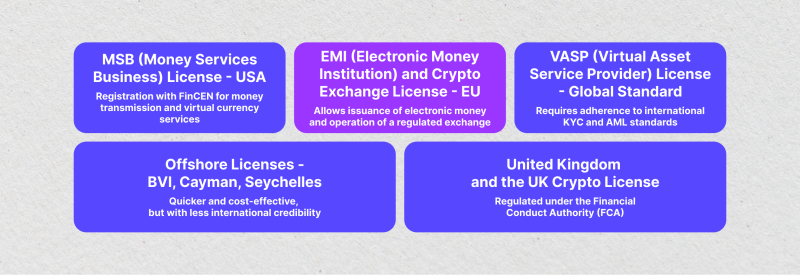

Principal Types of Crypto Exchange Licenses

When setting up a crypto firm, one of the most significant decisions you will make is the kind of crypto exchange license for your firm. Crypto asset businesses are governed differently from jurisdiction to jurisdiction. The ideal license for you will depend on your company model, target, and your firm’s long-term ambitions outlined within your company plan.

The most common license types for a crypto firm are presented below.

MSB (Money Services Business) License – USA

In the United States, exchanges must register at times as Money Services Business (MSB) with FinCEN. This form of license treats the platform as a financial organization involved in money transmission and virtual currency transactions.

An MSB license comes with stringent anti-money laundering procedures, counter-terrorist financing shielding, and regular reporting to the oversight governing body.

The benefit is that it gives your firm credibility within the largest global economy and access to an advanced financial marketplace. However, the intertwining of federal and state regulations creates complexity, and the option is thus better suited for projects that are well-financed and have an established compliance strategy built into the business plan.

EMI (Electronic Money Institution) and Crypto Exchange License – EU

In the European Union, exchanges are usually granted authorization as an Electronic Money Institution (EMI) or make a dedicated crypto exchange license application directly. This gives an entity the right to issue electronic money, process fiat rails, and operate a regulated exchange.

The licensing process involves stringent company registration, proof of a registered legal company address, and strict adherence to anti-money laundering compliance.

Although the requirements are burdensome—regular audits, detailed reporting, and thresholds of capital—the reward is entry into the entire EU market. As an emerging crypto business, it provides both credibility and scale.

VASP (Virtual Asset Service Provider) License – Global Standard

FATF created the Virtual Asset Service Provider (VASP) definition for the purpose of harmonizing worldwide regulation. The VASP license requires exchanges to adopt worldwide best practices for KYC, AML, and monitoring crypto asset activities.

Despite the considerable compliance costs, the payoff is simplification of cross-border expansion. To the holder of a crypto license, VASP status is a signal to the banking sector, investors, and collaborations that the exchange is serious about compliance with rules and is willing to operate under an open regime of regulation.

Offshore Licenses – BVI, Cayman, Seychelles

Others favor offshoring destinations such as the Seychelles, British Virgin Islands, or Cayman Islands. These licenses are typically quicker and more affordable, making them appealing for startups that wish to experiment with a different business model.

The compromise results in reduced international credibility and increased difficulty in securing banking partners. Offshore clearances can be a convenience in the cryptocurrency marketplace, but they may not be acceptable for institutional customers or authorities in prime financial centers such as the EU or the United Kingdom.

MENA and Asia Examples – Dubai VARA, Singapore MAS, Hong Kong SFC

In Asia and the Middle East, regulators are busy setting up frameworks that attract cryptocurrencies. Dubai’s VARA, Singapore’s MAS, and the SFC of Hong Kong all provide transparent structures that strike a balance between innovation and tight controls.

These regimes prioritize issues of money laundering and counter-terrorist financing compliance heavily, with a need for platforms to demonstrate technical robustness, AML policies, and reporting facilities.

Exchanges willing to comply with these standards are rewarded with the ability to tap into some of the globe’s quickest-growing markets, underpinned by a sound system of law and a forward-thinking regulatory framework.

United Kingdom and the UK Crypto License

The United Kingdom proved itself as one of the leading jurisdictions through the offer of a United Kingdom crypto license under the Financial Conduct Authority (FCA).

Any exchange first must establish a legal entity, possess an appropriate compliance framework, and show an ability to combat money laundering and terrorist financing.

Even though the FCA is known for tight control and detailed reporting requirements, it boosts the credibility of a firm once it possesses an FCA license. It also provides it with an advantage when it enters Europe and

Also, because investors and prospective partners anticipate that the FCA is monitoring them, as an emerging crypto company, the UK offers good recognition, along with relatively predictable corporate income tax exposure.

Costs Involved in Licensing

Acquiring a crypto license is costly and investment-heavy, and the fees vary depending on jurisdiction, license type, and your license model.

Government Application and Registration Fees

Official fees are remitted by the regulating body for them to check your legal entity and process company incorporation. They can be a few thousand dollars for small territories, up to the high tens of thousands for markets like the United Kingdom or the US.

General Counsel Fees

Professional help is essential. Lawyers and advisors assist with company documents, compliance policies, and risk assessments related to money laundering. Though expensive, it reduces the risk of refusal at the license stage.

Compliance Staff and Software

Licensed exchanges must employ compliance officers and implement monitoring software for the flow of cryptocurrencies, for the prevention of terrorist financing, and for anti-money laundering compliance purposes. Salaries and subscriptions for the software are a recurring cost element.

Estimated Total Cost Range

Overall fees can start at around $30,000 in offshore centres, $100,000–$250,000 in the EU, and exceed $500,000 in the most prominent markets, such as the US or the United Kingdom.

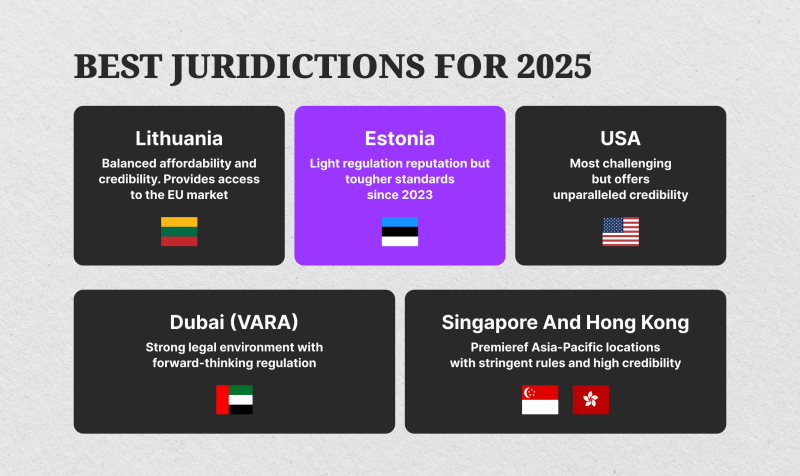

Best Jurisdictions for 2025

When you’re looking for a crypto exchange license, the choice of jurisdiction is just as important as the licensing process itself. Any nation has its licensing regime, fees, and recurring benefits for a crypto player.

Below, you can see the most promising crypto jurisdictions for 2025.

Lithuania

Lithuania is one of the leading destinations for European company registration, achieving the right balance of affordability and credibility. With the purchase of a crypto exchange license or just a license for an electronic money institution, a crypto firm can access the entire extent of the EU market.

The rules include proper anti-money laundering checks, compliance officers, and a registered company’s legal address, but are otherwise simpler than those of other European Union states.

Lithuania offers a favourable company environment and recognition from European regulatory authorities, making it an excellent alternative for startups with a scalable business model.

Estonia

Estonia was the most pursued European jurisdiction for a crypto license because it offered speedy setup and light regulation. Since 2023, the government has established more stringent standards for addressing the risks of money laundering and terrorist financing.

In the contemporary world, applicants for a license require more capital, a tangible office, and increased reporting to the host nation’s regulator. Although it has raised the complexity of the license process, a crypto exchange license in Estonia continues to command good recognition in the financial markets, provided the company is prepared and able to meet the strict regulatory compliance requirements.

USA

The United States is one of the toughest and most honourable jurisdictions for obtaining a crypto license. Exchanges prefer registering as Money Services Businesses (MSBs) and, in the vast majority of cases, need to obtain state authorisations as well. The process involves extensive background checks, clear-cut business models, and comprehensive anti-money laundering programs.

Although advisory and legal fees are amongst the highest in the world, a US license provides unmatched credibility. It means a crypto-licensed firm is capable and willing to operate under the strongest regulatory regimes and is attractive to institutional investors and scale-up alliance partners.

Dubai (VARA)

Dubai has become an international hub for crypto asset businesses through its Virtual Asset Regulatory Authority (VARA). The clarity and stability of the city’s legal environment, combined with forward-thinking regulations, make it highly appealing for both existing and emerging crypto businesses.

Licensing regulations cover anti-money laundering, counter-terrorist financing, and operational resilience. Although fees are sensible compared to the US or UK, the status of the Dubai crypto exchange license is quickly rising, especially for firms that want to expand across the Middle East region.

Singapore and Hong Kong

Both Singapore and Hong Kong are premier locations for crypto businesses in the Asia-Pacific region. In Singapore, exchanges are regulated and require a license from the Monetary Authority (MAS) under the Payment Services Act, with stringent AML/CTF rules. In Hong Kong, the Securities and Futures Commission (SFC) licenses exchanges that deal in crypto instruments such as security tokens.

Both locations offer access to deep capital markets, international investors, and a thriving financial system. Licensing is rigorous and costly, but the credibility it provides is invaluable. In the situation for an Asian crypto company seeking sustainable development, the locations offer credibility, innovation, and competent consumer protection.

Conclusion

In the era of increasingly stringent regulations and investors demanding transparency, the crypto exchange license is the gateway to sustainable growth. Whichever you choose, Lithuania for European entry, the United Kingdom for prestige, or Dubai for innovations, your license unlocks global credibility.

Thorough preparation of the business plan, sound compliance system, and careful choice of the jurisdiction will make your exchange stand out, not just barely make it through, in the coming years and the years beyond 2025.

FAQ

How long does it take to acquire a crypto exchange license?

The vast majority of states take 3–12 months, depending on the form complexity.

What country is best suited for a crypto license?

That is up to your goals. Lithuania and Estonia are friendly to the EU, the USA adds prestige, Dubai is becoming a center, and the Labuan crypto exchange license offers an easy entry.

How much does a crypto license cost?

Prices vary from around $30,000 for offshore centers up to more than $500,000 for the US or UK.