Investing in Currencies That Are More Valuable Than the American Dollar

Feb 20, 2023

Today, investment activities attract numerous people who, in the pursuit of high profits, want to find the holy grail of investing and earn interest from trading in various financial instruments. One of the most popular tools for investment is currency, which acts as a guarantor of financial stability, not only within a particular state but also within the investment. The most popular currency for investment is the U.S. dollar, but several other alternatives are ideal for investing and making a profit.

This article will talk about the top most popular currencies for investment that are more valuable than the U.S. dollar and reveal the range of capital markets where you can invest in various currencies to enrich your investment portfolio. In addition, we will look into the future and try to predict the prospects of the U.S. dollar as the strongest currency in the world.

Top Currencies for Investing that Are More Valuable Than the American Dollar

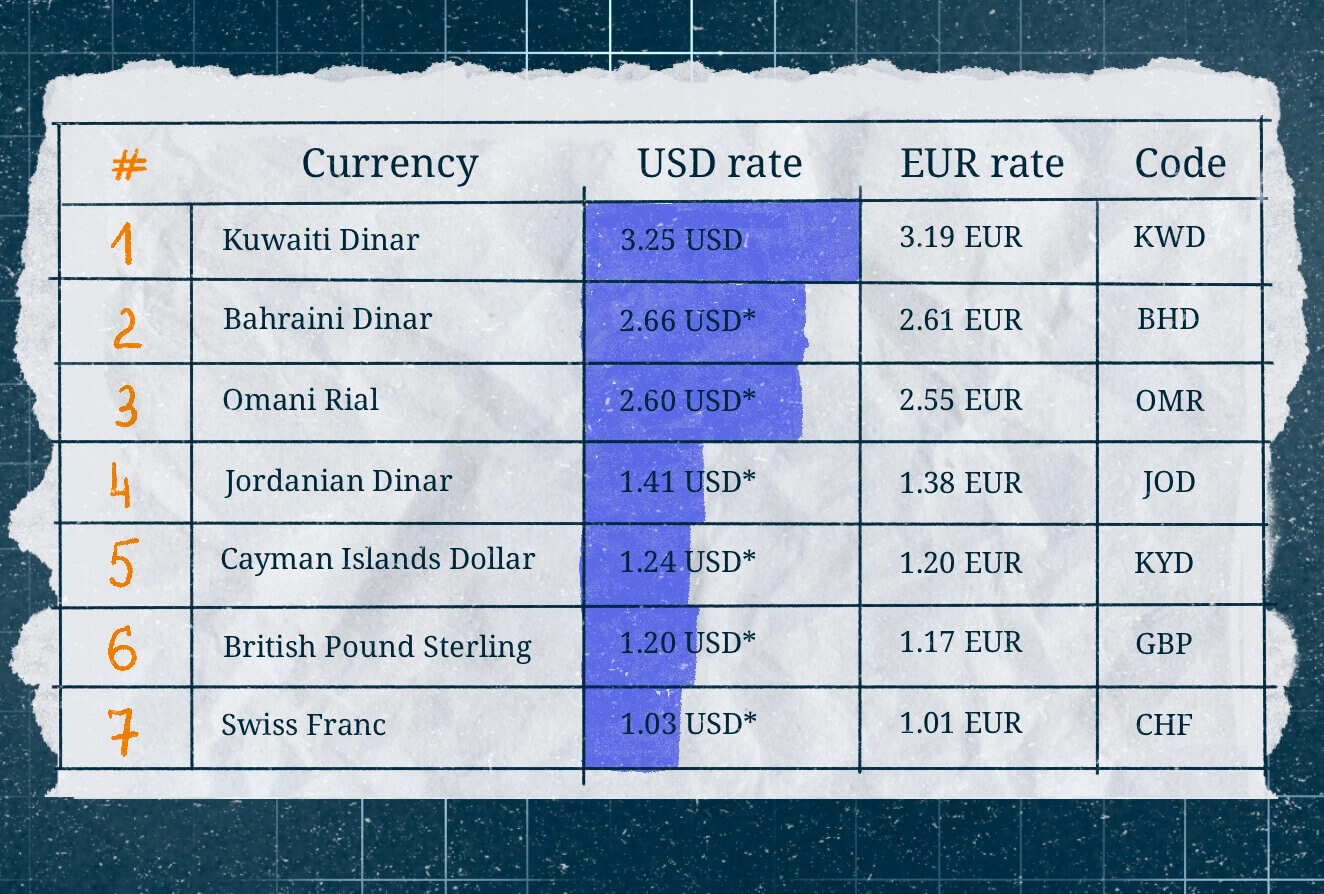

There are 197 nations in the world today, each with its own currency, but when it comes to investing in them, not every foreign currency is worthy of consideration. There are currencies that are worth much more than the U.S. dollar and therefore are of particular interest rates to the investing world. Let us look at a number of foreign currencies that are worth more than the U.S. dollar and are worth investing money in.

1) Kuwaiti Dinar: 1 KWD = 3.27 USD

The Kuwaiti dinar is the most expensive currency in the world. Initially, the Kuwaiti dinar was equal to the British pound sterling at a ratio of 0.857:1. After the introduction of a floating exchange rate of the pound sterling in 1972, the parity of the Kuwaiti dinar with the British currency was abolished. In 1975, after several devaluations of the U.S. dollar against the Kuwaiti dinar, parity with the U.S. currency was also abolished. Until 2003 the exchange rate of the Kuwaiti dinar was pegged to a basket of currencies of major trading partners. Then, from January 5, 2003, to May 20, 2007, the Kuwaiti dinar was pegged to the U.S. dollar in the proportion of 1:0.3 with a currency exchange rate fluctuation range ± 3.5%. Since then, the exchange rate of the Kuwaiti dinar to the U.S. dollar has remained stable at the same level.

2)Bahraini Dinar: 1 BHD = 2.66 USD

Until April 28, 1959, the Indian rupee was in circulation, in addition to British sovereigns and the Thaler of Maria Theresa, until it was replaced by the Persian Gulf rupee issued for the Gulf countries. The Persian Gulf rupee was pegged to the Indian rupee. When the Indian rupee depreciated in 1965, so did the value of the Gulf rupee. After that, the Bahraini government decided to introduce its own currency.

The Bahraini dinar was put into circulation on October 11, 1965, replacing the Persian Gulf rupee at the rate of 10 rupees = 1 dinar. The following year, the Bahraini dinar became the monetary unit of the Principality of Abu Dhabi until it was replaced by the UAE dirham in 1973. The issue of Bahraini currency was first carried out by the Bahrain Currency Board (from 1964 to 1973) and then by the Bahrain Currency Agency (from 1973), which was renamed the Central Bank of Bahrain in 2006. The dinar is pegged to the U.S. dollar, and against other major currencies, the dinar fluctuates in sync with the dollar.

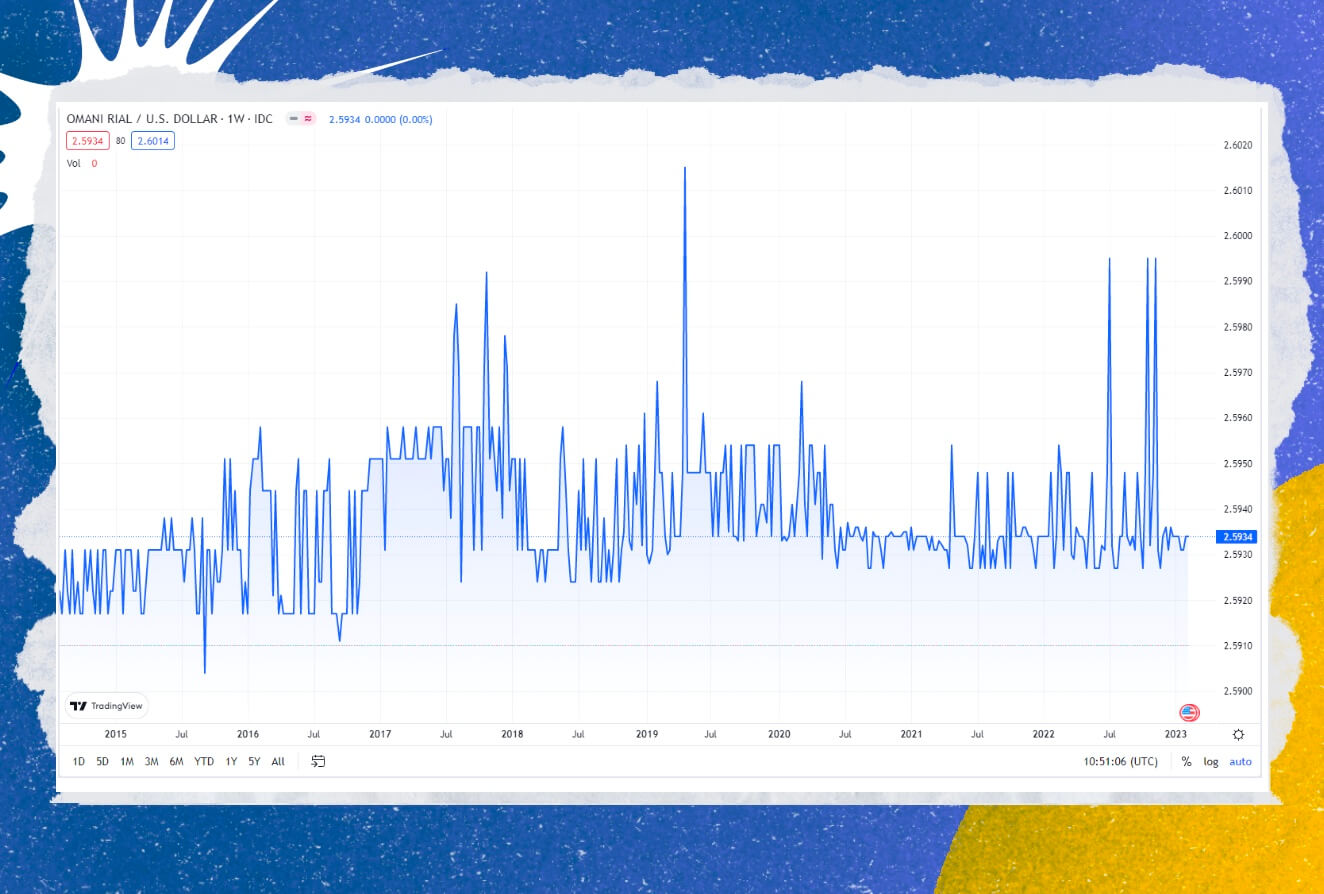

3) Omani Rial: 1 OMR = 2.60 USD

The Omani rial is the official currency of the Sultanate of Oman and is the third most valuable currency than the U.S. dollar. The Omani Rial (OMR) has maintained its value against the U.S. dollar due to Oman's traditionally tight monetary policies and financial restrictions. The OMR peg has remained at $2.60 since the last adjustment in 1986. Omani politicians have traditionally regulated the money supply to protect their country from frequent military conflicts and turmoil in the Middle East. As a result, the currency appreciates, and credit constraints favor offshore ventures and high-risk Forex trading initiatives.

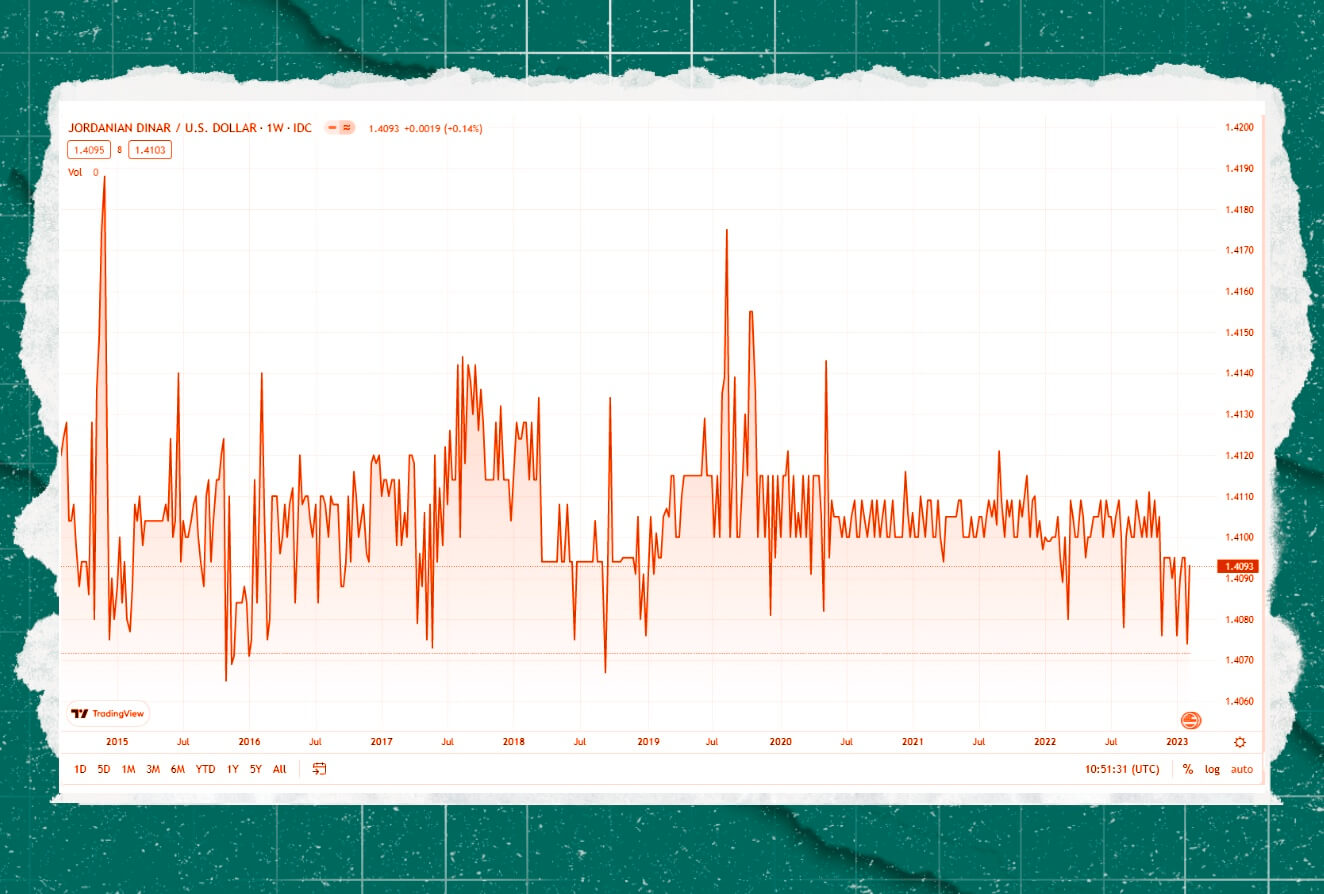

4) Jordanian Dinar: 1 JOD = 1.41 USD

As one of the emerging markets, Jordan has limited oil, gas, and coal reserves, so the primary source of income is the export of phosphate and foreign loans. The Jordanian dinar has a fixed exchange rate, which is pegged to the U.S. dollar and does not depend on the activities of the national Central Bank. This allows the exchange rate to remain steadily expensive and independent of the state of the economy, which ultimately helps avoid currency fluctuations. JOD has a higher value than U.S. dollars, although the Jordanian currency has been pegged to USD since 1995. This was done to preserve the stability of JOD and to attract U.S. investment.

5) British Pound Sterling: 1 GBP = 1.25 USD

The pound is also on the list of the world's most expensive currencies. For decades, the Bank of England (BOE) has kept up with global trends by maintaining a higher value for the pound than the U.S. dollar. The British national currency (GBP) was worth more than the U.S. dollar for most of the 20th century. In the 1980s, the economic situation changed, and the pound fell in value, but then the GBP regained its former advantage over the U.S. dollar.

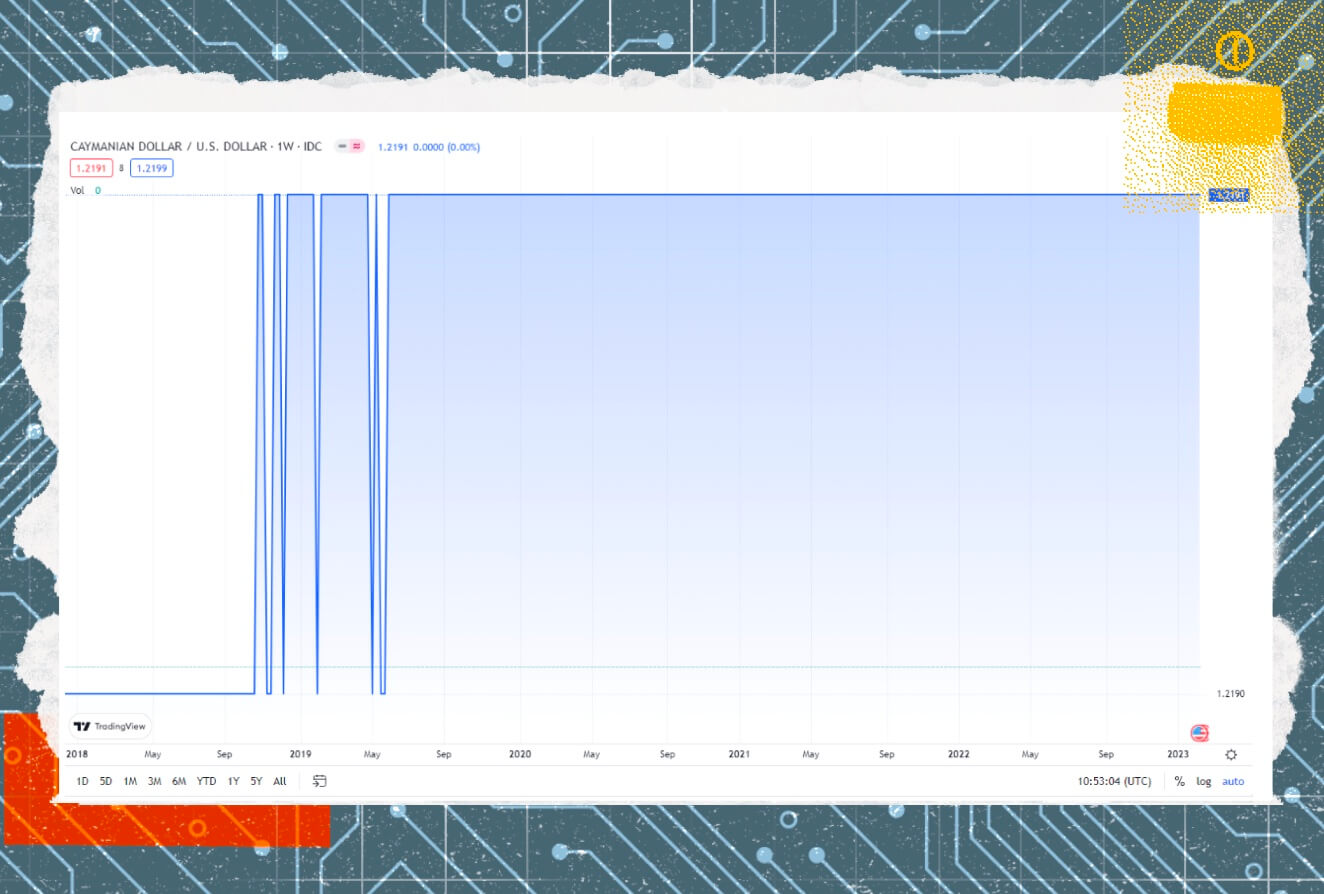

6) Cayman Islands Dollar: 1 KYD = 1.20 USD

It may seem easy to issue a currency superior to the U.S. dollar, but it is more complicated than it looks. From 1974 to 2013, the Cayman Islands dollar exchange rate was pegged to the U.S. dollar at a ratio of 1 KYD = $1.20. Since 2013, the dollar's exchange rate has mainly depended on the decisions of the island's governor. Such a currency peg is difficult to maintain in the face of a dysfunctional local economy and rising interest exchange rates from the U.S. The country's status as a tax haven for wealthy investors supports the value of the Cayman Islands dollar.

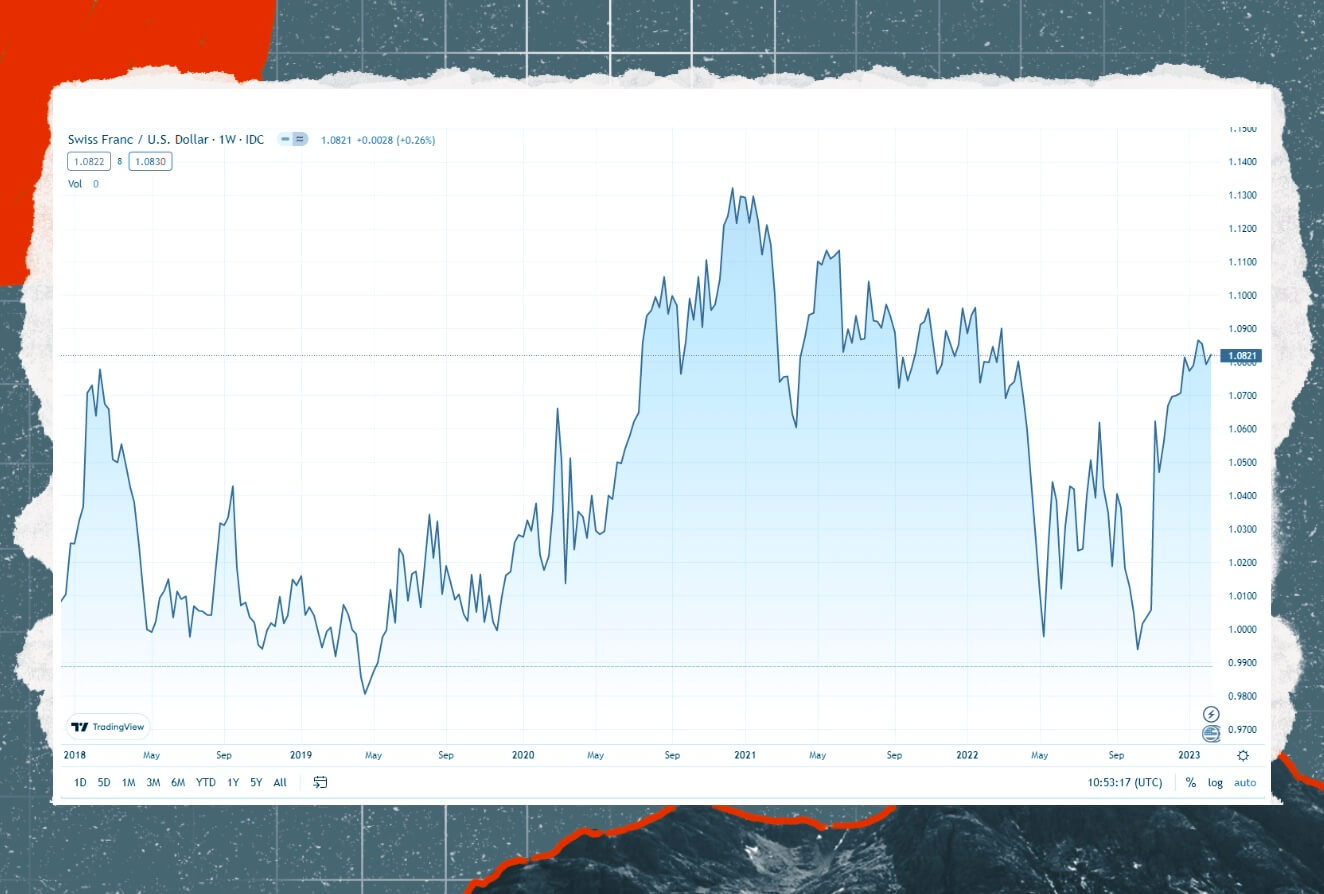

7) Swiss Franc: 1 CHF = 1.08 USD

The franc rose against the euro and the U.S. dollar due to the European debt crisis and U.S. monetary policy. In 2015, the Swiss National Bank announced that the franc was no longer pegged to the euro. The euro is often accepted as legal tender in Switzerland, but change is only given in Swiss francs. In 2008, when the financial crisis began, many investors chose CHF as an investment. The CHF is a very stable and strong currency. This fact allowed it to get the status of the rescue asset that everyone needed - this investment has consistently brought profits even during global crises.

KEY TAKEAWAYS

To date, the U.S. dollar is the most popular and strongest currency that is quoted throughout the world.

The investment strategy should take into account that a more valuable foreign currency does not always indicate that the foreign economy is bigger or stronger.

Although you can invest in currency mainly in the stock market, you can also own it in the crypto and foreign exchange markets, which would profit from the difference between the buying and selling prices.

Types of Capital Markets to Invest in Currency

Since their inception, foreign exchange markets have been a critical economically isolated link that is one of the most essential elements not only of an investment nature, but is also of enormous importance for the world's financial system. The Forex market is the most liquid market where it is possible to carry out operations on investment (or exchange) of currency, but there are other markets.

Stock Market

A stock exchange is a place of organized trade in securities with control of the participants. Every transaction made between participants is subject to registration. The issue of attracting additional financing for business and production development is resolved for legal entities through the stock exchange. Individuals have the opportunity to profit from the growth in the value of assets, the most popular of which are currencies, shares, bonds, funds, and so on.

To date, there are some stock exchanges, trading on which is convenient and safe, and the variability of the financial instruments provided for trading is fantastic for investors. The New York Stock Exchange (NYSE) is the largest stock exchange, and is located in New York, USA. It is followed by the National Association of Securities Dealers Automated Quotation (NASDAQ), the second most popular stock exchange, which is also based in the US. As a result of the merger of the two largest exchanges in Japan (the Osaka Securities Exchange and the Tokyo Stock Exchange), the third-largest trading platform in the world, the Japan Exchange Group, was formed, which began its work in 2013.

Currency Market

Initially, the currency exchange was a global exchange. Countries and state corporations made transactions to exchange national currencies for paying for exports and imports. Modern currency exchange includes much more than just currency exchange. Now you can trade stocks, metals, oil, and even cryptocurrencies here.

The Forex market is the only global exchange that operates 24 hours a day and simultaneously the largest market, involving a colossal volume of currency trading. However, the number of trading instruments available in this market is relatively limited. There is only a limited number of currency pairs that are freely traded.

Crypto Market

The daily volume of transactions in the cryptocurrency market is about $100 billion. Of course, this is not so much compared to $5.3 trillion in the foreign exchange market. However, $100 billion is still a very high capitalization indicator, which is not easy to achieve. Despite over-the-counter trading for cryptocurrencies, exchanges remain the most popular place to trade Bitcoin and other cryptocurrencies.

On many crypto exchanges, there are wallets that allow you to store many world currencies as well as trade them. Having, for example, Euro in their account, investors can sell them in the P2P trading system at a certain rate and thereby profit from the difference between the purchase price and the sale price.

FAST FACT

According to a statement from the U.S. Federal Reserve Bank, in August 2022, the euro to U.S. dollar exchange rate was 1 to 1 for the first time in nearly two decades, when the European currency was just emerging.

Prospects for the U.S. Dollar as the World's Strongest Currency

Today, the US dollar is not only the primary means of payment in international trade, but also of accumulation, so the end of this currency's era is still a long way off. Most of the predictions about the loss of its status as the world's reserve currency due to the slowing U.S. economy and uncontrolled money supply growth will not come true in the near future. The U.S. currency, criticized from all sides, became a safe haven for investors worldwide during the crisis.

When studying the dollar's position in the global monetary and financial system, the problem of its exchange rate to other currencies inevitably arises. In 1981-1984, the currency gained 58% against 10 major currencies. It dominated even when there were significant changes in its exchange rate, both upward and downward. By the end of the 1980s, it had fallen back to the initial values of the beginning of the decade. Meanwhile, such significant fluctuations have prevented the dollar from losing its position.

The dramatic fall of the exchange rate in 2005-2007, caused to a great extent by the American policy of its artificial undervaluation, did not result in any change in the dollar's status in the world market. On the contrary, it has strengthened and broadened them against an active form of the global financial market. The easing of the monetary policy of the Federal Reserve System in early 2008 provoked its further devaluation against the currencies of most countries. However, it started to strengthen after the dollar exchange rate approached $1.6 per euro in the second quarter of 2008. Overall, during 2009, the dollar strengthened against the euro by more than 20%. Some factors that influenced the exchange rate trend were the decrease in the US balance of payments, current account deficit, and recession in the euro area economy.

The Republic of Korea, Turkey, India, and Brazil experienced a significant weakening of their currency values. The change in financial flows due to the desire of investors to minimize their risks strengthened the dollar and, at the same time, led to the outflow of capital from countries with developing financial markets, which entailed a sharp decline in their currencies. All of this again confirms that there is no real alternative to the U.S. currency. The strength of its position will depend on the ability of the U.S. to maintain its leadership position in the global economy and ensure that its currency is reliable and attractive for the participants of the global economy.

Conclusion

It must be said that investing is an excellent tool not only to diversify your investment activities, but also to diversify your investment portfolio. The U.S. dollar has historically always been of value as the strongest currency in the world and as an excellent investment tool. On the other hand, there are other currencies that have greater value and can also act as protective assets, claiming in the future to be the strongest currency in the world financial system instead of the U.S. dollar.