Credit Cards vs. Debit Cards

June 1, 2023

In today’s digital era, online transactions have become an integral part of our daily purchases. The use of cash has significantly declined as we increasingly rely on card-based transfers. Let’s face it, carrying cash can be inconvenient.

That’s why credit and debit cards have emerged as the preferred choices for most individuals. These two options share many similarities and have become an essential part of our everyday lives.

For instance, both have 16-digit numbers, expiration dates and are equipped with magnetic strips and EMV chips. They’re handy for shopping, both in physical stores and online. However, the way they work is fundamentally different.

When you use a debit card, you’re spending money that you’ve already put into your bank account. It’s like an electronic version of cash or a check. But when you use a credit card, you’re borrowing money from the card’s provider, up to a certain limit, to buy things or get cash out.

Most people carry both a credit card and a debit card. They’re useful and offer some protection against loss or theft. But these two cards work differently, which can significantly impact your finances. It’s important to know which one to use for different types of spending, so let’s start discussing the main differences.

Key Takeaways

- A credit card allows borrowing money from your credit card provider for purchases and comes with diverse benefits and fees.

- A debit card pays directly from your bank account, offering a non-debt option with varied types.

- The choice between credit and debit cards depends on personal financial habits, goals, and debt management.

What Is a Credit Card?

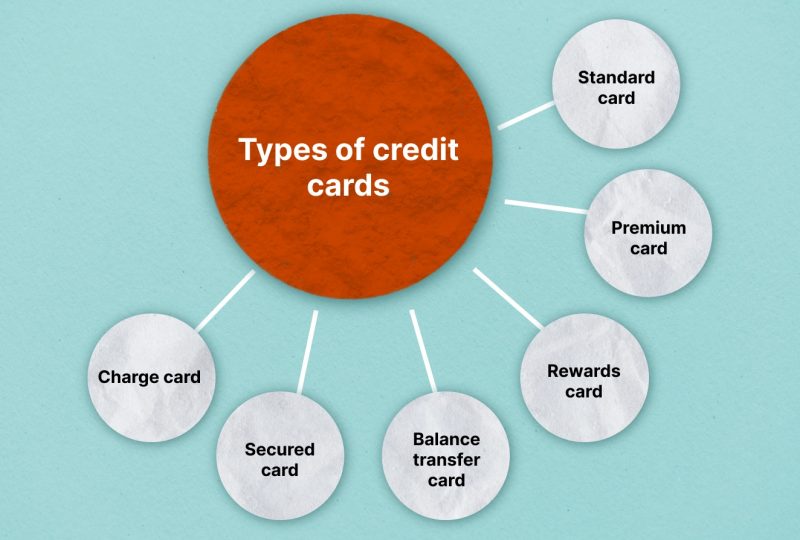

A credit card, typically provided by a financial institution such as a bank, is a versatile tool that allows the holder to borrow funds. The cardholder undertakes to repay the borrowed amount, along with any applicable interest, as set out in the terms of the institution. A fascinating feature of a credit card is the variety in which it comes, each designed to cater to specific needs and lifestyles.

First, we have the standard credit cards. These are the most basic forms that extend a credit line to users. They are mainly used for purchases, balance transfers, or cash advances. A big advantage is that they often come without an annual fee.

Then we have premium credit cards. These high-end variants come with a host of perks, like concierge services, airport lounge access, and exclusive event passes. However, these extra benefits usually mean a higher annual fee.

Rewards credit cards are next in line. These cards are particularly appealing as they offer incentives like cash back, travel points, or other benefits based on your spending habits.

Balance transfer cards are also a unique category. They come with low introductory interest rates and fees, specifically for transferring a balance from another credit card.

Secured credit cards are another exciting option. They require an initial cash deposit that the issuer holds as collateral, making them a good option for building or improving credit.

Last, we have a charge credit card. It doesn’t have a preset spending limit but generally doesn’t allow you to carry over unpaid balances from one month to the next.

One of the biggest advantages of credit cards, especially rewards cards, is the ability to earn perks like cash, discounts, and travel points, which the debit card typically doesn’t offer. These rewards can be applied at a flat or tiered rate.

For instance, one card might give you two miles for every dollar spent on any purchase, while another could offer three miles for travel spending, two for dining, and one for all other expenditures. The miles you earn can be used to make future travel arrangements, giving you another reason to use your credit card wisely.

Pros and Cons of Using a Credit Card

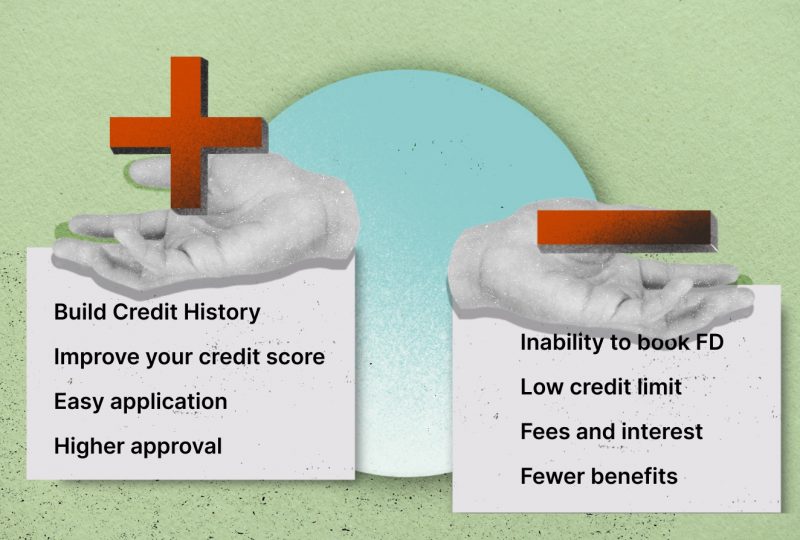

The advantages of using credit cards over debit cards can be significant, although they have potential drawbacks. Let’s delve into the advantages and disadvantages of spending with credit cards and how they can positively impact your financial health and lifestyle.

Credit Card Pros

Here are some main pros of using a credit card for your financial operations:

Building Credit History

One of the major benefits is the opportunity to build a credit history. The way you use your credit card gets reflected in your credit report. This includes positive aspects, such as making on-time payments and maintaining a low credit utilization ratio, and negative factors, like late payments or delinquencies. A history of responsible spending, punctual payments, and low card balances relative to your credit limits can elevate your credit scores.

Fraud Protection

Credit cards also offer robust fraud protection. According to the law, as long as you report the loss or theft of your card promptly, your maximum liability for purchases made after the card was lost is $50. By contrast, the Electronic Fund Transfer Act grants the same protection to debit card users, but only if they report the loss or theft within 48 hours. After this period, the liability increases to $500, and after 60 days, there’s no limit.

Warranty and Purchase Protections

Another significant advantage comes in the form of warranty and purchase protection. Credit cards often provide supplementary warranties or insurance on purchased items, extending beyond what the retailer or brand offers.

For instance, Under Section 75 of the Consumer Credit Act 1974, your credit card provider is jointly and severally liable for any breach of contract or misrepresentation by a retailer or trader. This means that if an issue arises with something that you purchased using a credit card and the retailer is unwilling to help; you may be able to claim a full refund.

Moreover, some cards come with built-in purchase and price protection, helping you replace stolen or lost items or refund price differences if the item you bought is sold for less elsewhere.

Dispute Resolution and Unauthorized Charges

Under the Fair Credit Billing Act, credit card users can dispute unauthorized purchases or purchases of goods damaged or lost during shipping. Debit card users, however, cannot reverse such charges unless the merchant agrees. Debit card theft victims must wait for an investigation to get their refund.

In contrast, credit cardholders are not held responsible for the disputed charges. The amount is usually deducted immediately and restored only if the dispute is withdrawn or settled in favor of the merchant. While some credit and debit card providers offer zero liability protection, the law is generally more lenient with credit cardholders.

Car Rental Benefits

Another benefit of credit cards comes into play when renting a car. Many credit cards offer a collision waiver, providing extra protection. Most car rental agencies require credit card information as a backup, even if you wish to use a debit card. The alternative for a customer might be to allow the rental agency to place a hold of several hundred dollars on their bank account debit card as a security deposit.

Overall, while credit cards require disciplined use to avoid potential pitfalls like high-interest debt, their advantages in terms of credit building, purchase protection, fraud protection, and convenience in situations like car rentals make them a valuable tool in your financial arsenal.

Credit Card Cons

While credit cards offer a variety of benefits, it’s equally important to consider their potential drawbacks. Let’s explore some key disadvantages of using credit cards and how they could impact your financial well-being.

Potential for Credit Card Debt Accumulation

One of the primary disadvantages of credit cards involves the risk of debt accumulation. When you make purchases with a credit card, you’re essentially borrowing the bank’s money, not spending your own. This borrowed amount must be repaid, typically with interest.

While you must make at least the minimum payment due each month, high balances across multiple cards can make these payments difficult to manage, potentially straining your budget and leading to a cycle of debt.

Impact on Credit Score

Credit cards can significantly influence your credit card score. While responsible use, such as timely bill payments and low credit card balances, can boost your credit score, misuse can negatively impact it. Habits like late payments, maxing out your cards, closing older accounts, or frequently applying for new credit can all harm your credit history and subsequently lower your credit score.

Interest and Associated Fees

As credit cards function as short-term loans, you must repay what you spend with interest. Your interest rate and the fees charged by the credit card company contribute to your annual percentage rate (APR). The higher the APR, the more costly it will be to carry a balance from month to month.

It’s essential to be aware of various charges associated with your card. These could include an annual fee, foreign transaction fee, balance transfer fee, cash advance fee, late payment fee, or a returned-payment fee. Generally, the more robust the card’s rewards program and the more benefits it offers, the higher the annual fee tends to be.

Potential for Overspending

One disadvantage not explicitly mentioned in the source but worth noting is the potential for overspending. Credit cards can create an illusion of increased spending power, leading some users to spend more than they can afford to pay back. This can contribute to debt accumulation and financial stress.

Overall, while credit cards offer many benefits, they come with potential pitfalls like high-interest debt, negative impacts on credit scores, various fees, and the risk of overspending. It’s essential to use credit cards responsibly, stay within a budget and make timely payments to mitigate these potential disadvantages.

What Is A Debit Card?

A debit card is a payment card linked directly to a user’s checking account. When transactions are made, funds are deducted immediately from the associated account, providing a cashless method of accessing your money rather than borrowing from a bank or card issuer.

This functionality gives a debit card the convenience of a credit card, with many of the same consumer protections, especially when issued by leading payment processors like Visa or Mastercard.

Different types of debit cards are available, catering to various consumer needs. The most common type is the standard debit card, which draws funds from your bank account. However, there are other types designed for particular circumstances.

For instance, Electronic Benefits Transfer (EBT) cards are provided by state and federal agencies to qualified individuals, enabling them to utilize their benefits for purchases. Meanwhile, prepaid debit cards offer a solution for those without access to traditional bank accounts.

These cards can be preloaded with a specific amount of money, allowing the holder to make electronic purchases up to that limit.

For those conscious about spending, debit cards often appeal due to their low or non-existent associated fees. Unless a user overspends, leading to an overdraft situation, debit cards typically don’t attract the charges common with credit cards. However, it’s worth noting that prepaid debit cards can be an exception, as they often carry activation and usage fees, among other charges.

In contrast, credit cards usually involve annual fees, over-limit fees, late payment penalties, and other charges, not to mention the monthly interest accrued on any outstanding balance. Thus, debit cards can offer many consumers a more straightforward and cost-effective way to manage day-to-day spending.

Pros and Cons of Using Debit Cards

Debit cards, much like their credit counterparts, come with their own sets of pros and cons. So let’s discuss this in depth.

Pros of Debit Cards

Here are some major advantages of using a debit card.

Financial Control

One of the main advantages of a debit card is that it allows users to avoid accumulating debt. Since funds are immediately drawn from the user’s own bank account, the risk of overspending and falling into debt is minimized. This makes debit cards a beneficial tool for those prone to impulse buying, as they can limit expenditures to their available funds, thus steering clear of high-interest debt.

Enhanced Fraud Protection

Historically, credit cards have offered more comprehensive fraud protection than debit cards. However, this gap is closing, with many debit cards, particularly those issued by major payment processors such as Visa or Mastercard, now offering similar protections.

But to take full advantage of this, users must promptly report any suspected fraudulent activity. Delaying such a report could increase the cardholder’s liability for unauthorized transactions. Unlike credit cards, since debit cards are directly linked to a user’s bank account, fraudulent transactions can quickly deplete the account or trigger overdraft fees.

Absence of Annual Fees

Unlike many credit cards, debit cards typically do not charge an annual fee. Furthermore, withdrawing cash at your bank’s ATM usually incurs no charge.

On the other hand, credit cards often impose a cash advance fee and high-interest rates for the same service. So, If you need to withdraw cash, a debit card will probably be the cheapest option as you won’t be charged interest unless you are using your overdraft.

Cons of Using Debit Cards

Despite these advantages, debit cards do come with certain drawbacks.

Lack of Reward Programs

One significant downside is the absence of rewards. While credit cards often offer rewards programs providing points, miles, or cash back, such benefits are typically absent with standard debit cards. Therefore, users who exclusively use debit cards might miss out on potential savings.

Limited Credit Building

Debit cards do not contribute to credit history. Credit scores depend on demonstrating responsible borrowing and repayment habits. Debit cards, being tied to your existing funds, do not provide the opportunity to present these credit-building behaviors.

Possible Account Fees

Though debit cards generally do not charge annual fees, users might encounter other fees related to their checking accounts. These can include monthly maintenance fees, overdraft charges if the account balance is exceeded, returned-item fees, and foreign ATM fees for using a machine outside of your bank’s network. Therefore, understanding your bank’s fee structure is essential when using a debit card.

So, Which One Is A Better Option?

Deciding whether to use a debit or credit card primarily largely depends on your personal financial habits and goals. A debit card might be a safer choice if you tend to spend more freely or struggle to track your expenditures. It can keep you within your financial limits and help avoid the pitfalls of substantial debt, making it a wise option for those keen on maintaining strict budgetary control.

On the other hand, if you diligently monitor your spending and adhere to a well-planned budget, a credit card could serve you better. It not only offers the opportunity to earn rewards but also assists in building a robust credit history, which can prove to be a significant asset in your financial journey. However, this advantage is contingent on your ability to meet your monthly payment obligations on time consistently.

In essence, neither option is universally ‘better.’ The right choice is the one that aligns with your personal financial habits, needs, and objectives. It’s about understanding your spending behavior and choosing the tool that best supports your financial health and goals.

FAQs

Can I overdraft my account with a credit card?

No, credit cards do not allow you to overdraft your account. They have a preset credit limit that cannot be exceeded.

Do credit cards and debit cards have annual fees?

Credit cards often have annual fees, but many debit cards do not charge annual fees. However, certain types of debit cards or checking accounts may have associated fees, so reviewing the terms and conditions is essential.

Is a credit card safer than a debit card?

Yes. Usually, credit cards provide more consumer protection than a debit card. Credit card purchases are protected by both Section 75 and Chargeback.

Can both credit cards and debit cards be used for purchases?

Yes, both credit and debit cards can be used to purchase in stores or online.