10 Best Penny Stocks in 2024: Investor Guide

Oct 30, 2024

For decades, investors have been captivated by Penny stocks. Their extremely low price and the alluring possibility of substantial gains attract everyone, especially early investors. However, this allure comes with a significant risk.

This guide explores the ten best penny stocks by market cap for 2024, including some of the high-volume options and penny stocks that could explode.

Key Takeaways:

- The best penny stocks for 2024 are in sectors like AI, biotech, and renewable energy, offering substantial growth potential.

- Penny stocks carry significant risks, including low liquidity and market manipulation. Investors must conduct thorough research and be aware of their risk appetite.

- Stick to high-volume penny stocks to minimize risks, and continually evaluate the financial health and market trends of your investing companies.

What Are Penny Stocks?

Penny stocks are typically defined as shares of companies trading for less than $5 per share (sometimes even below $1) on major stock exchanges or over-the-counter (OTC) markets. These companies often have a low market capitalization (market cap), indicating their relatively small overall value.

Penny stocks can be categorized by industry, with some focusing on established sectors like biotechnology or mining, while others operate in emerging fields like artificial intelligence (AI). Key characteristics of these stocks are:

- Low market capitalization

- High volatility

- Limited liquidity

- Potential for significant gains (and losses)

- Often traded over-the-counter (OTC)

While many penny stocks offer the allure of turning a small investment into substantial profits, they also carry considerable risks. Market manipulation, lack of transparency, and the potential for rapid price fluctuations make penny stocks a high-risk, high-reward proposition.

Top 10 Best Penny Stocks for 2024

While predicting future performance is impossible, the following top penny stocks have attracted attention due to their recent developments and growth potential:

1. GEVO (Gevo Inc.)

Gevo develops technologies to produce advanced biofuels from renewable resources. Biofuels could play a role in the transition to clean energy, but the technology is still evolving and faces competition from other alternatives.

Financial Highlights

- List price – $2,92

- Market cap – $699,25 million

- Trading volume – 7.02M

- 52-wk high – 3.39

- 52-wk low – 1.33

2. ALTM (Arcadium Lithium plc)

Established in January of 2024 and strengthened with a global network, Arcadium Lithium explores and develops lithium projects in South America. Lithium is a critical component in electric vehicle batteries, and ALTM has recently seen a significant share price rise.

Financial Highlights

- List price – $5,48

- Market cap – $5,89 billion

- Trading volume – 22.92M

- 52-wk high – 7,27

- 52-wk low – 2,19

3. RLX (RLX Technology Inc.)

As a leading branded e-vapor company in China, RELX leverages its strong in-house technology and product development capabilities to create superior e-vapor products tailored to adult smokers’ needs.

The company’s multi-layered development framework encompasses accessories, interactions, applications, phase transitions, and infrastructure to enhance the overall adult smoking experience.

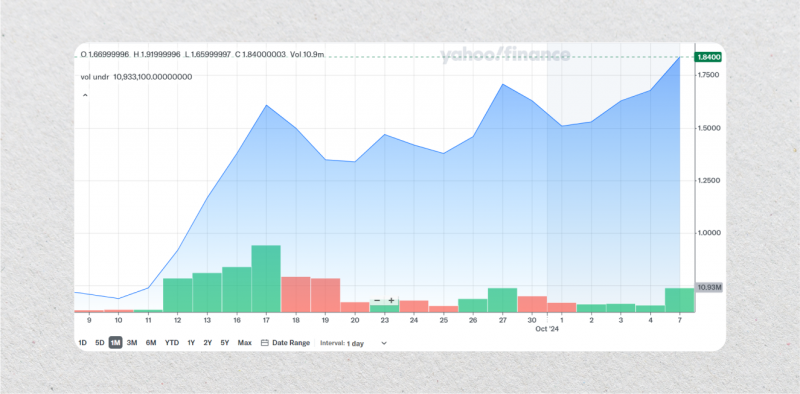

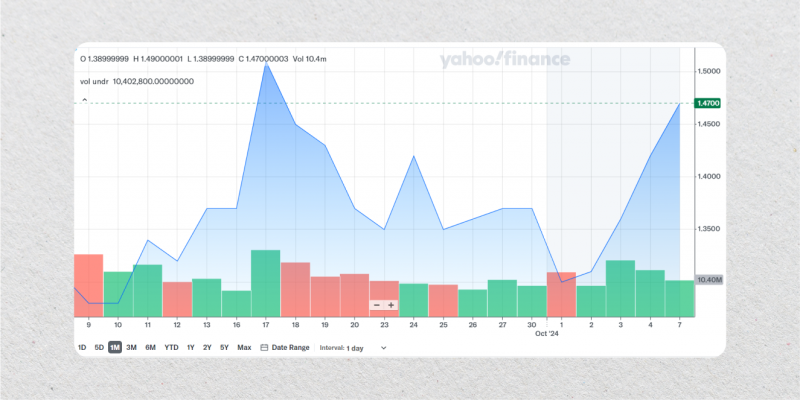

Financial Highlights

- List price – $1,70

- Market cap – $2,16 billion

- Trading volume – 4,69M

- 52-wk high – 2,40

- 52-wk low – 1.50

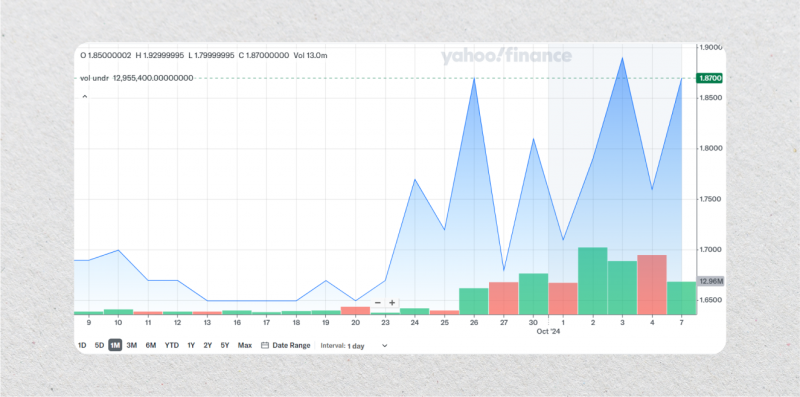

4. PLUG (Plug Power Inc.)

A leading provider of hydrogen fuel cell and fueling solutions, PLUG is positioned to benefit from the growing trend towards clean energy. However, the hydrogen infrastructure is still under development.

Financial Highlights

- List price – $2,24

- Market cap – $1,97 billion

- Trading volume – 36,41M

- 52-wk high – 6,96

- 52-wk low – 1.60

5. ACHR (Archer Aviation Inc.)

This American company develops and manufactures electric vertical takeoff and landing (eVTOL) aircraft. The eVTOL market holds immense potential but faces challenges in terms of regulation and infrastructure.

Financial Highlights

- List price – $3,41

- Market cap – $1,21 billion

- Trading volume – 21.89M

- 52-wk high – 7,02

- 52-wk low – 2,82

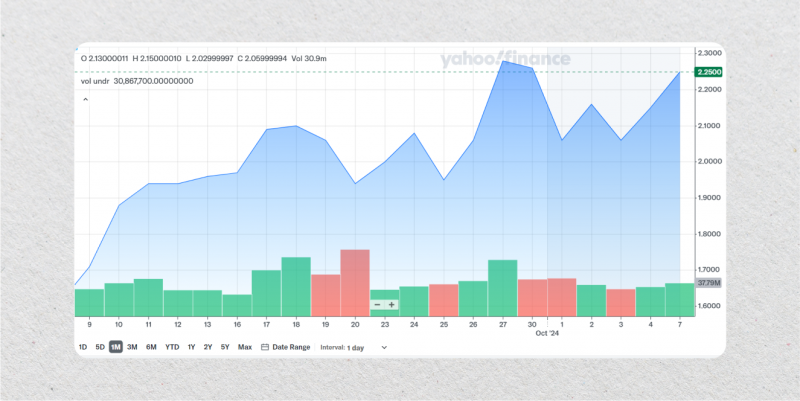

6. EOSE (Eos Energy Enterprises Inc.)

Eos designs and manufactures long-duration energy storage solutions using zinc technology. With the increasing focus on renewable energy, EOSE could see growth, but the competition in the energy storage space is fierce.

Financial Highlights

- List price – $3,45

- Market cap – $747,64M

- Trading volume – 6,75M

- 52-wk high – 3,66

- 52-wk low – 0.61

7. LAC (Lithium Americas Corp.)

A Canadian mining company focused on lithium exploration and development in South America. Like ALTM, LAC benefits from the demand for lithium but faces inherent risks associated with mining operations.

Financial Highlights

- List price – $4,14

- Market cap – $599,09M

- Trading volume – 22,25M

- 52-wk high – 7,86

- 52-wk low – 2.02

8. CHPT (ChargePoint Holdings Inc.)

A leading operator of electric vehicle (EV) charging stations, CHPT is well-positioned for growth as EV adoption rises. However, the success of CHPT depends heavily on the overall EV market expansion.

Financial Highlights

- List price – $1,28

- Market cap – $552,42M

- Trading volume – 11.15M

- 52-wk high – 3,54

- 52-wk low – 1.21

9. SAVE (Spirit Airlines Inc.)

A major American budget airline, SAVE, has seen its stock price recover somewhat after the pandemic’s impact. However, the airline industry remains susceptible to economic fluctuations and fuel price changes.

Financial Highlights

- List price – $2,87

- Market cap – $314,32M

- Trading volume – 20,71M

- 52-wk high – 17,02

- 52-wk low – 1,40

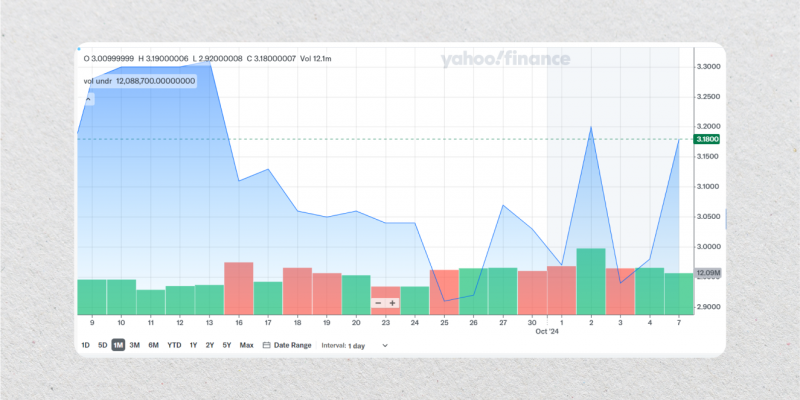

10. CRNC (Cerence Inc.)

Cerence was established in 2019 as a spin-off from Nuance Communications, a company with two decades of experience in providing voice recognition technology to car manufacturers. Nuance’s technology was widely adopted in the automotive industry, equipping half of new cars shipped globally in the first half of 2019.

Cerence began trading on the Nasdaq exchange in October 2019 and assumed existing contracts with numerous automakers, including BMW, Ford, and Toyota. Since its independence, the company has secured new deals with Fiat Chrysler and Mercedes-Benz.

In 2020, LG announced plans to integrate Cerence’s voice assistant into its in-car infotainment systems. As of August 2021, Cerence’s AI assistant technology has been installed in over 400 million vehicles worldwide.

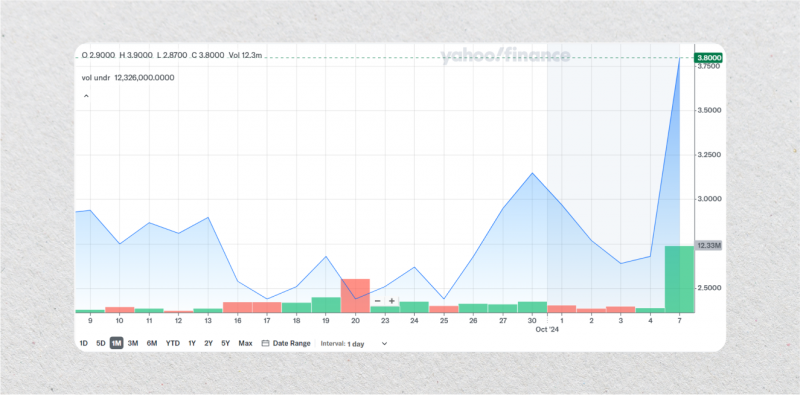

Financial Highlights

- List price – $3,24

- Market cap – $135,45M

- Trading volume – 1.47M

- 52-wk high – 21,66

- 52-wk low – 2.34

While this penny stocks list reflects current trading activity, it’s essential to remember past performance doesn’t guarantee future results. Conduct your own research before investing in any of these penny stocks.

Fast Fact:

Apple wasn’t always one of the largest tech companies in the world. In fact, hardly anyone knew about the company and its products for years. Back in the early 2000s, AAPL traded for under 80 cents per share — a legit penny stock.

How to Select the Right Penny Stock?

Finding the best penny stocks for 2024 requires thorough research into a company’s financial health, market trends, and growth potential. To make smart investments in penny stocks, you’ll need a good understanding of the following factors:

- Always assess a company’s financials, such as debt levels and revenue trends. High-risk investments like penny stocks can be more secure if the company has strong fundamentals.

- Look at the broader market trends and sectors showing growth potential, like AI, green energy, or fintech.

- High-volume penny stocks are generally safer because they’re frequently traded, making it easier to find buyers and sellers.

Consider booming spheres like Artificial intelligence. Some of the best AI penny stocks are currently trading at low prices but have shown strong fundamentals and growth potential. Keep an eye on companies involved in AI software, automation, and machine learning.

For risk-tolerant investors, penny stocks below 10 cents offer an even more affordable entry point into the market. While these stocks carry significant risks, the potential for substantial profits remains. Investors should be cautious and do in-depth research before purchasing such stocks, as their low price often reflects uncertain prospects.

Liquidity is crucial when it comes to penny stocks. High-volume penny stocks are frequently traded, allowing investors to easily buy and sell shares without much delay. High volume also reduces the chances of market manipulation, making these stocks safer bets for those new to penny stock trading.

Tips for Success in Trading Penny Stocks

While the potential for high returns is enticing, investing in penny stocks requires careful consideration and strategy. Here are some key tips for navigating the penny stock market:

- Dive deep into the company’s financial health, management team, and market position. Look for penny stocks with strong fundamentals and growth potential.

- Don’t put all your eggs in one basket. Spread your investments across different penny stocks and sectors to mitigate risk.

- Determine your investment objectives and risk tolerance before entering the penny stock market.

- Implement stop-loss orders to limit potential losses and protect your early investment.

- Keep up with market trends, company news, and regulatory changes that could impact your penny stock investments.

- Don’t fall for pump-and-dump schemes or overhyped stocks. Verify information from multiple reliable sources.

- Begin with a small investment to test the waters and gain experience in penny stock trading.

To trade penny stocks, you’ll need a Demat account with a brokerage that supports penny stock trading. Be prepared for price fluctuations and do your research to find stocks with high growth potential. Since penny stocks are generally traded over the counter, liquidity can be low, so it’s essential to trade cautiously.

Risks and Challenges of Penny Stock Investing

While penny stocks can offer significant returns, it’s crucial to understand the risks involved:

- Penny stocks often represent companies with uncertain prospects. Their success hinges on factors beyond their control, making them highly volatile investments.

- Many penny stock companies have minimal public information available, making thorough research challenging.

- Finding buyers when you want to sell can be difficult, potentially leading to losses.

- Some penny stocks may not meet the stringent requirements of major exchanges, increasing the risk of fraud or manipulation.

- Companies may issue new shares to raise capital, diluting the value of existing shares.

- Penny stocks are more susceptible to manipulation by unscrupulous actors who can inflate share prices artificially.

When investing in penny stocks, it’s crucial to have a risk appetite and a diversified portfolio. If you’re seeking a balance between potential gains and manageable risks, look for the safest penny stocks with stable financials, high liquidity, and a track record of growth.

These stocks may offer lower returns than more speculative options but are less likely to suffer from market manipulation and liquidity issues.

Conclusion

While the best penny stocks for 2024 can offer significant growth potential, they also come with substantial risks. To maximize your chances of success, conducting extensive research, diversifying your portfolio, and staying updated on market trends is crucial.

Remember, penny stocks should comprise only a small portion of your overall investments. Consult a financial advisor to determine if they’re a suitable fit for your specific goals and risk tolerance.

Disclaimer: This article is for informational purposes only and should not be interpreted as financial advice. Investing in financial markets and stocks, including penny stocks, carries ingrained risks, and individuals should conduct their own research before making any investment decisions.