A Brief and Comprehensive Guide to Spot Trading.

July 24, 2023

Spot market (SM) is a very active and highly liquid market that trades various financial instruments. A distinctive feature of the spot market is that orders here are executed instantly at the current rate for the time of the trade.

Spot trading can be easy and very profitable; however, thorough research and sufficient knowledge of a spot market are necessary to become a successful trader. In this article, we will answer the question of “What is a spot market?” and discuss the fundamental principles of spot trading, the benefits and weaknesses of the SM, and how SM differs from the futures market (FM).

Key Takeaways

- Spot markets are financial markets that trade various financial tools for instant delivery.

- Cash markets trading can occur OTC and on CEXs and DEXs.

- Spot markets differ from futures markets regarding price determination, risk management, and trade execution time.

- Spot trading can be very profitable but has drawbacks, like the possible need to store goods.

Basics of The Spot Market

So, what are the basics of the spot market? Let’s answer this question first.

- The spot market (SM) is a market where financial instruments are traded for instant delivery, though the assets can be delivered within a short period (commonly within 1 or 2 days). This market is sometimes also called a physical or a cash market. An asset should meet certain requirements and correspond to specific standards to be traded in the SM. You can find almost any asset in the spot market: cryptocurrency, stocks, gold, grain, natural gas, etc. But the most popular and the one that is regularly traded is oil.

- Spot trading, in its turn, is the method of buying and selling assets at the current market cost to deliver the underlying asset instantly. Nonetheless, delivery time often depends on the traded asset. Thus, if you buy crude oil, its actual delivery can take time. But as soon as the transaction is executed, you receive the right to possess the purchased amount of oil even if its actual delivery cannot be done right away.

- The bidding price of a financial asset in the physical market is called the spot price. It is the rate at which financial instruments can be sold or purchased instantly. Spot prices are formed by the purchase and sell orders routed to the order book by traders.

Types of Spot Trades

Spot trades are transactions where traders expect instant payment and shipment of the underlying investment. A spot transaction is executed at the spot price — the rate at which a spot trade is currently valued. The spot price is also called the cash price and is updated in real-time.

In simple words, a spot transaction is an order or a contract that has to be executed at the moment of its placement when two counterparties agree on the buying and selling of an asset.

In spot trading, market participants must have assets available at the moment of the transaction. Such a condition is established so that the buyer receives the acquired asset, and the seller receives the money immediately after the transaction execution.

Spot contracts can be grouped as follows:

- TOD, or T+0 (shortened from Today). The settlement for these transactions is made on the day of the trade.

- TOM, or T+1 (shortened from Tomorrow). The settlement for these transactions is made on the next trading day.

- SPT, or T+2 (shortened from Spot). This type of trade is settled two days after the transaction execution.

The payment and trading period depends on the following factors:

- asset liquidity;

- the spot rate of the transaction;

- the asset amount or volume that has to be sold or bought.

Most spot market transactions have a T+2 settlement date.

Where Spot Trading Takes Place

There are several ways to start trading in the SM. The vast majority of spot traders choose exchanges; however, there is an option of trading directly with other traders. Let’s discuss each of the options in more detail.

Centralized Exchange

Centralized exchanges (CEX) mainly trade such assets as currencies and goods. Cryptocurrency is another popular asset on CEXs.

A CEX serves as a mediator between the market participants. Such exchanges guarantee fair price formation, security of your trades and funds, and continuous execution of transactions. They also provide higher liquidity and a constant flow of assets, monitor regulatory compliance, and verify users through the KYC procedures, which adds to customers’ safety and protection.

However, to use the benefits of a CEX, you have to pay fees for most of the financial activities. Thus, due to a significant number of users, an exchange receives its revenue for being a medium between traders.

Decentralized Exchange

Decentralized exchanges (DEX) offer most of the services available on CEXs. The difference is that the DEX matches buy and sell orders using blockchain technology. Via smart contracts, trading here is carried out directly between the traders’ wallets.

Many users pick out DEXs since they provide more freedom and greater privacy. Plus, customers don’t pay additional fees for the exchange.

But the absence of client support and regulation procedures is a significant drawback that can threaten the security of your assets if an issue arises.

Over-The-Counter Trade

Over-the-Counter trade (or off-exchange) implies that assets are traded between market participants directly. OTC market trading includes various communication means to arrange transactions, such as telephones and instant messaging.

The core advantage of over-the-counter trading is the absence of the order book. However, in the case of low liquid assets trade, a large order can cause slippage, meaning that the trade will be executed at a rate different from the one you’ve expected. Therefore, large OTC trades are often made at better rates.

How Spot Trades Are Executed?

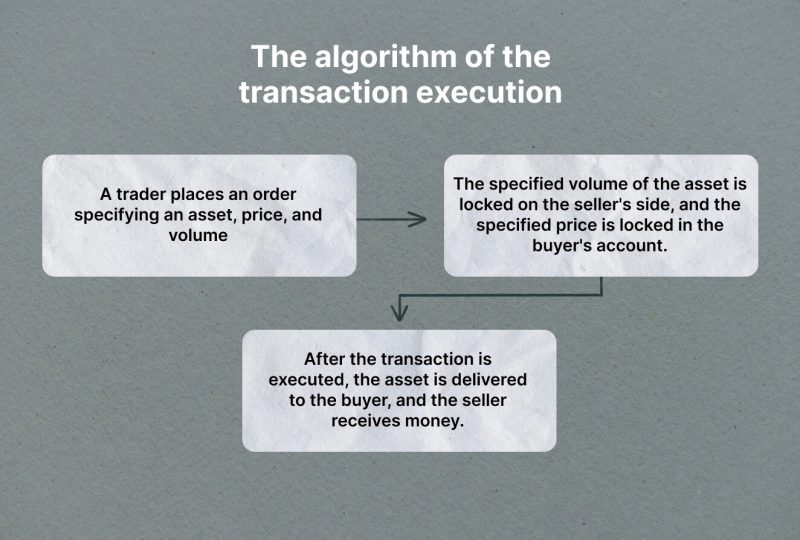

No matter what trading platform you selected, the algorithm of the transaction execution is the same.

- A trader places an order specifying an asset, price, and volume.

- The specified volume of the asset is locked on the seller’s side, and the specified price is locked in the buyer’s account.

- After the transaction is executed, the asset is delivered to the buyer, and the seller receives money.

Let’s introduce an example of a spot transaction and assume you want to buy 1,000 Amazon shares at $100,000:

- You place a buy order specifying the transaction volume and the price. It is also possible to specify the market price. In this case, the order will be executed at the current market rate.

- After the order is placed in the order book, it must be matched with the sell order that meets your buy-order requirements (asset, price, and volume) in full or partially.

- If the buy and sell order match in full, your transaction is executed, and the ownership of the assets is conveyed to you immediately after the seller receives the funds.

There are more options for possible order execution. Let’s suppose that there are only 700 shares at the specified price available in the order book. In this case, there are two options:

- 70% of the order is executed immediately, meaning that 700 shares of Amazon are sold for $100,000. The rest of the order, which is 300 shares, remains an open position until another trader is ready to sell it for $100,00.

- The whole volume of the trade is executed immediately, but only 700 shares are sold for $100,000, and the remaining part of the order will be closed at a higher rate depending on the order availability in the order book.

In the first case, the trade is executed after some time, and in the second case, it is executed without delay but not at the desired price. Such issues can be neutralized by the high liquidity found in large exchanges.

Spot Market vs. Futures Market

The spot market might seem very similar to the futures market. Nevertheless, there are major differences between them.

The core distinction of the SM is that the trades here are executed instantly at market price, while futures contracts are executed at a specific date and a predetermined cost.

Among other distinct features of these markets are the following:

| Spot | Futures |

| Price determination | |

| The cost of an asset is impacted by the asset bid and ask in the market. | The asset cost is defined by the value of the underlying asset. In other words, the asset price is based on the expected bid and ask which the asset is going to get in the future. |

| Trade execution time | |

| Trades are executed forthwith at the current market rate. | Trades are executed at the designated date at the pre-agreed rate. |

| Risk | |

| Lower risks due to the immediate execution of trades. | Higher risks due to the fact that the transaction happens at an upcoming date, and the situation in the market may change. |

| Hedging | |

| Positions in SMs are created to benefit from the price difference while executing the contract, thus it is impossible to hedge another position with the current one. | Futures contracts may be used for risk management, for instance, for hedging against price movements. |

Another remarkable distinction of spot markets from FMs: when trading in the SM, the asset must be available so that after the transaction execution, the buyer instantly receives the acquired asset, and the seller receives money. In the FMs, on the other hand, an asset can be delivered to the buyer in a week, a month, or a quarter, so its availability at the moment of transaction execution is not obligatory.

Benefits and Drawbacks of Spot Markets

Thanks to its nature, the SM might look like a perfect opportunity to gain significant profit quickly: the market is highly liquid, transactions are executed instantly, and with various order types, you can set the desired cost for an asset buying or selling.

However, SMs have benefits and downsides, like any other market.

Let’s begin with the pros.

- Trading in the SM is easy and clear. Even if you are new to the industry, managing instruments in the SM will take little trading experience. Moreover, the prices here are influenced by bid and ask, which adds to the market transparency and guarantees fair trade.

- You can monitor actual market costs in real-time.

- The spot market’s benefits make it a good means for gaining a significant profit.

- You can easily forecast the profitability of your trades.

- It is possible to open trades for any time period, from a few seconds to several years.

Despite all the bonuses you can have from SM trading, it is essential to consider some drawbacks.

- Based on financial tools, SM trading might need actual shipment and storage facilities for the goods. For example, if you spot-buy crude oil, you must deliver it and arrange storage. Another example is cryptocurrency: in the case of spot trading, you bear full responsibility for the security of the coins’ storage.

- The assets must be available for both counterparties. You can only execute a trade if one of the trade sides has a sufficient volume of an asset.

- In cash markets, you cannot hedge your positions against the usage and manufacturing of goods to reduce possible risks related to market volatility. In this case, a derivative market is a better option.

Conclusion

The SM is a highly volatile and active market that can be a good option for experienced trades and those making their first steps in the industry. Though spot market trading might seem easy, the physical market has benefits and drawbacks that have to be reviewed to avoid losses.

FAQs

How does the spot market differ from the futures market?

The core distinction of the markets is that trades are executed at a specified date and the pre-arranged cost in the futures markets. In contrast to that, in the spot (or cash) markets, trades execution occurs instantly at the actual prices.

Where are spot contracts used?

A spot contract can be used in currency trading as well as in stocks and goods trading, that is, in the field where instant shipment of an asset can be made.

What are the Instances of Spot Markets?

An excellent example of such a market is Nasdaq.

Platforms like NYSE or Forex are good illustrations of CEXs too, whereas Binance and Kraken are DEXs.

On the contrary, CME is an instance of a derivatives marketplace suitable for futures exchange.

How can I start spot market trading?

To start trading, you first need to find a reputable platform that offers the option of spot trading. Then, you can create an account on the platform, deposit funds into it, and begin to buy and sell assets in the cash market.