Building Your Business Based on MT5 White Label Platform

Feb 22, 2024

MetaTrader 4 has been the industry leader since its launch in 2005. Recently, however, there’s been a shift with brokers increasingly adopting MetaTrader 5.

Owing to its dependability, effectiveness, and extensive feature sets, MT5 establishes standards in the market and drives businesses to integrate the MT5 trading platform inside their brokerage. And one of the easiest and most cost-effective ways for this is the MT5 White Label solution.

This article aims to highlight the key features of MT5 that have made it a top choice in the industry and guide you on launching an MT5 White Label brokerage.

Key Takeaways:

- MT5 WL offers a cost-effective solution for starting a brokerage, eliminating the need for server licenses and management.

- Traders appreciate MT5 for its accuracy, trading robots, and compatibility with various devices.

- Trading on MT5 gives traders access to various financial markets, such as forex, commodities, crypto CFDs, stocks, futures, and indices.

- Setting up a MetaTrader broker on the MT5 WL model includes implementing the WebAPI Wrapper, configuring liquidity, customising the trading interface, integrating external solutions, and adding custom modules.

MT5 White Label – A Brief History

In 2010, MetaQuotes introduced MT5 as the follow-up to their extremely successful MetaTrader 4 platform, which had been the go-to choice in trading platforms since its launch five years earlier. MetaQuotes has maintained a high reputation for over a decade, serving individual retail customers and white-label partners.

As of January 2023, there were over 10 million active MT5 users, and the number increased greatly in the past year. Considering the massive popularity of MT5 among traders, offering the MT5 trading platform through your brokerage is a huge competitive edge for your business, automatically boosting your authority and attracting a broader client base.

Easily the most straightforward and affordable way to offer an MT5 trading platform to your traders is partnering with an MT5 white label provider.

With MetaTrader White Label, which is basically a ready-made solution, you can easily set up a White Label Forex broker, cryptocurrency broker, or multi-asset broker.

MT5 White Label providers save you from the need to purchase a full MetaTrader server license, build and manage a reliable backup system, construct a global network of servers, and employ staff for round-the-clock configuration and maintenance of server architecture. That’s because their WL solution of MT5 comes pre-equipped with all these features and much more.

What Advantages Does MT5 White Label Solution Offer to Brokers?

The right trading platform is fundamental not only for traders but also for brokers.

For brokers, it’s essential to have a platform that connects well with liquidity providers and supports various management functions, like copy trading and bonus schemes. They also value features that help build trading communities, such as social trading and PAMM systems, which enable the sharing of trading signals between accounts.

MetaTrader 5 is also packed with various indicators, giving it an edge over previous versions and other platforms. Accessing all these can be quick and affordable when partnering with MT5 white label provider.

Here’s a quick rundown of benefits brokers get when purchasing MT5 White Label:

No legal hurdles – MetaTrader White Label providers care of all the legal aspects involved during setup to ensure your brokerage operations are completely legitimate.

No additional fees besides MetaQuotes costs – Prices for MT platform components come directly from MetaQuotes.

Availability to support various balance and credit operations – MT5 WL solution providers allow brokers to separate different types of financial transactions.

Hedging and netting models – MT5 WL solutions support both position management models.

Third-party integrations – Many MT5 WL providers offer integrated payment systems, IB software solutions, and PAMM/MAM/Copy trading solutions.

24/7 technical support – 24/7 fast and reliable multilingual technical support is part of the successful operation of any brokerage, and the MT5 White Label solutions cover that, too.

Educational sessions – MT5 WL solution includes comprehensive education for MT Manager and Trading Platform interfaces and functionalities to help you customise your platform and meet your clients’ needs better.

Why Will Your Clients Love MT5?

Traders love MT5 for its accuracy in analysing markets. Also, what’s unique about MT5 is the inclusion of a market for trading robots, a database for strategy developers, and services for algorithmic trading, copy trading, and virtual hosting.

There’s even a community site where traders can exchange strategies, find free trading robots, and follow trading signals, creating a space for shared trading wisdom.

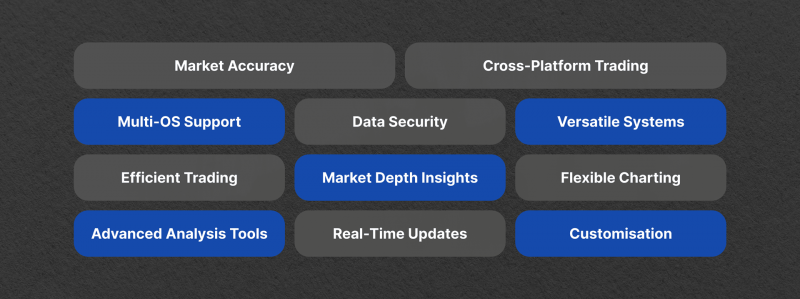

Another great thing about MetaTrader 5 White Label trading software is how it serves traders on the move. Whether you’re on a PC, smartphone, or tablet, you can trade from anywhere using a web browser, which is very convenient.

Here’s a quick rundown of why traders enjoy the MT5 trading platform:

- Compatible with Windows, Mac, and Linux

- Reliable and robust data protection

- Supports both netting and hedging systems

- Enables one-click trading operations

- Provides advanced market-depth insights

- Offers 3 chart types with 9 timeframes

- A comprehensive package of 30 indicators and 24 graphical elements for advanced technical analysis

- Delivers real-time quotes through Market Watch

- Supports personal indicators

- Includes an economic calendar

Key MT5 White Label Requirements for Brokers

When looking for an MT5 White Label solution, the requirements can differ based on the provider and your specific needs. Providers typically ask for the following:

1. Certificate of Incorporation – Services are only offered to registered companies involved in activities like investment services, financial instrument trading, online Forex, brokerage, and other financial services. Registration and possibly a brokerage license, depending on your location, are essential for accessing an MT5 WL platform. Notably, technology providers can also guide you on registration and license processes.

2. Director and Shareholder Documentation – Up-to-date, certified documents are also needed. This includes a copy of the director’s passport and a selfie with it. In some cases, video verification with the passport or ID might be required.

3. Addresses – Both a registered and a physical address are necessary. For the latter, a certified utility bill (like landline, water, gas, or electricity) is acceptable. Companies older than six months might need a recent certificate of good standing.

4. Domain Ownership – The domain should be registered under the company’s full name.

5. Corporate Account Verification – A bank-issued certified reference letter or statement is required to confirm an active bank account. This document should mention the company’s registration number and registered address.

Setting Up Your MT5 White Label Platform

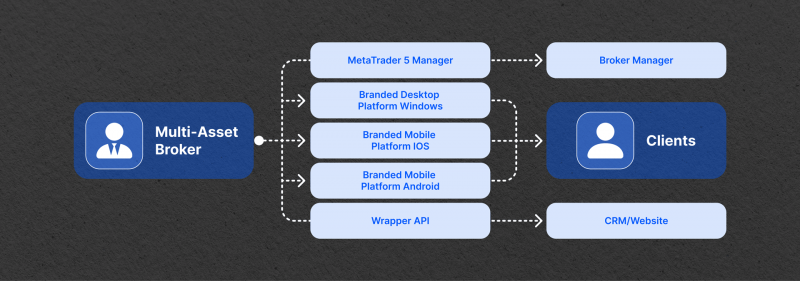

In the White Label process, you collaborate with an MT5 platform provider, who allows you to use their platform branded as your own. This involves signing a contract, personalising the platform with your brand, establishing trading terms, and then launching trading services for your clients.

Let’s look at the exact technical steps to establish a branded brokerage based on the MT5 White Label model.

Step 1: Implement the WebAPI Wrapper

The WebAPI Wrapper is a critical component of the MT5 WL solution. It’s responsible for ensuring the seamless integration of crucial parts of the White Label trading platform, such as the CRM system, trader’s room, and back office.

While this feature comes pre-installed, there’s the flexibility to modify certain operational parameters to suit your CFD or forex business needs, allowing for a customised approach to service connectivity.

Step 2: Configure Liquidity Connections

A key aspect of the MetaTrader 5 White Label solution is its ability to interface with various liquidity providers in the financial markets. Each company has its own unique liquidity requirements based on the types of instruments traded.

Therefore, it’s important to tailor the processes for receiving and managing cash flows, as well as to use Prime of Prime liquidity by linking up with several top-tier providers simultaneously.

Step 3: Customising the Trading Interface

The trading interface of MT5 includes a comprehensive set of tools and utilities for effective trading across different capital markets and with various instruments.

This interface is packed with elements for analytics, market analysis, reporting, and systems for efficient order execution. It’s important to meticulously configure these features, taking advantage of the customisation options provided by the WL solution to ensure a fluid and user-friendly trading experience.

Step 4: Integrating External Solutions like CRM or PSPs

MetaTrader 5’s open interfaces enable the platform to connect with a wide range of external applications. The integration possibilities are extensive.

For example, you can incorporate your CRM system to receive detailed trader information or even automate marketing communications based on client activities. CRM systems are instrumental in streamlining brokerage operations, elevating customer satisfaction, and boosting overall efficiency. They offer deep insights into client needs and preferences, letting brokerages customise their offerings more effectively.

You can also easily integrate a payment processor, which will enable traders to deposit and withdraw funds for their trading activities efficiently. Some of the popular payment processing solutions are B2BinPay, PayPal, Skrill, and Neteller.

These companies provide you with a payment API to integrate with your platform. They oversee the transactions, transferring the funds to the broker minus any applicable fees. Similarly, for withdrawals, the broker coordinates with the payment provider to transfer funds back to the client after deducting relevant charges.

The MT5 platform can also be configured to broadcast quotes and news from external vendors, delivering real-time information directly to traders.

Step 5: Adding Custom Modules

The MT5 WL solution’s high degree of customisation allows the integration of not just external products but also proprietary developments. If you have programming expertise, you can enhance the platform with additional modules such as market analytics tools, statistical data collection, and custom indicators for analysing price trends. These additions can significantly broaden your trading capabilities and add a unique touch to your platform.

MT5 White Label Cost

When starting a CFD or forex brokerage, entrepreneurs face the decision of acquiring MT5 through either a white-label solution or a full server license. This choice depends largely on the business model, future plans, and, of course, budget.

The white-label option for MT5 is often the more cost-effective route when compared to the substantial expenses associated with setting up and maintaining independent trading servers, which can exceed $250,000, considering the fact that you’d also need to hire a team of specialists who would handle hosting, plug-ins, infrastructure, LPs and 24/7/365 technical support in several languages.

The MetaTrader 5 cost of the WL license includes an initial fee of $5,000, along with a recurring monthly support fee of $1,750, covering both the mobile and desktop platform versions.

Fast Fact:

Apple withdrew MT4 and MT5 from the App Store on September 23, 2022, due to non-compliance issues. By March 6, 2023, MetaQuotes reinstated both apps by providing Apple with detailed explanations and additional insights into the apps’ technical operations.

Can Brokers Get a MetaTrader 5 White Label License from MetaQuotes?

Recently, MetaQuotes has placed stricter rules for brokers to purchase White Label licenses. The main reason behind the decision was that among the vast client base of MetaTrader products, there were many shady businesses ruining the company’s reputation. Also, the company started to actively promote its full server license – more expensive, extensive, and advanced.

Due to this, getting an MT5 WL license directly from MetaQuotes is no longer possible, but you can still obtain it from technology providers who hold the full server license.

Of course, you can also get your own full server license, but the price is quite high, with the basic version starting from $7,500, not including the extra costs for experts to manage your product, add various plugins, and provide 24/7 support.

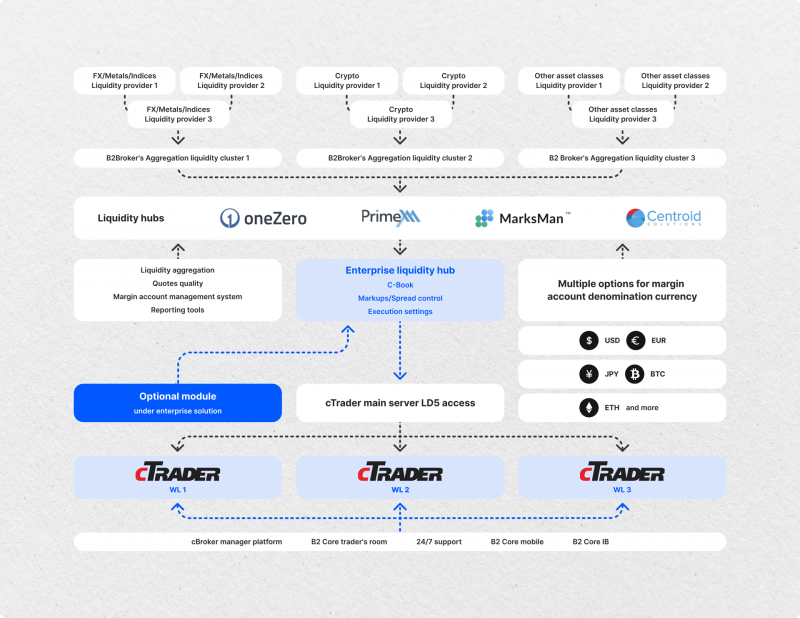

cTrader White Label Solution as an Alternative Solution

There are several MT5 alternatives on the market, and many tend to choose cTrader as a more budget-friendly yet equally functional and accessible trading platform.

The cTrader White Label model is designed to serve both institutional and retail brokerages globally, providing a streamlined and efficient infrastructure. With cTrader WL, brokerages can offer their clients a fully customisable trading service adjusted to their specific preferences and requirements.

Key features of the cTrader WL include a user-friendly interface, advanced trade flow management, and a range of setup options for risk management and price stream control. Brokerages can benefit from multi-currency margin accounts, reducing the impact of currency volatility on client equity.

An integral component of the cTrader White Label is cBroker, a back-office program for managing trade inquiries and customer accounts.

This tool provides comprehensive control over the trading environment with transparent procedures and advanced features. The platform also supports customisation and development through an open API, enabling cTrader brokers to create their own trading apps and integrate with platforms like TradingView.

cTrader White Label License Options

Spotware is the parent company of cTrader and provides cTrader Admin or Server Licenses to brokers, institutions, and technology providers, granting them comprehensive access to all aspects of the cTrader Trading Software.

Furthermore, they have the authority to distribute cTrader White Label Licenses to forex brokerage businesses, offering a cost-effective solution for those looking to enter the market or expand offerings of their trading platforms.

Startuppers seeking to set up a brokerage with limited upfront expenses often opt for the cTrader WL solution, which proves more economical than the cTrader Admin License.

Even an established forex business may choose the cTrader White Label Solution to meet client demands or diversify their platform options.

cTrader White Label Cost Structure

The cost structure for the cTrader WL Start-Up package covers essential components such as cBroker Suite, Client Office, LP Connection, and support for up to 500 symbols. This structure consists of three main elements:

- One-time Set Up Fee of $3000

- Monthly Support & Volume Fee of $2000

- Margin Amount/Collateral requirement of $5000

These flexible licensing options make cTrader White Label an attractive choice for brokerages seeking to deliver a competitive and fully branded trading experience to their clients.

Concluding Thoughts

Finding an all-in-one turnkey solution for your startup brokerage is a game-changer. MT5 White Label is a preferred choice for launching a successful brokerage firm quickly, thanks to its vast instrument support, easy-to-use interface, and advanced charting and analytical tools.

Yet, getting an MT5 white label is currently possible only through technology providers, like B2Broker, who hold the full server license. If you’re open to exploring other options, though, give cTrader white label a look, as it’s often a more budget-friendly, accessible alternative.

Wondering how these solutions can boost your business?

Leave a request, and let our experienced team guide you towards unparalleled success and growth.

FAQs

What is the difference between MetaTrader 4 and MetaTrader 5?

MT4 was specifically developed for Forex trading, while MT5 was created to facilitate more streamlined trading in instruments beyond the Forex industry.

What are the advantages of Forex Brokers with MT5?

Forex brokers that use MT5 provide traders with advanced trading tools, comprehensive market analysis features, multi-asset trading capabilities, and robust security. Additionally, MT5’s user-friendly interface and support for algorithmic trading enhance the trading experience.

Who uses MT5?

MT5 is compatible with a wide range of financial markets, not just the foreign exchange market. You can trade commodities and individual stocks for cash on the platform.

MT5 vs. MT4: Which is better?

MT4 and MT5 both use different programming languages. MT5’s backtesting speed, market depth, and access to MetaQuotes’ technical support are its strongest points. Though both are top-notch, the MT5 broker has a bigger chance of attracting more seasoned traders.

What is the MT5 White Label cost?

MetaQuotes charges a $5,000 flat fee upfront and an additional $1,750 monthly for support for each WL – MT4 white label and MT5 white label. This fee covers both mobile and desktop versions of the software. The MT5 full server license costs $7,500, not including the expenses of hiring a professional team.

Is MetaTrader a Broker?

MetaTrader is practically the best trading software for forex and CFDs. Yet, it’s important to note that it doesn’t function as a broker.