Crypto Market Outlook 2024: Trends that Shape the Market Dynamics

Aug 20, 2024

The cryptocurrency market continues its rapid development and passes new stages of gradual integration into new areas of the economic sector, every day taking on board new crypto projects that are designed to transform the usual mechanisms of work and interaction with both money and investment products, which not only generates increased interest in new technologies and crypto innovations but also increases the demand for the purchase of crypto coins, both new and already existing, firmly established in the crypto sphere.

This article will shed light on the crypto market outlook for 2024, what trends will dominate it, and which crypto coins are best to buy right now in mid-2024.

Key Takeaways

- The current state of the crypto market is assessed as stable, being in the process of long-term consolidation before the trend changes.

- The main trend in the crypto world is the development of the DeFi sector, which is based on related technologies, particularly NFTs and RWAs.

- Bitcoin is still the most popular asset to buy on the crypto market, given its investor qualities and advantages.

Current State of the Cryptocurrency Market

At any moment of interaction with the crypto assets market, one can observe a continuous change in the moods of its participants. This generates a rise or fall of a particular asset at a particular moment in time, forming the degree of interest in its purchase, sale, or hold. From this point of view, the cryptocurrency market is second after the Forex market not only because of the average daily trading volume but also because of the abundance of financial instruments available for work.

At the time of writing (August 2024), the crypto market is experiencing a process of consolidation for most crypto instruments in all types of markets. This can be clearly seen in the price indicators of the leading cryptocurrency, Bitcoin, which, after a severe spike in February this year, continues to be in deep consolidation and is currently trading in the price range of 55,000–60,000 U.S. dollars, with some preconditions for growth in the short term on the background of some good news.

Bitcoin’s exchange rate saw a steady rise on the eve amid the decreasing inflation rates that are predicted to cause interest rate cuts by the US Federal Reserve (Fed).

Lower interest rates, it is speculated, could reduce the appeal of traditional financial instruments and increase investor appetite for risky assets such as Bitcoin and some altcoins, as well as margin products.

Moreover, inflows into spot Bitcoin funds in the U.S. continue, with investors purchasing over 200 million USD worth of BTC ETFs in past few days.

Thus, against the backdrop of these events, the state of the crypto market is assessed as stable and positive, particularly given the ongoing process of consolidation of many assets, specifically Bitcoin, which has prerequisites for growth in the near future. This will also entail growth in the total capitalization of the entire crypto market, a large share of which is altcoins.

Fast Fact

The SEC’s recent approval of spot Solana ETF trading will be a turning point in stimulating interest in trading not only within the SOL ecosystem but also within other blockchain networks.

Crypto Market Outlook 2024

The cryptocurrency market is undergoing continuous change, and the ongoing development of blockchain technology is anticipated to open up new opportunities and revolutionize various industries in the near future.

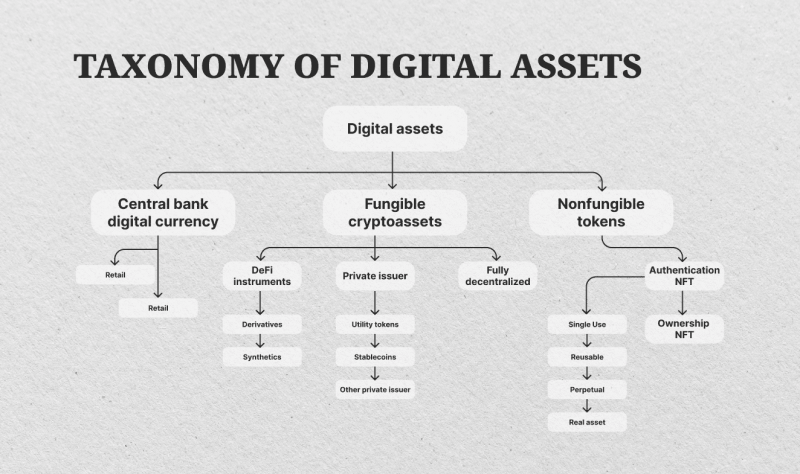

From the advancement of DeFi and the widespread adoption of NFTs to the incorporation of CBDCs and the increase in regulatory oversight, the outlook for 2024 presents the potential for substantial advancements.

Here are the most exciting trends in the crypto world that will drive its progress in the foreseeable future, including fuelling market participants’ interest in active trading of financial instruments.

1. Developments in Accounting Rules for Digital Assets

In December 2023, the Financial Accounting Standards Board (FASB) unveiled new regulations mandating companies to value cryptocurrencies such as Bitcoin at fair value. The unanimous adoption of these rules by FASB means they will come into effect after December 15, 2024, although companies can implement them earlier for financial statements that have yet to be issued. This is a significant development, as yet a specific U.S. accounting rule has addressed how companies should recognize and measure the digital currencies they possess.

Before these regulations, cryptocurrency was treated as an intangible asset. This meant that if the price dropped below the purchase price, companies had to record an impairment charge on their books, even if they did not sell. Conversely, if the price increased, there was only a benefit to recording it on the books if they sold.

2. Tax Reporting Standards Implementation

While tax administrations have been quieter than financial regulators, they have been actively working behind the scenes to introduce reporting standards for digital assets, with the aim of boosting transparency within the industry. Thus, there are some regulative practices that need to be designed and implemented in the crypto world.

DAC8 is created to align with the recently enacted Markets in Crypto-Assets (MiCA) and anti-money laundering regulations. These regulations will establish the framework for entering the EU market for crypto assets, replacing current national rules governing the issuance, trading, and safekeeping of such assets.

The CARF is an international tax transparency framework that enables the automatic exchange of tax information concerning crypto-asset transactions. CARF enforces due diligence requirements similar to the Common Reporting Standard (CRS) on reporting crypto-asset service providers (CASPs) and detailed reporting obligations for crypto-asset transactions.

The OECD is presently working on developing an implementation plan. Further guidance is expected to be issued in the upcoming years to ensure the efficient implementation of CARF by reporting CASPs and participating jurisdictions.

3. DeFi Elaboration

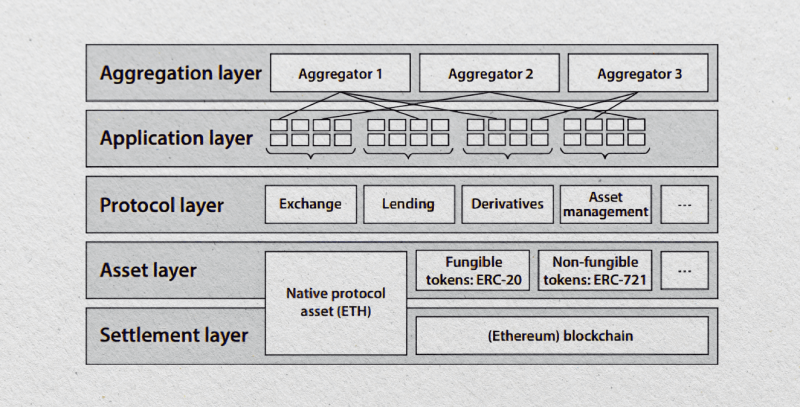

The DeFi market is poised for continued growth and innovation in 2024. DEXs will continue to gain popularity, allowing users to trade cryptocurrencies without a central authority. Additionally, yield farming through DeFi protocols is expected to trend upward.

The total value locked within DeFi protocols has reached $50 billion by the end of 2023, driven by new inflows from participants seeking attractive yields through staking, investing, and lending activities. It is anticipated that new DeFi use cases and applications will be developed, particularly in the fintech P2P/B2B/P2B space.

4. Real-World Assets (RWAs) Tokenization Growth

Risk-weighted assets (RWAs) tokenization, including real estate, stocks, and commodities, is projected to gain prominence by 2024. According to a report by Bernstein, tokenization presents a $5 trillion opportunity over the next five years. This trend involves breaking down an asset into digital tokens representing the underlying property, complete with all its rights and obligations, thereby enabling greater liquidity and accessibility.

In the upcoming years, it’s expected to see a surge in the widespread tokenization of RWAs, with traditional financial institutions and fintech companies actively participating in this transformative process. Since November 2023, UK regulators have actively begun exploring a framework for asset managers to utilize tokenization with standard asset classes.

5. NFTs Proliferation

NFTs have garnered significant attention in 2021 and 2022, with their integration into mainstream culture expected to grow in the coming years. The expansion of NFTs into various sectors, such as sports, art, gaming, music, and real estate, is on the horizon. Developing unique digital assets is set to attract creators and collectors, offering new revenue streams for artists and innovative investment opportunities for enthusiasts.

Regarding taxation, the IRS is preparing to guide classifying specific NFTs as collectibles under Section 408(m) of the Internal Revenue Code (IRC). This classification also impacts other aspects of the IRC, including the long-term capital gains tax rate (28%) applied to the sale or exchange of a collectible held as a capital asset for over a year.

In early 2023, the IRS Office of Chief Counsel released a memo stating that taxpayers must acquire a qualified appraisal to qualify for deductions on charitable donations of digital assets exceeding $5,000. It is important to note that the value of a cryptocurrency must be accurately reported.

6. Deep Central Bank Digital Currencies (CBDCs) Integration

In 2024, CBDCs are set to achieve significant milestones. The European Central Bank is gearing up to introduce a digital euro, while China is experimenting with a digital yuan. India is also in the works for a pilot program, and around 130 countries, accounting for 98% of the global economy, are delving into digital currencies.

These initiatives are geared towards enhancing financial inclusivity, cutting down transaction costs, and bolstering monetary stability, particularly in emerging markets where traditional financial systems are lacking. Countries venturing into CBDCs seek collaborations with blockchain technology firms, IT security providers, licensed financial institutions, and fintech companies.

7. Blockchain and AI Convergence

2024 will see a surge in interest in the fusion of AI and blockchain technology. The synergy between these two innovations holds promise for driving substantial advantages and advancements. Through the amalgamation of AI and blockchain, a fresh array of applications will surface, harnessing the efficiency enhancements enabled by AI and capitalizing on blockchain’s security and transparency features.

This convergence ushers in inventive solutions, promoting enhanced effectiveness, trustworthiness, and responsibility across various sectors, such as healthcare, energy, social impact, agriculture, and urban planning.

An illustrative instance involves utilizing satellite imagery to gather data to validate a farmer’s agricultural plot, pledged as tokenized collateral for a loan.

5 Best Crypto Coins to Consider for Buying in August 2024

The crypto market is changing every day, bringing new opportunities to make money on both old and well-known crypto projects and new ones that have great potential to develop and change certain aspects of the impact of crypto technology on the economic sector and trading system.

Here are a number of cryptocurrencies that deserve attention and can be considered for purchase right now in August 2024.

1. Bitcoin (BTC)

Contrary to certain inherent flaws in this coin, Bitcoin has been, remains, and will be a powerful investment tool for a long time, setting trends in the crypto market. Due to its unique qualities, this coin offers a wide range of opportunities to exaggerate capital and gain valuable investing experience. All of this ultimately makes Bitcoin one of today’s buyers’ priority options, both to preserve savings and generate income through more sophisticated investment products.

Coin’s Basic Tokenomics:

Market Cap — $1,159,208,992,008

Fully Diluted Valuation — $1,230,236,084,442

24 Hour Trading Vol — $19,831,838,573

Circulating Supply — 19,741,981 BTC

Total Supply — 19,741,981 BTC

Max Supply — 21,000,000 BTC

2. Solana (SOL)

Solana has quickly become a prominent player in the blockchain industry, recognized for its impressive speed and low transaction fees. With its innovative Proof of History (PoH) consensus mechanism, Solana can handle thousands of transactions per second, making it a top choice for high-frequency trading, gaming, and DeFi projects. The Solana ecosystem has experienced rapid growth, attracting numerous projects to its platform due to its scalability and efficiency.

With a potential bull market on the horizon, Solana’s SOL token could see significant gains from increased network activity and broader adoption. Investing in Solana now provides exposure to a rapidly expanding ecosystem that is well-positioned to capture a large market share. Its appeal as an alternative to Ethereum’s costly fees and network congestion reassures investors of its potential.

Coin’s Basic Tokenomics:

Market Cap — $66,882,987,648

Fully Diluted Valuation — $83,220,236,301

24 Hour Trading Vol — $2,028,132,984

Circulating Supply — 463,962,637

Total Supply — 582,571,890 SOL

Max Supply — ∞

3. Ethereum (ETH)

Ethereum, known as the king of smart contracts, has significantly impacted the world of cryptocurrency. The transition to Ethereum 2.0 from proof-of-work to proof-of-stake has dramatically improved its scalability, security, and energy efficiency. This upgrade has led to lower transaction fees and increased throughput, making Ethereum more appealing to developers and users.

The Ethereum ecosystem supports a wide range of DApps, DeFi platforms, and NFTs, solidifying its position as a pioneer in blockchain technology. This makes Ethereum an attractive investment for those benefiting from its technological advancements and growing popularity.

Coin’s Basic Tokenomics:

Market Cap — $314,597,025,109

Fully Diluted Valuation — $314,542,601,703

24 Hour Trading Vol – $10,276,769,650

Circulating Supply — 120,286,512 ETH

Total Supply — 120,286,512 ETH

Max Supply — ∞

4. Toncoin (TON)

Toncoin, a blockchain project created by the Telegram team, is at the forefront of innovation in decentralized applications and services. With the capability to process millions of transactions per second at minimal costs, Toncoin utilizes state-of-the-art technology to establish a user-friendly environment. Its origins within the Telegram community provide a solid groundwork and a substantial user following from the beginning.

Coin’s Basic Tokenomics:

Market Cap — $17,147,043,395

Fully Diluted Valuation — $34,735,106,205

24 Hour Trading Vol — $462,202,986

Circulating Supply — 2,520,189,248 TON

Total Supply — 5,110,571,020 TON

Max Supply — ∞

5. Hedera (HBAR)

Hedera is a public-distributed ledger technology that promises rapid, equitable, and secure decentralized applications. Hedera employs a distinctive consensus algorithm, Hashgraph, unlike conventional blockchains, ensuring superior throughput and minimal latency.

Investing in Hedera means gaining access to a remarkably scalable and effective platform making waves across different sectors, from finance to supply chain management. With the anticipated surge in the market, there is potential for a substantial increase in HBAR’s worth, offering significant returns as many businesses and developers embrace Hedera for their decentralized applications.

Coin’s Basic Tokenomics:

Market Cap — $1,885,729,683

Fully Diluted Valuation — $2,628,173,889

24 Hour Trading Vol — $31,714,796

Circulating Supply — 35,875,283,811 HBAR

Total Supply — 50,000,000,000

Max Supply — 50,000,000,000

Conclusion

Overall, the crypto market outlook 2024 seems very promising, with lots of positive trends shaping its bullish future. Therefore, the market is growing, and today, as never before, it offers an incredible number of crypto projects for investment, each of which has its own features and distinctive features, as well as advantages and disadvantages, taking into account which allows you to choose the appropriateness of their purchase.

At the same time, each currency in the list above offers the opportunity to earn a good income with a properly planned strategy that considers all the criteria that form the basis of the approach to trading in the crypto market.

Disclaimer: This article is for informational purposes only and should not be construed as financial advice. Investing in cryptocurrencies, including meme coins, carries ingrained risks, and individuals should conduct their own research before making any investment decisions.